Weed Vapes Market Summary

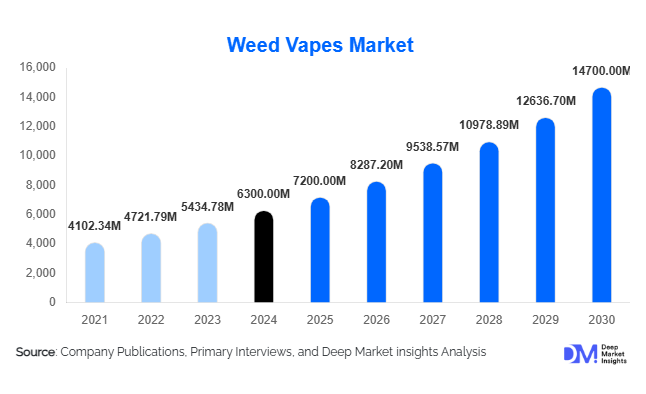

According to Deep Market Insights, the global weed vapes market size was valued at USD 6,300 million in 2024 and is projected to grow from USD 7,200 million in 2025 to reach USD 14,700 million by 2030, expanding at a CAGR of 15.1% during the forecast period (2025–2030). The market growth is primarily driven by the increasing legalization of cannabis in multiple regions, rising consumer preference for healthier alternatives to smoking, and rapid advancements in vaping technology that enhance convenience, efficiency, and overall user experience.

Key Market Insights

- Portable vaporizers dominate the product landscape, offering convenience, discreet usage, and portability, which are preferred by recreational and wellness-focused consumers alike.

- Dry herb vaporizers lead the ingredient segment, as users increasingly prefer unprocessed consumption methods that preserve the natural cannabinoids and terpenes of cannabis.

- Online retail channels are rapidly expanding, enabling consumers to access a broader range of products, detailed specifications, and convenient delivery options.

- North America is the largest regional market, with strong demand from the U.S. and Canada due to widespread legalization, mature distribution networks, and high consumer awareness.

- Europe is the fastest-growing regional market, led by Germany, the Netherlands, and the U.K., where changing regulations and rising social acceptance are driving growth.

- Technological integration, including precision heating, hybrid vaporizers, and smart device connectivity, is shaping consumer adoption and product differentiation.

What are the latest trends in the weed vapes market?

Health-Conscious Vaping Driving Adoption

Consumers are increasingly shifting from traditional smoking to vaping due to perceived health benefits, as weed vapes produce fewer harmful by-products and allow precise dosing. This trend has resulted in growing adoption among recreational users and medical patients seeking controlled consumption. Health-focused marketing campaigns and education around vaping’s relative safety have strengthened consumer confidence. Additionally, vape manufacturers are developing formulations that maximize cannabinoid extraction while minimizing harmful residue, further aligning with wellness trends.

Technology-Enhanced Vaporizers

Technological innovation is transforming the weed vape market. Products now feature precision temperature controls, hybrid compatibility (dry herb and oils), long-lasting batteries, and smartphone connectivity for personalized experiences. Consumers increasingly prefer devices that integrate app-based controls, dose tracking, and firmware updates. Induction and convection heating technologies enhance vapor quality and flavor, appealing to connoisseurs. This technological edge differentiates brands, drives premium pricing, and attracts tech-savvy users.

What are the key drivers in the weed vapes market?

Legalization and Social Acceptance

The legalization of cannabis in North America, parts of Europe, and Latin America has reduced social stigma and expanded market accessibility. Consumers are more willing to try weed vapes, fueling sales growth. As cannabis regulations become clearer, retailers and manufacturers gain confidence to expand product offerings, invest in marketing, and target new demographics.

Rising Health Awareness

Health-conscious users are avoiding smoking due to its harmful effects on the lungs and seeking alternatives like vaporizers. Weed vapes are marketed as cleaner, safer options, particularly in regions where medical cannabis is growing. The perception of improved health outcomes drives adoption among both recreational and medical users.

Technological Innovation and Product Differentiation

Continuous R&D is enhancing vaporizer efficiency, battery life, portability, and flavor quality. Hybrid and smart vaporizers provide versatile usage, including both dry herb and oil-based cannabis, increasing appeal across different consumer segments. Manufacturers leveraging innovation gain a competitive edge, which accelerates overall market growth.

What are the restraints for the global market?

Regulatory Variability

Despite legalization in many regions, cannabis remains tightly regulated in several countries. Complex regulations around manufacturing, distribution, and advertising restrict market expansion and create compliance challenges for manufacturers and retailers, potentially limiting growth.

Market Fragmentation

The weed vape market is highly fragmented with numerous brands offering similar products, making it challenging for new entrants to gain brand recognition. Consumers may also struggle to identify high-quality devices, impacting overall confidence and slowing adoption rates.

What are the key opportunities in the weed vapes market?

Expanding Legalized Markets

As more countries and states legalize cannabis, new consumer bases emerge. Businesses can capitalize by launching region-specific products, ensuring regulatory compliance, and educating consumers about vape benefits. Emerging markets in Latin America, Asia-Pacific, and parts of Europe provide substantial growth potential.

Technological Integration and Product Innovation

Advanced vaporizers with smart connectivity, hybrid functionality, and precise temperature controls present opportunities for differentiation. Companies investing in R&D can develop premium products that cater to both medical and recreational users. Integration of AI, app-based dosing, and IoT-connected vaporizers can further enhance consumer engagement and loyalty.

Growth of E-Commerce and Digital Channels

Online retail platforms allow brands to reach wider audiences with detailed product information, reviews, and direct delivery. Companies that optimize digital marketing, social media engagement, and e-commerce partnerships can capture a larger share of consumers, including those in regions with limited physical retail access.

Product Type Insights

Portable vaporizers dominate the market with a 42% share in 2024, driven by convenience and discreet usage. Tabletop vaporizers hold niche appeal among premium users seeking robust performance and customizable experiences. Hybrid vaporizers are gaining traction due to their versatility, appealing to consumers who prefer both dry herb and oil-based consumption.

Ingredient Insights

Dry herb vaporizers lead the segment with a 38% share in 2024, due to increasing consumer preference for natural cannabis consumption and better flavor retention. Oil-based vaporizers are growing in medical applications, offering precise dosing and cleaner consumption. Hybrid vaporizers are emerging as a premium option, integrating benefits from both segments.

Distribution Channel Insights

Online retail holds a leading share (45%) in 2024, driven by convenience, product variety, and detailed specifications. Offline retail remains significant for first-time buyers seeking in-store assistance and experience-based purchasing. E-commerce is expected to continue driving market growth, particularly in regions with restrictive offline retail regulations.

End-Use Insights

Recreational users represent the largest consumer base, particularly in legalized regions. Medical users are growing steadily due to controlled dosing and health-focused benefits. Wellness enthusiasts also contribute to adoption, aligning vaping with holistic health practices. Export demand is rising, with North American and European companies supplying emerging markets in Asia-Pacific and Latin America.

| By Product Type | By Ingredient Type | By Heating Method | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 48% of the 2024 market, with the U.S. leading demand due to broad legalization, mature retail networks, and high consumer awareness. Canada follows closely, supported by nationwide recreational cannabis policies. The region is expected to maintain leadership due to early adoption and continued innovation.

Europe

Europe contributes 22% of the 2024 market, with Germany, the U.K., and the Netherlands leading. Germany is the fastest-growing country due to expanding medical cannabis programs, while the U.K. and the Netherlands benefit from rising recreational acceptance and regulatory reforms. Overall, Europe is poised for strong growth driven by regulatory support and consumer education.

Asia-Pacific

Emerging markets in Japan, Australia, India, and China are gradually adopting cannabis vaping, though regulatory hurdles remain. Rising middle-class income and e-commerce penetration are expected to accelerate adoption over the forecast period.

Latin America

Uruguay and Mexico are leading regional growth due to cannabis legalization. Affluent consumers are driving recreational vape adoption, and export opportunities from North American and European suppliers are expected to expand.

Middle East & Africa

While Africa hosts natural cannabis cultivation regions, market demand remains nascent due to regulatory restrictions. Middle Eastern markets like the UAE and Israel are slowly opening for medical and recreational use, representing future growth potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Weed Vapes Market

- Storz & Bickel

- Planet of the Vapes

- PAX Labs

- G Pen

- V2 Cigs

- Grenco Science

- Boundless Technology

- Yocan

- AtmosRx

- KandyPens

- DaVinci Vaporizer

- Firefly Vapor

- Haze Technologies

- XVAPE

- Arizer

Recent Developments

- In March 2025, PAX Labs launched a hybrid vaporizer integrating dry herb and oil functionalities with Bluetooth connectivity and app-based controls.

- In January 2025, Storz & Bickel expanded production capacity in Germany to meet growing European and North American demand.

- In December 2024, DaVinci introduced precision temperature control vaporizers targeting medical cannabis patients for enhanced dosing accuracy.