WiFi Home Router Market Size

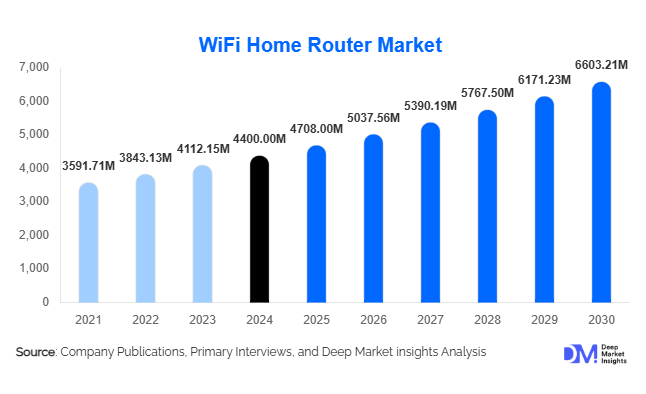

According to Deep Market Insights, the global wifi home router market size was valued at USD 4,400 million in 2024 and is projected to grow from USD 4,708.0 million in 2025 to reach USD 6,603.21 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). The market growth is primarily driven by increasing broadband penetration, rising adoption of smart home devices, the proliferation of remote-work households, and the emergence of new WiFi standards such as WiFi 6, WiFi 6E, and WiFi 7 that enhance home network performance.

Key Market Insights

- Smart home integration is a major driver, with routers acting as central hubs for IoT devices, including voice assistants, security cameras, and smart appliances.

- Premium performance routers, such as mesh WiFi systems and gaming-oriented routers, are growing due to multi-gigabit broadband adoption and demand for low-latency streaming and gaming.

- Asia-Pacific dominates in terms of growth, led by China and India, driven by expanding broadband infrastructure and rising smart-home penetration.

- North America remains a mature, high-value market, with strong demand for high-end WiFi routers supporting remote work and entertainment.

- Technology adoption is reshaping the market, with WiFi 6/6E, tri-band systems, and AI-enabled traffic management becoming key differentiators among consumers.

Latest Market Trends

WiFi 6/6E and Mesh Systems Adoption

Homeowners are increasingly upgrading from WiFi 5 to WiFi 6 and WiFi 6E routers to meet the growing bandwidth requirements of multiple connected devices. Mesh systems, particularly tri-band variants, are gaining popularity in large or multi-story homes, providing consistent coverage and better management of multiple devices. These systems are also being bundled with ISP subscriptions in emerging markets, accelerating adoption. Advanced features such as AI-based traffic optimization, app-based parental controls, and built-in security further enhance user experience and drive higher-value purchases.

Integration with Smart Home Ecosystems

Modern routers are evolving beyond connectivity devices to act as control hubs for smart homes. Integration with platforms like Google Home, Amazon Alexa, and other IoT ecosystems allows seamless management of connected devices, energy-efficient scheduling, and enhanced security. Consumer preference is shifting toward routers that offer easy setup, centralized device management, and remote monitoring. The proliferation of smart TVs, security cameras, voice assistants, and gaming consoles is reinforcing this trend, particularly in regions with high adoption of connected devices.

WiFi Home Router Market Drivers

Rising Broadband Penetration and FTTH Rollout

Expansion of fiber-to-the-home (FTTH) and high-speed broadband networks worldwide is a key driver for home router upgrades. Consumers are demanding routers capable of supporting multi-gigabit speeds, low latency, and multiple concurrent device connections. This trend is strongest in developed regions like North America and Europe, while emerging regions such as the Asia-Pacific are benefiting from new broadband infrastructure deployments that include router provisioning.

Increase in Connected Devices and Remote Work

The surge in smart home devices, gaming consoles, video streaming, and remote work solutions is driving demand for high-performance home routers. Households now require routers capable of managing multiple devices simultaneously, maintaining low latency, and providing secure connections. This has led to increased adoption of dual-band, tri-band, and mesh WiFi systems, particularly in medium-to-large homes and multi-dwelling units (MDUs).

Technological Advancements and New WiFi Standards

The rollout of WiFi 6, WiFi 6E, and the emerging WiFi 7 standards has accelerated replacement cycles for older routers. New technologies provide higher throughput, reduced latency, better energy efficiency, and increased device capacity. Manufacturers are leveraging these advancements to introduce premium routers with differentiated features such as AI traffic management, mesh networking, and enhanced security, creating opportunities for both new entrants and established players.

Market Restraints

Price Sensitivity and Component Costs

Despite the growth in premium routers, many consumers remain price-sensitive, especially in emerging markets. Rising costs of components such as WiFi chipsets, antennas, and printed circuit boards challenge manufacturers to maintain competitive pricing while offering advanced features, limiting margins, and potentially slowing adoption in budget-conscious segments.

Market Saturation in Mature Regions

In developed markets like North America and Europe, most households already have WiFi routers, and replacement cycles are relatively long (3–5 years or more). As a result, volume growth is constrained, and market expansion relies heavily on upgrades to higher-value products rather than first-time installations.

WiFi Home Router Market Opportunities

Smart Home and IoT Integration

The proliferation of smart home devices presents a significant opportunity. Routers that seamlessly integrate with IoT ecosystems, provide centralized management, and offer enhanced security features are increasingly in demand. Partnerships with smart-home platforms and software integration allow manufacturers to differentiate products and upsell higher-spec devices, creating new revenue streams.

Premium Routers for Gaming and Streaming

High-performance routers targeting gamers and heavy-streaming households represent a growing market segment. These routers often feature tri-band configurations, mesh networking, dedicated gaming ports, and low-latency optimization. As broadband speeds increase globally, demand for these premium routers is expected to rise, particularly in North America, Europe, and APAC.

Emerging Markets and ISP Bundling

Emerging markets in Asia-Pacific, Latin America, and Africa offer significant growth potential. Many ISPs bundle routers with broadband subscriptions, providing manufacturers with volume sales opportunities. Government-backed broadband expansion programs, rural connectivity projects, and smart-city initiatives further support growth in these regions, particularly in countries like India, China, and Brazil.

Product Type Insights

Dual-band routers dominate the global market, offering a balance between performance and affordability, and accounted for 43% of the market in 2024. WiFi 6 routers are the leading technology standard, representing 46.5% of the market due to strong replacement demand. Mid-range routers capture the largest value share, balancing cost and performance, while premium gaming and mesh routers are gaining traction. Entry-level routers remain popular in price-sensitive regions and for ISP bundles.

Application Insights

Residential households represent the primary end-use segment, with smart homes and remote-work households driving the fastest growth. Multi-dwelling units and large homes increasingly adopt mesh WiFi systems to cover multiple floors and devices. Emerging applications include home gaming, cloud streaming, online education, and IoT-enabled healthcare and monitoring systems, further expanding market demand.

Distribution Channel Insights

ISP/bundled device sales dominate the distribution channels, capturing 46% of the market in 2024, followed by online retail and offline electronics stores. Direct sales from manufacturers are gaining traction in regions with high internet penetration. E-commerce platforms provide consumers with product comparisons, reviews, and transparent pricing, while partnerships with ISPs ensure volume distribution in emerging markets.

| By Product Type | By Technology Standard | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 30–35% of the global market in 2024 (USD 4.5–5.0 billion). High broadband penetration, gaming and streaming adoption, and remote work support demand for high-end routers. Replacement cycles and upgrades to WiFi 6/6E routers continue to drive revenue growth in the region.

Europe

Europe represents 20–25% of the market (USD 3.0–3.6 billion), with countries like Germany, the UK, and France leading adoption. Growth is fueled by WiFi 6 upgrades, mesh networking, and smart-home integration. Sustainability and energy-efficient routers are increasingly important to European consumers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for 33.9% of the market (USD 4.9 billion). China and India drive adoption through broadband expansion and rising smart-home penetration. Tri-band and mesh systems are particularly popular in urban areas with multi-device households. The region benefits from both volume growth and increasing average selling prices.

Latin America

Latin America (5–8% of the market) is emerging, with Brazil, Mexico, and Argentina leading adoption. Growth is supported by new broadband deployments, increasing gaming and streaming penetration, and ISP bundling programs. The region is expected to see a higher CAGR due to infrastructure improvements.

Middle East & Africa

MEA (3–5% of the market) is a smaller but fast-growing region. Gulf countries such as the UAE, Saudi Arabia, and Qatar are driving premium router adoption, while Africa is benefiting from new broadband initiatives and smart-city programs. The region’s growth rate is among the highest globally despite its smaller market share.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the WiFi Home Router Market

- TP-Link

- Netgear

- ASUS

- D-Link

- Huawei

- Xiaomi

- Belkin

- Google (Nest WiFi)

- Amazon (Eero)

- Synology

- Tenda Technology

- Zyxel Communications

- Ubiquiti Networks

- Linksys

- Arris International

Recent Developments

- In March 2025, TP-Link launched its new WiFi 6E tri-band mesh system for large homes, featuring AI-based traffic management and enhanced parental controls.

- In February 2025, Netgear introduced a premium gaming router series with low-latency optimization and dedicated backhaul channels for high-performance home networks.

- In January 2025, ASUS rolled out a smart-home integrated router portfolio compatible with major IoT platforms, targeting urban multi-device households in APAC and North America.