Acoustic Camera Market Size

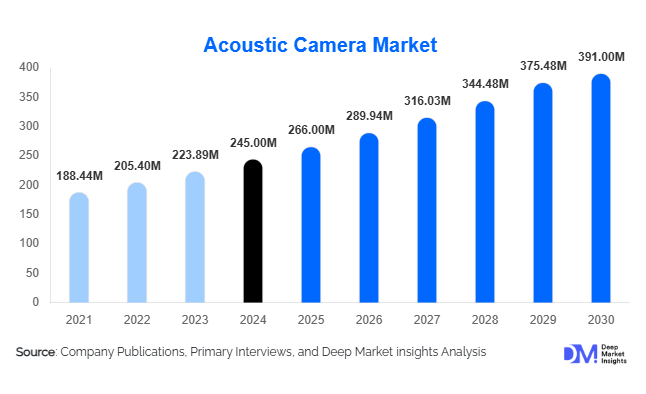

According to Deep Market Insights, the global acoustic camera market size was valued at USD 245 million in 2024 and is projected to grow from USD 266 million in 2025 to reach USD 391 million by 2030, expanding at a CAGR of 9.0% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for noise source identification, industrial leak detection, NVH testing in automotive and aerospace industries, and the integration of advanced sensors and AI technologies in acoustic imaging systems.

Key Market Insights

- Automotive & aerospace NVH testing remains a core application, driving significant demand for high-resolution 3D arrays and near-field measurement systems.

- Emerging markets in Asia-Pacific and MEA are witnessing rapid adoption, driven by industrial expansion, infrastructure development, and regulatory enforcement on noise compliance.

- Integration of AI and portable acoustic cameras is enabling field-based diagnostics and predictive maintenance, expanding use beyond laboratories and industrial R&D centers.

- Energy and infrastructure applications are growing fast, particularly in wind-turbine monitoring, smart-city noise mapping, and building acoustics.

- Technology adoption is accelerating, including MEMS microphone arrays, beamforming algorithms, and cloud-based sound analytics.

- Export-driven demand from North America and Europe to emerging markets in APAC and LATAM is supporting market growth.

Latest Market Trends

3D Arrays and Near-Field Measurement Systems Leading Adoption

The market is seeing a clear shift toward 3D array acoustic cameras, which accounted for roughly 55% of the 2024 market. These systems provide superior spatial resolution and are increasingly used in automotive, aerospace, and industrial environments for precise noise source localization. Near-field systems, holding about 60% of the market, remain dominant in controlled lab settings due to their ability to accurately capture sound emissions close to the object, essential for NVH testing and leak detection.

Portable and AI-Integrated Acoustic Cameras

Portable acoustic cameras with AI-driven analytics are gaining traction in field diagnostics, enabling predictive maintenance, leak detection, and environmental noise mapping. AI algorithms enhance detection, classification, and source localization, making devices more user-friendly and actionable for non-expert operators. This trend is particularly strong in industrial and infrastructure applications where real-time sound mapping is critical.

Acoustic Camera Market Drivers

Stringent Noise and Environmental Regulations

Governmental and regional noise compliance regulations are driving the adoption of acoustic cameras for monitoring and mitigation. Industries such as automotive, aerospace, and construction rely on these systems to meet stringent noise standards, thereby accelerating market penetration.

Rising NVH Testing Requirements in Automotive and Aerospace

EV adoption and modern vehicle design have heightened the importance of cabin sound quality. Acoustic cameras are now indispensable for identifying rattles, squeaks, and vibration sources, directly supporting quieter, more comfortable vehicles and aircraft.

Technological Advancements in Sensor Arrays and Analytics

Innovations such as MEMS microphone arrays, beamforming technology, and AI-powered software are improving accuracy, portability, and usability. These advancements are expanding the range of applications and driving growth across industrial, infrastructure, and research sectors.

Market Restraints

High Cost of Equipment

The initial investment for high-resolution acoustic camera systems remains substantial. This cost factor limits adoption, particularly among smaller enterprises or low-volume users, potentially slowing market growth.

Need for Skilled Operators and Integration Complexity

Effective use requires trained personnel in acoustics and signal processing. Integration into legacy industrial processes can be challenging, constraining adoption in some segments.

Acoustic Camera Market Opportunities

Smart-City Noise Monitoring

Urbanization and stricter noise regulations are creating demand for large-scale acoustic monitoring. Integration of acoustic cameras into IoT and smart-city systems allows real-time noise mapping, enabling municipalities and infrastructure developers to manage urban soundscapes effectively.

Portable Field Systems and AI Integration

Advancements in portable acoustic cameras with AI analytics allow predictive maintenance, leak detection, and on-site diagnostics. This trend opens new market opportunities for industrial plants, energy facilities, and utilities seeking real-time insights.

Emerging Regional Demand in APAC and MEA

Asia-Pacific and the Middle East are witnessing rapid industrialization and regulatory enforcement around noise and environmental compliance. Companies can tap these markets with localized solutions, while new entrants can serve smaller industrial facilities seeking affordable acoustic imaging systems.

Product Type Insights

3D array systems dominate the market due to their superior spatial resolution and precision, particularly in automotive, aerospace, and industrial environments where detailed cabin and structural NVH analysis is critical. This segment’s growth is primarily driven by OEMs and R&D teams seeking comprehensive 3D localization for internal noise source identification and complex structural inspections. In contrast, 2D arrays remain relevant for cost-sensitive applications such as external noise mapping and environmental assessments, offering a simpler, lower-cost solution suitable for entry-level buyers and portable deployments.

Handheld and portable acoustic cameras are increasingly adopted for on-site troubleshooting and maintenance, especially in compressors, valves, and production line inspections. Fixed or mounted systems are favored for continuous monitoring in factories, turbine nacelles, or permanent outdoor noise mapping applications, with IoT-enabled integrations facilitating long-term data collection and predictive analytics.

Application Insights

Noise source identification / NVH applications lead with approximately 45% of the 2024 market, largely due to automotive and aerospace OEMs pursuing quieter products to meet regulatory standards and competitive pressures. Leak detection is gaining rapid traction, offering direct cost savings through energy loss reduction, safety improvements, and high ROI in industrial settings. R&D and design verification applications continue to expand, integrating acoustic cameras into development cycles for automotive, consumer electronics, and aerospace products to accelerate troubleshooting. Structural and infrastructure inspections are emerging applications, driven by monitoring programs for wind turbines, bridges, and other public infrastructure assets.

Distribution Channel Insights

Direct sales to OEMs, industrial labs, and municipal authorities remain the dominant channel. Rental and service-based models are gaining traction for portable systems, particularly in price-sensitive emerging markets. Online B2B platforms provide a wider reach for small-to-medium enterprises, enabling cost-effective procurement. Bundling of hardware with AI-based software subscriptions and long-term service contracts is becoming a key strategy for generating recurring revenues, enhancing value for end-users through integrated solutions and predictive maintenance capabilities.

End-Use Insights

The automotive and mobility sector leads the market with a 25% share, driven by NVH testing, cabin comfort improvements, and exterior noise compliance requirements. Aerospace & defense is a major growth sector, fueled by high R&D spending and stringent certification needs for acoustic signatures. Industrial and manufacturing industries increasingly deploy acoustic cameras for predictive maintenance, leak detection, and production QA. Energy & power applications, such as wind turbine noise diagnostics and pipeline monitoring, are also driving demand. Emerging sectors include smart-city noise monitoring, urban infrastructure assessment, and building acoustics, with a notable contribution from export-driven adoption from North America and Europe to the Asia-Pacific and LATAM regions.

| By Product Type | By Measurement Field / Mode | By Application / Use Case | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 25% of the global market in 2024. The U.S. dominates due to strong automotive and aerospace R&D, substantial industrial maintenance budgets, and widespread use of acoustic cameras for lab testing and manufacturing optimization. Adoption is further supported by early technology uptake, regulatory enforcement, and the presence of major service providers offering integrated solutions. Overall, the region’s mature industrial infrastructure and focus on continuous process improvements are key drivers of growth.

Europe

Europe holds 20% of the market, led by Germany, the UK, and France. Growth is driven by tight environmental and noise regulations, strong demand from leading OEMs in automotive and wind energy sectors, and extensive infrastructure monitoring programs, such as wind-turbine noise and structural health assessments. Europe’s certification-driven purchases and regulatory compliance emphasis foster consistent demand, while advanced industrial infrastructure and R&D capabilities further support market expansion.

Asia-Pacific

Asia-Pacific is both the largest (35%) and fastest-growing region. Growth is propelled by rapid industrialization, expanding automotive manufacturing, large-scale infrastructure projects, and the rise of R&D centers in China, Japan, South Korea, and India. Price-sensitive buyers are driving the adoption of portable and entry-level models, while industrial and urban infrastructure projects encourage the deployment of fixed systems for continuous monitoring. The combination of regulatory pressure, industrial growth, and increasing investment in R&D makes Asia-Pacific the most dynamic regional market.

Middle East & Africa (MEA)

MEA accounts for 12% of the market. Demand is largely driven by oil & gas operators seeking leak detection and preventive maintenance solutions, alongside infrastructure monitoring projects. Growth is moderated by uneven budgets and limited availability of skilled personnel, which constrains widespread adoption. However, high-value projects and strategic industrial investments in GCC countries are supporting niche growth within the region.

Latin America

LATAM represents 8–10% of the market, with Brazil, Mexico, and Argentina leading adoption. Market growth is linked to infrastructure upgrades, expanding oil & gas and mining maintenance activities, and retrofitting older plants where leak detection and predictive maintenance are particularly attractive. The region’s developing industrial base and increasing focus on operational efficiency create opportunities for acoustic camera deployment, particularly in manufacturing and energy sectors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Acoustic Camera Market

- Brüel & Kjær (Spectris)

- Siemens AG

- Norsonic AS

- gfai tech GmbH

- Microflown Technologies

- CAE Software & Systems GmbH

- Signal Interface Group

- SINUS Messtechnik GmbH

- SM Instruments

- Sorama

- Polytec GmbH

- Ziegler-Instruments GmbH

- Fluke Corporation

- Teledyne FLIR

- HEAD acoustics GmbH

Recent Developments

- In May 2025, Brüel & Kjær launched a new 3D acoustic camera system with AI-powered sound source detection for automotive NVH labs.

- In April 2025, Siemens introduced portable acoustic cameras for field-based industrial leak detection and predictive maintenance.

- In February 2025, Microflown Technologies expanded its MEMS-based array solutions to the Asia-Pacific region, targeting the automotive and infrastructure sectors.