Smart Sports Equipment Market Size

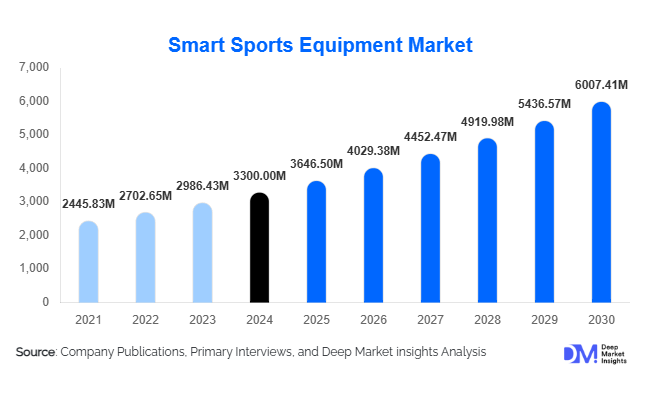

According to Deep Market Insights, the global smart sports equipment market size was valued at USD 3,300 million in 2024 and is projected to grow from USD 3,646.5 million in 2025 to reach USD 6,007.41 million by 2030, expanding at a CAGR of 10.5% during the forecast period (2025–2030). The market growth is primarily driven by rising health and fitness awareness, the adoption of wearable technologies, AI integration in sports devices, and increasing demand from professional athletes and fitness enthusiasts worldwide.

Key Market Insights

- Smart wearables are the dominant product type, combining performance tracking, health monitoring, and AI-driven analytics, catering to both amateur and professional athletes.

- Asia-Pacific is the fastest-growing region, led by rising sports participation, urbanization, and government initiatives promoting sports infrastructure in countries such as China, India, and Japan.

- North America holds the largest market share, driven by high disposable income, technology adoption, and professional sports demand, with the U.S. being the major contributor.

- Technological advancements, including AI, IoT, and sensor-based equipment, are reshaping training methods and home fitness solutions globally.

- Online retail channels dominate distribution, offering convenience, product variety, and integration with subscription-based fitness apps.

- Professional athletes represent the leading end-user segment, seeking precision data for performance optimization, injury prevention, and training efficiency.

Latest Market Trends

Rise of AI and Sensor-Based Smart Equipment

Smart sports equipment is increasingly leveraging AI, IoT, and advanced sensors to provide real-time performance tracking, predictive analytics, and personalized training recommendations. Smart wearables, rackets, and balls now capture detailed metrics such as motion patterns, impact force, and speed, which are analyzed via connected apps to enhance performance. This trend has boosted demand among professional athletes, fitness enthusiasts, and sports academies, as devices become more intelligent, user-friendly, and integrated with AI-driven fitness platforms.

Home Fitness Integration and Gamification

Home-based smart sports equipment has gained momentum, particularly after the COVID-19 pandemic. Devices like smart treadmills, AI-enabled weights, and connected fitness platforms enable interactive, gamified training experiences. Integration with mobile apps and online communities allows users to track progress, participate in challenges, and engage with virtual trainers. Gamification of training not only enhances user motivation but also expands the market beyond traditional sports participants to wellness-focused consumers and tech-savvy home fitness users.

Smart Sports Equipment Market Drivers

Growing Health and Fitness Awareness

The increasing global emphasis on health and wellness is a key driver for the smart sports equipment market. Consumers and athletes are adopting wearables, smart shoes, and sensor-based equipment to monitor heart rate, calories, steps, and performance metrics. Rising awareness of lifestyle-related diseases and fitness goals has accelerated the adoption of smart devices for proactive health management.

Technological Advancements in Sports Devices

Advancements in AI, IoT, GPS tracking, and motion sensors are transforming training methodologies. Devices now provide actionable insights, predictive performance analysis, and personalized recommendations, making them essential for both amateur and professional athletes. The integration of AR/VR-based training and gamified platforms is further fueling market expansion.

Professional Sports and Competitive Gaming Demand

The rise of professional sports leagues and e-sports has increased the need for precision training tools. Smart balls, AI-enabled rackets, and sensor-equipped training devices enable coaches and athletes to analyze performance, prevent injuries, and optimize training regimens, creating significant demand across the professional segment.

Market Restraints

High Cost of Advanced Equipment

The premium pricing of smart sports devices can limit adoption, particularly among amateur players and educational institutions. High upfront investment remains a challenge in price-sensitive regions, restricting market penetration.

Data Privacy and Security Concerns

Smart devices collect sensitive biometric and performance data, raising concerns over privacy and data security. Regulatory restrictions and consumer apprehensions regarding data misuse can potentially slow adoption rates in certain regions.

Market Opportunities

Technology Integration for Enhanced Training

Integrating AI, IoT, and sensor-based technologies provides manufacturers with an opportunity to differentiate products. Devices offering predictive analytics, motion tracking, and AR/VR-assisted training cater to professional athletes and fitness enthusiasts seeking personalized performance optimization.

Emerging Markets and Regional Expansion

Rising sports participation, urbanization, and disposable incomes in Asia-Pacific, Latin America, and parts of the Middle East are creating new growth avenues. Strategic market entry and localized offerings can help companies tap into these high-growth regions.

Institutional and Government Partnerships

Governments and educational institutions are increasingly investing in smart sports equipment for training, talent identification, and fitness programs. Collaborating with schools, sports academies, and national initiatives provides long-term procurement opportunities and stable demand.

Home Fitness and Direct-to-Consumer Models

The shift toward home-based fitness and wellness solutions presents a recurring revenue opportunity through subscription-based apps and connected smart devices. Gamified and app-integrated platforms enhance consumer engagement and expand the user base.

Product Type Insights

Smart wearables dominate the market, representing approximately 35% of the 2024 market share. Multi-functional devices such as smartwatches, fitness bands, and sensor-integrated apparel are preferred due to their ability to monitor performance, health metrics, and lifestyle data. Sensor-based equipment, including smart balls and rackets, accounts for 30% of the market and is highly adopted by professional athletes for precise performance insights. Smart training devices, such as AI-enabled treadmills and weights, are gaining traction among home fitness enthusiasts and institutional users.

Application Insights

Professional sports remain the primary application, contributing around 40% of the market in 2024. Amateur athletes and fitness enthusiasts form the next largest segment. Emerging applications include gamified home fitness, rehabilitation for sports injuries, and educational programs at sports academies. These applications leverage AI-driven feedback, motion analytics, and connected training modules to enhance user experience and performance outcomes.

Distribution Channel Insights

Online retail channels dominate with 45% of market share, offering convenience, product variety, and seamless app integration. Offline retail, including specialty sports stores and departmental outlets, remains significant for high-value equipment requiring hands-on experience. Direct B2B sales to institutions and professional sports organizations are also growing steadily, supported by long-term partnerships and bulk procurement contracts.

End-User Insights

Professional athletes are the largest end-user segment, followed by fitness enthusiasts and educational institutions. Rapid adoption among home fitness users and sports academies is creating additional growth potential. Export-driven demand is rising, particularly from North America and Europe to the Asia-Pacific region, highlighting the market’s global connectivity.

| By Product Type | By Technology | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 35% of the 2024 market, driven by high disposable income, professional sports demand, and early adoption of technology. The U.S. leads the region, with strong growth in smart wearables and AI-based training equipment.

Europe

Europe accounts for 28% of the market, with Germany, the UK, and France leading adoption. Demand is propelled by professional sports leagues, fitness awareness, and government-led wellness initiatives.

Asia-Pacific

Asia-Pacific is the fastest-growing region, exhibiting a CAGR of 13%. Rising sports participation, urbanization, and government investment in infrastructure are fueling demand in China, India, Japan, and South Korea.

Latin America

Brazil, Mexico, and Argentina are witnessing rising adoption of smart sports equipment due to growing interest in soccer, basketball, and fitness training. E-commerce penetration is improving access to premium and mid-range devices.

Middle East & Africa

Africa hosts iconic sports destinations and training facilities, with South Africa, the UAE, and Saudi Arabia showing increasing demand. High-income consumers and luxury fitness adoption drive market growth in these regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Sports Equipment Market

- Nike, Inc.

- Adidas AG

- Under Armor, Inc.

- Garmin Ltd.

- Fitbit, Inc.

- Puma SE

- Wilson Sporting Goods Co.

- Asics Corporation

- Decathlon S.A.

- Samsung Electronics

- Huawei Technologies

- Polar Electro Oy

- Catapult Sports

- VERT Technologies

- ELEMNT / Wahoo Fitness

Recent Developments

- In May 2025, Garmin launched a new AI-driven fitness smartwatch series with advanced motion sensors for professional athletes and fitness enthusiasts.

- In April 2025, Nike unveiled smart apparel with integrated performance tracking for elite training programs in North America and Europe.

- In February 2025, Adidas introduced AI-powered smart shoes for precision motion analysis in professional soccer and basketball training.