Adaptogens Market Size

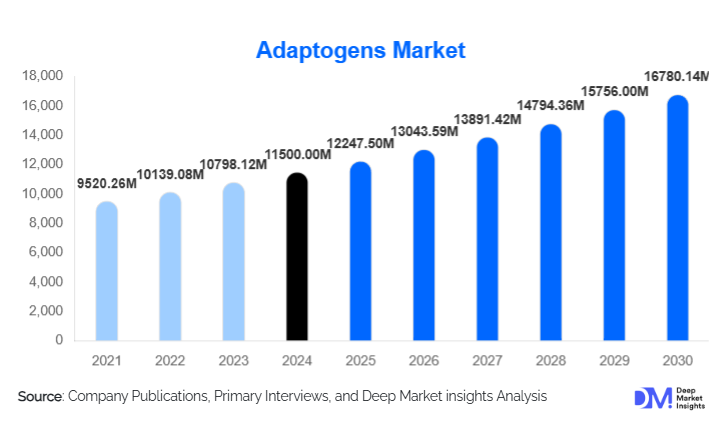

According to Deep Market Insights, the global Adaptogens market size was valued at USD 11,500 million in 2024 and is projected to grow from USD 12,247.5 million in 2025 to reach USD 16,780.14 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer awareness about stress management, increasing adoption of functional foods and beverages, and expanding applications of adaptogens in dietary supplements, cosmetics, and wellness products.

Key Market Insights

- Growing demand for natural and standardized adaptogens is driving innovation in synthetic and lab-based adaptogen extracts, which ensure consistent quality and bioactive content.

- Ashwagandha dominates the market as the leading adaptogen due to its proven efficacy in stress relief, immunity support, and cognitive enhancement, capturing a significant share of global revenue.

- North America holds the largest market share, supported by high consumer spending, wellness trends, and advanced e-commerce and retail channels.

- Asia-Pacific is the fastest-growing region, led by India and China, driven by rising health awareness, middle-class income growth, and traditional herbal medicine adoption.

- Food & beverage and dietary supplements segments are the largest applications, propelled by consumer preference for convenient, functional, and clean-label products.

- Technological integration, including advanced extraction methods, standardized formulations, and novel delivery formats (capsules, powders, beverages, gummies), is enhancing market penetration and product adoption.

What are the latest trends in the adaptogens market?

Functional Food & Beverage Integration

Adaptogens are increasingly incorporated into functional foods, beverages, and ready-to-drink products. Consumers prefer convenient, daily-use formats like adaptogen-infused teas, smoothies, powders, and lattes. This integration helps manufacturers expand market reach beyond traditional supplement categories while aligning with the growing trend of clean-label and plant-based wellness products.

Digital & E-Commerce Expansion

The rise of digital platforms and direct-to-consumer (D2C) channels is driving adaptogen sales globally. E-commerce enables small and medium-sized brands to reach international markets, educate consumers on adaptogen benefits, and offer personalized formulations. Online marketing, social media influencers, and subscription-based delivery models are creating strong engagement and brand loyalty among health-conscious consumers.

Emphasis on Clinical Validation & Sustainability

Companies are investing in clinical trials to substantiate health claims and improve regulatory approval, especially in North America and Europe. Simultaneously, there is a growing focus on sustainable sourcing, organic cultivation, and supply chain traceability, catering to consumers seeking ethically produced and environmentally responsible adaptogen products.

What are the key drivers in the adaptogens market?

Rising Health & Wellness Consciousness

Increasing stress, anxiety, and lifestyle-related health concerns are driving demand for natural remedies. Consumers are gravitating toward adaptogens for stress relief, immunity support, cognitive enhancement, and sleep improvement. This trend is particularly strong among millennials and working professionals seeking functional wellness solutions incorporated into daily routines.

Expansion of Functional Foods & Supplements

Functional foods, beverages, and dietary supplements are integrating adaptogens, expanding consumer reach. Clean-label preferences, convenience, and taste innovations support this trend. Products like adaptogen lattes, powders, and fortified snacks are contributing to market growth by appealing to health-conscious consumers in North America, Europe, and Asia-Pacific.

Technological Advancements in Extraction & Delivery

Innovations in extraction methods, standardization, and bioavailability are enhancing product efficacy and consistency. Novel delivery formats, such as gummies, capsules, and liquid tinctures, improve user convenience and adoption rates, making adaptogens more accessible and appealing across various demographics.

What are the restraints for the global market?

Regulatory & Safety Challenges

Regulatory uncertainties regarding health claims, dosage, and long-term safety hinder market expansion. Varying standards across countries create compliance challenges, increasing costs for manufacturers and limiting entry for smaller players without sufficient resources for clinical validation.

Supply Chain & Raw Material Constraints

Seasonal fluctuations, wild harvesting, and quality variability of natural adaptogens pose supply chain challenges. Organic and sustainably sourced materials often carry higher costs, affecting pricing and profitability. Consistency and standardization remain key obstacles for manufacturers seeking global market expansion.

What are the key opportunities in the adaptogens industry?

Emerging Markets & Regional Demand

Asia-Pacific, Latin America, and the Middle East present significant growth potential due to rising health awareness, increasing disposable income, and traditional herbal medicine familiarity. India and China, as major producers and consumers, offer opportunities for both domestic expansion and export-driven growth.

Product Innovation & Personalized Nutrition

Developing novel delivery formats, combination products (e.g., adaptogens with probiotics or nootropics), and personalized formulations provides an avenue for differentiation. Subscription models, D2C channels, and integration with digital wellness platforms enable tailored solutions for stress management, cognitive support, and immunity enhancement.

Sustainability & Ethical Sourcing

Brands that focus on organic cultivation, fair trade, and traceable supply chains can capture premium segments. Sustainable practices not only meet consumer demand for ethical products but also secure a long-term supply of high-quality raw materials, enhancing brand credibility and market positioning.

Product Type Insights

Synthetic and standardized adaptogens dominate due to consistent quality, scalability, and ease of regulatory compliance, capturing nearly 76% of the global market. Natural and organic variants are growing in niche segments where consumers prioritize clean-label and ethically sourced products. Capsules remain the leading delivery format (42% of the market) due to convenience, dosage accuracy, and consumer familiarity, while powders and beverages are gaining traction in functional food applications.

Application Insights

Food & beverages (50% share) and dietary supplements (35% share) are the leading applications. Adaptogen-infused teas, functional beverages, powders, and gummies dominate F&B offerings, while dietary supplements focus on capsules and tinctures. Cosmetics and personal care represent a growing segment, leveraging adaptogens for skin health and anti-aging properties. Pharmaceutical applications remain niche due to regulatory barriers but are expanding with clinical validation.

Distribution Channel Insights

B2B channels (79% of market) dominate, supplying bulk adaptogen extracts to manufacturers of supplements, functional foods, beverages, and cosmetics. Online and D2C platforms are growing rapidly, particularly in North America and Europe, enabling direct consumer engagement, personalized offerings, and subscription-based sales. Specialty health stores and retail outlets complement online sales by providing visibility and experiential engagement.

End-Use Insights

Dietary & sports supplements are the fastest-growing end-use segment, driven by demand for stress, immunity, and cognitive support. Functional food & beverages are expanding through adaptogen-infused teas, smoothies, and RTD products. Cosmetics and personal care applications are emerging, leveraging adaptogens for skin rejuvenation, anti-aging, and wellness-focused products. Export-driven demand is strong, particularly from India and China to North America and Europe, supporting international market expansion.

| By Ingredient | By Form | By Application | By Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest market share (35% in 2024), led by the U.S. due to high wellness awareness, disposable income, and a mature e-commerce infrastructure. Canada also shows steady demand. Growth is supported by functional foods, dietary supplements, and cosmetic applications, with strong emphasis on organic and clinically validated products.

Europe

Europe (25% share) is driven by Germany, the UK, and France, where clean-label trends, consumer education, and regulatory frameworks support growth. Eco-friendly, ethically sourced, and sustainable adaptogen products are highly preferred. Younger demographics and wellness-conscious consumers are fueling mid-range and premium product adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by India, China, Japan, South Korea, and Australia. India and China serve as both major producers and consumers. Rising health awareness, middle-class growth, and traditional medicine practices accelerate adoption. Functional foods, beverages, and supplements dominate regional demand, with e-commerce enabling wider penetration.

Latin America

Brazil, Mexico, and Argentina show gradual growth in adaptogen adoption, primarily in dietary supplements and functional foods. Outbound consumption to North America and Europe contributes to market expansion among affluent urban populations.

Middle East & Africa

MEA markets, including the UAE, Saudi Arabia, and South Africa, are witnessing increasing adoption driven by high-income populations and wellness trends. Africa benefits from local adaptogen production, particularly for export and regional consumption. Intra-African trade is supporting regional market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Adaptogens Market

- Organic India

- Himalaya Global

- Nutraceutical International Corporation

- REBBL

- Embria Health Sciences

- Natreon

- PLT Health Solutions

- Amax NutraSource

- Ixoreal Biomed Inc. (KSM-66 Ashwagandha)

- DSM-Firmenich

- Cargill

- Novus International

- Adisseo

- Alltech

- Delacon

Recent Developments

- In March 2025, Organic India expanded its global distribution network, launching new Ashwagandha and Tulsi-based supplements in North America and Europe.

- In April 2025, Himalaya Global introduced a line of adaptogen-infused functional beverages and gummies targeting young adult consumers in the U.S. and India.

- In May 2025, Nutraceutical International Corporation invested in advanced extraction facilities to improve bioactive standardization and production capacity for global markets.