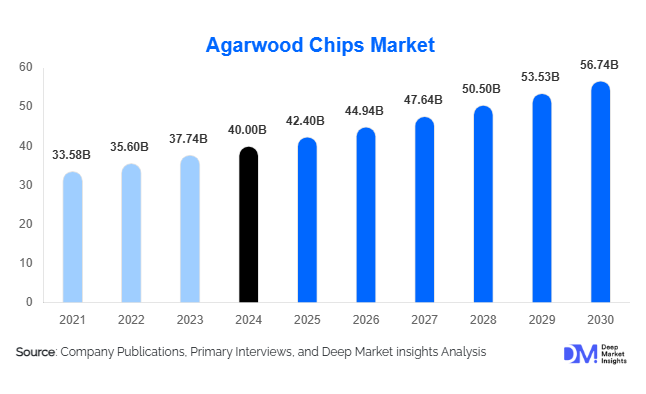

Agarwood Chips Market Size

According to Deep Market Insights, the global agarwood chips market was valued at approximately USD 40 billion in 2024 and is projected to reach around USD 42.40 billion in 2025, growing steadily to about USD 56.74 billion by 2030. This represents a compound annual growth rate (CAGR) of 6.0% during the forecast period (2025–2030). This robust growth is underpinned by the rising demand for natural luxury fragrance inputs, increasing adoption in wellness and aromatherapy, and the expansion of sustainable, plantation-grown agarwood supply chains.

Key Market Insights

- Sustainable cultivation is reshaping supply dynamics, with plantation-grown and certified agarwood gaining favor over wild-harvested sources due to regulatory and ecological pressures.

- Oud oil (agarwood oil) production dominates value creation, as resin-rich chips are highly prized in high-end perfumery and extract markets.

- Incense and ritual applications remain a strong anchor market, particularly in Middle Eastern and Asian regions where traditional and spiritual uses of agarwood persist.

- E-commerce and indirect distribution channels are expanding reach, enabling growers to connect directly with global luxury and wellness customers.

- Asia-Pacific leads in both production and consumption, supported by major producer countries like Indonesia, Vietnam, and India, alongside growing domestic demand in places such as China.

- Wellness and aromatherapy segments are fast emerging, with agarwood increasingly featured in premium diffusers, spa products, and meditation rituals.

What are the latest trends in the agarwood chips market?

Rise of Certified and Plantation-Grown Agarwood

To address sustainability concerns and deregulate supply, plantation-grown agarwood is becoming more widespread. Growers are adopting advanced inoculation techniques to stimulate resin production, enabling more predictable yields. Certified agarwood, organic, traceable, CITES-compliant, is gaining traction among buyers in luxury perfumery and wellness markets. This shift not only helps suppliers avoid the pitfalls of illegal logging but also supports long-term ethical sourcing, giving consumers confidence in provenance and environmental stewardship.

Integration with Wellness and Aromatherapy

Agarwood chips are increasingly being used in wellness rituals, diffusers, meditation incense, luxury spa treatments, and aromatherapy oils. The rising global wellness trend has opened up new use cases beyond traditional perfumery. High-resin agarwood chips are now formulated into premium oud oils and oils for mindfulness practices. This convergence of fragrance and wellness helps companies tap into the growing population of consumers prioritizing natural, therapeutic, and spiritually resonant experiences.

Digital & Traceable Supply Chains

Technology is playing a critical role in transforming the agarwood chips industry. Producers are leveraging digital traceability systems (QR codes, blockchain) to provide buyers with reliable origin data. Meanwhile, e-commerce platforms are enabling direct-to-consumer sales, allowing smaller growers to reach global markets. This transparency and connectivity are building trust, especially in regulated markets, and supporting the premium positioning of certified chips.

What are the key drivers in the agarwood chips market?

Growing Demand for Natural and Luxury Fragrances

The increasing appetite among consumers for rare, exotic, and natural aromatic ingredients is fueling demand for agarwood chips. Oud-based fragrances are highly prized globally, especially in luxury perfumery. Because resin-rich pulses from agarwood deliver the highest quality oud oil, perfumers and fragrance houses continue to source premium chips, pushing demand and supporting value growth.

Wellness & Aromatherapy Adoption

As wellness culture deepens worldwide, agarwood is being positioned not just as a fragrance raw material but also as a key wellness ingredient. Its calming, spiritual scent is increasingly integrated into aromatherapy oils, meditative incense, and upscale spa rituals. This broadening of use cases is drawing in a newer, younger, wellness-oriented consumer base, expanding beyond traditional religious or perfumery markets.

Sustainability and Ethical Sourcing Trends

With growing environmental awareness and stricter regulations (e.g., CITES), sustainable agarwood cultivation has become a mainstream business imperative. Plantation-grown agarwood using artificial inoculation reduces pressure on wild Aquilaria populations, enhances traceability, and ensures a more stable supply. Ethical sourcing is also helping brands meet consumer demands for transparency and responsible production.

What are the restraints for the global agarwood chips market?

Supply Constraints and Illegal Harvesting

Despite growing plantation operations, a significant proportion of agarwood still comes from wild-harvested trees, only a fraction of which are naturally resinous. Illegal logging remains a persistent challenge, which restricts legal supply and inflates price volatility. This supply fragility makes scaling the market difficult.

High Capital Intensity and Long Maturation Periods

Establishing an agarwood plantation requires substantial upfront investment. Aquilaria trees take many years (often 5–7 years or more) before they produce resin-rich heartwood. Coupled with costs for inoculation, maintenance, and grading, this long gestation period increases financial risk for new entrants and can slow down expansion plans.

What are the key opportunities in the agarwood chips industry?

Premiumization through Traceability and Certification

Producers who invest in traceability (e.g., using blockchain, QR-tagging), organic or CITES-certified agarwood can command premium prices. Ethical and verified sourcing is becoming more important for buyers in luxury perfumery and wellness. This certification-led premiumization is a powerful lever for value creation and brand differentiation.

Global Wellness Market Penetration

There is a growing opportunity to deepen agarwood’s presence in the wellness segment. By partnering with wellness brands, spa chains, meditation centers, and yoga retreats, agarwood growers and suppliers can position chips as ingredients for therapeutic incense, diffuser blends, and meditation rituals. This collaboration opens up recurring demand and high-margin use cases.

Direct-to-Consumer and E-Commerce Expansion

E-commerce is reshaping how agarwood chips reach end users. Producers can bypass traditional intermediaries, market their origin story and sustainability credentials directly, and sell premium-grade chips to a global audience. This model increases margins and builds brand loyalty. Furthermore, digital tools to verify provenance build trust among discerning buyers.

Product Type Insights

The agarwood chips market varies sharply by product type. High-grade (resin-rich) chips dominate the value chain, prized for oil production and luxury oud extraction. Medium-grade chips offer a balance of quality and affordability, often used in mainstream fragrances or ritual incense. Low-grade chips, while less valuable, still serve bulk incense makers or budget-conscious buyers. On the supply side, plantation-grown agarwood chips are gaining ground due to sustainability and scalability, while wild-sourced chips continue to command a premium but face regulatory and ecological pressure.

Application Insights

Agarwood chips are primarily used in oil production, especially for extracting oud oil, which is highly valuable in high-end perfumery. Incense and ritual use remain a significant application, particularly in religious and spiritual contexts across the Middle East and Asia. Traditional medicine uses, including in systems like TCM and Ayurveda, also drive demand. More recently, wellness and aromatherapy applications have surged, with agarwood chips being used in diffusers, meditation incense, and spa rituals.

Distribution Channel Insights

Indirect sales, including wholesale distributors and specialized incense or perfumery suppliers, continue to be important, especially for large-scale manufacturers. E-commerce (direct-to-consumer) is a fast-growing channel, enabling agarwood growers to reach international customers interested in origin, quality, and sustainability. Traditional direct sales (from plantation or wild producers to large perfumery houses) also remain central for high-grade chip supply.

Buyer / End-User Insights

The buyers of agarwood chips can be broadly grouped into: luxury perfume houses, wellness & aromatherapy brands, incense manufacturers, and spiritual/religious users. Luxury perfume houses are major value customers, especially for resin-rich chips. Wellness brands and meditation centers are increasingly important, leveraging agarwood's calming profile. Incense producers and spiritual consumers maintain strong, steady demand, particularly in regions with ritual traditions. Boutique D2C brands and hobbyists also form a growing niche, especially when provenance and sustainability are emphasized.

| By Product Type | By Application | By Distribution Channel | By End Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds the largest share of the agarwood chips market, estimated at 45–55% in 2024, driven by major producing nations such as Indonesia, Vietnam, India, and Malaysia. Domestic consumption in China and Southeast Asia for incense, traditional medicine, and luxury oud is strong. Plantation investments in Vietnam and Indonesia are scaling, bolstering export capacity.

Middle East & Africa

The Middle East, led by countries like the UAE, Saudi Arabia, and Qatar, is a major consumer of agarwood chips because of the high demand for oud oils and ritual incense. Africa, particularly East Africa, is not only significant for safari tourism but also for local trade in aromatic woods, though its production role is limited. This region contributes a high-value, high-margin demand for premium-grade chips.

North America

North America, especially the U.S. and Canada, is experiencing rising demand in wellness, aromatherapy, and niche perfumery. Consumers are drawn to natural, ethically sourced agarwood, driving import growth. Though the share is smaller compared to APAC, this region is one of the fastest-growing for high-end agarwood products.

Europe

European markets, particularly France, Germany, and the UK, are increasingly important for perfumery-grade agarwood chips and oud oil. Buyers in Europe value sustainability and traceability, making certified agarwood especially attractive. The region is steadily expanding its import volumes.

Latin America

Latin America (notably Brazil and Mexico) is a smaller but emerging market. Affluent buyers and boutique perfumers in the region are beginning to import agarwood chips, particularly for niche fragrance and wellness applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Agarwood Chips Market

- Asia Plantation Capital

- Hoang Giang Agarwood Ltd

- Lao Agar International Development

- K.A.B. Industries

- Binh Nghia Agarwood Co., Ltd

- Myanma Treasure Co-op Ltd

- ASSAM AROMAS

- Green Agro Sadaharitha Plantations

- Sadaharitha Plantations Ltd

- Homegrown Concept Sdn. Bhd

- Duy Hai Agarwood

- Thien Phu Agarwood Co.

- Aalam Ul Oud

- Ori Oud Asia

- Grandawood Agarwood Australia