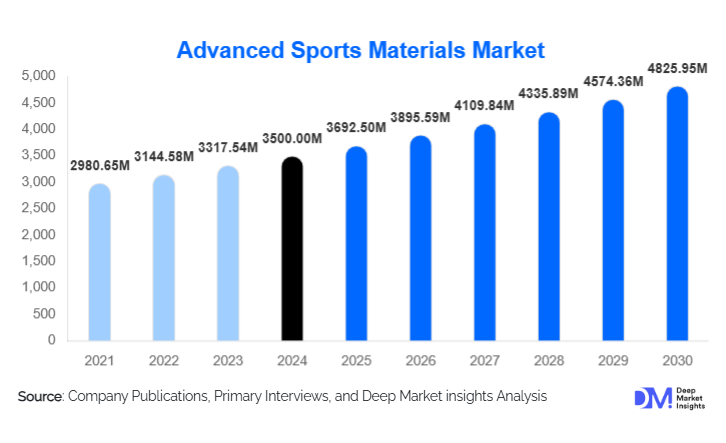

Advanced Sports Materials Market Size

According to Deep Market Insights, the global advanced sports materials market size was valued at USD 3,500 million in 2024 and is projected to grow from USD 3,692.5 million in 2025 to reach USD 4,825.95 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The growth of the advanced sports materials market is primarily driven by rising demand for lightweight, high-performance materials, expanding participation in professional and recreational sports, and rapid adoption of smart textiles and composite-based equipment across global athletic industries.

Key Market Insights

- Polymers dominate the market with an estimated 35% share, owing to their versatility, lightweight properties, and widespread use across apparel, footwear, equipment, and accessories.

- Sports equipment remains the largest application segment, driven by rapid innovation in racquets, bicycles, helmets, skis, and high-impact protective gear.

- Asia-Pacific is the fastest-growing region, supported by rising sports participation, expanding manufacturing capacity, and increasing investments in sports infrastructure.

- North America leads the global market due to strong demand for premium sports gear, professional sports leagues, and rapid adoption of advanced composites.

- Smart materials and sensor-embedded textiles are emerging as high-value technologies reshaping athlete performance tracking and equipment functionality.

- Sustainability-focused materials, including recycled polymers and bio-based composites, are gaining momentum as brands commit to circularity and eco-credentials.

What are the latest trends in the advanced sports materials market?

Smart & Sensor-Embedded Sports Materials Rising Rapidly

Sports brands are increasingly integrating electronics, biometric sensors, and conductive fibers into apparel, footwear, and equipment. Smart materials now facilitate real-time performance tracking, impact monitoring, fatigue measurement, and injury prevention insights. This trend is accelerating partnerships between material suppliers, electronics manufacturers, and premium sports brands. Smart compression wear, intelligent insoles, and connected helmets are transitioning from niche offerings to mainstream performance products. Furthermore, innovations in flexible electronics and washable smart textiles are enabling broader adoption across professional and amateur sports segments.

Sustainable & Circular Materials Gaining Momentum

Growing regulatory pressure and consumer preference for eco-friendly gear are driving rapid market adoption of recycled polymers, bio-based resins, natural-fiber composites, and recyclable sports equipment. Sports manufacturers are investing in closed-loop production, carbon-neutral materials, and composites with reduced environmental impact. Brands are promoting sustainability as a performance differentiator, integrating recycled carbon fiber, regenerated nylon, and plant-based foams into footwear, protective pads, and equipment. The growing emphasis on circular design is reshaping procurement strategies and material innovation pipelines across the sports industry.

What are the key drivers in the advanced sports materials market?

Growing Demand for Lightweight, High-Performance Equipment

Sports equipment manufacturers are increasingly prioritizing materials that deliver superior strength-to-weight ratios, durability, and impact resistance. Carbon-fiber composites, advanced polymers, and titanium alloys enable athletes to achieve better agility, speed, and precision. High-performance gear, such as bicycles, racquets, helmets, and skis, relies heavily on advanced materials to enhance competitive advantage. Professional athletes and sports teams are significant early adopters, influencing broader commercial market trends and driving sustained innovation.

Expansion of Sports Participation and Fitness Culture

Rising global involvement in organized sports, recreational fitness, and outdoor activities fuels demand for premium sports gear. Increasing disposable incomes, urbanization, and health awareness are compelling consumers to upgrade to higher-quality, technologically advanced sports products. Emerging markets in Asia-Pacific and Latin America are seeing accelerated growth in youth sports, cycling, athletic footwear, and protective gear, creating a strong pull for advanced materials in downstream manufacturing.

What are the restraints for the global market?

High Material and Manufacturing Costs

Advanced materials such as carbon-fiber composites, specialty polymers, and sensor-integrated textiles require sophisticated manufacturing processes and significant R&D investment. These high costs limit adoption in mid-range and budget sports products, restricting market penetration to premium segments. High tooling and fabrication expenses for composite frames, helmets, and high-impact protective gear also increase final consumer prices, slowing adoption in cost-sensitive regions.

Recycling and Supply Chain Challenges

Many advanced materials are difficult to recycle due to complex composite structures or chemical treatments, creating sustainability and disposal challenges. Supply chain volatility, especially in specialty fibers, performance resins, and advanced alloys, can increase operational risks and production costs. Regulatory pressure for recyclability, combined with inconsistent global standards for material certification, may create barriers for manufacturers seeking to scale production.

What are the key opportunities in the advanced sports materials industry?

Smart Sports Materials & Performance Monitoring Systems

The integration of materials with embedded electronics, such as pressure sensors, accelerometers, and conductive yarns, offers significant growth potential. Smart apparel that measures biomechanics, footwear with performance analytics, and helmets capable of detecting concussive impacts represent lucrative emerging categories. These advancements appeal to professional athletes, fitness enthusiasts, and youth training programs, opening new revenue streams for material innovators.

Sustainable and Bio-Based Advanced Materials

The drive toward sustainability is creating demand for natural-fiber composites (flax, hemp), biodegradable foams, and recycled polymer systems. Sports brands are investing in eco-friendly alternatives to traditional composites in products such as bicycle frames, apparel, footwear soles, and protective padding. Companies that develop low-carbon and circular solutions will benefit from brand partnerships, green-label certifications, and compliance with evolving sustainability regulations.

Material Type Insights

Polymers lead the market with a 35% share due to their versatility and adaptability across applications. Thermoplastics and elastomers are widely used in footwear midsoles, protective padding, sportswear, and accessories, while smart polymers are emerging in compression wear and wearable technology. Composites remain a premium segment driven by carbon-fiber and glass-fiber applications in bicycles, racquets, and helmets. Metals and alloys, notably aluminum, magnesium, and titanium, play crucial roles in frames and high-strength components. Ceramics and advanced foams are expanding in impact protection, footwear, and specialty equipment.

Application Insights

Sports equipment dominates the market with a 40% share, propelled by innovation in racquets, bicycles, protective helmets, skis, and high-performance training gear. Protective gear is benefiting from rising awareness of athlete safety, leading to stronger adoption of impact-resistant foams, carbon composites, and advanced ceramics. Apparel and footwear are witnessing rapid growth driven by smart textiles, advanced foams, and lightweight polymers. Sports accessories such as eyewear, gloves, and backpacks continue to integrate performance materials for enhanced durability and comfort.

End-User Insights

Professional athletes account for the largest share (34%), driven by premium equipment purchases and early adoption of advanced innovations. Amateur sports enthusiasts represent a fast-growing segment as consumers upgrade to premium gear for performance and safety. Schools and universities increasingly invest in advanced protective and training equipment, while fitness centers and gyms are adopting advanced-material-based equipment for durability and ergonomics.

| By Material Type | By Application | By End-Use (Sports) | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the leading market, accounting for roughly 35% of global revenue. Strong professional sports leagues, early adoption of advanced materials, and high spending on premium sports equipment drive regional dominance. The U.S. leads demand for carbon-fiber products, smart wearables, and advanced protective gear.

Europe

Europe maintains a significant market share with strong manufacturing capabilities in composites, technical textiles, and specialized sports equipment. Growing emphasis on sustainable materials and high-performance protective gear is supporting steady market expansion. Germany, France, Italy, and the U.K. are major hubs for advanced sports equipment production.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rising sports participation, rapid urbanization, and manufacturing-scale advantages. China, India, Japan, and South Korea are investing heavily in sports infrastructure and premium equipment. APAC is also becoming a major exporter of sports gear, incorporating advanced materials.

Latin America

Latin America is experiencing gradual growth as sports culture strengthens across Brazil, Argentina, and Mexico. Demand centers around mid-range sports equipment and protective gear, with increasing import volumes of advanced materials for regional manufacturing.

Middle East & Africa

The region is seeing rising interest in premium sports equipment, driven by health and fitness trends in the GCC and growing sports participation in Africa. South Africa, Saudi Arabia, and the UAE are key contributors. Local manufacturing remains limited, leading to strong import demand for advanced materials.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Advanced Sports Materials Market

- Toray Industries, Inc.

- 3M Company

- BASF SE

- DuPont de Nemours, Inc.

- Hexcel Corporation

- Mitsubishi Chemical Holdings Corporation

- Teijin Limited

- Covestro AG

- Solvay SA

Recent Developments

- In March 2025, Toray Industries launched a new generation of ultra-light carbon-fiber composites optimized for bicycle frames and high-impact sports equipment.

- In January 2025, BASF introduced a recyclable performance polymer series designed for sustainable sports footwear and protective padding.

- In September 2024, Hexcel Corporation expanded its advanced composites facility in the U.S. to increase supply for premium sports equipment manufacturers.