Anti-Acne Makeup Market Size

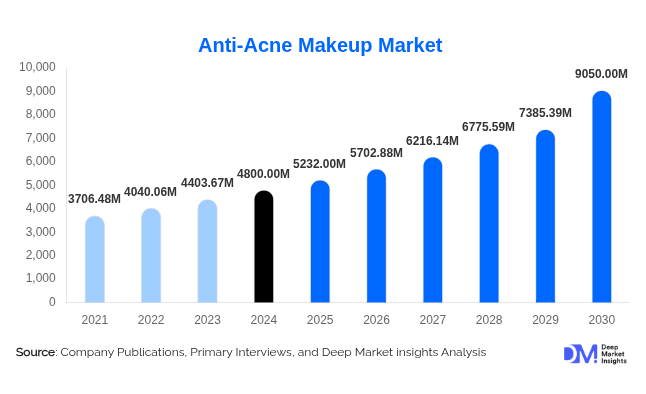

According to Deep Market Insights, the global Anti-Acne Makeup Market is estimated to have been valued at approximately USD 4,800 million in 2024, and is projected to grow to around USD 5,232 million in 2025, ultimately reaching about USD 8,050.08 million by 2030, expanding at a CAGR of approximately 9.0% during the forecast period (2025–2030). The growth of this market is primarily driven by increasing consumer awareness of skin health, rising prevalence of acne (including adult acne), demand for multifunctional makeup that also treats skin issues, and expanded e-commerce and digital engagement in beauty shopping.

Key Market Insights

- Coverage makeup for acne-prone skin is gaining traction, with foundations, concealers, and powders formulated specifically for blemish-prone skin becoming core product types in the category.

- Emerging markets in Asia-Pacific are leading demand, with regional share among the highest globally due to large youth populations, increasing disposable income, and growing beauty/skincare consciousness.

- Teenagers remain the largest end-user demographic in anti-acne makeup, given higher acne prevalence, but adult acne is becoming a major growth lever.

- Offline retail still dominates distribution globally in this niche, thanks to consumer preference for in-store product testing, especially for skin-sensitive formulations.

- “Non-comedogenic” and “dermatologist-tested” claims are key purchase drivers for formulations that minimize pore-clogging and irritation have a strong competitive edge.

- Digital innovation and e-commerce penetration are reshaping the category, with DTC brands, personalized make-up tools, and social-media influence accelerating growth.

Latest Market Trends

Skincare-Infused Makeup for Acne-Prone Skin

Consumers are increasingly looking for makeup that does more than simply cover blemishes; they want formulations that actively support acne-prone skin, such as oil control, anti-inflammatory actives (e.g., salicylic acid, niacinamide), and non-comedogenic bases. This “makeup meets skincare” trend is clearly influencing new product development, as brands expand anti-acne specific variants within foundations, concealers, and powders. With adult acne on the rise and younger users seeking gentle formulations, the fusion of coverage + treatment is becoming a norm rather than a niche.

Digital Beauty & Personalization in the Acne-Safe Makeup Category

Digital and tech-driven tools are playing a growing role in the anti-acne makeup market. Virtual try-ons, AI skin-analysis apps, and personalized formulation services help consumers with acne-prone skin feel more confident in their purchase decisions. Social-media-driven beauty influencers also amplify acne-safe makeup messaging (non-comedogenic, dermatologist-approved). E-commerce platforms enable niche brands and specialist lines to reach underserved demographics (male grooming, adult acne) efficiently. Thus, technological integration is enhancing both product reach and consumer trust in this category.

Anti-Acne Makeup Market Drivers

Rising Prevalence of Acne and Adult Acne

The prevalence of acne remains high globally, not just among adolescents but increasingly among adults. As adult acne becomes more common, driven by hormonal shifts, stress, lifestyle, and environmental factors, the demand for specialized makeup designed for acne-prone skin is growing. These products appeal to individuals seeking both concealment and skin-safe formulations, thus expanding the addressable market.

Growing Demand for Multifunctional Products (Makeup + Skin Care)

Consumers today expect more from their makeup products; they want coverage plus skincare benefits. In the anti-acne makeup niche, this means formulations that not only hide blemishes but also support oil control, minimize pore-clogging, soothe skin irritation, and align with dermatologist-approved standards. This bridging of cosmetics and skincare supports stronger purchasing behavior and brand loyalty.

E-Commerce Growth & Social Media Influence

The shift to online retail and the influence of social media on beauty purchasing cannot be overstated. For acne-safe makeup, online channels facilitate the discovery of niche products, peer reviews, and influencer recommendations, which are especially powerful for younger consumers with acne concerns. Additionally, DTC distribution lowers barriers for specialist brands, expanding competition and product range in this category.

Restraints

High Formulation Costs and Regulatory/Certification Hurdles

Products formulated for acne-prone skin often require more rigorous testing (non-comedogenic certification, dermatological endorsement, safe-for-sensitive-skin claims) and non-standard ingredients, which elevate manufacturing costs. In price-sensitive markets, this restricts adoption or forces margin compression. Moreover, differing regulatory frameworks across regions (for cosmetics vs therapeutic claims) add complexity for global brands.

Consumer Skepticism and Credibility of Acne-Safe Claims

While many products claim “non-comedogenic”, “dermatologist-tested”, or “safe for acne-prone skin”, consumers with persistent acne may be skeptical of efficacy. If the coverage does not match expectations or if skin irritation occurs, brand trust is lost. This barrier to adoption means brands must invest in credible clinical results, transparent communication, and reliable formulation. Failure to do so can hinder growth.

Anti-Acne Makeup Market Opportunities

Integration of Skincare and Cosmetics

The merging of skincare actives with color cosmetics presents a major opportunity in the anti-acne makeup market. Consumers increasingly seek hybrid products that conceal blemishes while treating acne, driving innovation in formulations infused with salicylic acid, niacinamide, and green tea extracts. Brands are capitalizing on this demand by launching non-comedogenic, dermatologist-tested lines that provide therapeutic benefits alongside aesthetic coverage. The convergence of skincare and cosmetics is expected to expand market reach, particularly among health-conscious millennials and Gen Z consumers prioritizing skin health and transparency in ingredients.

Expansion of Clean and Vegan Beauty Lines

The rising global movement toward clean, vegan, and cruelty-free beauty products is opening new avenues for growth. Consumers are shifting away from synthetic formulations toward natural and ethically sourced ingredients. This trend is encouraging cosmetic companies to introduce plant-based, hypoallergenic, and paraben-free anti-acne makeup lines that align with sustainability and ethical beauty values. Certifications such as “vegan,” “cruelty-free,” and “dermatologist-approved” are emerging as key differentiators in brand positioning, helping manufacturers appeal to environmentally and ethically conscious buyers.

Product Type Insights

Anti-acne foundations dominate the product category, offering high coverage with acne-fighting ingredients like salicylic acid and sulfur. These products are particularly popular among consumers with mild to moderate acne seeking both treatment and aesthetic correction. Anti-acne concealers and BB/CC creams are gaining traction due to their portability and dual-purpose appeal, providing spot coverage and skincare benefits in a single application. Primers and powders designed for oily or acne-prone skin are increasingly formulated with oil-absorbing minerals and antibacterial agents, ensuring longer wear and reduced pore blockage. Continuous innovation in lightweight, breathable, and non-comedogenic formulas is driving sustained demand across all product types.

Application Insights

Daily use makeup represents the largest application segment, driven by the growing need for long-lasting, skin-friendly cosmetics suitable for work and social activities. The therapeutic makeup segment is rapidly growing, with products developed under dermatologist guidance to target acne treatment alongside coverage. Themed makeup for special occasions, designed for acne-prone users, is also gaining attention, particularly in online retail. In addition, medicated and tinted skincare hybrids such as acne serums with a light tint are blurring the line between traditional cosmetics and skincare, creating a new functional niche within the market.

Distribution Channel Insights

Online retail dominates the anti-acne makeup market, fueled by the convenience of e-commerce platforms, influencer-driven marketing, and the accessibility of product reviews. Direct-to-consumer (D2C) brand websites and online pharmacies are witnessing strong growth as brands increasingly leverage social media engagement and subscription-based replenishment models. Offline channels, including drugstores, specialty beauty shops, and dermatology clinics, remain critical for consumers seeking personalized recommendations and product trials. The hybrid retail model combining in-store experiences with online loyalty programs is emerging as a preferred approach for established beauty brands.

End User Insights

Women represent the largest consumer base for anti-acne makeup, driven by rising awareness of skin health and the availability of gender-targeted cosmetic formulations. The men’s segment is expanding rapidly as male consumers adopt skincare routines and seek lightweight, natural-looking acne coverage products. Teenagers constitute a vital growth demographic due to high acne prevalence and increasing comfort with using skincare-infused cosmetics. Educational marketing campaigns and dermatologist collaborations are further enhancing product acceptance across all user groups.

Age Group Insights

Consumers aged 18–30 years hold the dominant share of the anti-acne makeup market, driven by higher acne incidence, social media influence, and preference for clean beauty products. The 31–45 age group represents a stable and lucrative segment, with growing interest in anti-aging and skin-repair makeup hybrids. Older consumers (46 years and above) are adopting non-comedogenic, soothing formulas that offer both gentle coverage and skin barrier support. As awareness of skin sensitivity increases across age brackets, demand for dermatologist-endorsed, hypoallergenic products is expected to rise significantly through 2030.

| By Product Type | By Ingredient Type | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Analysis

North America

North America remains a key region for anti-acne makeup, driven by high per-capita beauty spending, well-developed dermatology networks, and strong consumer awareness of adult acne and specialist products. In 2024, North America is estimated to hold about 25%-30% of the global market (USD 1,200 – 1,440 million). The U.S. leads within the region with significant demand for premium anti-acne makeup lines, digital-first beauty brands, and dermatologist-endorsed products. Growth is steady, supported by innovation, but somewhat mature compared with emerging markets.

Asia-Pacific

Asia-Pacific is the largest region for anti-acne makeup, accounting for approximately 41.1% of the global market in 2024 (USD 1,970 million). Major countries include China, Japan, South Korea, and India. China drives large volume due to a huge youth population and rising beauty & skincare culture; South Korea is an innovation hot-spot; India is among the fastest-growing markets thanks to rising disposable incomes, increasing e-commerce penetration, and strong acne awareness in younger consumers. For example, India’s anti-acne cosmetics segment alone is projected to grow at a CAGR of 12.4% from 2025–30. Asia-Pacific is thus both the largest and fastest-growing regional market for this category.

Europe

Europe is another key region with strong demand for anti-acne makeup, especially in Germany, the UK, and France. With growing consumer preference for clean beauty, vegan formulations, and dermatologist-safe products, Europe is estimated at around 20% of the global market (USD 960 million) in 2024. Growth is driven by remiumization, ingredient transparency, and multi-channel retail innovation.

Latin America

Latin America is smaller in terms of absolute value (estimated at 8-10% of the global market) but represents high growth potential. Key countries include Brazil and Mexico. Demand is fuelled by younger demographics, increasing social media beauty influence, and rising e-commerce availability of acne-safe makeup products.

Middle East & Africa

The Middle East & Africa region accounts for about 5-7% of the global anti-acne makeup market in 2024. Key markets like the GCC (UAE, Saudi Arabia) and South Africa are seeing rising interest in specialist beauty and grooming for acne-prone skin, aided by luxury retail expansion and higher awareness of skincare-makeup hybrids. The growth rate here is estimated to be above the global average, given the lower base and increasing retail infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Anti-Acne Makeup Market

- L’Oréal S.A.

- The Estée Lauder Companies Inc.

- Shiseido Company, Limited

- Procter & Gamble Co.

- Unilever PLC

- Maybelline New York

- Clinique Laboratories LLC

- Neutrogena (Johnson & Johnson Consumer Health)

- Innisfree Corporation

- The Ordinary (DECIEM Beauty Group)

- e.l.f. Beauty, Inc.

- Fenty Beauty by Rihanna

- bareMinerals

- NYX Professional Makeup

- Paula’s Choice

Recent Developments

- In August 2025, L’Oréal launched a new “Dermablend Clear Cover” foundation line formulated with salicylic acid and probiotics, targeting acne-prone consumers seeking full coverage and active skin benefits.

- In June 2025, Estée Lauder introduced its first non-comedogenic, vegan anti-acne BB cream under the Clinique brand, focusing on oil control and microbiome balance.

- In April 2025, e.l.f. Beauty expanded its Blemish Breakthrough range into Asia-Pacific, responding to the rising demand for affordable, dermatologist-tested anti-acne makeup products among Gen Z users.

- In March 2025, Shiseido announced a research collaboration with dermatologists to develop AI-powered shade-matching and skin diagnostics for acne-prone consumers in its D2C platforms.

- In January 2025, The Ordinary (DECIEM) unveiled a dual-function tinted serum line combining niacinamide, zinc PCA, and mineral pigments—bridging skincare and makeup for sensitive, acne-prone users.