Animation Outsourcing Market Size

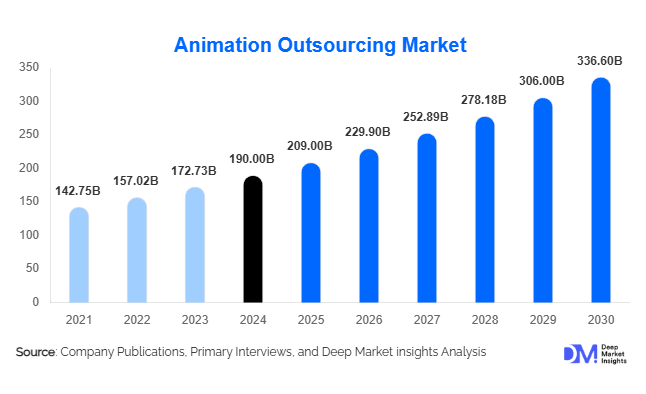

According to Deep Market Insights, the global animation outsourcing market size was valued at USD 190 billion in 2024 and is projected to grow from USD 209 billion in 2025 to reach USD 336.60 billion by 2030, expanding at a CAGR of 10.0% during the forecast period (2025–2030). The animation outsourcing market growth is primarily driven by increasing global content production (streaming, games, advertising), the rising demand for 3D and real-time pipelines, and the rapid scaling of offshore/nearshore animation service hubs supporting global creators.

Key Market Insights

- The outsourcing model is shifting from cost-arbitrage to strategic value-added partnerships, as clients demand end-to-end services (concept to delivery), faster turnaround and higher-quality pipelines.

- 3D animation and cinematics dominate the revenue share, supported by large budgets in feature films, streaming series, and AAA game titles requiring high-end visual content.

- Asia-Pacific (APAC) leads supply-side outsourcing, with India, the Philippines, Vietnam, and Southeast Asia offering large talent pools, established pipelines, and lower costs, while North America remains the largest commissioning region.

- Nearshore and regional content localisation are growing rapidly, especially in LATAM and Eastern Europe, thanks to proximity to demand centres and cultural alignment.

- Technological integration is advancing quickly, with cloud rendering, AI-assisted animation, and real-time engines (Unreal/Unity) reshaping production pipelines and enabling faster, more cost-efficient workflows.

- The corporate, e-learning, and simulation segments are emerging as under-penetrated growth areas, offering outsourcing vendors diversification beyond traditional film/game markets.

What are the latest trends in the animation outsourcing market?

Real-time Engine Integration and Interactive Content Outsourcing

Animation outsourcing providers are increasingly integrating real-time engines (like Unreal Engine and Unity) into their service offerings. This enables clients, especially game studios, streaming platforms, and interactive experience developers, to outsource interactive cinematics, virtual-production assets, and live-event graphics, not just traditional linear animation. The shift allows faster iteration and cross-platform reuse of assets, making outsourcing more than just a cost centre; it becomes a strategic partner for interactive storytelling. Studios investing in real-time talent, GPU render pipelines, and cross-discipline teams (technical artists + animators) are capturing higher-margin contracts and increasing recurring engagements.

AI-Enabled Volume Animation and Workflow Automation

Vendors are deploying AI/ML tools for tasks like automatic lip-sync, in-betweening, background generation, and render-farm optimisation, especially for high-volume, lower-complexity content (social media shorts, explainer videos, ad spots). By automating repetitive tasks, studios reduce turnaround time and cost, allowing outsourcing clients to scale volume content production. The strategic opportunity lies in combining high-value creative work with large-scale automated workflows, offering tiered service models: premium hand-crafted animation, and volume-driven AI-enhanced output. This trend pushes down unit costs and broadens the addressable market for outsourcing firms.

Regional Content Surge & Nearshore Expansion

Growth in regional streaming platforms (in APAC, LATAM, MENA) and local-language content budgets opens new outsourcing demand pockets. Studios are setting up nearshore delivery centres (Latin America for North America, Eastern Europe for Western Europe) to capitalise on cultural affinity, lower latency, time-zone alignment, and cost advantage compared with distant offshores. Government incentives (tax rebates, creative-industry funding) in these regions further enhance attractiveness. Outsourcing firms that expand into these geographies can access new demand, diversify their client base, and reduce reliance on traditional US/UK/European pipelines.

What are the key drivers in the animation outsourcing market?

Streaming & Game Production Boom

The explosion of original content commissioned by streaming platforms and the rising budgets in the gaming industry are major drivers of animation outsourcing. As more series, films, and games require high-quality animation, studios and publishers increasingly outsource to specialist vendors to scale quickly and manage cost base. The shift to episodic releases, global localisation, and multi-platform distribution further elevates demand for outsourced animation pipelines.

Global Talent Pools & Cloud-Enabled Collaboration

Outsourcing growth is enabled by the maturation of talent pools in countries such as India, the Philippines, Vietnam, and parts of Eastern Europe, combined with robust remote-collaboration tools, cloud-rendering services, and standardised pipelines. These factors reduce lead times and allow clients in North America and Europe to commission large-scale work offshore without sacrificing quality or communication efficiency. As remote workflows become normalised, geographic boundaries matter less, and outsourcing becomes more accessible.

Technological Advancement & Process Efficiency

Advances in GPU-based rendering, cloud rendering farms, real-time engines, and AI automation are improving the cost and speed of animation production. Outsourcing firms that adopt these technologies can offer faster turnaround times, higher throughput, and scalable models, making them more attractive to clients. The competitiveness of outsourcing is increasingly defined by tech-led efficiency, not only by wage arbitrage.

Restraints: Price Compression and IP/Security Concerns

Price Competition and Commoditisation

As outsourcing capabilities expand globally and automation tools proliferate, especially for lower-complexity animation, pricing pressure mounts. Basic 2D/3D work is increasingly commoditised, causing margin erosion for studios that do not specialise or automate. Buyers are segmenting work into premium (high cost, high value) and volume (low cost), limiting outsourcing growth in the mid-range without clear differentiation.

Creative Ownership, Quality & Security Risk

High-value projects, feature films, and major game cinematics often involve sensitive IP and require stringent creative oversight. Clients may be reluctant to outsource key narrative or character animation segments offshore due to concerns about quality consistency, pipeline control, data security, and creative ownership. These issues restrict the outsourcing of marquee work unless vendors demonstrate accredited security, quality guarantees, nd secure workflows.

What are the key opportunities in the animation outsourcing industry?

Real-time/Interactive Pipeline Outsourcing

One of the top opportunities lies in expanding into real-time and interactive production pipelines. As game engines become more central to animation, vendors can offer outsourced real-time cinematics, virtual production assets, interactive ads, AR/VR animations, and live-event graphics. Firms that build teams skilled in Unreal/Unity, technical animation, and pipeline integration can move beyond linear deliverables into higher-value, recurring contracts. This allows outsourcing houses to capture upstream work, embed in clients’ development cycles, and increase pricing power.

AI-Augmented High-Volume & Localised Content Production

With demand for short-form and localised content growing (social media animations, regional language assets, e-learning modules), outsourcing firms can deploy AI tools to scale volume projects profitably. By automating routine tasks (inbetweening, lip-sync, background generation) and standardising workflows, studios can take on large volumes of segmented content while maintaining margin. This is especially valuable for regional platforms, advertising agencies, and corporate training content where throughput matters more than bespoke storytelling.

Regionalisation & Nearshore Studio Growth

Regional content budgets, especially in APAC, LATA, M, and MENA, are growing rapidly, driven by local streaming demand, government-subsidised creative industries, and nearshore outsourcing models. New entrants can establish studios in lower-cost, regulatory-friendly zones and serve both local clients and export to global buyers with cultural and language advantages. Additionally, nearshore locations give time-zone advantages and faster turnaround for North America and Europe. This diversification enables vendors to hedge global demand fluctuations and access untapped growth pockets.

Service Type Insights

The global animation outsourcing market is segmented by service type into pre-production, production, and post-production services. Among these, production services dominate the market, accounting for approximately 42% of the global market share in 2024. This segment’s leadership is driven primarily by the growing demand for 3D animation, character animation, and cinematic sequences, which are highly technical, resource-intensive, and typically outsourced to specialist vendors by major studios and gaming publishers. The increasing complexity of modern storytelling, the adoption of real-time rendering engines (such as Unreal Engine and Unity), and the growing popularity of streaming episodic content are fueling steady growth within this segment.

Moreover, the integration of AI-assisted animation pipelines, used for automating in-between frames, background creation, and lip synchronization, is enhancing production efficiency, reducing turnaround times, and improving scalability for large-scale projects. As a result, production outsourcing has evolved from a cost-saving exercise into a strategic partnership model, enabling global content creators to achieve both quality and volume. In contrast, pre-production services (concept design, storyboarding, and asset design) and post-production services (compositing, editing, and sound design) represent smaller market shares due to lower outsourcing volumes and pricing, yet remain integral to the full production cycle. As content platforms increasingly commission high-quality, serialized animated productions, the 3D animation production sub-segment will continue to expand its dominance throughout the forecast period.

End-Use Insights

The media and entertainment sector remains the largest end-use segment of the animation outsourcing market, commanding the highest share of global outsourcing revenues. This segment’s dominance stems from the unprecedented surge in global content creation, particularly among OTT platforms, film studios, and streaming services that are increasingly commissioning outsourced animation for original series, films, and short-form digital content. The demand for high-quality 3D and CGI animation has risen sharply due to intensified competition among streaming giants aiming to capture diverse international audiences.

However, several other end-use categories are witnessing rapid acceleration in outsourcing demand. The gaming industry has emerged as one of the fastest-growing segments, fueled by the rising production of cinematic trailers, character animations, and environmental assets for AAA titles and mobile games. Additionally, corporate, education, and e-learning animation are gaining momentum as organizations adopt visual storytelling to enhance training effectiveness and engagement. The digital advertising and social media segment is also expanding rapidly due to the proliferation of animated marketing campaigns and short-form videos designed for online audiences. Export-driven demand continues to underpin the sector’s global expansion, North American and European commissioning studios increasingly rely on cost-effective animation service hubs in Asia-Pacific and nearshore regions, reinforcing the cross-border collaboration model that defines the industry’s scalability and growth.

| By Service Type | By End-Use Industry |

|---|---|

|

|

Regional Insights

Asia-Pacific (APAC)

The Asia-Pacific (APAC) region holds the largest share of the global animation outsourcing supply side, representing approximately 37% of the market, or about USD 71 billion in 2024. This dominance is underpinned by the region’s expansive animation workforce, strong technical capabilities, and cost advantages. India, the Philippines, Vietnam, Malaysia, and China have emerged as major outsourcing hubs due to their well-developed studio ecosystems and robust government support for the creative industry. APAC’s growth, projected to outpace all other regions during 2025–2030, is driven by rising export contracts from Western markets and surging domestic demand from regional OTT platforms and gaming publishers.

Key drivers in APAC include favorable government incentives (such as India’s National Animation, Visual Effects, Gaming, and Comics [AVGC] policy), rapid infrastructure digitization, and an influx of foreign investment in animation education and training institutes. The expansion of high-speed internet and cloud-based production tools has further enabled real-time collaboration between APAC studios and Western clients. As localization and regional content creation become mainstream, APAC’s dominance in both supply and demand is expected to solidify through the next decade.

North America

North America serves as the largest commissioning hub for animation outsourcing, accounting for approximately 28% (USD 53.8 billion) of the global market in 2024. The region’s growth is driven by the surge in streaming content production, large-scale game development, and ongoing technological innovation in animation pipelines. The United States and Canada are home to major animation powerhouses, including Hollywood studios, streaming platforms, and top-tier game publishers that rely on offshore partners for large-scale content delivery.

Key regional growth drivers include the rising appetite for high-fidelity 3D content across entertainment and advertising sectors, strategic outsourcing partnerships formed to reduce production bottlenecks, and increased adoption of virtual production and real-time rendering technologies. The growth of hybrid work models and cloud-based production workflows has made collaboration with offshore vendors more seamless, cementing North America’s role as the primary demand centre in the global animation outsourcing value chain.

Europe

Europe accounts for roughly 20% of the global animation outsourcing market (USD 38.4 billion in 2024). The United Kingdom, France, and Germany are leading commissioning markets, while Eastern European countries such as Poland, Romania, and Hungary are emerging as key nearshore outsourcing destinations. Europe’s growth is driven by its strong creative ecosystem, government-funded animation subsidies and tax incentives, and rising demand for localized animated content across multilingual audiences.

In addition, the European Union’s emphasis on digital content and cultural preservation has boosted investments in original animation projects, which in turn fuels outsourcing partnerships with both regional and offshore vendors. The growing adoption of real-time production tools and cross-border collaboration networks is expected to maintain Europe’s stable growth trajectory in the coming years.

Latin America (LATAM)

Latin America represents around 8% of the global animation outsourcing market (USD 15.4 billion in 2024) and is emerging as a prominent nearshore destination for North American clients. Countries such as Mexico, Brazil, and Argentina are leading this growth due to their favorable labor costs, linguistic and cultural proximity to the U.S. market, and increasing pool of skilled digital artists.

Regional growth is driven by rising investment in creative hubs and animation training programs, government incentives aimed at expanding media exports, and growing demand for Spanish and Portuguese-language content from local and global streaming platforms. The region’s ability to provide time-zone alignment and rapid communication makes it an attractive nearshore option for Western studios seeking agility and collaboration efficiency. Over the forecast period, LATAM is expected to grow faster than Europe, supported by expanding gaming and advertising industries.

Middle East & Africa (MEA)

The Middle East and Africa (MEA) region currently accounts for approximately 7% of the global animation outsourcing market (USD 13.4 billion in 2024). Though still developing, MEA is increasingly investing in creative economy infrastructure and media production capacity. Saudi Arabia, the United Arab Emirates, Egypt, Nigeria, and South Africa are at the forefront of this transformation.

Key regional growth drivers include government-backed initiatives to diversify economies (such as Saudi Vision 2030 and the UAE’s National Media Strategy), public-private partnerships to nurture digital content creation, and a growing youth population driving demand for localized animation and gaming content. Additionally, intra-African outsourcing collaborations are emerging, allowing African studios to participate in global value chains while developing local IPs. As international studios look to diversify outsourcing footprints, MEA’s growing creative talent base and supportive policy frameworks will make it an increasingly relevant regional contributor to the global animation outsourcing market.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Animation Outsourcing Market

- DNEG

- Framestore

- MPC

- Wētā FX

- Industrial Light & Magic (ILM)

- Sony Pictures Imageworks

- Technicolor / Vantiva

- Prime Focus

- Tata Elxsi

- Prana Studios

- Toonz Media Group

- DQ Entertainment

- Pixomondo

- Blue Zoo

- Aardman

Recent Developments

- In Q2 2025, a leading studio announced the expansion of its real-time production unit, offering game-engine pipeline services to streaming clients, signalling outsourcing houses’ transition into interactive content delivery.

- In Q1 2025, several mid-sized studios unveiled AI-augmented animation workflows and made strategic acquisitions of smaller AI-tool firms to expand their automation capabilities and scale high-volume content delivery.

- In late 2024, multiple regional governments (in LATAM and Southeast Asia) introduced new tax incentives and creative-industry funding for animation/VFX outsourcing, catalysing new nearshore studio openings and talent training programmes.