Air Sports Market Size

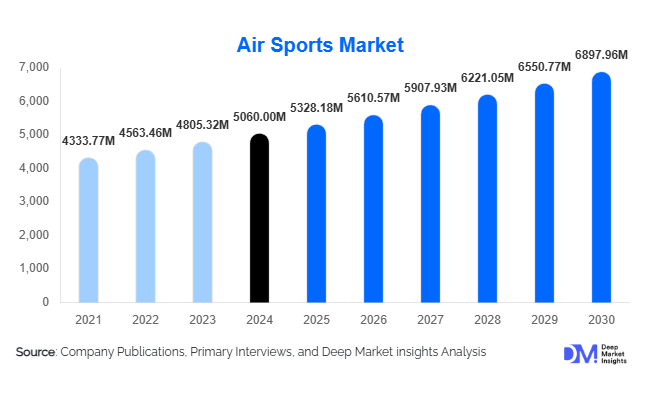

According to Deep Market Insights, the global air sports market size was valued at USD 5,060.00 million in 2024 and is projected to grow from USD 5,328.18 million in 2025 to reach USD 6,897.96 million by 2030, expanding at a CAGR of 5.3% during the forecast period (2025–2030). The air sports market growth is primarily driven by increasing participation in adventure and experiential tourism, technological advancements in safety and performance equipment, and the expansion of air-sport tourism infrastructure across emerging regions.

Key Market Insights

- Rising global enthusiasm for adventure and experiential leisure is propelling participation in paragliding, skydiving, hang-gliding, and ultralight aviation.

- Technological innovation in materials and safety systems, such as automatic activation devices and lightweight composites, is enhancing accessibility and trust among participants.

- North America dominates the air sports market with strong infrastructure, disposable income, and mature participation networks.

- Asia-Pacific is the fastest-growing region, supported by expanding middle-class tourism spending and government promotion of adventure tourism.

- Adventure tourism integration in destinations like India, Nepal, and Latin America is fueling new commercial operator demand.

- Digital platforms, training apps, and AR-based instruction are transforming safety management and training efficiency.

Latest Market Trends

Adventure Tourism Integration Boosting Air Sports Participation

Adventure tourism operators worldwide are embedding air sports into their offerings, from tandem paragliding and skydiving to hot-air balloon flights and ultralight tours. Mountainous regions in Asia and Europe, coastal areas, and desert tourism hubs in the Middle East are rapidly developing new flight zones and certified takeoff sites. Governments are recognizing the economic potential of these sports, incorporating them into broader tourism promotion initiatives. This convergence of leisure and adventure travel is significantly increasing participation rates and demand for equipment.

Smart Safety Gear and Digital Monitoring Systems

Manufacturers are introducing smart parachute systems, telemetry-based harnesses, and integrated flight analytics to improve safety and training precision. Automatic deployment systems, GPS-based flight tracking, and mobile applications for weather and airspace updates are becoming standard across equipment classes. Clubs and rental fleets are adopting digital inspection and maintenance records to reduce downtime and enhance reliability. This technology-driven evolution is expected to strengthen consumer confidence and stimulate market adoption among first-time flyers and recreational participants.

Air Sports Market Drivers

Growing Popularity of Experience-Based Leisure

The global shift toward experience-driven lifestyles is significantly fueling demand for adventure activities. Air sports, offering adrenaline, scenic immersion, and social-media-friendly experiences, are attracting millennials, Gen Z, and affluent adventure travelers alike. The affordability of introductory tandem flights and the availability of training schools worldwide make participation easier than ever.

Advances in Equipment Design and Affordability

Continuous improvements in lightweight materials, modular harness systems, and aerodynamic design have made equipment safer and more affordable. Manufacturers’ adoption of carbon fiber, Kevlar, and Dyneema composites has reduced overall weight while enhancing durability. Rental-based and subscription models are lowering ownership barriers, enabling wider access in emerging markets.

Government Support and Adventure Tourism Policies

Governments in regions such as Asia-Pacific, Eastern Europe, and Latin America are prioritizing adventure tourism through infrastructure investment, streamlined certification processes, and safety standardization. Designated air-sport corridors and public-private partnerships for paragliding and balloon festivals are expanding participation. These supportive measures underpin steady market expansion through 2030.

Market Restraints

Safety Risks and Liability Costs

Despite improved safety mechanisms, air sports continue to face perception barriers due to potential injury risk. High insurance premiums, liability coverage costs, and stringent regulatory compliance can limit smaller operators’ profitability. Incidents, though rare, can significantly impact public perception and regional participation rates.

Seasonality and Infrastructure Limitations

Air sports are heavily weather-dependent, restricting year-round operations in many regions. Seasonal wind and thermal variations, alongside the requirement for specific terrains, limit accessibility. In emerging destinations, inadequate airspace zoning and a lack of specialized takeoff and landing infrastructure pose logistical challenges, constraining growth potential.

Air Sports Market Opportunities

Expansion of Adventure Tourism Ecosystems

Rising global adventure tourism spending offers a major opportunity for air-sports operators, training schools, and equipment suppliers. Destinations such as the Himalayas, Southeast Asia, and Latin America are becoming prominent hubs for tandem paragliding, skydiving, and ultralight flights. Companies can form alliances with local tourism boards and resorts to embed certified air-sport experiences into destination itineraries.

Technological Innovation and Smart Equipment

New entrants focusing on smart sensors, IoT-enabled gear, and AR-based pilot training stand to gain significant market share. Digital telemetry for altitude, temperature, and performance tracking allows real-time monitoring and predictive maintenance for fleets. OEMs integrating connected ecosystems, where flight data syncs to safety dashboards, can command premium pricing and loyalty from commercial operators.

Regulatory Support and Institutional Adoption

Adventure-sport-friendly policies, including simplified licensing and dedicated flight corridors, are creating conducive environments for growth. Institutional users such as the military, rescue teams, and academic training centers are adopting air-sport-style parachuting and gliding programs. Vendors collaborating with government and educational institutions for standardized certification will benefit from long-term contracts and credibility.

Product Type Insights

Paragliding & Paramotor Equipment dominates the global air-sports market, accounting for approximately 38% of total market share in 2024. The segment’s leadership stems from lower entry barriers, broad geographic suitability, and widespread adoption by recreational participants. Affordable tandem flights and tourism-linked packages are boosting unit demand, while technological upgrades, such as improved wing fabrics and modular harnesses, are expanding both individual and commercial usage.

Application Insights

Recreational Air Sports holds the largest market share, representing nearly 53% of the global air-sports market in 2024. This segment benefits from mass participation through tourism, club flying, and leisure events. Competitive and professional segments, while smaller, continue to grow as international federations formalize championship circuits, driving sponsorship and media visibility.

End-User Insights

Individual Consumers and Enthusiasts remain the core demand base, comprising around 46% of 2024 revenue. Growth is driven by rising disposable incomes and a cultural shift toward outdoor recreation. Training schools and adventure-tourism operators are emerging as the fastest-growing end-use categories, supporting ecosystem development through equipment rentals, certification programs, and partnerships with resorts.

| By Sport Type | By Equipment Type | By Participant Type | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global air-sports market with a 35% share in 2024. The United States dominates regional demand owing to a well-established adventure-sport culture, abundant flight zones, and high consumer spending. Canada contributes through its expanding paragliding and skydiving tourism sectors. Market maturity keeps growth moderate (4-5% CAGR), but ongoing equipment modernization sustains profitability.

Europe

Europe represents roughly 28% of the global market share in 2024, supported by strong traditions in paragliding, hang-gliding, and ultralight sports across France, Germany, Italy, and Switzerland. Regulation-focused safety improvements, expanding tourism programs, and organized competitions maintain steady demand. Mountainous and coastal destinations continue to attract domestic and inbound adventure travelers.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, accounting for 22% of global demand in 2024 and projected to record a CAGR above 8%. Rapid growth in China, India, Japan, and Australia is driven by middle-class affluence, social-media influence, and expanding government-backed adventure infrastructure. Regions such as Himachal Pradesh (India) and Guilin (China) are emerging as international air-sport destinations.

Latin America

Latin America holds approximately a 10% share in 2024, with Brazil and Argentina leading due to favorable geography and tourism initiatives. The expansion of adventure tourism, coupled with international event hosting, is fostering local manufacturing and operator ecosystems.

Middle East & Africa

Accounting for nearly 5% of the global market in 2024, the Middle East & Africa region offers significant untapped potential. The UAE and Saudi Arabia are pioneering high-end skydiving and ballooning experiences, while South Africa remains a key recreational hub. Investment in luxury adventure offerings and supportive tourism policies signal steady future growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Air Sports Market

- Ozone Gliders Ltd.

- SUP’AIR SAS

- Apco Aviation Ltd.

- Aerodyne Research LLC

- Velocity Sports Equipment Inc.

- Mirage Systems Inc.

- Sun Path Products Inc.

- Fly Neo Ltd.

- Dudek Paragliders SJ

- North Wing LLC

- Firebird Skydiving Equipment GmbH

- Advance Composite Engineering AG

- Sky Country Ltd.

- Gin Gliders Inc.

- Paratec GmbH

Recent Developments

- In June 2025, Ozone Gliders introduced a new generation of ultra-light paragliding wings using bio-composite fabrics, reducing overall weight by 15% while improving glide efficiency.

- In April 2025, Aerodyne Research announced its cloud-based telemetry platform for parachute performance analytics, enabling real-time monitoring for training schools and tandem operators.

- In January 2025, SUP’AIR launched its smart safety harness line featuring integrated GPS and automated emergency alert systems aimed at improving solo-flyer safety.