Spin Casting Fishing Rods Market Size

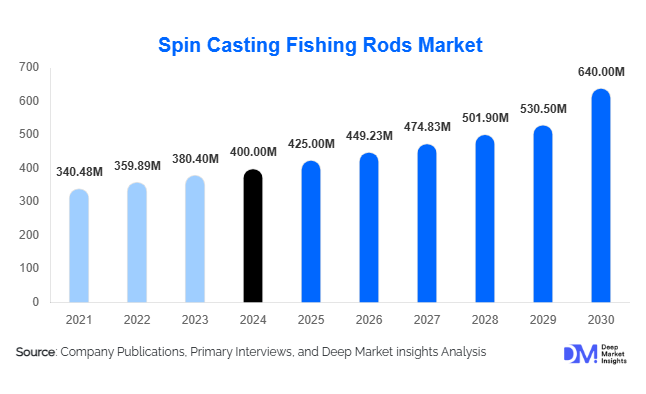

According to Deep Market Insights, the global spin casting fishing rods market size was valued at USD 400 million in 2024 and is projected to grow from USD 422.80 million in 2025 to reach USD 557.84 million by 2030, expanding at a CAGR of 5.7% during the forecast period (2025–2030). The market growth is primarily driven by increasing recreational fishing participation, rising adoption of lightweight and technologically advanced rods, and expanding e-commerce distribution channels that improve accessibility for global consumers.

Key Market Insights

- Freshwater spin casting rods dominate the global market, catering to the majority of recreational anglers due to accessibility, affordability, and ease of use.

- Mid-range rods are leading in value share, balancing quality and affordability, and appealing to a wide range of hobbyist and semi-serious anglers.

- North America remains a key market, with the U.S. and Canada accounting for nearly 25–30% of global demand in 2024.

- Asia-Pacific is the fastest-growing region, driven by rising incomes, urbanization, and increasing interest in recreational and sport fishing.

- Online and direct-to-consumer sales channels are expanding, enabling manufacturers to reach remote markets and offer customized or bundled products.

- Technological innovations, including lightweight carbon fiber rods, modular designs, and IoT-enabled accessories, are reshaping the product landscape.

What are the latest trends in the spin casting fishing rods market?

Material Innovation Driving Performance

Manufacturers are increasingly adopting advanced composites, carbon fiber, and hybrid materials to create lightweight, sensitive, and durable spin casting rods. These innovations improve casting accuracy, rod longevity, and overall user experience, attracting both novice and experienced anglers. Modular rod designs allow interchangeable tips and sections, providing versatility for different fishing environments and species. This trend is expanding penetration in mid-tier and premium segments, as consumers seek high-performance rods at accessible prices.

Growth of E-commerce and Direct-to-Consumer Models

The adoption of online sales channels is rapidly transforming the spin casting fishing rods market. E-commerce platforms, brand websites, and direct-to-consumer initiatives allow manufacturers to bypass intermediaries, reach global audiences, and offer product customization. Digital marketing campaigns, instructional videos, and social media communities help educate anglers and stimulate trial purchases. Subscription and kit-based offerings, including rods bundled with reels, lines, and instructional content, are enhancing consumer engagement and loyalty.

What are the key drivers in the spin casting fishing rods market?

Rising Participation in Recreational Fishing

The global rise in outdoor leisure activities, wellness-oriented hobbies, and weekend recreational pursuits is driving demand for spin casting fishing rods. Novice anglers prefer spin casting systems due to their ease of use and minimal learning curve, fueling market expansion. Increased participation in freshwater angling, urban fishing programs, and angling tourism contributes to sustained growth.

Technological Advancements and Product Innovation

Advances in rod materials, sensitivity, modularity, and corrosion resistance have elevated product performance. Carbon fiber rods, hybrid composites, and lightweight alloys provide superior strength-to-weight ratios. Additionally, integration of smart features like line sensors and Bluetooth-enabled apps is emerging, attracting tech-savvy anglers and enhancing market differentiation.

Expansion of Online Retail and Global Distribution

Improved e-commerce penetration and the rise of digital retail platforms enable manufacturers to access underserved regions, including APAC, Latin America, and Africa. Online channels also facilitate education, product comparison, and bundled offerings, accelerating adoption among recreational anglers and hobbyists.

What are the restraints for the global market?

Competition from Alternative Rod Types

Spin casting rods face competition from open-face spinning and baitcasting systems, which may offer greater versatility for advanced anglers. As users progress in skill, they often migrate toward alternative rod types, limiting spin casting adoption in certain segments.

Raw Material Price Volatility and Supply Chain Risks

Fluctuating prices of carbon fiber, fiberglass, epoxy resins, and corrosion-resistant metals can impact manufacturing costs and profit margins. Global supply chain disruptions may lead to production delays or higher prices, posing challenges for manufacturers and constraining market expansion.

What are the key opportunities in the spin casting fishing rods industry?

Emerging Markets and Regional Penetration

Underserved regions in Southeast Asia, South Asia, Latin America, and Africa offer significant growth potential. Expanding access to affordable, high-quality spin casting rods and targeting recreational fishing initiatives in these regions can create new consumer bases. Government-led programs promoting sport fishing and tourism further enhance market opportunities.

Integration of Smart and Connected Technologies

Embedding sensors, Bluetooth connectivity, and data-logging features in spin casting rods provides unique value to tech-oriented anglers. Apps offering bite detection, cast analysis, and lure recommendations can increase engagement, drive premium product adoption, and differentiate offerings in a competitive market.

Direct-to-Consumer and Subscription Models

D2C sales, subscription programs, and bundled offerings (rods with reels, lines, or accessories) help manufacturers increase margins and build customer loyalty. These models also enable product customization, feedback collection, and data-driven innovation, enhancing long-term market competitiveness.

Product Type Insights

Freshwater spin casting rods lead the global market due to ease of use, affordability, and high recreational participation, capturing approximately 65% of the 2024 market. Mid-range rods dominate in value, balancing quality and cost, while graphite and carbon fiber materials provide superior performance and account for around 55% of the market share. Medium-length rods (6–8 ft) remain the most popular, representing 60% of total rod sales due to their versatility and casting control.

Application Insights

Recreational fishing is the primary application, representing 70–75% of total demand. Competitive or sport fishing drives secondary demand, particularly for specialized rods in tournaments. Emerging applications include rental and charter fishing operations, where spin casting rods are preferred for durability and ease of maintenance.

Distribution Channel Insights

Online platforms and D2C websites dominate growth, accounting for roughly 30–35% of 2024 sales. Specialty fishing stores and sporting goods chains maintain a significant presence, while mass merchandisers contribute to entry-level and mid-tier penetration. Subscription and kit-based models are gaining traction as innovative distribution approaches.

End-User Insights

Recreational and hobbyist anglers account for the largest market share, followed by competitive/sport anglers. Families and first-time anglers are a rapidly growing segment. Charter, rental, and tourism-based operations represent emerging end-use opportunities, particularly in the Asia-Pacific and Latin America.

| By Product Type | By End-Use/Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 25–30% of the global market, with the U.S. as the dominant country. High disposable income, established angling culture, and strong retail infrastructure support sustained growth. Recreational and competitive anglers drive steady adoption, particularly in freshwater environments.

Europe

Europe represents around 20% of global demand, led by the U.K., Germany, and Scandinavia. Mature markets favor mid-to-premium spin casting rods for recreational and sport fishing. Sustainability, durability, and quality drive purchasing decisions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, capturing 30–35% of market share. China, India, Japan, and Southeast Asian countries are driving growth due to rising incomes, urbanization, and increased interest in recreational fishing. The region is projected to achieve a CAGR of 7–8% during 2025–2030.

Latin America

Latin America holds 8–10% of the market, led by Brazil, Mexico, and Argentina. Growth is driven by recreational fishing tourism and rising disposable incomes among middle-class consumers. Market penetration remains moderate, offering expansion opportunities.

Middle East & Africa

MEA represents 5–7% of the market. South Africa, the UAE, and coastal African nations are emerging as key markets due to sport fishing tourism and expatriate communities. Growth is constrained by infrastructure and import limitations, but increasing recreational interest presents potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Spin Casting Fishing Rods Market

- Shimano Inc.

- Daiwa Corporation

- Pure Fishing, Inc.

- Okuma Fishing Tackle Co., Ltd.

- G. Loomis

- Zebco Brands

- St. Croix Rods

- PENN

- Fenwick

- Piscifun

- Hardy

- Eagle Claw

- Okazaki

- Abu Garcia

- Tica

Recent Developments

- In March 2025, Shimano launched a new line of lightweight carbon fiber spin casting rods optimized for freshwater anglers, incorporating modular tips for enhanced versatility.

- In January 2025, Pure Fishing introduced an IoT-enabled spin casting rod with sensor-based bite detection and Bluetooth connectivity to its companion mobile app.

- In February 2025, Daiwa expanded production capacity in Vietnam to meet rising demand in the Asia-Pacific region, targeting mid-range and recreational spin casting segments.