AI in Sports Market Size

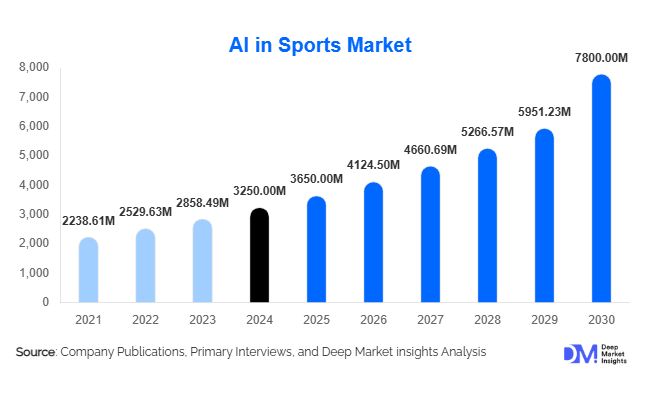

According to Deep Market Insights, the global AI in Sports market size was valued at USD 3,250 million in 2024 and is projected to grow from USD 3,650 million in 2025 to reach USD 7,800 million by 2030, expanding at a CAGR of 13% during the forecast period (2025–2030). The AI in Sports market growth is primarily driven by increasing adoption of AI-powered performance analytics, injury prevention systems, and fan engagement solutions, along with the rapid integration of wearable devices, computer vision technologies, and predictive analytics across professional and recreational sports.

Key Market Insights

- AI is revolutionizing player performance optimization, enabling real-time monitoring, injury prediction, and tactical analysis for competitive advantage.

- Wearables and biometric sensors are transforming training and rehabilitation, allowing data-driven insights for athletes, coaches, and medical teams.

- North America dominates the AI in Sports market, driven by adoption in the NFL, NBA, and NHL, as well as strong investment in sports technology infrastructure.

- Asia-Pacific is the fastest-growing region, fueled by expanding cricket, football, and esports leagues in India, China, and South Korea.

- Europe maintains a significant market share with extensive adoption across professional football leagues and government-supported AI initiatives.

- Technological adoption, including cloud-based AI, machine learning, computer vision, and fan engagement platforms, is reshaping the sports ecosystem globally.

Latest Market Trends

AI-Driven Player Performance and Training

Sports organizations are increasingly leveraging AI-powered analytics to optimize player performance, predict injuries, and enhance training routines. Machine learning algorithms process historical performance data and biometric inputs to generate actionable insights, enabling coaches to tailor individualized training plans. Wearable sensors and IoT integration provide real-time feedback, supporting strategic decision-making during matches and training sessions. This trend is particularly prevalent in football, basketball, and cricket, where competitive advantage relies heavily on precision analytics and injury prevention.

Fan Engagement and Broadcasting Innovations

AI technologies are transforming fan engagement and broadcasting by enabling predictive match insights, personalized content, and interactive experiences. Platforms integrating AI with AR/VR provide immersive viewing experiences, while computer vision and automated highlight generation enhance content delivery for broadcasters. Fans can access real-time statistics, personalized player tracking, and predictive analytics for match outcomes, driving engagement and revenue through sponsorships and merchandise sales.

AI in Sports Market Drivers

Rising Demand for Performance Analytics

Teams and leagues are adopting AI analytics to gain a competitive edge. From optimizing player positioning to analyzing opponents’ strategies, AI-driven insights enhance team performance and match outcomes. Predictive models also support scouting and talent identification, reducing subjectivity in recruitment and strategic planning.

Advancements in Wearable and Sensor Technologies

Wearables such as smart clothing, biometric monitors, and GPS devices enable AI to capture precise player metrics. These devices facilitate injury prediction, recovery tracking, and skill optimization. Teams deploying such technologies experience measurable improvements in player efficiency and long-term health management, making this a significant growth driver.

Expansion of AI-Based Fan Engagement Solutions

AI-enabled platforms are personalizing fan experiences, from predictive match insights to interactive gaming and virtual participation. Enhanced engagement boosts viewership, sponsorship, and merchandise sales, prompting leagues and broadcasters to adopt AI solutions extensively. This trend has accelerated with digital transformation and post-pandemic broadcasting innovations.

Market Restraints

High Implementation Costs

Deploying AI solutions involves substantial investment in software, hardware, and skilled personnel. Smaller teams or sports academies may face budgetary constraints, restricting adoption despite high interest in advanced analytics and training solutions.

Data Privacy and Security Challenges

Player biometric and performance data collection raises privacy and compliance concerns. Adherence to GDPR in Europe and HIPAA in the U.S., along with sensitive data management, can slow AI adoption and require significant investment in secure infrastructure.

AI in Sports Market Opportunities

Emerging Regional Demand in APAC and LATAM

The rapid commercialization of sports in the Asia-Pacific and Latin America presents significant growth opportunities. Cricket in India, basketball in China, and football in Brazil are increasingly integrating AI solutions for analytics, training, and fan engagement. New entrants can tap into these markets through partnerships with local leagues, academies, and sports federations, capturing untapped demand and early adopter advantages.

Integration with Advanced Technologies

Combining AI with IoT, AR/VR, and computer vision enables real-time performance tracking, immersive fan experiences, and automated tactical analysis. This convergence opens new revenue streams and product offerings, particularly in esports and emerging digital sports platforms. Companies innovating in wearable devices, virtual coaching, and predictive analytics are well-positioned to gain a competitive edge.

Governance and Policy Support

Government initiatives, including digital sports transformation programs and AI research grants, facilitate technology adoption. Supportive policies encourage AI deployment in public sports infrastructure, school programs, and professional leagues. Compliant AI solutions can leverage incentives, funding, and early adoption programs, accelerating market growth in both developed and emerging regions.

Product Type Insights

Performance analysis solutions dominate the market, with teams investing in AI-based analytics software, wearable devices, and tactical simulation platforms. Fan engagement solutions and injury prevention tools are gaining traction as complementary offerings. Cloud-based AI platforms lead deployment due to scalability, cost efficiency, and real-time collaboration, accounting for more than half of market deployments globally.

Application Insights

Player performance enhancement is the leading application, enabling precise tracking of fitness, skill progression, and injury risk. Coaching and training optimization follow closely, leveraging predictive analytics and video analysis for tactical improvements. Fan engagement and broadcasting applications are also expanding rapidly, driven by AI-enabled interactive content, virtual experiences, and personalized statistics.

End-Use Insights

Professional sports teams and leagues represent the largest end-use segment, driven by heavy investment in AI for competitive advantage. The fastest-growing segments include esports, fitness centers, and broadcasting companies, leveraging AI for performance monitoring, fan engagement, and content creation. Export-driven demand is increasing, particularly from North America and Europe, where leagues and academies source AI solutions for analytics and training, contributing to overall market expansion.

| By Technology | By Solution Type | By Application | By Sport Type | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest market share (40% in 2024), with the U.S. and Canada leading adoption. Professional leagues such as the NFL, NBA, and NHL are heavily investing in AI-powered performance analytics, wearable integration, and broadcasting technologies. Strong infrastructure and high digital penetration drive widespread deployment.

Europe

Europe accounts for 30% of the 2024 market, led by the U.K., Germany, and France. High adoption in football leagues, government-backed AI initiatives, and rising interest in fan engagement technologies support growth. Europe is a mature market with strong technological integration and regulatory frameworks that enable responsible AI use.

Asia-Pacific

APAC is the fastest-growing region (15% CAGR), with China, India, Japan, and South Korea investing in sports commercialization and AI solutions. Rising digital penetration, growing esports popularity, and government programs for technology adoption accelerate growth. Cricket, football, and basketball leagues are early adopters of AI-powered analytics, wearable devices, and fan engagement platforms.

Latin America

LATAM holds 7% of the market, with Brazil and Argentina driving AI adoption in football analytics, player development, and broadcasting. Demand is steadily rising due to the increasing professionalization of sports leagues and the focus on competitive advantage through analytics.

Middle East & Africa

The Middle East and Africa account for 8% of the market. Iconic sports infrastructure projects in South Africa, Kenya, and the UAE are integrating AI technologies. High-income populations in the UAE, Qatar, and Saudi Arabia, combined with luxury sports initiatives, create adoption opportunities. Intra-African sports exchanges further contribute to regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the AI in Sports Market

- IBM

- Microsoft

- SAP

- STATS Perform

- Catapult Sports

- Zebra Technologies

- Oracle

- Hawk-Eye Innovations

- Kinexon

- Second Spectrum

- Hudl

- ShotTracker

- Genius Sports

- Sportlogiq

- Vicon

Recent Developments

- In June 2025, STATS Perform announced an AI-powered performance analytics platform for professional football leagues in Europe and APAC.

- In May 2025, Catapult Sports expanded wearable solutions for basketball and cricket leagues across North America and India, enhancing real-time injury prediction capabilities.

- In March 2025, IBM introduced AI-based fan engagement software integrating AR/VR experiences for esports tournaments in Asia-Pacific.