Aluminum Outdoor Furniture Market Size

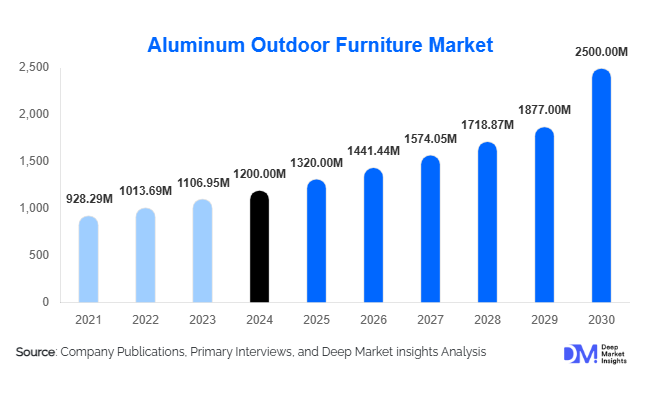

According to Deep Market Insights, the global aluminum outdoor furniture market size was valued at USD 1,200 million in 2024 and is projected to grow from USD 1,320 million in 2025 to reach USD 2,500 million by 2030, expanding at a CAGR of 9.2% during the forecast period (2025–2030). The market growth is primarily driven by the increasing adoption of durable, low-maintenance, and lightweight outdoor furniture solutions for residential, commercial, and hospitality applications. Rising consumer preference for eco-friendly materials and the growing popularity of outdoor living spaces are further propelling demand globally.

Key Market Insights

- Aluminum furniture is increasingly favored for its durability, corrosion resistance, and aesthetic versatility, catering to both residential and commercial customers seeking long-lasting outdoor solutions.

- Integration of smart features, such as solar lighting and weather-adaptive designs, is emerging as a key differentiator, enhancing user experience and product appeal.

- North America dominates demand, with the U.S. and Canada leading due to premium residential and hospitality projects adopting high-quality outdoor furniture.

- Europe remains a fast-growing market, driven by design-conscious consumers and regulatory emphasis on sustainable and recyclable furniture materials.

- Asia-Pacific is witnessing rapid expansion, fueled by urbanization, rising disposable incomes, and growing interest in modern outdoor living solutions in countries like China and India.

- E-commerce and direct-to-consumer channels are increasingly shaping market dynamics by improving accessibility and enabling personalized buying experiences.

Latest Market Trends

Durability and Sustainability Driving Adoption

Aluminum outdoor furniture is gaining traction due to its exceptional durability, low maintenance, and recyclability. Consumers are increasingly prioritizing furniture that withstands varying weather conditions without compromising aesthetics. Eco-conscious buyers prefer aluminum products over traditional wood or plastic options because of their lower environmental impact. Manufacturers are responding by offering powder-coated finishes, modular designs, and corrosion-resistant frameworks. Sustainability initiatives, including the use of recycled aluminum, are enhancing brand appeal and aligning with global trends toward environmentally responsible living. Additionally, modular and customizable designs allow consumers to adapt outdoor spaces for multi-functional use, further strengthening aluminum furniture’s market position.

Technological Integration in Outdoor Furniture

Smart and connected furniture is redefining outdoor living. Features such as integrated solar lighting, heating modules, and app-controlled lounge adjustments are increasingly adopted in premium segments. These technological enhancements appeal to affluent residential customers and upscale hospitality providers seeking convenience and modern aesthetics. Companies are investing in R&D to combine comfort, design, and tech-driven functionality, catering to younger, tech-savvy homeowners. The integration of Internet of Things (IoT) technology, weather sensors, and UV-protective coatings ensures longer product life and optimized performance under diverse environmental conditions.

Aluminum Outdoor Furniture Market Drivers

Rising Outdoor Living Trends

The growing popularity of outdoor spaces for leisure, dining, and entertainment has significantly increased demand for durable and stylish furniture. Homeowners and hospitality providers are investing in outdoor lounges, patios, and rooftop areas, with aluminum furniture offering the ideal combination of strength, lightweight design, and weather resistance. Urban residential developments and premium resorts increasingly showcase aluminum outdoor sets as standard amenities to enhance property appeal.

Eco-Friendly Material Preference

Consumer awareness about sustainability and recyclability is a major driver. Aluminum, being 100% recyclable and corrosion-resistant, aligns with environmentally conscious choices. Manufacturers emphasizing sustainable production processes, powder-coated finishes, and recyclable packaging are attracting eco-sensitive customers. Regulatory encouragement in regions like Europe further strengthens demand for green outdoor furniture options.

Versatility and Design Appeal

Aluminum’s malleability allows diverse product designs, from classic patio chairs to modern modular seating. This adaptability is driving adoption across residential, commercial, and hospitality sectors. The material also supports lightweight yet structurally strong furniture, allowing easy mobility and long-term functionality, which is particularly appealing for urban and luxury applications.

Market Restraints

High Production Costs

While aluminum offers long-term durability, its initial production cost is higher than alternative materials like wood or plastic. This pricing challenge can limit adoption in cost-sensitive segments or emerging markets, necessitating strategic pricing, promotions, and financing options to expand reach.

Competition from Alternative Materials

Wood, plastic, and synthetic rattan continue to compete by offering varied aesthetics at lower price points. These alternatives provide flexibility in design and affordability, creating a barrier for aluminum furniture manufacturers to capture budget-conscious consumers, particularly in developing regions.

Aluminum Outdoor Furniture Market Opportunities

Expansion in Emerging Markets

Rapid urbanization and increasing disposable income in the Asia-Pacific and Latin America are creating new demand for outdoor furniture. Manufacturers can tap into these markets by offering region-specific designs, local distribution partnerships, and targeted marketing campaigns. Government initiatives supporting urban lifestyle enhancements also present opportunities for growth in residential and public spaces.

Technological Enhancements

Integrating smart features such as solar panels, weather sensors, and automated maintenance systems offers differentiation in premium segments. Early adoption of connected furniture in luxury resorts and smart residential complexes allows companies to capture high-margin opportunities and increase brand loyalty.

Eco-Conscious Product Lines

With global emphasis on sustainability, offering products made from recycled aluminum and environmentally friendly coatings provides a competitive edge. Marketing eco-conscious initiatives, aligning with regulations, and obtaining certifications can open new markets and attract environmentally aware consumers.

Product Type Insights

Tables and chairs dominate the market segment due to their essential use in residential and hospitality outdoor spaces. Aluminum’s lightweight and modular properties allow easy design customization, enhancing adoption. In 2024, tables and chairs accounted for approximately 42% of the global market, reflecting consumer preference for multifunctional and durable furniture for outdoor settings.

Application Insights

Residential applications lead globally, driven by homeowners investing in patios, balconies, and rooftop gardens. In 2024, the residential segment contributed nearly 50% of total market revenue. Hospitality and commercial applications are growing rapidly due to the demand for long-lasting, low-maintenance furniture in hotels, resorts, and restaurants. New applications, including smart and multifunctional furniture for urban outdoor spaces, are emerging.

Distribution Channel Insights

Online platforms and e-commerce are the fastest-growing channels, offering convenience, real-time reviews, and customization options. Offline retail continues to serve traditional buyers, with specialty furniture stores in Europe and North America catering to high-end consumer segments. Direct-to-consumer models are increasingly used to improve margins and enable bespoke product offerings.

| By Product Type | By Application / End-Use | By Distribution Channel | By Material Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at approximately 35% in 2024, led by the U.S. and Canada. Premium residential projects and the hospitality sector drive demand, with consumers prioritizing durability, design, and low maintenance. Urban outdoor spaces and luxury resorts are major adoption areas, bolstered by high disposable incomes and lifestyle trends.

Europe

Europe accounted for 28% of the global market in 2024, with Germany, France, and the U.K. leading adoption. Sustainability regulations, design preferences, and rising residential investments in outdoor living spaces are primary drivers. Europe is also the fastest-growing market for eco-friendly and smart outdoor furniture.

Asia-Pacific

Asia-Pacific is the fastest-growing region, particularly in China, India, and Japan, due to urbanization, increasing disposable income, and expanding hospitality projects. Rapid adoption of modern outdoor living concepts and government-supported infrastructure projects is contributing to growth.

Latin America

Brazil, Mexico, and Argentina show moderate growth. Emerging middle-class consumers and hotel developments are driving adoption, with a focus on affordable yet durable furniture solutions.

Middle East & Africa

High demand in the UAE, Saudi Arabia, and South Africa is driven by luxury residential and hospitality projects. Government investment in urban and tourism infrastructure supports market growth, while extreme climate conditions favor aluminum due to its weather resistance.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Aluminum Outdoor Furniture Market

- Brown Jordan

- LANE VENTURE

- OW Lee

- Hanamint

- Tropitone

- Kingfisher Outdoor

- Telescope Casual

- Woodard

- Gloster

- Kettal

- Royal Botania

- Dedon

- Harmonia Living

- Fermob

- Gensun

Recent Developments

- In March 2025, Brown Jordan launched a new eco-friendly outdoor furniture collection with 100% recycled aluminum and powder-coated finishes for North America.

- In January 2025, Gloster introduced modular smart outdoor seating systems with integrated solar-powered lighting and IoT-enabled features in Europe and Asia-Pacific.

- In June 2025, Tropitone expanded its operations in India, targeting high-growth residential and hospitality sectors with region-specific aluminum furniture designs.