4K Set-Top Box Market Size

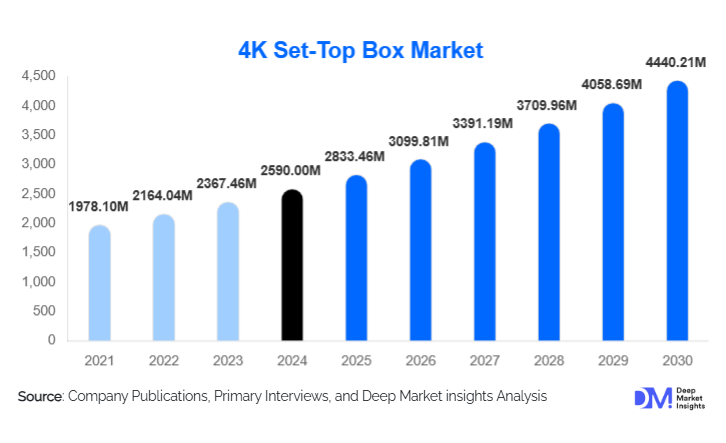

According to Deep Market Insights, the global 4k set top box market size was valued at USD 2,590 million in 2024 and is projected to grow from USD 2,833.46 million in 2025 to reach USD 4,440.21 million by 2030, expanding at a CAGR of 9.4 during the forecast period (2025–2030). The market growth is primarily driven by the rising adoption of 4K televisions, the rapid expansion of OTT streaming platforms, and the increasing availability of high-speed broadband that enables reliable UHD content delivery.

Key Market Insights

- IPTV-based 4K set-top boxes dominate the market due to widespread broadband penetration and operator-driven bundling strategies.

- Android-based 4K set-top boxes hold the largest OS share, supported by expansive app ecosystems and user familiarity.

- Asia-Pacific leads the global market with rapidly growing broadband infrastructure, surging middle-class consumption, and large-scale manufacturing capacity.

- Residential applications account for the majority of demand, driven by the mainstream shift to 4K TVs and streaming-first home entertainment habits.

- Operator-bundled STBs remain a crucial distribution channel, especially in emerging markets where subscription packages drive hardware adoption.

- Technological integration, including AI-enhanced video processing, AV1/HEVC codecs, smart-home control, and voice assistants, is redefining next-generation 4K STBs.

What are the latest trends in the 4K set-top box market?

OTT-Centric and Hybrid Streaming Devices Accelerating

OTT platforms are increasingly shaping the design and functionality of 4K set-top boxes. Devices optimized for Netflix, Amazon Prime Video, Disney+, and regional OTT services are rapidly gaining market share. Hybrid boxes that combine broadcast delivery (IPTV, satellite, DTT) with integrated OTT platforms are becoming the preferred choice for consumers seeking unified content hubs. Operators are partnering with streaming platforms to provide co-branded 4K boxes, enabling access to premium UHD content with seamless user interfaces. This trend is pushing manufacturers to focus on low-latency streaming, advanced compression technologies, and robust DRM, ensuring flawless playback of 4K HDR content.

AI-Enabled and Smart-Home-Integrated STBs Growing in Popularity

Newer 4K STBs are incorporating AI for content recommendations, voice recognition, and real-time image enhancement. Integration with smart-home ecosystems is becoming a differentiating factor, with support for Matter, Zigbee, or built-in assistants such as Alexa or Google Assistant. These capabilities transform STBs from simple media receivers into smart-home hubs, allowing users to control lighting, security systems, and IoT devices using the TV interface. As households adopt more connected devices, 4K STBs with smart-home gateway features are expected to gain substantial traction, especially in high-income markets.

What are the key drivers in the 4K set-top box market?

Rapid Penetration of 4K and Smart TVs

The global shift toward 4K TV ownership is a major catalyst for 4K STB demand. As the cost of UHD televisions continues to decline, consumers expect compatible content delivery solutions. Pay-TV operators and OTT providers are introducing more 4K content, prompting users to upgrade from older HD or Full HD receivers to 4K-enabled devices. The standardization of 4K panels even in mid-range TVs significantly accelerates hardware refresh cycles, boosting market growth.

High-Speed Broadband Expansion

Fiber-to-home (FTTH) rollouts, cable broadband upgrades, and 5G-driven home internet solutions are enabling consumers to stream data-heavy 4K content without buffering. Markets across Asia-Pacific, Europe, and North America are witnessing improved broadband affordability and performance, fueling the adoption of IPTV and OTT-centric 4K STBs. The growth of cloud gaming and high-bandwidth households further reinforces demand for powerful, high-performance streaming devices.

What are the restraints for the global market?

Cost Sensitivity in Emerging Markets

Despite declining hardware prices, 4K set-top boxes remain relatively costlier than HD or basic smart-TV interfaces. In developing markets, consumers may hesitate to upgrade hardware when smart TVs already provide streaming apps. Operators also face challenges in subsidizing 4K boxes for lower-ARPU customers. This price sensitivity slows penetration in regions such as Africa, parts of Southeast Asia, and Latin America.

Fragmented Ecosystems and Compatibility Challenges

The market is highly fragmented across OS platforms, content delivery modes, codecs, and operator-specific requirements. Ensuring seamless compatibility with OTT apps, DRM systems, and varying network infrastructures raises development costs and slows adoption. Fragmentation also leads to inconsistent user experiences, affecting consumer satisfaction and increasing technical support needs for operators.

What are the key opportunities in the 4K set-top box industry?

Smart-Home and IoT Gateway Integration

4K STBs are increasingly positioned as multifunctional home hubs capable of managing connected devices, voice assistants, and automation routines. Operators and OEMs can unlock new revenue streams through smart-home services layered onto STB hardware. This opportunity is especially strong in mature markets where smart-home adoption is already high, and consumers seek unified interfaces for home control and entertainment.

Expansion in Emerging Broadband-Accelerated Markets

Countries in the Asia-Pacific, Latin America, and Africa are rapidly upgrading broadband infrastructures. This presents significant potential for affordable 4K set-top boxes, especially hybrid IPTV + OTT models. Domestic manufacturing incentives, such as India’s electronics production schemes, further lower costs, opening the door for high-volume shipment of 4K STBs tailored to price-sensitive markets.

Product Type Insights

IPTV 4K set-top boxes dominate the market, benefiting from operator-led deployments and widespread fiber-broadband availability. These boxes offer smooth UHD playback and integrated OTT support, making them ideal for modern home entertainment. OTT-centric 4K STBs such as Android-based streaming boxes are rapidly gaining share due to rising cord-cutting trends. Satellite and cable 4K STBs remain relevant in regions where pay-TV retains strong penetration. Hybrid boxes, combining OTT, IPTV, and broadcast access, are emerging as a leading product category for consumers seeking flexibility across content sources.

Application Insights

Residential usage accounts for the largest share of the global 4K STB market, driven by home-based streaming and the rise of connected living rooms. Multi-device households increasingly rely on STBs for premium-content aggregation, parental controls, and unified viewing experiences. Commercial applications, including hotels, hospitals, restaurants, and corporate environments, are expanding quickly as businesses adopt 4K displays for entertainment, digital signage, and information systems. Cloud gaming and interactive education applications are emerging segments leveraging high-performance 4K STBs.

Distribution Channel Insights

Operator-bundled distribution remains dominant as telecom and pay-TV providers supply 4K STBs with IPTV or broadband plans to increase subscriber stickiness. Online retail channels, including e-commerce platforms and direct-to-consumer brand stores, are expanding rapidly due to the popularity of standalone OTT streaming boxes. Offline electronics retail continues to serve markets where in-person purchasing and operator stores are primary consumer touchpoints. Subscription-based hardware models and monthly rental plans are also emerging as alternative channels.

User Type Insights

Mass-market consumers adopting 4K TVs form the largest user group, driving mid-range 4K STB sales. Enthusiast users seeking high-performance, AI-enhanced STBs with advanced codecs represent a growing premium segment. Commercial users such as hotels and enterprises contribute meaningfully through bulk procurement. Meanwhile, cord-cutters and streaming-first households are rapidly shifting toward Android-based OTT STBs as primary viewing devices.

Age Group Insights

Consumers aged 25–45 dominate the market, driven by strong adoption of OTT platforms, smart-home devices, and gaming systems. Younger audiences increasingly prefer streaming-first experiences that require high-performance 4K boxes. Older consumers (50–65) contribute significantly to operator-driven subscriptions, relying on bundled 4K boxes for traditional broadcast alongside OTT access. The under-30 segment shows high affinity for portable, app-driven, budget-friendly 4K streaming boxes.

| By Type | By Operating System | By Connectivity | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents a mature and high-value market, supported by strong broadband connectivity and heavy OTT consumption. U.S. households drive high uptake of Android and proprietary streaming boxes such as Amazon Fire TV and Roku. Operators continue upgrading legacy HD boxes to 4K hardware as part of broadband + TV bundles. Demand is also driven by smart-home integration and premium UHD streaming.

Europe

Europe shows robust adoption of 4K STBs driven by digital broadcasting transitions, strong IPTV markets, and high regulatory standards for content delivery. Countries such as the U.K., Germany, and France lead adoption, with hybrid STBs gaining popularity. Consumers are highly receptive to energy-efficient, AI-enabled, and sustainability-focused devices.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, led by China, India, Japan, and South Korea. Rapid broadband expansion, large-scale electronics manufacturing, and rising middle-class consumption fuel market growth. India represents a high-potential market with rapid IPTV adoption and government-backed electronics manufacturing incentives. China continues to dominate the production and export of cost-competitive 4K STBs.

Latin America

Latin America is witnessing growing demand for 4K STBs as broadband improves and OTT consumption increases. Brazil and Mexico lead adoption, with operators upgrading to 4K IPTV and hybrid boxes. Price-sensitive consumers gravitate toward mid-range models and operator-subsidized STBs.

Middle East & Africa

The Middle East shows strong demand driven by high-income households, smart-home growth, and premium content consumption. Africa is an emerging market where digital terrestrial transitions and improving mobile-broadband networks are gradually enabling 4K adoption. Operator-led deployments and affordable hybrid STBs are expected to accelerate regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the 4K Set-Top Box Market

- Amazon.com Inc.

- Roku Inc.

- ZTE Corporation

- HUMAX Electronics Co., Ltd.

- Infomir Group

- Sagemcom Group

- Inspur Group

Recent Developments

- In March 2025, Amazon unveiled its next-generation 4K Fire TV STB with AV1 codec support and enhanced AI-driven picture optimization.

- In January 2025, ZTE introduced an AI-enabled hybrid 4K IPTV box designed for telecom operators across Asia and Europe.

- In February 2025, Roku launched a premium 4K streaming player with upgraded Wi-Fi 6E capability and expanded OTT marketplace integration.