Video LED Panel Light Market Size

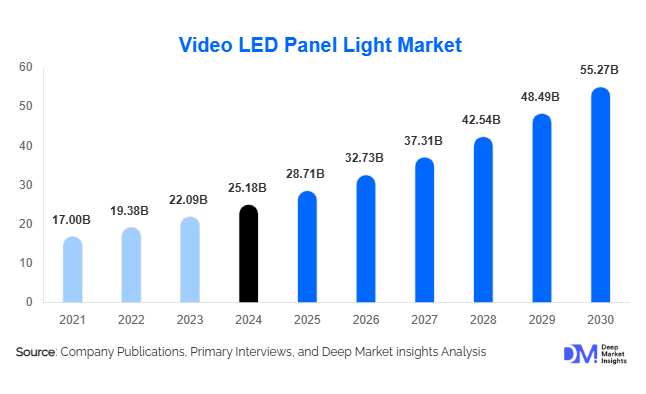

According to Deep Market Insights, the global video LED panel light market size was valued at USD 25.18 billion in 2024 and is projected to grow from USD 28.71 billion in 2025 to reach USD 55.27 billion by 2030, expanding at a CAGR of 14.0% during the forecast period (2025–2030). The market growth is primarily driven by the rising demand for energy-efficient lighting solutions, integration of smart technologies, and rapid urbanization across emerging economies. Increasing adoption in commercial, residential, and industrial applications is also accelerating market expansion.

Key Market Insights

- Energy-efficient and IoT-enabled LED panel lights are gaining traction across commercial and residential spaces, providing real-time control, automation, and significant cost savings.

- Emerging markets in the Asia-Pacific region are witnessing rapid adoption due to urbanization, infrastructure development, and government initiatives promoting sustainable lighting.

- North America dominates demand due to stringent energy efficiency regulations, high commercial construction rates, and technological advancements in smart lighting solutions.

- Europe is focusing on sustainability, with strong growth in smart office and industrial lighting solutions aligned with environmental policies.

- Government programs such as “Make in India” and similar initiatives in China are boosting local manufacturing and reducing import dependencies.

- Technological integration, like IoT-enabled LED panels, color temperature customization, and intelligent dimming features, is reshaping lighting experiences globally.

What are the latest trends in the video LED panel light market?

Integration with Smart Building Technologies

LED panel lights are increasingly being integrated into smart building solutions, enabling IoT-based control for lighting automation, energy monitoring, and remote management. Businesses and homeowners are leveraging these smart systems to reduce electricity costs while optimizing lighting conditions for productivity and comfort. Advanced sensors, motion detection, and app-based interfaces are becoming standard features, particularly in commercial offices, educational institutions, and industrial facilities. This trend enhances energy efficiency, improves user convenience, and is driving the adoption of LED panel lights across modern infrastructure projects.

Energy-Efficient Lighting Solutions

The global push toward sustainability and energy conservation is influencing the widespread adoption of LED panel lights. These lights consume significantly less electricity than traditional fluorescent or incandescent lighting, offering long-term operational cost savings. Governments are incentivizing the replacement of legacy lighting with LEDs through subsidies, tax benefits, and energy efficiency mandates. Commercial spaces, hospitals, retail stores, and educational institutions are key beneficiaries of this trend, fueling growth in the video LED panel light market.

What are the key drivers in the video LED panel light market?

Rising Demand for Energy Efficiency and Cost Savings

With rising electricity costs and sustainability concerns, energy-efficient lighting solutions have become a priority across industries and households. LED panel lights offer up to 50% more energy efficiency than conventional lighting, leading to widespread adoption. Commercial and industrial applications, in particular, benefit from lower operational expenses, which makes LED panel lights a preferred option for cost-conscious organizations.

Advancements in LED Technology

Continuous innovations in LED panel lighting, such as enhanced color rendering, customizable brightness levels, and flexible form factors, have broadened their applications. Smart LED panels equipped with sensors and remote controls enable users to create adaptive lighting environments, aligning with modern building standards and occupant comfort requirements. These advancements have been key in driving global market expansion.

Urbanization and Infrastructure Development

Rapid urbanization in emerging economies, especially in the Asia-Pacific, is driving demand for LED panel lights in commercial, residential, and industrial constructions. New offices, retail centers, and manufacturing facilities are increasingly deploying LED panel lights to meet energy codes, enhance aesthetics, and improve workspace lighting quality. This trend is creating substantial opportunities for manufacturers and suppliers in these high-growth regions.

What are the restraints for the global market?

High Initial Investment Costs

The upfront cost of LED panel lights remains higher compared to conventional lighting systems. While the long-term energy savings and reduced maintenance costs offset the initial investment, price-sensitive buyers, especially in developing regions, may delay adoption. The high capital requirement can hinder growth in segments where cost is the primary purchasing driver.

Market Fragmentation and Standardization Challenges

The LED panel light market is highly fragmented, with numerous manufacturers offering varied product qualities and features. Lack of standardization across products and inconsistent quality control can lead to reliability concerns, affecting consumer confidence. This fragmentation also creates pricing pressures and limits the ability of smaller players to scale globally.

What are the key opportunities in the video LED panel light market?

Expansion in Emerging Markets

Rapid infrastructure development, urbanization, and rising disposable incomes in Asia-Pacific, Latin America, and parts of the Middle East are creating significant demand for LED panel lights. Manufacturers can capitalize on affordable, energy-efficient lighting solutions tailored to residential, commercial, and industrial applications in these high-growth regions.

Integration with Smart and IoT Technologies

Smart lighting solutions offer opportunities for differentiation and premium pricing. LED panel lights with IoT integration enable remote control, adaptive brightness, color temperature adjustments, and energy monitoring, appealing to commercial and high-end residential users. Technology-enabled solutions provide a competitive edge and support sustainability goals, creating new revenue streams for manufacturers.

Government Policies and Incentives

Initiatives promoting energy efficiency, such as subsidies, tax incentives, and “Make in India” or “Made in China 2025” programs, encourage local manufacturing and adoption of LED solutions. Governments are replacing legacy lighting in public buildings, hospitals, schools, and transportation infrastructure, offering substantial market opportunities for suppliers of LED panel lights.

Product Type Insights

Ceiling-mounted LED panel lights dominate the market, accounting for approximately 40% of global market share in 2024. Their widespread use in commercial offices, educational institutions, and healthcare facilities is driven by their ability to provide uniform, glare-free lighting. Standard-sized panels (2x2 and 2x4 feet) are preferred for ease of installation in drop ceilings and compatibility with existing infrastructure. The trend toward energy efficiency, combined with improved aesthetics and low maintenance, continues to fuel demand in this product segment.

Application Insights

Commercial applications lead demand for LED panel lights, driven by offices, retail stores, and hospitality establishments seeking energy-efficient, visually appealing lighting. Industrial sectors such as manufacturing facilities and warehouses are also adopting LED panels for brighter illumination, lower energy consumption, and enhanced worker productivity. Residential adoption is growing steadily as homeowners upgrade to energy-efficient and aesthetically versatile lighting. Emerging applications include smart homes, IoT-enabled lighting, and hybrid lighting systems integrating LED panels with digital signage for commercial use.

Distribution Channel Insights

LED panel lights are distributed through multiple channels, including direct sales, online platforms, and retail outlets. E-commerce platforms and B2B sales dominate urban and tech-savvy regions, offering real-time pricing, delivery, and customization options. Specialized lighting distributors remain important in commercial and industrial segments, while OEM partnerships and contractor-led projects ensure bulk adoption. Increasingly, manufacturers are leveraging digital marketing and D2C sales channels to enhance reach and brand visibility globally.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America, led by the U.S. and Canada, represents a substantial share of the global market due to strict energy-efficiency standards, extensive infrastructure, and high adoption of smart lighting systems. In 2024, the region accounted for approximately 30% of the market. Corporate offices, healthcare facilities, and educational institutions are major consumers, with a focus on energy savings and advanced lighting technologies.

Europe

Europe, particularly Germany, the U.K., and France, contributes significantly to global demand, emphasizing sustainability and green building initiatives. Europe holds roughly 25% of the market share in 2024, driven by commercial and industrial adoption. Government regulations mandating energy-efficient lighting and incentives for retrofitting existing buildings are key growth drivers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and Australia. Rapid urbanization, infrastructure expansion, and rising middle-class income levels drive demand for residential and commercial LED panel lights. Adoption in industrial facilities and smart city projects further contributes to the growth trajectory.

Middle East & Africa

The MEA region is witnessing steady growth, particularly in GCC countries such as the UAE, Saudi Arabia, and Qatar, due to construction booms and energy efficiency mandates. The region is increasingly adopting LED panels for offices, retail spaces, and public buildings.

Latin America

Brazil and Mexico lead the LATAM market, driven by urban infrastructure projects and increasing commercial and industrial adoption. Growth is moderate but steady, supported by energy efficiency initiatives and the modernization of lighting systems in large-scale buildings.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Video LED Panel Light Market

- Signify N.V.

- OSRAM GmbH

- Acuity Brands, Inc.

- Eaton Corporation plc

- Current Lighting Solutions LLC

- Zumtobel Group AG

- Cree, Inc.

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- LG Innotek Co., Ltd.

- Havells India Ltd.

- GE Lighting

- Delta Electronics, Inc.

- Fagerhult Group

- NVC Lighting Technology Corp.

Recent Developments

- In 2025, Signify launched a new line of smart LED panel lights integrated with IoT-enabled energy monitoring for commercial buildings.

- In 2025, OSRAM introduced energy-efficient LED panels with advanced dimming and color temperature control for industrial and educational facilities.

- In 2024, Acuity Brands expanded its LED panel lighting portfolio with IoT-enabled solutions tailored for office and healthcare environments.