3D Projectors Market Size

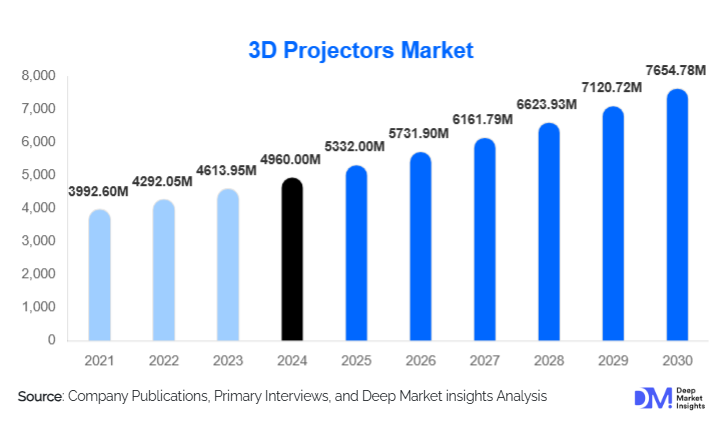

According to Deep Market Insights, the global 3d projectors market size was valued at USD 4,960 million in 2024 and is projected to grow from USD 5,332 million in 2025 to reach USD 7654.78 million by 2030, expanding at a CAGR of 7.5 during the forecast period (2025–2030). Market growth is fueled by rapid advancements in laser projection, rising demand for immersive visual experiences across education, cinema, and corporate sectors, and an accelerated shift toward high-brightness, long-life projection systems enabled by LED and laser technologies.

Key Market Insights

- Laser projectors are becoming the dominant light-source segment due to their long operating life, low maintenance, and superior brightness consistency for 3D applications.

- DLP technology holds the largest share of the 3D projectors market, supported by high contrast ratios, reliability, and scalability for cinema and large-venue installations.

- Asia-Pacific remains the largest and fastest-growing region, driven by cinema expansion, smart classroom adoption, and high-density event markets in China and India.

- Cinema and large-venue applications continue to generate strong demand for high-lumen, fixed-installation 3D projectors designed for theatrical and immersive experiences.

- The corporate and education sectors are rapidly adopting 3D projection for simulation, training, and interactive learning environments.

- Technological integration, including software-based calibration, automated mapping tools, and content ecosystem partnerships, is reshaping competitive differentiation.

What are the latest trends in the 3D projectors market?

Growing Adoption of Laser-Based 3D Projection Systems

Laser light sources are rapidly replacing lamp-based systems in both commercial and institutional environments. Their longer lifespan, minimal maintenance requirements, and high brightness output make them ideal for 3D applications that demand color accuracy and consistent luminance. Cinema chains, universities, and event venues are undergoing large-scale upgrades to laser 3D projectors to reduce operating costs and enhance visual quality. Manufacturers are increasingly expanding their laser portfolios, offering models optimized for high brightness, energy efficiency, and lower total cost of ownership.

Expansion of Immersive and Experiential Visual Solutions

Immersive entertainment, projection mapping, and experiential events are reshaping demand for high-performance 3D projectors. Large venues, museums, concerts, and theme parks are incorporating 3D projection to create multi-sensory experiences. The trend is also influencing corporate environments, where immersive design review rooms and simulation spaces are integrating 3D projection systems. Software-driven experiences, such as auto-calibration, multi-projector blending, and cloud-based content management, are further expanding adoption across creative industries and live events.

What are the key drivers in the 3D projectors market?

Advancement in Projection and Light Source Technologies

Continuous advancements in DLP chips, high-lumen laser engines, and compact optical systems are driving the adoption of next-generation 3D projectors. Laser technology, in particular, enhances color accuracy and reduces maintenance costs, making it attractive for high-demand sectors like cinema, education, and corporate training. Improvements in 4K resolution, frame interpolation, and 3D content compatibility are increasing the usability and longevity of 3D projectors across multiple applications.

Rising Demand for Immersive Learning and Training Environments

Educational institutions and enterprises are increasingly embracing 3D projection to enhance engagement, retention, and real-world visualization. Complex concepts in STEM education, engineering, healthcare, and design are being taught using interactive 3D visuals. In corporate environments, 3D projection supports simulation-based training, product demonstrations, and collaborative design sessions. Government-backed digital education programs in regions such as India, China, and the Middle East are accelerating adoption.

What are the restraints for the global market?

High Upfront Costs and Limited Budget Accessibility

High-performance 3D projectors, especially those with laser light sources and high brightness, carry significant upfront costs. This limits adoption among budget-sensitive institutions, small businesses, and smaller cinema operators. Even though laser technology reduces long-term maintenance costs, the initial investment remains a major barrier. Additionally, 3D content development and system integration costs further elevate total project expenditure.

Content Availability and Compatibility Challenges

Despite growing interest in immersive visuals, high-quality 3D content remains limited, especially in education and corporate segments. Creating or converting 3D content requires specialized tools and expertise, raising costs and slowing adoption. Compatibility challenges, such as mismatched frame rates, 3D formats, and glasses technologies, also complicate deployment, particularly for institutions lacking specialized AV support teams.

What are the key opportunities in the 3D projectors industry?

Expansion of Projection Mapping and Experiential Event Markets

The surge in experiential entertainment, large-scale festivals, immersive art exhibits, and brand activations presents a major opportunity for 3D projector manufacturers. High-brightness 3D projectors enable large-format visuals on buildings, irregular surfaces, and natural landscapes. This market is expanding rapidly as event organizers seek more engaging and visually striking installations. Manufacturers can capitalize by offering rugged, high-lumen laser 3D projectors paired with advanced mapping software.

Growth of Smart Classrooms and Simulation-Based Education

Digital transformation across global education systems is fueling the adoption of interactive 3D learning tools. 3D projectors offer an effective way to visualize scientific models, historical environments, engineering structures, and complex processes. There is a significant opportunity for vendors to partner with content developers, education ministries, and EdTech providers to deliver bundled solutions. Affordable, mid-brightness units optimized for classrooms represent a high-growth market segment.

Product Type Insights

DLP-based 3D projectors dominate the market due to their superior contrast ratios, reliability, and suitability for high-lumen applications. Laser projectors are rapidly gaining share across all product categories, especially in cinema and large-venue deployments. Mid-range Full HD and 4K projectors offer strong adoption across education, business, and home entertainment users seeking immersive displays at affordable costs. High-brightness (4,000–9,999 lumens) laser projectors are the preferred choice for auditoriums, exhibition halls, and events, while ultra-high-brightness models serve specialized venues and premium cinemas.

Application Insights

Cinema and theatrical applications remain the leading segment, with consistent demand for premium 3D experiences from global cinema chains. The education sector is among the fastest-growing segments, driven by smart classroom initiatives and interactive learning. Corporate applications, including simulation, design visualization, and training, are expanding rapidly due to hybrid work models. Large venues, events, and projection mapping form another high-growth application area. Home theater and gaming represent smaller but steady niche segments, with enthusiasts adopting compact 3D projectors for immersive viewing.

Distribution Channel Insights

Direct sales and systems integrators dominate high-value segments such as large venues, cinema, and corporate installations. Online retail channels, including major e-commerce platforms, play a growing role in mid-range and portable 3D projectors aimed at education and home entertainment users. Specialized AV distributors continue to play a vital role in consulting, installation, and after-sales maintenance. Subscription-based leasing and long-term service agreements are emerging as attractive models for institutions seeking to reduce upfront costs.

End-Use / Consumer Type Insights

Enterprises and educational institutions form the backbone of the mid-range and premium 3D projector market. Large event organizers, museums, and venues represent high-value buyers of high-lumen systems. Cinema chains remain the largest consumers of ultra-bright, fixed-installation 3D projectors. Home users, particularly gamers and film enthusiasts, adopt compact models with moderate brightness and 3D compatibility. Simulation-heavy industries such as aerospace, automotive, and healthcare represent a growing category for immersive visualization tools.

| By Technology Type | By Resolution | By Light Source | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains a major market for high-end 3D projectors, driven by strong adoption in cinema, corporate training, and educational technology. The U.S. shows robust demand for laser upgrades in theaters and large-venue installations. Growing interest in immersive entertainment and enterprise visualization solutions further strengthens the region’s market position.

Europe

Europe shows strong adoption across museums, cultural venues, education, and corporate learning environments. The region’s emphasis on sustainable technologies supports the transition to energy-efficient laser projectors. Western Europe, especially Germany, the U.K., and France, drives demand, while Eastern Europe presents emerging opportunities for cinema and education deployments.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing regional market, led by China, Japan, India, and Southeast Asia. Cinema expansion, government-led digital education initiatives, and rising disposable incomes are accelerating adoption. China remains the manufacturing hub for projectors and components, driving exports worldwide. India’s nationwide digital classroom penetration is expected to dramatically increase market volume during the forecast period.

Latin America

Latin America is experiencing steady growth driven by corporate modernization, educational upgrades, and an expanding events industry. Brazil and Mexico lead in adoption, especially for mid-range 3D projectors. Budget constraints in some markets slow adoption of high-lumen and laser systems, but long-term growth prospects remain positive.

Middle East & Africa

The Middle East shows increasing demand for high-end 3D projectors across entertainment, hospitality, and corporate sectors. Major investments in museums, mega-events, and smart city initiatives (particularly in the UAE and Saudi Arabia) are boosting adoption. Africa presents strong potential through cinema expansion, education investments, and tourism-driven entertainment infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the 3D Projectors Market

- Seiko Epson Corporation

- Sony Corporation

- Barco NV

- Christie Digital Systems

- BenQ Corporation

- Optoma / Coretronic Corporation

- Panasonic Holdings Corporation

- Sharp NEC Display Solutions

- ViewSonic Corporation

- Vivitek (Delta Electronics)

Recent Developments

- In 2025, Barco expanded its laser-based cinema projector lineup to support next-generation 3D formats and high-frame-rate content across global theaters.

- In 2025, Epson launched a new series of compact, high-lumen 3D laser projectors designed for classrooms and corporate training rooms, emphasizing low maintenance and high color accuracy.

- In 2025, Optoma introduced an ultra-bright 3D projector lineup for large venues, incorporating AI-based color calibration and cloud-enabled content management tools.