Agate Jewelry Market Size

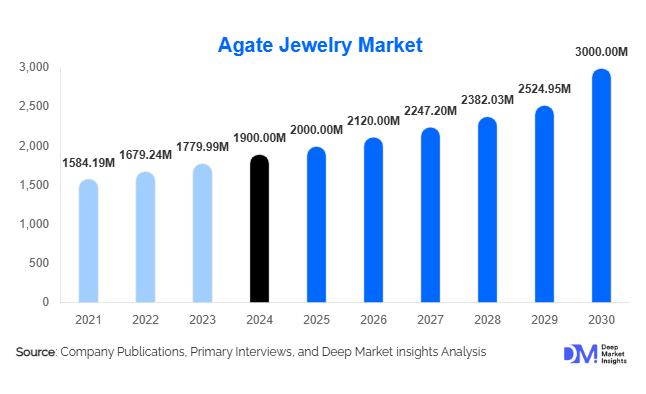

According to Deep Market Insights, the global agate jewelry market size was valued at USD 1,900 million in 2024 and is projected to grow from USD 2,000 million in 2025 to reach USD 3,000 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The market growth is primarily driven by the rising popularity of natural and artisanal gemstone jewelry, increasing consumer preference for ethically sourced materials, and the expansion of online and e-commerce sales channels, facilitating global reach.

Key Market Insights

- Natural and untreated agate jewelry remains the most preferred choice, driven by authenticity, unique patterns, and metaphysical appeal among collectors and wellness-focused consumers.

- Pendants and necklaces dominate the product segment, offering versatility, visual appeal, and suitability for both fashion and spiritual applications.

- North America is currently the largest market, with the U.S. and Canada leading in premium and mid-range agate jewelry demand.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class income, increasing fashion awareness, and growth in domestic artisanal production and exports.

- Online retail and e-commerce channels are rapidly expanding, providing global visibility to niche and artisan pieces while enhancing consumer trust through transparent sourcing and certifications.

- Technological integration, including 3D design, digital customization, and AR-based virtual try-ons, is enhancing consumer engagement and design innovation.

Latest Market Trends

Growing Preference for Authentic and Artisanal Agate Jewelry

Consumers increasingly seek natural and untreated agate jewelry for its unique banding, color variations, and authenticity. Artisanal craftsmanship, customized cuts, and designer settings are gaining traction, especially among fashion-forward and wellness-oriented buyers. Mid-range and premium segments benefit from this trend as buyers are willing to pay a premium for natural agate and handcrafted designs. Small-scale artisans are leveraging e-commerce to reach global audiences, while top-tier brands emphasize traceable sourcing and sustainable mining practices to enhance credibility and brand appeal.

Digital and E-Commerce Expansion

Online platforms are transforming agate jewelry sales, offering consumers access to a wide variety of designs and the ability to compare prices and authenticity certifications. Social media and influencer marketing play a critical role in creating awareness for artisanal and designer pieces. Augmented reality (AR) and virtual try-on technologies are increasingly deployed to enhance the online shopping experience, enabling buyers to visualize pendants, rings, and bracelets before purchase. Digital customization platforms allow consumers to select stone cuts, settings, and price tiers, boosting engagement and overall market penetration.

Agate Jewelry Market Drivers

Rising Fashion and Wellness Trends

Increasing consumer preference for unique, visually striking, and spiritually significant jewelry is driving market growth. Agate jewelry appeals to both fashion-conscious and wellness-focused buyers seeking gemstones believed to offer healing or metaphysical benefits. The combination of aesthetic appeal and perceived functional benefits has created a diverse consumer base across age groups and geographies. This driver is particularly strong in regions like North America and Asia-Pacific, where both fashion trends and wellness practices are rapidly evolving.

Expansion of E-Commerce Channels

The growth of online marketplaces and direct-to-consumer platforms allows manufacturers and artisans to reach wider audiences, reduce distribution costs, and scale operations. E-commerce supports cross-border sales, enabling niche products and rare agate varieties to gain international visibility. Platforms offering customization and AR-based visualization are particularly appealing to younger, tech-savvy consumers, further fueling demand.

Ethical Sourcing and Sustainability Focus

Increasing awareness of ethical mining practices and sustainability is creating opportunities for brands to differentiate themselves. Consumers prefer certified, traceable sources, eco-friendly treatments, and socially responsible manufacturing. Governments in producing countries are also supporting sustainable mining clusters and artisan networks, promoting responsible practices. This trend enhances brand trust and allows companies to target premium segments with higher profit margins.

Market Restraints

Supply Constraints of High-Quality Agate

The limited availability of high-quality, naturally patterned agate restricts large-scale production and premium pricing. Variability in color, banding, and translucency can affect consistency, impacting market growth in high-end segments. Ethical sourcing, environmental regulations, and scarcity of rare varieties add complexity and cost, constraining expansion.

Competition from Treated and Synthetic Alternatives

Dyed, stabilized, or synthetic agate stones offer lower-cost alternatives, creating competitive pressure on natural agate jewelry. Price-sensitive consumers may opt for artificially enhanced stones, reducing demand for authentic, untreated variants. Maintaining authenticity and consumer trust through certifications and marketing requires additional investment by manufacturers and can limit profit margins in certain segments.

Agate Jewelry Market Opportunities

Integration of Spiritual and Fashion Applications

Agate jewelry is increasingly crossing over from traditional fashion into spiritual, wellness, and metaphysical applications. Pendants, beads, and bracelets with healing or energy-related claims attract buyers seeking mindfulness and wellness benefits. Brands can combine aesthetics with purpose-driven value, tapping into both fashion and wellness markets simultaneously. Customized spiritual jewelry, limited editions, and artisan storytelling enhance engagement and provide higher-value offerings.

Emerging E-Commerce and Global Exports

Online platforms and global shipping capabilities allow artisans and manufacturers to reach international buyers more efficiently. Export-driven demand from North America, Europe, and the Asia-Pacific provides growth opportunities for producers in India, China, and Brazil. The rising interest in ethically sourced and handcrafted pieces enhances the appeal of exported agate jewelry, creating a strong revenue stream and boosting brand recognition in key overseas markets.

Product Type Insights

Pendants and necklaces dominate the market due to their versatility and ability to showcase agate’s natural patterns. Rings and bracelets follow in popularity, offering mid-range price points and fashion appeal. Earrings and designer pieces appeal to niche audiences seeking statement jewelry. The market shows strong growth in custom and artisan-crafted items, with unique cuts and finishes attracting premium buyers, while mid-range mass-produced jewelry remains important for accessibility and scale.

Application Insights

Fashion-oriented jewelry remains the primary application, accounting for the largest volume of agate jewelry demand. Spiritual and wellness applications are expanding rapidly, especially for pendants, bracelets, and beads marketed for healing and metaphysical properties. Collectors and artisan jewelry enthusiasts drive demand for limited-edition or rare agate varieties. Emerging applications include hybrid designs for home décor and wearable art, leveraging agate’s visual appeal beyond conventional jewelry.

Distribution Channel Insights

Online retail channels dominate, enabling global reach for artisan and niche pieces. Physical jewelry stores and specialty boutiques maintain a strong presence in premium and high-trust segments. Direct-to-consumer and brand-owned stores allow for personalized services and stronger branding. Trade fairs, exhibitions, and craft markets provide additional opportunities for small-scale manufacturers and artisans. Social media and influencer marketing play a crucial role in discovery, engagement, and conversions.

End-User Insights

Women remain the largest end-user segment, accounting for over 50% of demand in 2024, primarily in fashion and trend-driven categories. Men’s jewelry and unisex designs are growing steadily. Spiritual and wellness buyers are increasing their share, particularly in North America, Europe, and Asia-Pacific. Collectors and high-end consumers are driving premium segment growth, while fashion-conscious younger consumers fuel mid-range and online sales. The gifting segment also supports volume demand across occasions and demographics.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest share of the global agate jewelry market (32% in 2024), led by the U.S. Strong fashion consciousness, disposable income, and robust e-commerce infrastructure drive market demand. Canadian consumers also contribute significantly, particularly for artisanal and spiritual jewelry. Demand is increasingly focused on ethically sourced, premium, and online-accessible products.

Europe

Europe contributes 22% of the 2024 market, with the U.K., Germany, France, and Italy leading. Consumers favor ethically sourced, sustainable, and high-quality designs. Growth is driven by fashion trends, collector interest, and wellness-oriented purchases. Younger demographics are adopting online platforms and artisan products, supporting mid-range and premium segment expansion.

Asia-Pacific

The Asia-Pacific region is the fastest-growing, contributing 28% in 2024. India, China, Japan, and Southeast Asian countries are key markets. Rising middle-class wealth, growing fashion awareness, and domestic artisanal production fuel demand. Export-driven growth also strengthens the region’s importance. China leads luxury adoption, while India dominates artisanal and mid-range segments.

Latin America

Brazil, Mexico, and Argentina contribute 9% of the market. Brazil is a major producer and exporter, while local demand grows gradually. Interest is mostly driven by fashion and tourism-linked sales. Export-oriented manufacturers in the region target U.S. and European buyers.

Middle East & Africa

The Middle East accounts for 5% of global revenue, with the UAE, Saudi Arabia, and Qatar driving demand for premium, luxury, and gift-oriented agate jewelry. Africa contributes through production hubs and export supply. Intra-African trade is also expanding, particularly in artisanal jewelry markets in South Africa, Nigeria, and Kenya.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Agate Jewelry Market

- Yanghong Agate

- HL Gemas

- Xinchangbao Agate

- Yangji Agate

- Weicheng Agate

- Miran Agate

- Shengli Agate

- Gemstone

- Xinlitun Agate

- Yasin & Sohil Agate

- Agate Creations

- Global Gemstones Co.

- Crystal Arts Jewelry

- StoneCraft Agate

- Bead & Stone Ltd.

Recent Developments

- In March 2025, Yanghong Agate launched a premium collection of handcrafted pendants and necklaces featuring natural fire and blue lace agate, emphasizing ethical sourcing and traceable supply chains.

- In January 2025, HL Gemas expanded e-commerce operations globally, integrating AR-based virtual try-ons for rings and bracelets to enhance online consumer engagement.

- In December 2024, Xinchangbao Agate partnered with wellness and lifestyle brands to introduce spiritually themed agate jewelry targeting North American and European markets.