Animation Collectibles Market Size

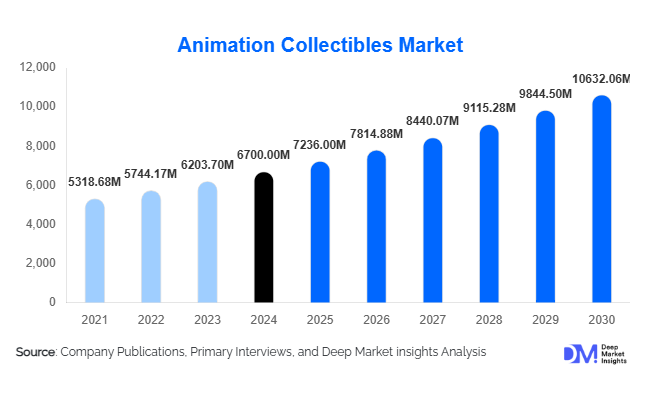

According to Deep Market Insights, the global animation collectibles market size was valued at USD 6,700 million in 2024 and is projected to grow from USD 7,236 million in 2025 to reach USD 10,632.06 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The animation collectibles market growth is driven by the expanding fandom culture around animation and gaming IPs, the rise of online direct-to-consumer retail, and digital integration that blends physical collectibles with augmented reality and NFT experiences.

Key Market Insights

- Action figures and statues dominate the product mix, accounting for nearly 45% of global revenue in 2024.

- Anime and manga IPs are leading growth drivers, capturing 35% of total sales due to global anime popularity and cross-media licensing.

- North America holds 41% of the 2024 market, but the Asia-Pacific region is the fastest-growing, led by Japan, China, and Southeast Asia.

- E-commerce channels contribute 56% of overall sales, underscoring the dominance of online drops, preorders, and direct-to-fan models.

- Premium collectibles priced above USD 200 represent 23% of total revenue, with limited-edition drops commanding higher margins.

- Digital hybrid collectibles (NFC, AR, NFT integrations) are emerging as a high-value niche, bridging traditional collectors and Web 3.0 enthusiasts.

Latest Market Trends

Hybrid Physical-Digital Collectibles

Manufacturers are integrating digital layers into traditional collectibles using NFC authentication, blockchain certificates, and AR-enabled displays. These innovations enhance collectible verification, storytelling, and personalization, allowing fans to own both physical and digital representations of beloved characters. Hybrid drops and limited digital twins are driving new engagement models and expanding addressable audiences beyond traditional collectors.

Limited-Edition Drops and Subscription Models

“Drop culture” has redefined collectible purchasing. Brands now release short production runs, exclusive artist collaborations, and timed sales that build scarcity and hype. Subscription-based collector boxes and membership clubs provide predictable recurring revenues while maintaining exclusivity. This model is gaining traction among adult collectors seeking curated experiences and investment-grade pieces.

Animation Collectibles Market Drivers

Expanding Global Fandom and IP Commercialization

The globalization of anime and animation franchises through streaming platforms such as Netflix, Disney+, and Crunchyroll has created vast fanbases worldwide. This surge in fandom directly translates into heightened demand for physical merchandise, limited-edition statues, and display collectibles. Studios increasingly monetize intellectual property (IP) through licensing partnerships that fuel collectible sales.

Online Retail and Direct-to-Consumer Models

Digital commerce has revolutionized how collectibles are marketed and sold. Direct-to-consumer websites, global marketplaces, and live-stream sales have lowered entry barriers and broadened reach. Collectors now enjoy instant global access to preorders and exclusive editions, leading to higher purchase frequency and better brand-to-fan engagement.

Rise of Premium Collectors and Investment Appeal

Adult collectors now form a significant share of the market, viewing high-end pieces as both lifestyle expressions and long-term investments. Manufacturers are responding with hand-crafted resin statues, numbered editions, and signed art prints that appreciate. As disposable incomes increase, demand for premium collectibles and designer collaborations continues to rise.

Market Restraints

Counterfeiting and Authenticity Concerns

Grey-market imports and counterfeit products erode consumer trust and undercut legitimate brands. Collectors’ reluctance to invest in expensive items without verifiable authenticity remains a major challenge. Companies are combating this through digital verification systems and blockchain-based certificates.

High Production Costs and Supply-Chain Complexity

Premium collectibles require intricate sculpting, limited-run tooling, and costly licensing, resulting in high unit costs. Resin and PVC price volatility, coupled with specialized packaging and global logistics, constrains profitability. These challenges disproportionately affect smaller entrants and limit penetration in price-sensitive regions.

Animation Collectibles Market Opportunities

Digital Authentication and AR Integration

Incorporating smart chips, QR codes, and AR companion experiences represents a major opportunity. Verified authenticity not only combats counterfeiting but also creates new digital engagement layers. The fusion of collectibles with interactive storytelling and mobile AR apps strengthens brand value and collector retention.

Regional Expansion into Emerging Collector Markets

Asia-Pacific, Latin America, and the Middle East are rapidly evolving as high-potential markets. Rising middle-class spending power, growing anime penetration, and online retail adoption are driving demand. Localized product lines, culturally relevant IPs, and regional influencer marketing can unlock significant untapped value for both established brands and new entrants.

Sustainable and Eco-Friendly Collectibles

With increasing global awareness of environmental issues, collectors and manufacturers alike are gravitating toward eco-conscious products. Using biodegradable packaging, recycled materials, and carbon-neutral manufacturing processes is becoming a key differentiator. This sustainability shift aligns with younger consumers’ values and offers reputational benefits for brands.

Product Type Insights

Action Figures & Statues dominate the global animation collectibles market, accounting for approximately 45% of 2024 revenue (USD 3 billion). Their appeal spans both mass-market and premium categories, offering a tangible connection to beloved franchises. Advances in 3D printing and paint application technology have elevated quality and detail, reinforcing their leadership. Plush collectibles and trading cards follow as volume-driven segments, while digital collectibles are emerging rapidly due to NFT and AR integration.

Distribution Channel Insights

E-commerce and online marketplaces lead distribution, contributing roughly 56% of global sales. Direct-to-consumer brand stores and global platforms like Amazon, Shopee, and specialty sites such as Crunchyroll Store and BigBadToyStore have become central to revenue generation. Specialty hobby shops remain vital for premium and collector-grade merchandise, while auction platforms cater to rare or discontinued items, often achieving significant mark-ups.

Price Tier Insights

The premium/high-end tier (> USD 200) represents 23% of market value, driven by scarcity, artistry, and investment potential. Mid-range collectibles (USD 50–200) appeal to the mainstream fandom, combining affordability with quality. Mass-market items (< USD 50) retain large unit sales but contribute lower margins. The premium segment’s rapid CAGR (> 9%) underscores collectors’ willingness to pay for authenticity and craftsmanship.

| By Product Type | By Animation Genre | By Distribution Channel | By End-User Demographics | By Material Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the market with a 41% share in 2024 ( USD 2.75 billion). The U.S. leads due to high disposable income, mature collector communities, and extensive licensing agreements with global studios. Growth is supported by conventions, online retail integration, and widespread pop-culture influence.

Asia-Pacific

Asia-Pacific holds approximately a 27% share ( USD 1.8 billion) and is the fastest-growing region. Japan’s deep collector heritage, China’s booming anime and game fandom, and expanding e-commerce in Southeast Asia drive regional momentum. China is projected to grow 6–7% CAGR to 2030, fueled by domestic animation IPs and cross-border retail exports.

Europe

Europe accounts for a 25% share ( USD 1.67 billion), led by the U.K., Germany, and France. European consumers favor anime-licensed collectibles and limited-edition art prints. High collector maturity, event culture, and strong retail distribution support stable growth.

Latin America

Latin America represents a smaller (10%) yet accelerating share. Brazil and Mexico are primary importers, with fandom communities growing via conventions and social media. Local distributors increasingly secure official licenses, improving market formalization and reducing counterfeit risk.

Middle East & Africa

MEA contributes 7% share ( USD 0.47 billion). The Gulf Cooperation Council (GCC) countries exhibit rising luxury collectible spending, while African markets like South Africa and Nigeria are experiencing gradual growth through e-commerce and pop-culture festivals.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top 15 Companies in the Global Animation Collectibles Market

- Funko Inc. (U.S.)

- Bandai Namco Holdings (Japan)

- Hasbro Inc. (U.S.)

- Good Smile Company (Japan)

- Kotobukiya Co., Ltd. (Japan)

- Mighty Jaxx (Singapore)

- Hot Toys Ltd. (Hong Kong)

- Medicom Toy Corporation (Japan)

- Sideshow Collectibles (U.S.)

- MGA Entertainment (U.S.)

- TOMY Company Ltd. (Japan)

- Playmates Toys (Hong Kong)

- Ravensburger AG (Germany)

- Moose Toys Pty Ltd (Australia)

- VTech Holdings Ltd (Hong Kong)

Recent Developments

- June 2025 – Funko introduced its first blockchain-authenticated collectible series, linking physical figurines to digital twins for secure ownership verification.

- April 2025 – Bandai Namco expanded its premium Tamashii Nations line in China, investing in new resin-casting facilities for large-scale statues.

- March 2025 – Good Smile Company launched “Nendoroid Digital,” an AR companion app enhancing interaction with physical figures through animation overlays.