Anti-Acne Serum Market Size

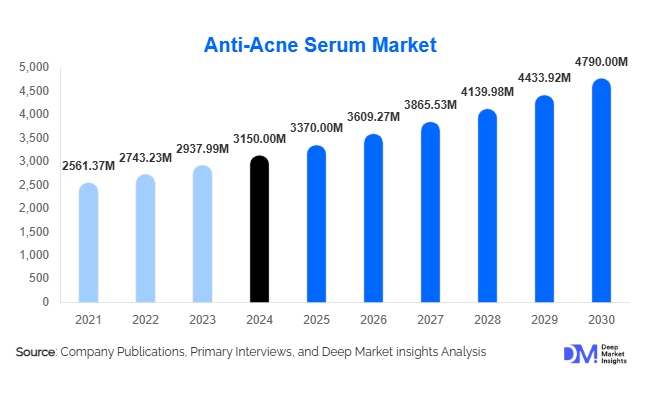

According to Deep Market Insights, the global anti-acne serum market size was valued at USD 3,150 million in 2024 and is projected to grow from USD 3,370 million in 2025 to reach USD 4,790 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The market growth is primarily driven by rising acne prevalence, increasing consumer awareness of skincare routines, the adoption of dermatology-backed serums, and the expansion of natural and organic product offerings across emerging and mature markets.

Key Market Insights

- Salicylic acid-based serums dominate the market due to their proven efficacy in unclogging pores and reducing inflammation, capturing 32% of the 2024 market.

- Full-face application serums lead usage trends, addressing widespread acne concerns and accounting for 45% of overall market share.

- Online retail is the fastest-growing distribution channel, representing 28% of global sales, driven by convenience, digital marketing, and broader product access.

- Teenagers and young adults remain the largest end-use segment, contributing over 55% of demand, due to high acne prevalence and skincare awareness.

- North America holds the largest regional share (35%), led by the U.S., while Asia-Pacific is the fastest-growing region (8.5% CAGR), fueled by rising middle-class adoption in India, China, and South Korea.

- Technological adoption in personalized skincare, including AI-based skin analysis apps and controlled-release formulations, is enhancing product effectiveness and consumer engagement.

Latest Market Trends

Shift Toward Natural and Organic Formulations

Anti-acne serum manufacturers are increasingly incorporating herbal and natural extracts to address consumer preferences for safer, chemical-free skincare solutions. Ingredients such as niacinamide, aloe vera, green tea, and turmeric are gaining prominence for their anti-inflammatory and antibacterial properties. Companies are investing in research to combine these botanicals with clinically proven actives like salicylic acid and retinoids to deliver multifunctional formulations. Marketing campaigns emphasize transparency, cruelty-free testing, and eco-friendly packaging, reflecting a broader trend toward sustainability in the personal care industry.

Technology-Driven Personalized Skincare

AI-powered apps and digital dermatology consultations are reshaping how consumers select and use anti-acne serums. Personalized formulations based on skin type, acne severity, and environmental factors are becoming more widely available. Controlled-release encapsulation and micro-delivery systems improve the efficacy of active ingredients, enhancing results while minimizing irritation. Smart packaging and subscription-based models allow continuous monitoring of product usage, driving higher consumer engagement and loyalty.

Anti-Acne Serum Market Drivers

Increasing Acne Prevalence Worldwide

Acne affects more than 85% of adolescents and nearly 40% of adults globally. Rising hormonal imbalances, stress, urban pollution, and dietary factors have amplified demand for targeted acne treatments. This high prevalence drives consistent demand for specialized serums that offer faster and more visible results compared to conventional creams and cleansers.

Growing Online Retail Penetration

The expansion of e-commerce platforms enables brands to reach tech-savvy consumers, providing detailed product information, reviews, and personalized recommendations. Online channels are particularly effective in emerging markets, where physical retail infrastructure is limited, and they help brands build global visibility at lower distribution costs.

Rising Awareness of Dermatology-Backed Products

Consumers increasingly trust serums recommended or tested by dermatologists. Clinical efficacy, backed by scientific research, reassures buyers of product safety and performance. Dermatology endorsements and professional partnerships strengthen brand credibility, particularly in premium and mid-range segments.

Market Restraints

Skin Sensitivity and Side Effects

Active ingredients like benzoyl peroxide and retinoids can cause irritation, dryness, or redness. Sensitive skin populations often hesitate to adopt such serums, creating a barrier to mass-market adoption. Manufacturers need to innovate gentler formulations without compromising efficacy.

High Competition and Price Sensitivity

The market is moderately fragmented with intense competition among mid-tier and premium players. Price-sensitive consumers in emerging markets often prioritize affordability, limiting growth potential for high-priced serums unless value-added features are introduced.

Anti-Acne Serum Market Opportunities

Expansion in Emerging Markets

Regions like India, Southeast Asia, and the Middle East are witnessing rapid adoption due to rising disposable incomes and increased skincare awareness. Establishing localized manufacturing, distribution, and marketing strategies can help global players penetrate these high-growth markets efficiently.

Integration of AI and Personalized Skincare

Technological innovations enable personalized formulations, predictive recommendations, and smart product tracking. Brands leveraging AI and dermatology partnerships can offer superior consumer experiences, driving loyalty and increasing repeat purchases.

Rising Demand for Natural and Organic Serums

Consumer preference for chemical-free and environmentally friendly products is creating growth opportunities. Companies investing in plant-based or hybrid formulations can capture niche demand and differentiate themselves in a competitive market. Integration with sustainable packaging and certification (cruelty-free, vegan) further enhances market appeal.

Product Type Insights

Salicylic acid-based serums are the most widely adopted product type, with 32% market share in 2024, due to their proven effectiveness in managing acne and reducing inflammation. Retinoid and benzoyl peroxide serums follow closely, particularly in adult acne treatment. Herbal and natural extract serums are witnessing rapid growth (10% CAGR), reflecting consumer inclination toward chemical-free solutions. Multi-functional formulations combining active ingredients with natural extracts are gaining traction, driving innovation across product lines.

Application Insights

Full-face application serums dominate usage (45% share), as they provide holistic treatment for widespread acne. Spot treatments and T-zone-specific serums are growing among younger consumers who prefer targeted, rapid-action solutions. Body application serums for back and chest acne are emerging as niche segments, supported by rising awareness of complete skincare regimens.

Distribution Channel Insights

Online retail is the leading channel (28% market share), driven by convenience, access to a wide range of brands, and consumer education. Pharmacies and drugstores remain critical for dermatology-endorsed products, particularly in North America and Europe. Supermarkets, specialty stores, and direct selling complement the market, while subscription-based and D2C models are emerging channels for premium products.

End-Use Insights

Teenagers and young adults are the largest consumers (55%), due to high acne prevalence and growing skincare awareness. Adult women follow, focusing on anti-aging and acne-combination concerns. Emerging male grooming trends are increasing male adoption, particularly in urban areas. The cosmetic and dermatology industries drive the majority of demand, with exports from Asia-Pacific to North America and Europe supporting global consumption.

| By Product Type | By Application | By Distribution Channel | End-Use | Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 35% of the global market, led by the U.S., due to high disposable income, advanced dermatology infrastructure, and strong online retail penetration. Canadian demand is also growing, supported by similar consumer preferences. Awareness campaigns, digital marketing, and teledermatology services further drive regional adoption.

Europe

Europe holds 25% of the market, with Germany, the UK, and France as major consumers. High skincare awareness, preference for dermatology-tested and premium formulations, and strong online retail networks contribute to demand. Eco-friendly and natural product adoption is also higher, reflecting regional consumer trends.

Asia-Pacific

Asia-Pacific is the fastest-growing region (8.5% CAGR), led by India, China, South Korea, and Japan. Rising youth population, increasing skincare awareness, social media influence, and growing disposable income are driving market expansion. China and India are key hubs for both production and consumption.

Latin America

Brazil, Argentina, and Mexico are driving regional demand, with middle-class growth, urbanization, and rising e-commerce adoption supporting serum sales. Affordability and localized marketing strategies are key for market penetration.

Middle East & Africa

GCC countries, particularly the UAE and Saudi Arabia, are witnessing increasing demand due to high-income populations and premium skincare adoption. Africa is a smaller but emerging market, with growing interest in natural and herbal skincare products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Anti-Acne Serum Market

- L’Oréal

- Johnson & Johnson

- Procter & Gamble

- Estée Lauder

- Shiseido

- Unilever

- Beiersdorf

- GlaxoSmithKline

- Amorepacific

- Rohto Pharmaceutical

- Kao Corporation

- LG Household & Health Care

- Pierre Fabre

- Dermalogica

- The Ordinary

Recent Developments

- In May 2025, L’Oréal launched a new herbal anti-acne serum line targeting young adults in Asia-Pacific, emphasizing natural ingredients and clinical efficacy.

- In April 2025, Johnson & Johnson expanded its acne serum portfolio in North America with AI-driven personalized formulations for dermatology clinics.

- In February 2025, Estée Lauder introduced a controlled-release retinoid serum for adult acne, combining efficacy with minimal skin irritation, targeting premium urban consumers.