Active Noise-Cancelling (ANC) Headset Market Size

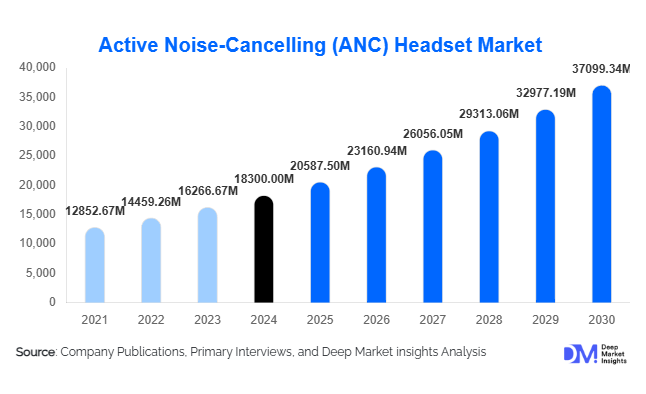

According to Deep Market Insights, the global Active Noise-Cancelling (ANC) headset market was valued at USD 18,300 million in 2024 and is projected to grow from USD 20,587.50 million in 2025 to reach USD 37,099.34 million by 2030, expanding at a CAGR of 12.5% during the forecast period (2025–2030). The ANC headset market growth is fueled by the rising demand for immersive sound experiences, the transition to wireless and smart audio devices, and the growing adoption of hybrid work and travel lifestyles that prioritize noise-free communication and entertainment.

Key Market Insights

- Wireless and in-ear ANC headsets dominate the global market, accounting for over 55% of total value in 2024, driven by convenience and smartphone integration.

- Asia-Pacific emerges as the fastest-growing region, supported by rising disposable incomes, mobile-first consumers, and expanding e-commerce penetration.

- Premium audio upgrades and AI-driven ANC technology are reshaping competitive differentiation among leading brands.

- Remote and hybrid work adoption continues to fuel enterprise and professional headset demand across global markets.

- Battery optimization, comfort engineering, and spatial audio are key innovation areas enhancing product appeal.

- The top five players, Sony, Bose, Sennheiser, Jabra, and Beats, collectively hold about 60–65% market share, indicating moderate concentration amid expanding competition from mid-tier entrants.

Latest Market Trends

AI-Powered and Adaptive Noise-Cancelling Technology

Manufacturers are increasingly deploying AI-based adaptive ANC that dynamically adjusts sound profiles to ambient noise and user preferences. These intelligent systems enhance real-time listening experiences by combining machine learning with digital signal processing (DSP) to differentiate between human voices, traffic, or mechanical noise. The trend is further amplified by integration with virtual assistants and mobile apps that personalize ANC levels and equalizer settings. Such innovation is enabling brands to differentiate their products in both premium and mid-tier categories.

Integration into Smart and Hybrid Work Ecosystems

As hybrid work becomes standard, ANC headsets are evolving into productivity tools rather than lifestyle accessories. Advanced microphones, multi-device pairing, and unified communication certifications are now essential features for enterprise-grade models. The surge in remote meetings has prompted businesses to bulk-purchase ANC headsets for distributed teams. Companies like Jabra and Plantronics are focusing on professional-grade noise-cancelling devices, integrating seamlessly with Microsoft Teams, Zoom, and other collaboration platforms.

Active Noise-Cancelling (ANC) Headset Market Drivers

Surge in Wireless and Mobile Audio Adoption

The global migration toward wireless technology is the strongest growth driver. Consumers prefer Bluetooth and true wireless stereo (TWS) headsets for portability, mobility, and convenience. With smartphone manufacturers phasing out wired headphone jacks, demand for wireless ANC headsets has surged, accounting for approximately 65% of market value in 2024. Enhanced connectivity, longer battery life, and compact form factors are reinforcing this trend.

Hybrid Work and Remote Communication Demand

Enterprise adoption of ANC headsets has grown significantly as remote collaboration becomes standard. Noise isolation, long-wear comfort, and microphone clarity are crucial features for call centers, hybrid employees, and online educators. The enterprise communication segment is projected to grow at a CAGR of nearly 13% through 2030, supported by investments in digital workplace infrastructure and IT procurement for audio peripherals.

Rising Consumer Preference for Premium Audio

Consumers are upgrading from basic earphones to premium ANC headsets featuring hi-res audio, spatial sound, and luxury materials. This premiumization trend is boosting value growth, particularly in developed markets. The premium tier captured about 45% of total market value in 2024, with brands like Bose, Sony, and Sennheiser leading through innovation, sound quality, and brand trust.

Market Restraints

Price Sensitivity in Emerging Markets

Despite falling costs of ANC technology, the premium segment remains expensive for many emerging markets. The affordability gap limits penetration in countries with price-sensitive consumers. Budget and mid-tier brands from China and India are addressing this by launching sub-USD 100 ANC models, but cost barriers persist for wider adoption.

Supply-Chain Disruptions and Component Costs

Fluctuations in semiconductor, battery, and rare-earth material prices pose significant challenges. Supply-chain disruptions in Asia can delay production schedules and affect product availability. These factors, coupled with logistics volatility, may compress profit margins and impact pricing stability across regions.

Active Noise-Cancelling (ANC) Headset Market Opportunities

Expansion Across Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and Africa present vast untapped potential. Growing middle-class populations, smartphone proliferation, and expanding retail infrastructure are opening new demand centers for mid-range ANC headsets. Localization of design and language-based assistant features could further improve adoption.

Integration with Smart Audio and Wearable Ecosystems

ANC headsets are increasingly forming part of connected ecosystems that include smartwatches, voice assistants, and mobile apps. The next wave of growth will come from context-aware devices capable of fitness tracking, health monitoring, and AI-driven sound optimization. Partnerships between headset manufacturers and smartphone OEMs will define future competitive advantages.

Enterprise and Professional Communication Solutions

Corporate procurement for hybrid and remote work environments offers a stable, high-margin opportunity. Manufacturers can capitalize on professional-grade ANC headsets featuring multiple microphones, noise filtration, and certified interoperability with UC platforms. The rising demand for privacy and focus tools in open-office environments further amplifies this segment’s relevance.

Product Type Insights

Among all form factors, in-ear ANC headsets lead the market with a 55% share in 2024, driven by true wireless stereo (TWS) technology and the growing trend of compact mobility. Over-ear models maintain a premium status due to superior audio quality and comfort, representing around 30% of total revenue. On-ear and niche hybrid models contribute the remaining share, catering to specific enterprise and travel applications. Technological evolution continues to favor in-ear devices for their portability and design integration with smartphones and smartwatches.

Application Insights

Consumer and personal use remains the dominant application, accounting for nearly 70% of market value in 2024. This includes daily commuting, travel, gaming, and leisure activities. The enterprise and commercial segment is expanding rapidly, fueled by hybrid work adoption and rising investments in unified communication hardware. Emerging industrial applications such as manufacturing, aviation, and healthcare are adopting ANC headsets for improved safety and communication efficiency in noisy environments.

Price Tier Insights

The premium segment leads by revenue share, contributing about 45% of market value in 2024, supported by advanced ANC features, luxury materials, and established brand loyalty. The mid-tier category is expanding fastest as new entrants from Asia offer high-performing ANC models at accessible prices. The budget tier is gaining traction in emerging economies, where affordability and decent performance drive mass-market appeal.

| By Product Type | By Application | By Price Tier | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, contributing approximately 35% of global revenue in 2024. The U.S. dominates due to widespread adoption of premium models, strong retail networks, and the prevalence of hybrid work. Technological innovation and consumer purchasing power make this region a hub for early adoption of next-gen ANC technology.

Europe

Europe holds nearly 25% of the market share, led by Germany, the U.K., and France. Demand is driven by commuters, travelers, and audiophiles seeking sustainability and quality. European consumers show a growing preference for eco-friendly materials and long-lasting battery solutions, aligning with regional environmental policies.

Asia-Pacific

Asia-Pacific is the fastest-growing region, capturing around 30% of market value in 2024 and projected to surpass North America by 2028. China dominates production and exports, while India leads in consumption growth due to a booming middle class and rising digital lifestyles. Japan and South Korea remain technology-driven markets emphasizing high-fidelity sound and brand innovation.

Latin America

Latin America accounts for about 6% of the global market, with Brazil and Mexico being key contributors. Growth is fueled by expanding online retail and local manufacturing partnerships, though economic fluctuations and import tariffs present ongoing challenges.

Middle East & Africa

MEA contributes roughly 8–10% of the market, led by the UAE, Saudi Arabia, and South Africa. Rapid urbanization, increased tourism, and rising digital consumption support growth. The region’s premium electronics retail sector is expanding, offering opportunities for luxury and mid-range headset brands.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Active Noise-Cancelling (ANC) Headset Market

- Sony Corporation

- Bose Corporation

- Sennheiser Electronic GmbH & Co. KG

- Jabra (GN Group)

- Beats Electronics LLC (Apple Inc.)

- Audio-Technica Corporation

- AKG (Harman International)

- Philips Audio (TP Vision)

- Skullcandy Inc.

- JBL (Harman International)

- Marshall Headphones (Zound Industries)

- Plantronics (Poly)

- Soundcore (Anker Innovations)

- Nothing Technology Ltd.

- boAt Lifestyle India

Recent Developments

- In June 2025, Sony introduced its next-generation WH-1000XM6 headset featuring AI-driven adaptive ANC and 40-hour battery life, targeting both consumer and professional users.

- In April 2025, Jabra expanded its enterprise portfolio with the Evolve2 Pro series, designed for hybrid work environments with triple-mic noise suppression.

- In February 2025, boAt launched an affordable ANC TWS line in India, bringing active noise cancellation under USD 100 for mass-market adoption.