Sport Leggings Market Size

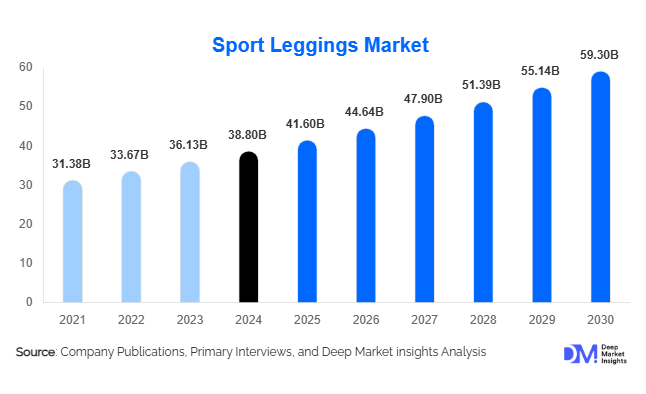

According to Market Insights, the global sport leggings market size was valued at USD 38.8 billion in 2024 and is projected to grow from USD 41.6 billion in 2025 to reach USD 59.3 billion by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). The market growth is primarily driven by the rising adoption of athleisure trends, increasing participation in fitness and wellness activities, and the growing preference for performance-enhanced, eco-friendly, and fashion-forward activewear across global consumers.

Key Market Insights

- Athleisure is reshaping consumer behavior, with leggings increasingly worn for both exercise and everyday casual fashion, expanding the target market beyond traditional athletes.

- Women remain the dominant end-user segment, accounting for approximately 65–70% of global demand, driven by fitness, yoga, and casual wear preferences.

- North America holds the largest regional market share, with the U.S. leading demand for premium and performance leggings.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class incomes, urbanization, and increasing fitness awareness in countries such as China and India.

- Technology integration and sustainability trends are reshaping product development, including advanced fabrics, moisture-wicking features, compression, eco-friendly materials, and wearable sensors.

- E-commerce and specialty retail channels are rapidly expanding, enabling brands to reach global audiences and capitalize on digital-first consumer shopping behavior.

What are the latest trends in the sport leggings market?

Performance-Driven and Sustainable Fabrics

Manufacturers are increasingly focusing on high-performance materials that enhance comfort, flexibility, moisture-wicking, anti-odor, UV protection, and thermal regulation. At the same time, eco-friendly and sustainable fabrics such as recycled polyester, organic cotton, and bamboo-based fibers are gaining traction. Certifications like OEKO-TEX and GRS are becoming key differentiators, helping brands meet consumer demand for environmentally responsible and ethically produced activewear.

Athleisure and Hybrid Use

Sport leggings are no longer confined to gyms and fitness centers. The fusion of performance and fashion has led to the widespread adoption of leggings for casual, work-from-home, and social settings. This trend has encouraged brands to invest in designs, patterns, and color variations, while balancing performance features for multiple activities. Hybrid-use leggings allow consumers to transition seamlessly from workouts to daily activities, driving volume growth across all demographics.

What are the key drivers in the sport leggings market?

Rising Health and Fitness Awareness

Global participation in fitness, yoga, running, and other wellness activities has surged, motivating consumers to invest in high-quality, functional activewear. Gyms, fitness studios, and community sports programs continue to grow, creating a consistent demand base for sport leggings. Governments and private wellness initiatives further amplify awareness, particularly in emerging economies where the fitness culture is rapidly developing.

Growing Athleisure Adoption

The convergence of fashion and function in the athleisure segment is driving significant market expansion. Consumers increasingly prefer leggings that combine comfort, style, and performance, allowing them to wear activewear in social, professional, and leisure contexts. Influencer marketing and social media campaigns have accelerated this trend, especially among younger demographics, further boosting global sales.

Technological Fabric Innovation

Innovations in knitting, seamless stitching, and advanced fabric technologies have enhanced the performance and appeal of sport leggings. Features such as compression, anti-chafing seams, gusset panels, reflective elements, and wearable sensors are becoming common in premium offerings. These advancements improve user experience, justify higher price points, and differentiate brands in an increasingly competitive market.

What are the restraints for the global market?

Price Sensitivity and Competitive Pressure

While premium products attract high margins, the mass segment faces intense competition and price sensitivity. Low-cost competitors and fast-fashion entrants often undercut prices, pressuring margins for established brands. Managing production costs while maintaining quality is a persistent challenge, particularly in developing regions where consumers are highly price-conscious.

Fit and Quality Inconsistencies

Leggings require precise sizing and durable fabrics, yet variations in fit and quality remain a concern, especially in online retail, where try-on is limited. Poor fit or material defects can lead to higher return rates, reduce customer satisfaction, and damage brand reputation. Ensuring consistent sizing standards across markets is critical for sustaining growth.

What are the key opportunities in the sport leggings industry?

Sustainable and Eco-Friendly Product Lines

As environmental consciousness rises, developing sustainable product lines offers a significant opportunity for market differentiation. Brands that integrate recycled fabrics, organic fibers, and low-impact manufacturing processes can appeal to premium and environmentally conscious consumers. Certification programs and transparent supply chains can further strengthen brand loyalty and justify higher price points.

Emerging Markets Expansion

Rapid urbanization, rising disposable incomes, and increasing fitness culture in Asia-Pacific, Latin America, and the Middle East & Africa create high-growth opportunities. Localized product offerings, culturally relevant designs, and strategic e-commerce expansion can help new entrants capture market share in these regions. Partnerships with regional sports and fitness organizations can further enhance brand penetration.

Integration of Technology and Smart Textiles

Wearable technology, biometric tracking sensors, and smart fabrics are gradually being incorporated into leggings to monitor performance, heart rate, or posture. Such innovations cater to tech-savvy consumers, especially in premium segments, providing an opportunity to differentiate products and command higher prices.

Product Type Insights

Full-length polyester/spandex leggings dominate the market, offering high durability, stretch, and moisture management. Capri and knee-length variants are growing in popularity for seasonal and outdoor use. Eco-friendly and performance-enhanced fabrics represent a premium niche but are rapidly gaining consumer acceptance. High-waisted, seamless designs with gusset panels and compression features lead global trends due to comfort and functional benefits, capturing approximately 35–40% of the 2024 market share.

Application Insights

Yoga and Pilates remain the leading applications, reflecting global wellness trends and the dominance of women as the primary consumer base. Running, HIIT, and general fitness activities are rapidly growing, particularly in North America and the Asia-Pacific. Athleisure applications are increasingly significant, with consumers wearing leggings for casual, remote-work, and social settings, driving additional demand. Outdoor and cycling-specific leggings are emerging as niche applications in premium segments.

Distribution Channel Insights

Online retail platforms dominate the fastest-growing channel, offering direct-to-consumer access, customization options, and global shipping. Specialty sports stores and brand-owned retail outlets maintain significant shares, particularly for premium offerings. Department stores and value retailers remain important for the mass segment. Social commerce and influencer-led campaigns are increasingly shaping purchasing behavior among younger demographics.

End-User Insights

Women account for the majority of the market (65–70%), followed by men (20–25%) and children. The male segment is expanding, particularly in running, cycling, and fitness activities. Inclusive sizing and plus-size ranges are opening new growth avenues. Younger consumers (18–30) drive fashion-conscious and budget segments, while the 31–50 age group contributes significantly to premium and performance segments. Older demographics (51+) remain a niche but important segment for high-value comfort-oriented offerings.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest market (30–35% share in 2024), led by the U.S. High disposable incomes, established fitness culture, and strong online retail infrastructure support sustained demand. Premium, performance-oriented, and branded products dominate this region.

Europe

Europe (20–25% share) shows moderate growth, with Germany, the UK, France, and Italy driving demand. Sustainability, fashion, and performance are key decision factors. Premium and eco-friendly products are well-accepted, while mass-market value options retain relevance in Eastern European countries.

Asia-Pacific

Asia-Pacific (25–30% share) is the fastest-growing region. China and India lead demand growth, driven by urbanization, rising fitness awareness, and expanding middle-class incomes. Japan, Australia, and Southeast Asia contribute to premium and performance segments, with strong e-commerce adoption supporting rapid growth.

Latin America

Latin America (5–10% share) is emerging, with Brazil, Mexico, and Argentina as key markets. Affluent and younger consumers are adopting athleisure and fitness apparel. Outbound and premium purchases are increasing among higher-income groups.

Middle East & Africa

MEA (3–7% share) combines local demand and inbound tourism interest. The GCC countries (UAE, Saudi Arabia) drive premium adoption, while South Africa and Nigeria represent regional hubs for sportswear awareness. High-income populations and growing fitness culture are key drivers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sport Leggings Market

- Nike

- Adidas

- Lululemon Athletica

- Under Armour

- Gymshark

- Puma

- Athleta

- Spanx

- Reebok

- Columbia Sportswear

- Fila

- ASICS

- Decathlon

- New Balance

- Champion

Recent Developments

- In March 2025, Lululemon launched a sustainable performance legging line using recycled fabrics and carbon-neutral manufacturing.

- In February 2025, Gymshark expanded its digital-first e-commerce operations in Asia-Pacific to target emerging markets with localized products and influencer partnerships.

- In January 2025, Nike introduced smart leggings integrated with motion sensors for tracking workouts and providing performance insights via mobile apps.