Aloe Vera Extract Market Size

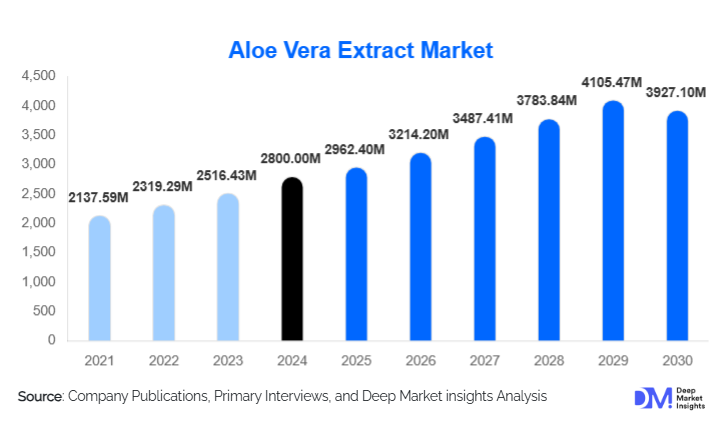

According to Deep Market Insights, the global aloe vera extract market size was valued at USD 2,800 million in 2024 and is projected to grow from USD 2,962.40 million in 2025 to reach USD 3,927.10 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer preference for natural and botanical ingredients, increasing adoption in cosmetics, personal care, and functional beverages, and technological advancements in extraction and formulation that enhance bioavailability and product stability.

Key Market Insights

- Natural and organic formulations are increasingly shaping demand, with consumers preferring clean-label, plant-based ingredients in skincare, supplements, and beverages.

- Functional beverages and nutraceuticals are expanding rapidly, incorporating aloe vera for digestive, immune, and wellness benefits.

- Asia-Pacific dominates production and consumption, driven by India, China, and Southeast Asia, with strong traditional medicine use and growing industrial processing capacity.

- Europe is the fastest-growing regional market, due to premiumization, regulatory standards, and high consumer willingness to adopt certified and organic extracts.

- Technological integration, including cold-press extraction, freeze-drying, and microencapsulation, is enhancing product quality and bioactive content, enabling higher-value applications.

- Export-driven demand is rising, particularly from Asia to North America and Europe, supporting growth in cosmetics, supplements, and functional beverages.

What are the latest trends in the aloe vera extract market?

Organic and Premium Extracts

Manufacturers are increasingly focusing on organic-certified aloe extracts, which command premium pricing and meet consumer demand for clean-label products. Certifications such as USDA Organic and IASC (International Aloe Science Council) provide credibility, allowing companies to differentiate themselves in a competitive landscape. The premium segment is also being driven by wellness-focused applications in cosmetics and nutraceuticals, where traceability and high bioactive content are valued by consumers.

Functional Beverage Integration

The functional beverage segment is witnessing substantial growth, with aloe vera being incorporated into juices, wellness tonics, and dietary supplements. Consumer interest in digestive health, hydration, and immunity support is prompting beverage companies to formulate aloe-enriched products. Innovations in low-calorie, sugar-free, and fortified aloe drinks are creating new avenues for extract producers, particularly in North America, Europe, and the Asia-Pacific.

What are the key drivers in the aloe vera extract market?

Rising Consumer Demand for Natural Ingredients

Consumers increasingly prefer plant-based and naturally derived ingredients in personal care, food, and supplement products. Aloe vera extract’s anti-inflammatory, hydrating, and soothing properties make it ideal for these applications. The rising adoption of clean-label products is a key factor driving global market growth, particularly in cosmetics and functional beverages.

Health & Wellness Trends

Growing awareness of the health benefits of aloe vera, including immune support, digestive health, and anti-inflammatory effects, has increased its use in nutraceuticals, dietary supplements, and functional beverages. The wellness-driven lifestyle shift in developed and emerging markets has contributed to strong and sustained demand for aloe-derived products.

Technological Advancements

Innovations in extraction and formulation, including cold-pressing, freeze-drying, and microencapsulation, are improving the stability, potency, and bioavailability of aloe extracts. This technological adoption enables expansion into high-value applications in pharmaceuticals and supplements while supporting premium positioning in cosmetics and personal care.

What are the restraints for the global market?

Raw Material Supply Volatility

Aloe vera cultivation is subject to climate variability, seasonal fluctuations, and agricultural challenges. Volatility in raw leaf supply can impact extract availability and pricing, posing challenges to manufacturers and limiting consistent growth.

Regulatory and Quality Standards

Maintaining consistent bioactive content and meeting stringent quality regulations for food, pharmaceutical, and cosmetic applications are critical challenges. Variability in raw materials, risk of contamination, and adherence to international standards such as IASC and FDA guidelines can constrain market growth.

What are the key opportunities in the aloe vera extract market?

Expansion in Organic and Premium Extracts

The organic and certified segment offers high-margin opportunities, appealing to consumers who prioritize natural, traceable, and sustainably sourced products. Investment in organic farming, vertical integration, and certification programs can help companies capture premium market share in cosmetics, nutraceuticals, and functional beverages.

Functional Beverage and Nutraceutical Innovation

Rising consumer health consciousness and demand for functional drinks are creating opportunities to integrate aloe extracts into juices, wellness beverages, and dietary supplements. Innovations in low-calorie, sugar-free, and fortified formulations are expanding product portfolios and driving growth.

Technological Advancements in Extraction

Adoption of advanced extraction techniques enhances potency, stability, and bioactive content. Companies leveraging technologies such as microencapsulation and freeze-drying can develop premium and high-performance products, opening new applications in pharmaceuticals and cosmetics while strengthening brand differentiation.

Product Type Insights

Liquid aloe vera extract remains the leading product type, accounting for approximately 64% of the global market in 2024. Its dominance is driven by its versatility across various applications, including beverages, cosmetics, and pharmaceuticals, as well as its superior bioavailability, which ensures maximum therapeutic and functional benefits. Powdered and encapsulated forms are rapidly gaining traction in the nutraceutical and supplement sectors due to their convenience, stability, and long shelf life, catering to global consumer preference for ready-to-use health products. Gel extracts continue to lead in skincare applications, leveraging aloe’s natural moisturizing, soothing, and anti-inflammatory properties, particularly in premium and organic beauty products. Innovation in formulation, such as combination with other botanicals or functional ingredients, is further driving product diversification and adoption across industries.

Application Insights

Cosmetics and personal care remain the largest application segment, representing around 48% of the global market in 2024. Aloe vera extract is extensively used in skincare, haircare, and beauty products due to its hydrating, healing, and soothing properties, which appeal to the rising consumer demand for natural and clean-label formulations. Functional beverages and nutraceuticals are the fastest-growing applications, fueled by increasing awareness of aloe’s digestive, immunity-boosting, and wellness benefits. Pharmaceutical applications, including wound care, topical anti-inflammatory products, and therapeutic formulations, are expanding steadily, supported by advancements in extraction technology and formulation techniques that enhance bioactive retention. Overall, applications across industries are being driven by consumer preference for natural, multipurpose, and health-oriented ingredients.

Distribution Channel Insights

Offline retail continues to dominate the aloe vera extract distribution landscape, particularly through supermarkets, specialty stores, and pharmacies, supporting widespread consumer access for both cosmetic and beverage applications. However, online channels are increasingly influential, enabling direct-to-consumer (D2C) sales, subscription-based models, and e-commerce solutions. The growth of online sales is accelerated by consumer demand for convenience, product transparency, and premium or organic-certified offerings. Social media marketing, influencer endorsements, and digital campaigns are further strengthening brand visibility and driving adoption in younger demographics. Hybrid distribution models combining online and offline channels are becoming essential for global market penetration and premium product positioning.

End-Use Industry Insights

Cosmetic manufacturers and nutraceutical companies are the largest consumers of aloe extracts globally, leveraging its multifunctional properties to enhance product differentiation. Functional beverage producers represent a rapidly expanding end-use segment, incorporating aloe for digestive health, hydration, and immunity support. Export-driven demand is notable from Asia-Pacific to Europe and North America, primarily driven by premium skincare, nutraceuticals, and beverage formulations. Emerging end-use applications in animal nutrition and ingestible beauty supplements present additional growth opportunities, particularly in regions where wellness and natural ingredient adoption are accelerating. The continuous integration of aloe extracts into diverse product portfolios positions it as a high-value ingredient across multiple end-use industries.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the aloe vera extract market with approximately 32% of global revenue in 2024. India and China are the largest producers, supported by extensive cultivation infrastructure and favorable climatic conditions for high-yield aloe farming. Traditional medicine practices and widespread consumer acceptance of botanical ingredients in cosmetics and wellness products drive regional demand. Japan and Southeast Asia contribute to high-value applications, particularly in premium skincare and functional beverages. Growth in the region is supported by increasing industrial processing capabilities, rising health awareness, government incentives for agriculture and organic production, and a strong export orientation targeting Europe and North America. The widespread adoption of liquid aloe extract in beverage and cosmetic formulations underpins the region’s market leadership.

Europe

Europe is the fastest-growing regional market, driven by Germany, the UK, and France. Key growth drivers include rising consumer preference for organic and certified ingredients, premiumization in cosmetics and personal care, and stringent regulatory standards that encourage high-quality extract usage. Clean-label and wellness-oriented product trends are expanding demand for aloe extracts in both nutraceuticals and functional beverages. Investments in organic farming, sustainable sourcing, and technologically advanced extraction methods further support regional growth. Additionally, increasing awareness of aloe’s therapeutic and cosmetic benefits among European consumers is boosting adoption across premium skincare and dietary supplement segments.

North America

The U.S. and Canada are major consumption markets, particularly for functional beverages, supplements, and cosmetics. High disposable income, established wellness ecosystems, and strong consumer awareness of natural ingredients drive steady demand. Growth is further supported by innovation in product formulations, including functional drinks and natural personal care products incorporating liquid aloe extracts for maximum bioactivity. Regulatory compliance and quality certifications are also significant drivers, ensuring consumer trust and market stability. The region’s robust distribution networks, both offline and online, enhance accessibility to high-value aloe-based products.

Latin America

Brazil and Mexico are emerging markets with rising consumer interest in functional beverages and cosmetic applications. Increasing awareness of natural wellness products, higher disposable income among middle- and upper-class populations, and the growing popularity of clean-label and organic products drive market growth. Local aloe cultivation and processing infrastructure are expanding to support domestic demand, while export potential to North America and Europe provides additional market incentives. The integration of aloe in skincare and beverage formulations, particularly in liquid extract form, is facilitating regional adoption.

Middle East & Africa

Africa, particularly South Africa and Kenya, serves as a key cultivation hub, ensuring raw material availability and supporting global export supply chains. The Middle East, including the UAE, Saudi Arabia, and Qatar, is an emerging demand market for premium aloe-based products, driven by high disposable income, increasing wellness awareness, and a preference for luxury and functional personal care items. Adoption is further accelerated by the use of aloe extracts in premium cosmetic formulations and functional beverages, supported by urbanization, lifestyle changes, and government initiatives promoting natural health products. Investments in extraction technology and product innovation in these regions are also contributing to market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Aloe Vera Extract Market

- Terry Laboratories

- Lily of the Desert (Aloeceuticals)

- Aloecorp

- Foodchem International Corporation

- Aloe Laboratories

- Natural Aloe Costa Rica

- Aloe Farms

- Pharmachem Laboratories

- Patanjali Ayurved

- Herbalife Nutrition Ltd.

- Green Leaf Aloe

- Forever Living Products

- Aloe Life

- MexiAloe

- Direct Aloe

Recent Developments

- In January 2025, Terry Laboratories expanded its cold-press extraction facility to increase production of high-potency aloe liquid extracts for nutraceutical applications.

- In March 2025, Lily of the Desert introduced an organic-certified aloe extract line targeting premium skincare and dietary supplement markets in North America and Europe.

- In June 2025, Aloecorp launched a freeze-dried aloe powder product to enhance shelf stability and bioactive retention for global functional beverage manufacturers.