Wooden Accordion Market Overview

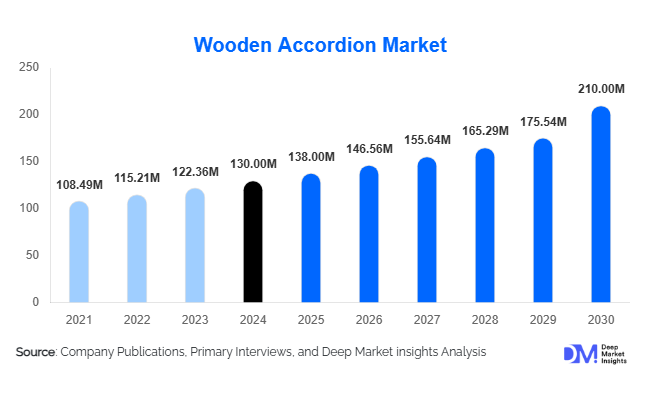

According to Deep Market Insights, the global wooden accordion market size was valued at USD 130 million in 2024 and is projected to grow from USD 138.06 million in 2025 to reach USD 186.50 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for authentic folk and traditional musical instruments, increasing investment in music education, and growing interest in premium, handcrafted wooden accordions across global regions.

Key Market Insights

- Premium craftsmanship and sustainable materials are shaping demand, as musicians, collectors, and institutions increasingly prefer high-quality wooden accordions made from maple, cherry, and other premium woods.

- Professional performance and educational institutions dominate consumption, supporting revenue growth in high-end and semi-professional instrument segments.

- Europe leads global demand, with Italy, Germany, and France driving consumption due to their strong musical heritage and artisan manufacturing capabilities.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, expanding music education programs, and cultural revival trends in India, China, and Southeast Asia.

- Online and direct-to-consumer channels are increasingly important, enabling artisans to reach international markets and niche audiences.

- Integration of hybrid and electronic features in traditional wooden accordions is emerging, appealing to modern performers seeking amplified or MIDI-compatible instruments.

What are the latest trends in the wooden accordion market?

Hybrid and Digitally Integrated Accordions

Manufacturers are increasingly combining traditional wooden accordion designs with modern technology, such as built-in pickups, MIDI compatibility, and electronic amplification. These hybrid instruments allow performers to expand into studio recording, live amplification, and digital music integration while retaining the warmth and authenticity of wood-based acoustics. This trend particularly appeals to younger musicians, professional performers, and content creators seeking versatility without sacrificing traditional tonal quality. Workshops are also adopting CNC tools and precision machinery to enhance consistency and reduce production bottlenecks while preserving handcrafted finishing for premium models.

Sustainability and Eco-Friendly Manufacturing

Environmental awareness is influencing purchasing behavior, with demand rising for instruments made from FSC-certified or reclaimed woods, low-VOC finishes, and sustainable supply chains. Artisans are branding eco-friendly features as a differentiator, especially for collectors and high-end buyers. Governments and regulatory bodies in Europe, North America, and parts of Asia have tightened controls on raw wood imports, further incentivizing manufacturers to adopt sustainable sourcing and environmentally responsible production practices.

What are the key drivers in the wooden accordion market?

Folk and Traditional Music Revival

The resurgence of folk and traditional music globally is driving growth for wooden accordions, particularly in Europe, Latin America, and parts of Asia. Cultural festivals, heritage preservation programs, and growing interest in live acoustic performances are fueling demand. Button-type and chromatic wooden accordions, widely used in traditional music, account for the largest portion of revenue within this segment.

Expansion in Music Education and Institutional Support

Music schools, conservatories, and cultural institutions are increasingly investing in wooden accordions for student training and institutional programs. Grants, subsidies, and government-backed initiatives targeting cultural preservation and education are contributing to stable demand, particularly in the mid-tier and entry-level segments.

E-commerce and Global Market Access

Online platforms and marketplaces allow artisans and manufacturers to reach international consumers directly. These channels facilitate global exposure, enable pre-ordering of custom designs, and support niche demand for specialty instruments. Digital marketing, social media promotion, and virtual demonstrations are reshaping market reach and reducing reliance on local retail networks.

What are the restraints for the global market?

High Production Costs and Skilled Labor Shortages

Crafting wooden accordions requires high-quality woods, skilled artisans, and labor-intensive production processes. Rising raw material prices and limited availability of trained luthiers restrict production capacity and drive higher unit costs. This limits affordability and constrains growth, particularly in emerging markets.

Competition from Synthetic and Mass-Produced Alternatives

Plastic and composite accordions, as well as fully electronic instruments, offer cheaper alternatives for beginners and casual users. These products can deter price-sensitive consumers from investing in wooden instruments, reducing market penetration for premium handcrafted models. The competitive pressure particularly impacts entry-level and mid-tier wooden accordions.

What are the key opportunities in the wooden accordion industry?

Emerging Markets and Cultural Revival

Regions such as India, Southeast Asia, and Latin America are experiencing increased interest in folk and traditional music, creating a growing customer base for wooden accordions. Collaborations with cultural institutions, music schools, and festivals provide opportunities for manufacturers to expand into previously untapped markets. Localized pricing strategies, culturally inspired designs, and educational programs can accelerate adoption in these regions.

Hybrid Acoustic-Electronic Instruments

Integrating digital and electronic features into wooden accordions presents opportunities to meet modern performance requirements without compromising acoustic quality. Artists and performers can leverage amplification, MIDI connectivity, and recording features, broadening appeal across studio, live, and online music settings. Hybrid models also facilitate adoption in educational and professional contexts.

Sustainable and Certified Materials

Growing consumer preference for environmentally responsible products offers a unique market advantage for brands emphasizing FSC-certified wood, low-emission finishes, and sustainable manufacturing. These certifications also support export compliance in Europe and North America, creating trust with conscious buyers and collectors.

Product Type Insights

Button-type wooden accordions dominate the market, particularly for folk and traditional music. Piano wooden accordions are also significant, catering to classical and semi-professional musicians. High-end custom and professional-grade wooden accordions account for the largest revenue share, due to premium pricing and collector demand, while entry-level student models support volume in educational and institutional segments. The mid-tier segment balances quality with affordability, targeting semi-professional and amateur performers.

Application Insights

Professional performance and concert applications lead the market in revenue, followed by educational and institutional use. Recreational, hobbyist, and collector applications represent niche segments, with growing interest in decorative or limited-edition instruments. Cultural festivals, heritage programs, and online content creation are emerging applications driving additional demand.

Distribution Channel Insights

Offline retail and specialty music stores remain the primary distribution channels, enabling customers to experience instruments firsthand. Institutional procurement for schools, conservatories, and festivals also represents a significant portion of sales. Online platforms, marketplaces, and direct-to-consumer channels are rapidly growing, particularly for reaching international buyers, offering customization options, and supporting niche artisan brands.

End-Use Insights

Educational institutions and professional performers account for the majority of wooden accordion demand. Rising investment in music education and cultural programs supports institutional growth, while professional performers contribute to premium revenue. Emerging markets and content creators provide new end-use opportunities, particularly for hybrid and digitally integrated models. Export-driven demand is substantial, with European and North American institutions importing high-quality instruments from established artisan regions such as Italy and Germany.

| By Product Type | By Wood Type | By Application | By Price Tier | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe accounts for approximately 35–40% of the global wooden accordion market in 2024. Italy, Germany, and France are major consumers and producers, driven by rich musical heritage, skilled artisans, and strong institutional support. Eastern European countries such as Poland and Hungary are the fastest-growing sub-regions, fueled by cultural revival programs and increasing disposable incomes.

Asia-Pacific

APAC holds roughly 25–30% of the market, with India, China, Japan, and Southeast Asia driving growth. Expanding music education programs, cultural revival initiatives, and rising middle-class incomes are key factors. India and Southeast Asia represent the fastest-growing sub-regions, with increasing institutional and hobbyist adoption.

North America

North America accounts for approximately 20–25% of the market. The U.S. leads demand, with Canadian markets contributing moderately. Interest is concentrated in professional performers, cultural organizations, and educational institutions, supported by high disposable incomes and an affinity for traditional musical instruments.

Latin America

Latin America contributes roughly 5–8% of the market, with Brazil and Mexico emerging as growth hubs. Demand is largely driven by folk music traditions and expanding middle-class interest in quality instruments for performance and festivals.

Middle East & Africa

MEA represents about 5–7% of the market. Key demand comes from urban centers in South Africa, the UAE, and Turkey. Cultural festivals and expatriate communities drive niche adoption, while local production remains limited.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wooden Accordion Market

- Hohner

- Victoria Accordion Company

- Yamaha

- Scarlatti

- Excelsior

- Pigini

- Binaswar

- Rossetti

- Sonola

- Crucianelli

- Bugari

- Paolo Soprani

- Victoria (Italy)

- Steirische Harmonika

- Saltarelle

Recent Developments

- In March 2025, Hohner introduced a new line of hybrid wooden accordions with integrated MIDI functionality, targeting professional performers and recording artists.

- In January 2025, Pigini launched a sustainable collection using FSC-certified woods and eco-friendly finishes, aimed at collectors and premium buyers.

- In February 2025, Victoria Accordion Company expanded its distribution to Southeast Asia, leveraging online direct-to-consumer channels for institutional and performance markets.