Tankless Water Heaters Market Size

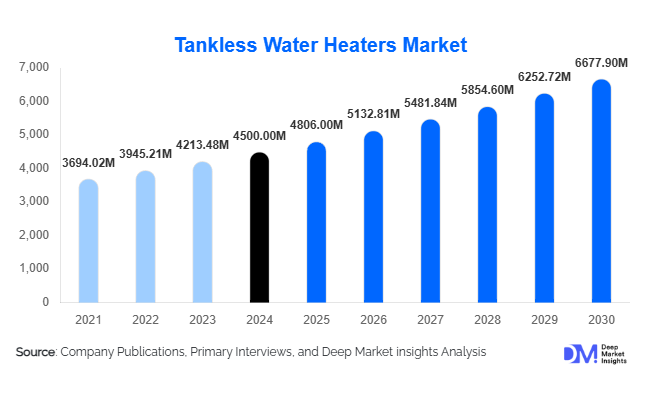

According to Deep Market Insights, the global tankless water heaters market size was valued at USD 4,500 million in 2024 and is projected to grow from USD 4806 million in 2025 to reach USD 6677.90 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for energy-efficient and space-saving water heating solutions, technological innovations in tankless water heater systems, and the rapid urbanization and infrastructure development in emerging economies.

Key Market Insights

- Energy efficiency and reduced operational costs are driving the adoption of tankless water heaters in both residential and commercial applications.

- Technological integration, including smart features, Wi-Fi connectivity, and advanced heat exchangers, is improving user experience and system reliability.

- North America dominates the market, with the U.S. and Canada leading due to stringent energy efficiency standards and high consumer awareness.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, rising disposable incomes, and increasing demand for modern water heating solutions.

- Europe shows steady growth, supported by strong environmental awareness and government incentives for energy-efficient appliances.

- Commercial demand, particularly in hotels, restaurants, and healthcare facilities, is expanding as businesses prioritize continuous and efficient hot water supply.

Latest Market Trends

Smart and Connected Water Heating Systems

Manufacturers are integrating smart technologies into tankless water heaters, allowing remote operation, energy consumption monitoring, and predictive maintenance. These features provide enhanced convenience and efficiency for both residential and commercial users. The growing adoption of IoT-enabled appliances is accelerating the market shift toward intelligent water heating solutions, with mobile apps enabling remote control and alerts for maintenance or energy optimization.

Shift Toward Eco-Friendly and Compact Designs

Tankless water heaters are increasingly preferred over traditional storage water heaters due to their compact form factor and eco-friendly performance. Consumers and commercial operators value the reduced carbon footprint, space-saving installation, and lower long-term energy costs. The trend is further reinforced by government energy-efficiency mandates and consumer preference for sustainable products.

Tankless Water Heaters Market Drivers

Growing Energy Efficiency Awareness

The rising cost of electricity and environmental concerns are driving demand for tankless water heaters, which provide hot water on demand without the standby energy losses associated with traditional storage systems. Households and businesses are increasingly prioritizing appliances that lower utility bills while contributing to sustainability goals.

Urbanization and Space Constraints

With urban living spaces becoming smaller, the compact and wall-mounted designs of tankless water heaters are highly desirable. Apartments, condos, and small commercial facilities benefit from space-saving installations that do not require large water storage tanks, enabling flexible plumbing integration.

Technological Advancements

Advancements in heat exchanger technology, flow rate optimization, and smart connectivity have enhanced the efficiency, reliability, and user convenience of tankless water heaters. These innovations support premium pricing and encourage upgrades from traditional water heating systems.

Market Restraints

High Initial Investment

The upfront cost of tankless water heaters, including purchase and installation, is higher than conventional water heaters. This limits adoption among cost-sensitive consumers despite long-term energy savings.

Complex Installation Requirements

Installing tankless water heaters often requires electrical or gas line upgrades and plumbing modifications, particularly in retrofitting scenarios. This complexity can slow market penetration in older buildings or regions with limited technical expertise.

Tankless Water Heaters Market Opportunities

Government Incentives and Energy Policies

Governments worldwide are offering subsidies, tax credits, and energy-efficiency programs that encourage adoption of tankless water heaters. These incentives reduce upfront costs and stimulate consumer interest, particularly in North America, Europe, and Asia-Pacific.

Emerging Market Demand

Rapid urbanization and rising disposable incomes in countries like China, India, and Brazil create significant growth opportunities. Manufacturers can target these regions with affordable, high-performance, and locally adapted tankless water heating solutions.

Technological Integration and Smart Homes

The growing smart home ecosystem presents opportunities to integrate tankless water heaters with home automation systems. Features like mobile app control, energy monitoring, and predictive maintenance appeal to tech-savvy consumers, creating a premium product segment that can enhance profitability.

Product Type Insights

Electric tankless water heaters dominate the market with approximately 60% of the global share in 2024, primarily due to their simple installation, suitability for small residential applications, and low maintenance requirements. Gas tankless water heaters account for the remaining 40%, favored in larger residential and commercial applications for higher flow rates and energy efficiency. Market trends show increasing consumer preference for compact, energy-efficient electric models in urban households, while commercial facilities lean toward gas systems for continuous high-volume demand.

Application Insights

The residential segment accounted for 70% of market share in 2024, driven by urban apartments and single-family homes upgrading from traditional storage water heaters. The commercial segment, representing 30% of the market, is expanding rapidly in hotels, restaurants, and healthcare facilities due to the need for on-demand hot water and lower energy consumption. Emerging applications include smart home integrations and hybrid renewable energy systems that combine tankless heaters with solar or heat pump technology.

| By Product Type | By End-Use Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America dominates the market, with the U.S. holding approximately 60% of the regional market share in 2024. Demand is driven by energy efficiency regulations, growing home automation trends, and consumer preference for sustainable appliances. Canada also contributes to steady growth with rising adoption in residential and commercial projects.

Europe

Key markets include Germany, France, and the U.K., where environmental regulations and consumer awareness support steady growth. Europe accounted for 25% of the global market share in 2024. Smart home integration and eco-friendly designs are primary growth drivers.

Asia-Pacific

Rapid urbanization, increasing disposable incomes, and infrastructure growth in China, India, and Japan are driving the fastest growth in this region. Emerging middle-class consumers are increasingly adopting energy-efficient and compact water heating solutions.

Latin America

Brazil and Mexico are key markets, with rising demand for residential energy-efficient appliances. Although current adoption is lower compared to developed regions, growth potential is significant as urbanization and disposable incomes increase.

Middle East & Africa

Commercial adoption in hospitality and healthcare sectors drives demand in the Middle East. Africa’s market growth is slower but gradually increasing due to expanding urban infrastructure and renewable energy initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tankless Water Heaters Market

- Rinnai Corporation

- Noritz Corporation

- Bosch Thermotechnology

- Navien Inc.

- AO Smith Corporation

- Stiebel Eltron

- Rheem Manufacturing Company

- Bradford White Corporation

- Takagi Industrial Co., Ltd.

- Ariston Thermo Group

- Hajoca Corporation

- Aragaz Ltd.

- Ferroli S.p.A.

- Vaillant Group

- Paloma Industries Ltd.

Recent Developments

- In March 2025, Rinnai Corporation launched a new series of Wi-Fi-enabled tankless water heaters with improved energy efficiency and compact designs.

- In February 2025, Navien Inc. expanded its commercial tankless water heater product line to support large-scale hospitality projects in North America.

- In January 2025, Bosch Thermotechnology introduced a smart hybrid tankless system for residential applications in Europe, integrating IoT and renewable energy compatibility.