Alcohol Wipes Market Size

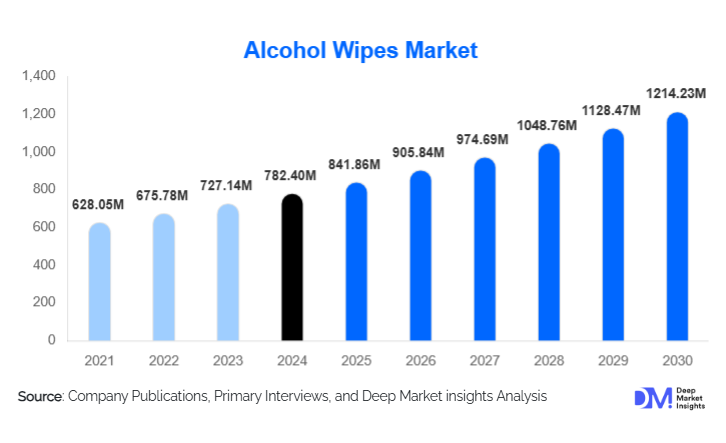

According to Deep Market Insights, the global alcohol wipes market size was valued at USD 782.4 million in 2024 and is projected to grow from USD 841.86 million in 2025 to reach USD 1,214.23 million by 2030, expanding at a CAGR of 7.6 during the forecast period (2025–2030). The alcohol wipes market growth is primarily driven by rising hygiene awareness, expanding healthcare infrastructure, increasing institutional demand for rapid disinfection solutions, and the growing adoption of portable sanitization products across consumer and commercial environments.

Key Market Insights

- Healthcare and institutional sanitation remain the largest demand drivers, supported by strict infection-control guidelines across hospitals, clinics, and laboratories.

- Biodegradable and eco-friendly alcohol wipes are gaining rapid traction, driven by sustainability mandates and consumer preference for green hygiene solutions.

- North America dominates the global market, supported by advanced healthcare systems and strong consumer hygiene adoption.

- Asia-Pacific is the fastest-growing region, propelled by rising middle-class spending, expanding hospital networks, and increased hygiene awareness post-pandemic.

- Isopropyl-alcohol-based wipes (≥70%) lead the formulation segment due to their high disinfectant efficacy and widespread use in medical and industrial settings.

- E-commerce and direct-to-consumer (D2C) channels continue to surge, driven by subscription models, bulk discounts, and ease of replenishment.

What are the latest trends in the alcohol wipes market?

Sustainable & Biodegradable Wipes Accelerating Market Transition

Manufacturers are increasingly shifting toward biodegradable substrates such as cotton, bamboo fiber, and plant-based nonwovens to address environmental concerns surrounding wipe disposal. These eco-friendly options significantly reduce landfill waste and align with evolving regulatory frameworks targeting single-use plastics. Brands are also experimenting with compostable packaging, plastic-free containers, and refillable pouches. This sustainability shift is becoming a core differentiator, appealing to environmentally conscious consumers and institutions seeking to reduce their carbon footprint. Demand for “green-grade” alcohol wipes is expected to rise consistently through 2030 as new formulations improve durability and alcohol retention.

Smart Packaging and Technologically Enhanced Wipe Solutions

Technology adoption is emerging as a key trend, particularly in commercial and healthcare settings. Smart dispensers, IoT-integrated usage trackers, and touchless wipe stations are being deployed in hospitals, airports, offices, and retail environments. These systems help monitor refill cycles, ensure compliance with sanitation protocols, and reduce product wastage. On the consumer side, compact resealable packs, moisture-lock lids, and leak-proof canisters enhance convenience and portability. In industrial and electronics applications, specialized low-lint alcohol wipes with static-resistant properties are seeing increased demand, reflecting a broader move toward precision hygiene solutions.

What are the key drivers in the alcohol wipes market?

Growing Healthcare Infrastructure and Infection-Control Protocols

One of the most significant drivers for alcohol wipes is the continued expansion of global healthcare facilities and increasing emphasis on strict infection-control measures. Hospitals, clinics, diagnostic labs, and ambulatory care centers rely heavily on alcohol wipes for rapid disinfection of medical tools, surfaces, and skin preparation. Regulatory bodies mandate regular cleaning cycles, and alcohol wipes with their fast action and ease of use are widely adopted as a standard hygiene tool. The sustained demand from medical environments provides a strong base-level market stability.

Rising Consumer Hygiene Awareness and On-the-Go Sanitization Demand

Consumer demand for convenient, portable, and effective sanitization solutions has surged, driven by heightened hygiene awareness and lifestyle changes. Alcohol wipes are increasingly used for personal items, travel, electronics, gyms, workplaces, and household surfaces. The ease of on-the-go sanitization is influencing purchasing behavior, with multipacks, pocket-sized packs, and family bundles becoming mainstream. The rise of remote work and hybrid workplaces has further supported demand for personal disinfecting products, ensuring strong momentum across both retail and e-commerce channels.

What are the restraints for the global market?

Environmental Impact and Waste Management Concerns

A major restraint for the alcohol wipes market is the environmental challenge posed by synthetic nonwoven substrates that are not biodegradable. Improper disposal contributes to landfill accumulation and microplastic pollution. Increasing regulations on single-use plastics in several regions, especially in Europe, create additional compliance requirements for manufacturers. This places pressure on companies to adopt greener materialsoften at a higher potentially affecting product margins and pricing.

Raw Material Price Volatility and Supply Chain Disruptions

The cost of key raw materials such as isopropyl alcohol, ethanol, and synthetic nonwovens is subject to market fluctuations, often influenced by industrial demand, regulatory shifts, or global supply chain disruptions. Volatility can result in production delays and increased manufacturing costs, which can be difficult to pass on to price-sensitive segments like institutional buyers. For new entrants, high production costs and competitive pricing further complicate market penetration.

What are the key opportunities in the alcohol wipes industry?

Growth of Biodegradable & Premium Hygiene Categories

Demand for biodegradable wipes is creating a premium, high-margin segment for industry players. Brands that invest early in sustainable materials, plant-based substrates, and low-waste packaging can secure a strong competitive advantage. As consumers increasingly prioritize eco-friendly products, this segment is poised to become a critical growth engine. Additionally, premium wipes with skin-friendly additives, dual-alcohol formulations, and dermatologically tested ingredients offer opportunities for product differentiation.

Institutional Expansion Across Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East present significant opportunities for alcohol wipe manufacturers. Rapid expansion of healthcare facilities, public transportation systems, hospitality infrastructure, and corporate offices fuels demand for professional-grade sanitization products. Large-scale institutional procurement, government hygiene campaigns, and rising infection-control awareness in developing markets offer strong growth potential, particularly for cost-effective, high-volume product lines.

Product Type Insights

Surface and equipment disinfecting wipes represent the largest share of the market, widely used in hospitals, laboratories, commercial buildings, and transportation hubs. Their broad-spectrum antimicrobial efficacy and fast evaporation rate make them essential for high-touch surface disinfection. Hand and body sanitizing wipes are experiencing strong consumer growth due to rising personal hygiene awareness. Specialty wipes, including electronics-safe alcohol wipes and sterile medical-grade wipes, are gaining traction in industrial and clinical niches, driven by precision cleaning requirements. Facial and body bath wipes cater to personal care needs, with demand boosted by travel, fitness, and on-the-go lifestyles.

Application Insights

Healthcare remains the largest application segment, with alcohol wipes used extensively for equipment disinfection, skin prep, and rapid cleaning of healthcare environments. Commercial and institutional settingsincluding offices, hotels, restaurants, hospitals, and public transportrepresent rapidly expanding applications due to heightened sanitation standards. Household and personal-use wipes are seeing strong adoption for everyday cleaning and portable hygiene. Industrial applications, such as electronic manufacturing, cleanrooms, and food production, require specialized low-residue, anti-static, or sterile alcohol wipes, creating opportunities for premium-grade product lines.

Distribution Channel Insights

Supermarkets and hypermarkets dominate the distribution landscape due to high consumer footfall and broad product visibility. Pharmacies and drug stores maintain strong positioning, especially for medical-grade and dermatologically tested wipes. Online platforms are the fastest-growing channel, driven by bulk-order convenience, auto-replenishment subscriptions, and direct brand-to-consumer (D2C) strategies. Institutional procurement channelscovering hospitals, government facilities, and enterprisesaccount for substantial volume purchases, with increasing reliance on long-term supply contracts and B2B platforms.

End-Use Insights

The healthcare sector leads the market, accounting for the largest share due to continuous demand for sterilization and infection control. Commercial facilitiesincluding hospitality, corporate offices, gyms, retail, and airportsrepresent a major growth segment as hygiene protocols become standardized. Personal and household users contribute steadily through demand for quick-cleaning, travel-friendly wipes. Industrial end-users, especially in electronics and cleanrooms, rely on high-purity alcohol wipes for delicate surface preparation, contributing to premium product demand.

| By Product Type | By Material Type | By Packaging Type | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, driven by advanced healthcare systems, strict sanitation regulations, and strong consumer hygiene adoption. The U.S. leads the region with widespread use of alcohol wipes across hospitals, homes, offices, and industrial facilities. Retail penetration is high, and the region is an early adopter of biodegradable and premium-grade wipes. Commercial and institutional demand continues to strengthen due to standardized cleaning protocols.

Europe

Europe exhibits strong demand, particularly from the U.K., Germany, France, Italy, and Spain. The region is a global leader in sustainability-driven wipes adoption, with consumers and institutions strongly favoring biodegradable and plastic-free solutions. Stringent regulations regarding disinfectant claims, labeling, and environmental impact shape product development. Healthcare and commercial settings remain key demand contributors.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by expanding healthcare infrastructure, rising middle-class spending, and heightened hygiene awareness. China and India dominate due to large population bases and significant investment in hospitals and public sanitation systems. Japan, South Korea, and Australia represent mature markets with high adoption of premium, skin-friendly, and technologically sophisticated wipe solutions.

Latin America

Latin America shows steady growth, led by Brazil, Mexico, and Argentina. Institutional and commercial applications such as hospitality, corporate offices, and clinics contribute strongly to developing demand. Consumer uptake is rising with improved retail distribution and growing awareness of hygiene practices, although price sensitivity remains a key factor.

Middle East & Africa

The Middle East & Africa region is expanding steadily, driven by strong demand from hospitals, airports, hotels, and shopping malls. Countries such as the UAE, Saudi Arabia, and South Africa are key markets. Increased public health investment, tourism-driven sanitation needs, and growing retail accessibility are supporting uptake. Africa’s developing healthcare infrastructure offers long-term growth potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Alcohol Wipes Market

- GAMA Healthcare

- 3M Company

- The Clorox Company

- Procter & Gamble (P&G)

- Kimberly-Clark Corporation

- Reckitt Benckiser Group

- Unilever

- Ecolab Inc.

- Nice-Pak Products Inc.

- Gojo Industries

- Cardinal Health

- PDI (Professional Disposables International)

- Diamond Wipes International

- Berkshire Corporation

- Edgewell Personal Care

Recent Developments

- In 2024, leading manufacturers expanded biodegradable alcohol wipe product lines to align with sustainability mandates across Europe and North America.

- In 2024, several companies introduced smart dispenser systems for institutional clients, enabling real-time tracking of wipe consumption and refill frequency.

- In 2023–2024, major players invested in new production facilities in the Asia-Pacific to meet rising regional demand and reduce dependence on imported raw materials.