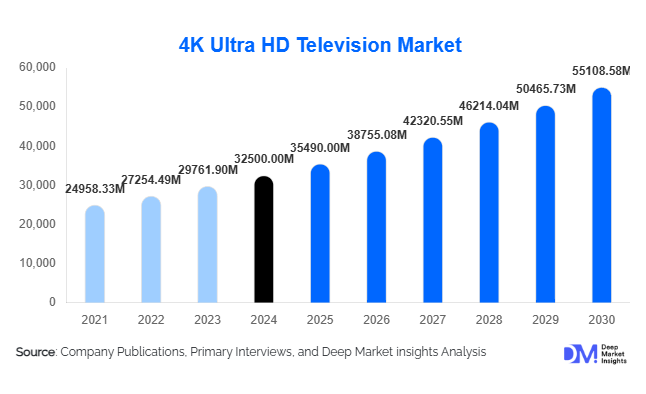

4K Ultra HD Television Market Size

According to Deep Market Insights, the global 4K Ultra HD television market size was valued at USD 32,500 million in 2024 and is projected to grow from USD 35,490.00 million in 2025 to reach USD 55,108.58 million by 2030, expanding at a CAGR of 9.2% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer demand for immersive home entertainment, rapid adoption of smart TV technologies, and technological advancements in display panels such as OLED, QLED, and MicroLED.

Key Market Insights

- Large-screen 4K TVs are becoming increasingly popular, with the 50–65 inch segment leading global demand due to home theater adoption and improved affordability.

- Smart TVs dominate the market, accounting for a significant share of consumer preference driven by OTT streaming, gaming, and AI-based content recommendations.

- LED technology remains the most widely adopted display type, offering a balance of cost-effectiveness, reliability, and energy efficiency, while premium segments are shifting toward OLED and QLED.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class income, urbanization, and government incentives supporting local electronics manufacturing.

- North America and Europe continue to hold major market shares, fueled by high disposable income, tech-savvy consumers, and strong penetration of smart TVs.

- Connectivity and smart integration trends are reshaping the market, with consumers demanding Wi-Fi-enabled TVs, IoT compatibility, and voice assistant integration.

Latest Market Trends

Rise of Smart and Connected TVs

Smart TVs with AI-enabled interfaces, voice recognition, and streaming service integration are driving market adoption. Consumers increasingly prefer devices that provide seamless access to content platforms such as Netflix, Amazon Prime, and Disney+. The trend toward smart home connectivity, including integration with IoT devices and home automation systems, is enhancing TV usage beyond conventional entertainment, creating a unified home ecosystem. Additionally, AI-based recommendations and personalized content delivery are influencing purchase decisions, making smart features a primary differentiator in a competitive market.

Shift Toward Larger Screen Sizes

The 50–65 inch and above segments are witnessing substantial growth due to consumer demand for immersive viewing experiences. Price reductions for large panels and enhancements in display technology, including high dynamic range (HDR) and 4K resolution, have made larger TVs more accessible to mainstream consumers. Curved panels are being explored in premium segments, offering immersive visual experiences, while flat panels remain the standard for affordability and ease of installation.

4K Ultra HD Television Market Drivers

Growing Home Entertainment Adoption

Consumer preference for home entertainment, accelerated by increased content consumption from OTT platforms and gaming, is a major driver. High-quality display experiences, coupled with the affordability of larger screens, are encouraging households to upgrade from HD to 4K TVs. This is further supported by enhanced broadcast quality and wider availability of 4K content worldwide.

Technological Advancements in Display Panels

Advances in OLED, QLED, and MicroLED technologies have improved picture quality, energy efficiency, and lifespan. These innovations attract premium consumers who value vibrant colors, contrast ratios, and immersive experiences, thereby increasing adoption in high-income markets.

Rapid Growth of Smart TVs and Streaming Services

The proliferation of OTT platforms and interactive media is significantly boosting smart TV sales. Integration of AI-powered content recommendations, gaming optimizations, and voice controls is driving consumer preference toward 4K smart TVs over conventional models.

Market Restraints

High Cost of Advanced Display Technology

Premium technologies such as OLED and MicroLED remain expensive, limiting adoption in price-sensitive markets. Consumers in developing regions often opt for standard LED TVs, constraining overall market penetration of advanced display types.

Competition from Alternative Viewing Devices

Rising use of projectors, large-format monitors, and mobile devices for media consumption poses a potential restraint. Space constraints in urban homes further limit the adoption of large-screen TVs, slightly dampening market growth.

4K Ultra HD Television Market Opportunities

Emerging Market Expansion

Emerging economies, particularly in the Asia-Pacific, Latin America, and parts of Africa, offer significant untapped demand. Rising middle-class income, urbanization, and government incentives for local electronics manufacturing are driving affordability and accessibility, creating vast growth potential for manufacturers and new entrants.

Integration with Smart Technologies and IoT

4K TVs integrated with IoT devices and smart home ecosystems present opportunities for differentiation. Features such as voice assistants, AI-based recommendations, and interactive gaming interfaces are becoming key decision factors for tech-savvy consumers, enabling higher adoption and brand loyalty.

Expansion in Commercial Applications

Hotels, hospitals, offices, gaming cafes, and broadcast studios are increasingly adopting 4K displays for both entertainment and operational purposes. Digital signage, high-quality media production, and gaming demand offer new revenue streams beyond the residential segment.

Product Type Insights

LED TVs dominate due to affordability and widespread adoption, while OLED and QLED cater to premium consumer segments. Mid-tier TVs in the $500–$1000 range are growing fastest due to the balance of features and pricing. Curved panels and high-refresh-rate displays are niche but gaining traction among premium and gaming-focused buyers.

Application Insights

Residential applications account for the largest market share, driven by increasing home entertainment consumption. Commercial adoption, including hotels, offices, and hospitals, is steadily rising. Gaming applications, particularly in North America, Japan, and South Korea, are emerging as high-growth niches due to low latency and immersive visuals. Export-driven demand from North America and Europe is further supporting global market expansion.

Distribution Channel Insights

Traditional retail remains a significant channel for TV sales, but online platforms, including e-commerce and direct-to-consumer websites, are gaining share. Enhanced digital presence, dynamic pricing, and interactive marketing campaigns are influencing purchasing decisions. Distributor partnerships and subscription-based services are emerging as additional channels for both premium and mid-range segments.

End-User Insights

Households represent the primary end-use segment, accounting for 70% of market share. The commercial segment, including hotels, offices, and gaming centers, is expanding at a 6–8% CAGR. Gaming, content production, and digital signage applications are emerging as significant growth drivers in niche markets.

| By Product Type | By Screen Size | By Panel Type | By Price Range | By Connectivity | By Application / End-Use |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 28% of the global market, led by the U.S. and Canada. High disposable income, tech-savvy consumers, and strong OTT penetration drive the adoption of large-screen 4K and smart TVs. Premium OLED and QLED adoption is strong, supported by gaming and home theater demand.

Europe

Europe accounts for roughly 26% of the market, with Germany, the UK, and France leading demand. Consumers prefer energy-efficient models and smart TVs, with eco-friendly initiatives supporting market growth. Mid-tier TVs dominate in volume, while OLED/QLED capture premium buyers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and South Korea. Rising middle-class income, urbanization, and government incentives for electronics manufacturing accelerate adoption. Mid-range TVs are most popular, while premium segments are expanding in metropolitan areas.

Latin America

Brazil, Mexico, and Argentina lead adoption, accounting for 12% of the global market. Outbound demand and premium adoption are growing among affluent consumers, supported by increasing online sales and digital marketing.

Middle East & Africa

The region accounts for 8% of the global market share. High-income populations in the UAE, Saudi Arabia, and Qatar prefer premium 4K TVs. African markets show gradual adoption in urban centers, with potential for growth in commercial applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the 4K Ultra HD Television Market

- Samsung

- LG Electronics

- Sony

- TCL

- Hisense

- Panasonic

- Sharp

- Philips

- Vizio

- Xiaomi

- Skyworth

- Toshiba

- Haier

- Changhong

- Grundig

Recent Developments

- In March 2025, Samsung launched a new 4K QLED TV lineup with AI-based smart integration and enhanced HDR support for premium segments.

- In February 2025, LG introduced a MicroLED series targeting high-end residential and commercial applications, emphasizing energy efficiency and immersive visuals.

- In January 2025, Sony expanded its OLED 4K TV portfolio in Europe and North America, focusing on gaming features and AI-enhanced picture processing.