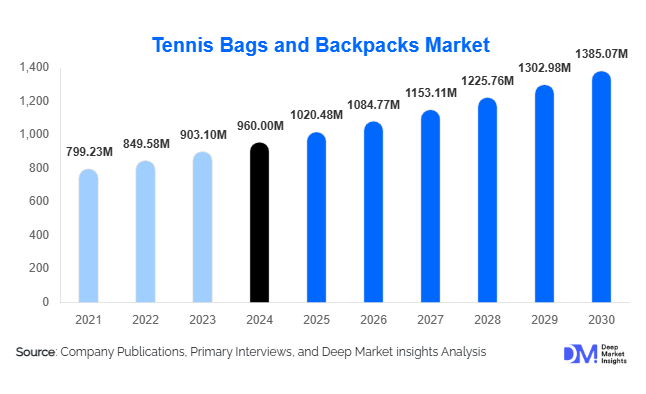

Tennis Bags and Backpacks Market Size

According to Deep Market Insights, the global tennis bags and backpacks market size was valued at USD 960 million in 2024 and is projected to grow from USD 1,020.48 million in 2025 to reach USD 1,385.07 million by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). The market growth is primarily driven by increasing global participation in tennis, rising demand for functional and stylish tennis accessories, and ongoing innovations in bag design and material technology.

Key Market Insights

- Backpacks are dominating the product type segment due to versatility, ergonomic design, and increasing adoption among younger tennis players.

- Polyester-based bags are the preferred material globally for their durability, water resistance, and cost-effectiveness, accounting for half of the market share.

- Online retail channels are the fastest-growing distribution mode, offering convenience, a wide product variety, and access to international brands.

- North America holds the largest market share, led by the U.S., where tennis remains highly popular among both amateur and professional players.

- Asia-Pacific is the fastest-growing regional market, driven by rising middle-class income, increased sports infrastructure, and the growing popularity of tennis in China, Japan, and India.

- Technological integration in bag design, including smart compartments, GPS trackers, and lightweight ergonomic materials, is enhancing consumer experience and differentiating products.

What are the latest trends in the tennis bags and backpacks market?

Smart and Functional Bag Designs

Manufacturers are increasingly focusing on integrating smart features into tennis bags, such as GPS trackers, Bluetooth-enabled compartments, and built-in charging ports. These innovations cater to tech-savvy players and professionals who demand functional, multifunctional bags. The trend is gaining traction in premium and mid-range segments, where consumers are willing to pay higher prices for enhanced usability and durability.

Sustainable and Eco-Friendly Materials

The demand for environmentally sustainable products has influenced manufacturers to adopt recycled polyester, organic fabrics, and eco-friendly production methods. Bags made from sustainable materials appeal to environmentally conscious consumers and reinforce brand positioning. Manufacturers are also marketing these bags as lightweight and durable, bridging the gap between eco-friendliness and functionality.

What are the key drivers in the tennis bags and backpacks market?

Increasing Global Tennis Participation

The number of professional and recreational tennis players worldwide is steadily increasing. Tennis academies, clubs, and school programs are driving the adoption of specialized tennis gear, including backpacks and bags designed for rackets, balls, and accessories. Players prioritize high-quality bags that offer durability, protection, and convenient storage, fueling market demand.

Product Innovation and Differentiation

Continuous innovation in materials, weight optimization, ergonomic designs, and smart compartments has elevated consumer expectations. Players and enthusiasts prefer products that are functional yet stylish, leading to the growth of mid-to-premium segments. Design partnerships with athletes and influencers also boost brand visibility and sales.

Brand Collaborations and Marketing

Collaborations with renowned athletes, tournaments, and sportswear brands are helping companies increase market presence and credibility. Limited edition collections and co-branded products generate high consumer engagement, particularly in online retail channels, and drive premium pricing opportunities.

What are the restraints for the global market?

High Competition Among Brands

The market is highly competitive, with numerous global and regional brands vying for market share. This intense competition can limit profitability and put pressure on pricing, especially in the mid-range segment. Smaller players struggle to differentiate their offerings in a crowded landscape.

Economic and Disposable Income Fluctuations

Consumer spending on non-essential sports accessories is highly sensitive to economic conditions. Fluctuations in disposable income, economic slowdowns, or recessions can restrict sales of premium and mid-range tennis bags, slowing overall market growth.

What are the key opportunities in the tennis bags and backpacks market?

Integration of Smart Technology

The adoption of wearable and smart accessories in sports is growing rapidly. Tennis bags with features like GPS tracking, Bluetooth-enabled storage, and app-linked compartments present an opportunity for brands to differentiate products, target tech-oriented consumers, and enhance user convenience. This trend is likely to expand in premium and mid-tier segments.

Expansion in Emerging Markets

Regions such as Asia-Pacific and Latin America are experiencing a surge in tennis participation due to rising middle-class income, urbanization, and increasing sports infrastructure. Manufacturers have the opportunity to capture first-mover advantage in these regions through targeted marketing, localized products, and partnerships with academies and sports clubs.

Sustainability Initiatives

Eco-conscious consumers are driving demand for tennis bags made from recycled or biodegradable materials. Companies investing in sustainable production and materials can capture brand loyalty, meet regulatory requirements in developed markets, and leverage growing consumer interest in environmentally responsible products.

Product Type Insights

Backpacks dominate the global market due to their ergonomic design, versatility, and ability to carry multiple rackets and accessories. In 2024, backpacks accounted for approximately 40% of the total market. Tote bags and duffle bags remain popular for niche segments, such as casual players and premium buyers seeking stylish, limited-edition products.

Material Insights

Polyester is the leading material in tennis bags, holding nearly 50% market share in 2024. Its durability, water resistance, and affordability make it ideal for both professional and recreational players. Nylon and PU leather are used in premium bags, targeting fashion-conscious and high-end consumers.

Distribution Channel Insights

Online retail is the fastest-growing distribution channel, contributing around 35% of market sales in 2024. E-commerce platforms provide consumers with convenient access to global brands, competitive pricing, and customer reviews. Specialty sports stores and retail chains complement this channel by offering personalized service, fittings, and immediate availability.

End-Use Insights

Professional and amateur tennis players represent the largest end-use segment. Recreational players, students, and academy participants are driving growing demand, particularly in emerging markets. Export-driven demand is also significant, with countries like the U.S. and European nations importing high-quality tennis bags from Asia, reflecting a shift toward international supply chains.

| By Product Type | By Material | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at approximately 35% in 2024, with the U.S. leading due to high tennis participation, well-established academies, and disposable income levels. Canada is also contributing to market growth with increasing engagement in sports activities among youth and adults.

Europe

Europe accounted for 28% of the market in 2024, with France, Spain, and Germany showing strong demand due to tennis’s popularity and robust sports infrastructure. Premium and mid-range products are particularly popular in Western Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, Japan, India, and Australia. Rising disposable income, urbanization, and sports promotion programs contribute to rapid market adoption. Online retail is especially effective in this region.

Latin America

Brazil and Argentina are emerging markets, with increasing interest in tennis among young populations. Growth is being driven by sports clubs and school programs, alongside urban middle-class expansion.

Middle East & Africa

South Africa, the UAE, and Saudi Arabia are witnessing rising demand due to increasing sports participation and the presence of premium tennis brands. Investments in sports infrastructure are expected to drive future growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tennis Bags and Backpacks Market

- Wilson Sporting Goods

- Head NV

- Prince Global Sports

- Babolat

- Yonex Co., Ltd.

- Adidas AG

- Nike, Inc.

- Asics Corporation

- Fila

- Reebok International Ltd.

- Li-Ning Company Limited

- Puma SE

- New Balance

- Volkl Tennis GmbH

- Pacific Headwear

Recent Developments

- In March 2025, Wilson Sporting Goods launched a new line of lightweight, ergonomic tennis backpacks with smart compartments for digital devices and rackets.

- In February 2025, Head NV introduced eco-friendly polyester bags, incorporating recycled materials and water-resistant coatings, targeting the European market.

- In January 2025, Babolat collaborated with professional tennis players to release a premium edition tennis backpack featuring advanced storage and ventilation systems.