Wearable Hidden Camera Market Size

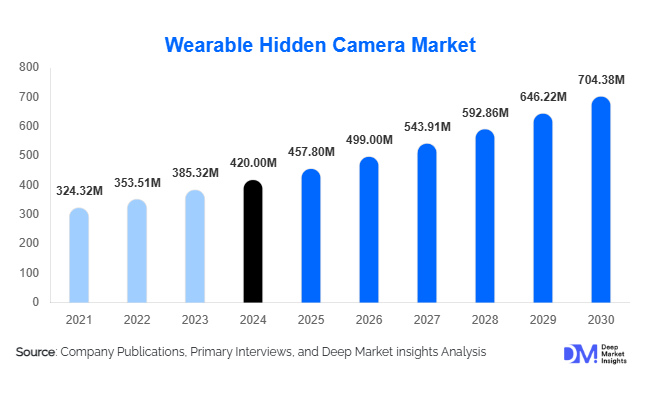

According to Deep Market Insights, the global wearable hidden camera market size was valued at USD 420 million in 2024 and is projected to grow from USD 457.80 million in 2025 to reach USD 704.38 million by 2030, expanding at a CAGR of 9% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for security and surveillance applications, increasing adoption of wearable technology integrated with AI and wireless connectivity, and growing consumer awareness for personal safety and covert monitoring solutions.

Key Market Insights

- Law enforcement and private security remain the largest end users, procuring wearable hidden cameras for accountability, transparency, and evidentiary purposes.

- Camera glasses and head-mounted devices are leading form factors globally, favored for discreet recording and hands-free operation.

- North America dominates the market in 2024, with the U.S. accounting for a significant share due to stringent transparency and safety mandates.

- Asia-Pacific is the fastest-growing region, led by China and India, driven by rising consumer adoption, expanding security infrastructure, and increasing disposable income.

- Technological integration, including AI-based motion detection, facial recognition, edge computing, and cloud connectivity, is reshaping product differentiation and driving premium adoption.

- Online retail channels are the preferred distribution mode for consumer segments, offering discreet purchase options and a wide product selection.

Latest Market Trends

AI-Enabled and Smart Wearable Cameras

Emerging wearable hidden cameras are increasingly integrating AI features such as motion detection, facial recognition, object tracking, and automated redaction. Edge computing capabilities allow on-device processing, reducing latency and improving privacy compliance. Cloud-connected models enable real-time monitoring and secure remote storage. These innovations appeal to both institutional and consumer users, providing actionable insights, enhancing usability, and improving covert operations without compromising detection risk. Manufacturers are prioritizing miniaturization, ruggedness, and low-light capabilities, making devices suitable for law enforcement, personal safety, and investigative applications.

Growing Consumer and Healthcare Adoption

While security and surveillance remain dominant, adoption in healthcare and personal safety is accelerating. Hospitals and elder care facilities are leveraging wearable hidden cameras for discreet patient monitoring, while consumers increasingly use devices for personal safety, activity tracking, and adventure documentation. Startups are innovating with disguised camera devices in accessories, clothing, and wearables to appeal to privacy-conscious buyers. The convergence of AI, IoT, and wearable tech is expanding the market beyond traditional security use cases, enabling diversified growth opportunities.

Wearable Hidden Camera Market Drivers

Rising Demand for Security and Surveillance

Increasing public safety concerns, workplace monitoring needs, and regulatory mandates are driving institutional adoption of wearable hidden cameras. Law enforcement agencies and private security firms are procuring covert devices to enhance accountability, capture evidence in real-time, and ensure staff or citizen safety. These applications provide recurring revenue streams for manufacturers, as institutions invest in certified and durable devices tailored for covert operations.

Technological Advancements and Miniaturization

Recent improvements in battery technology, storage solutions, high-resolution imaging, and connectivity have enhanced the usability and appeal of wearable hidden cameras. Miniaturized designs allow devices to remain inconspicuous while providing high-quality video and audio capture. Integration with AI and wireless networks further adds value, driving higher adoption among institutional and consumer users. The ability to embed cameras into glasses, watches, pins, and other accessories expands market penetration opportunities.

Growing Awareness and Personal Safety Needs

Increasing consumer awareness of personal security and the need to record incidents for accountability are contributing to market growth. Social media, viral incidents, and rising concerns over public safety have heightened demand for wearable hidden cameras in urban and high-risk environments. Consumers prefer compact, user-friendly devices that can be easily worn or concealed without compromising functionality.

Market Restraints

Privacy and Regulatory Challenges

Privacy concerns and varying legal frameworks across regions limit adoption. Recording without consent can lead to legal consequences, and strict data protection regulations (e.g., GDPR in Europe) impose compliance requirements. These constraints increase production costs and may restrict market growth in regulated jurisdictions.

Technical Limitations and Cost Sensitivity

Battery life, storage capacity, low-light performance, and device durability are technical limitations that may hinder adoption. High-end devices with advanced AI features and rugged designs can be expensive, limiting penetration in price-sensitive consumer segments. Manufacturers must balance affordability with technological sophistication to expand market reach.

Wearable Hidden Camera Market Opportunities

Institutional Procurement and Government Initiatives

Governments worldwide are investing in public security infrastructure, offering significant opportunities for manufacturers to supply law enforcement and private security agencies. Compliance with regulatory standards and the provision of evidence-grade recording devices can position companies favorably for large-scale institutional contracts. Programs promoting domestic manufacturing (e.g., “Make in India”) also encourage local production and innovation.

Integration of AI and Smart Technologies

The adoption of AI-enabled and smart wearable cameras provides opportunities for differentiation. Manufacturers can develop products with real-time analytics, cloud integration, and advanced motion/object detection, appealing to both institutional and consumer markets. These innovations enable premium pricing, recurring service-based revenue, and stronger competitive positioning.

Expansion into Emerging End-Use Segments

Healthcare, personal safety, adventure, and investigative journalism are underpenetrated markets for wearable hidden cameras. Hospitals, elder care facilities, and insurance providers are exploring covert monitoring solutions. Consumers are increasingly adopting wearable hidden cameras for personal security and recreational recording. Companies targeting these new segments can capture additional revenue streams and diversify market risk.

Product Type Insights

Camera glasses and head-mounted devices dominate the wearable hidden camera market due to their discretion, hands-free functionality, and growing consumer appeal. Watch-based cameras and clothing-integrated cameras are gaining traction, particularly in consumer and personal safety applications. Devices with AI-assisted motion detection and WiFi connectivity are increasingly preferred across all segments, providing value-added features that drive adoption.

Application Insights

Security and surveillance are the largest applications, driven by institutional adoption for law enforcement, private security, and investigative purposes. Consumer applications, such as personal safety and adventure documentation, are expanding rapidly. Healthcare monitoring and elder care are emerging use cases, while investigative journalism and content creation are niche but growing markets. The convergence of AI, wireless connectivity, and compact form factors is enabling cross-segment adoption.

Distribution Channel Insights

Online retail channels, including e-commerce platforms, dominate sales due to discreet purchasing options and wide product selection. Authorized distributors and specialty security stores cater to institutional buyers, providing compliance-certified and ruggedized devices. Direct sales contracts with government agencies and private security firms are significant revenue contributors. Emerging subscription-based models for AI-assisted features and cloud storage are creating new engagement channels.

End-Use Segment Insights

Law enforcement and private security are the largest end-use segments, accounting for approximately 35–40% of the market in 2024. Healthcare and personal safety are the fastest-growing segments, driven by hospitals, elder care, and individual consumers. Adventure, sports, and investigative applications contribute niche but growing demand. Export-driven growth is notable, with devices manufactured in Asia-Pacific being shipped to North America, Europe, and emerging markets for both institutional and consumer purposes.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest market, with the U.S. accounting for the majority of demand. Institutional procurement, strict accountability regulations, and high consumer awareness drive adoption. Devices with evidence-grade certification, rugged design, and AI features are preferred. Canada contributes moderately, mainly in consumer and security segments.

Europe

Europe accounts for 20–25% of the 2024 market, led by the UK, Germany, and France. Strong privacy regulations and data protection laws influence adoption patterns. Growth is driven by law enforcement modernization, private security, and emerging healthcare applications. Eco-conscious consumers are also showing interest in discreet monitoring solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China and India. Rising consumer awareness, expanding law enforcement budgets, and increasing disposable income support adoption. Japan and South Korea show steady demand for consumer and recreational applications. The region is expected to increase its share to 35–40% by 2030.

Latin America

Brazil and Mexico lead adoption in Latin America, primarily for personal safety and private security. Price sensitivity remains a constraint, but growing awareness of public safety and urban security concerns is boosting demand. Niche operators target high-value consumers seeking adventure or monitoring solutions.

Middle East & Africa

MEA accounts for 3–5% of the global market. Demand is concentrated in the UAE, Saudi Arabia, and South Africa, driven by government security initiatives and high-income consumers. Intra-regional growth is supported by private security adoption and selective consumer use in urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wearable Hidden Camera Market

- Digital Ally

- VIEVU

- Reveal

- Safety Innovations

- Panasonic

- Titathink

- Conbrov

- Maximus

- Littleadd

- Antaivision

- Minox

- Pinnacle Response

- PRO-VISION Video Systems

- Shenzhen AEE Technology

- GoPro

Recent Developments

- In March 2025, Digital Ally launched a next-generation camera glasses series with AI motion detection and secure cloud storage, targeting law enforcement agencies in North America.

- In February 2025, Panasonic introduced a ruggedized wearable hidden camera for institutional security, featuring extended battery life and low-light recording capabilities.

- In January 2025, VIEVU expanded its global distribution in Asia-Pacific, focusing on healthcare and personal safety applications with compact and discreet wearable devices.