Smart Headphones Market Size

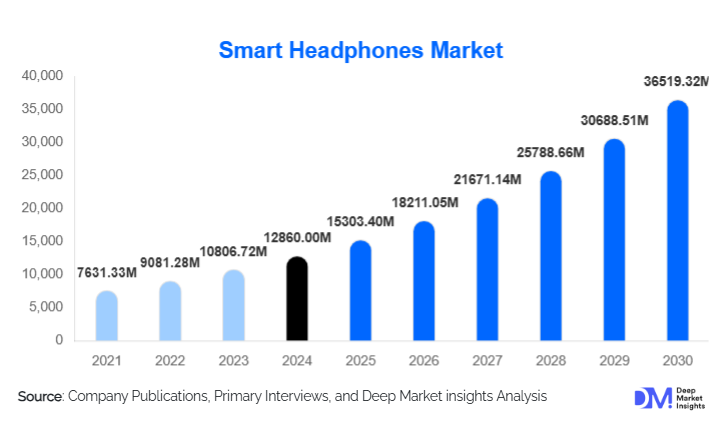

According to Deep Market Insights, the global smart headphones market size was valued at USD 12,860 million in 2024 and is projected to grow from USD 15,303.40 million in 2025 to reach USD 36,519.32 million by 2030, expanding at a CAGR of 19% during the forecast period (2025–2030). The smart headphones market growth is primarily driven by the rapid adoption of wireless and true wireless stereo (TWS) devices, increasing consumer preference for immersive and feature-rich audio experiences, and integration of smart functionalities such as active noise cancellation (ANC), voice assistants, and biometric monitoring.

Key Market Insights

- True wireless stereo (TWS) earbuds dominate the global market, accounting for over half of total revenue due to portability, convenience, and strong compatibility with smartphones.

- Active Noise Cancellation (ANC) leads smart feature adoption, with increasing inclusion even in mid-tier models as chipsets and software algorithms become cost-efficient.

- North America remains the largest regional market, holding nearly 37% share in 2024, driven by high disposable incomes and strong brand penetration.

- Asia-Pacific is the fastest-growing region, with India, China, and Southeast Asia witnessing rapid uptake of affordable smart audio devices through e-commerce channels.

- Health and biometric integration is emerging as a major growth frontier, enabling fitness and wellness tracking through ear-based sensors.

- Online channels account for over 60% of global sales, fueled by digital-first consumers and the dominance of direct-to-consumer (D2C) brands.

Latest Market Trends

Health and Wellness Integration in Audio Devices

Smart headphones are evolving from simple listening accessories to holistic wellness companions. Leading brands are incorporating biometric sensors capable of tracking heart rate, SpO₂, and movement, providing users with real-time health insights. This convergence of audio and wellness technology is supported by AI-powered analytics, allowing personalized recommendations for workouts, relaxation, or hearing safety. Partnerships between consumer electronics firms and health-tech startups are expanding, driving certification and medical-grade validation. As fitness and wellness wearables converge with audio devices, this trend is expected to reshape consumer expectations, with “hearables” becoming integral components of connected health ecosystems.

Spatial and Immersive Audio Experiences

Immersive sound technologies such as spatial audio, Dolby Atmos, and 3D sound mapping are transforming listening experiences. Manufacturers are leveraging AI-driven adaptive sound systems that adjust output based on environment and user activity. This technology is gaining traction in gaming, virtual reality (VR), and hybrid work applications where spatial awareness enhances realism. Brands such as Apple and Sony are leading this segment by integrating head-tracking sensors, delivering lifelike audio environments. As more streaming services and gaming platforms support immersive audio formats, this trend is expected to become mainstream across both premium and mid-tier product lines.

Smart Headphones Market Drivers

Rapid Adoption of Wireless and TWS Devices

The shift from wired to wireless connectivity has revolutionized the global headphones market. True wireless stereo (TWS) devices are now the preferred choice, driven by improved Bluetooth standards, battery longevity, and declining component costs. The removal of the headphone jack in flagship smartphones further accelerated this transition. In 2024, wireless devices accounted for approximately 78% of the global market share, highlighting their dominance across all consumer segments.

Rising Demand for Premium Audio and ANC Technology

Consumers are increasingly investing in premium headphones equipped with active noise cancellation (ANC), high-fidelity codecs, and multipoint connectivity. The ability to create immersive, distraction-free listening experiences during travel or work-from-home setups is a major growth factor. Advancements in chipsets and AI-based adaptive noise control have enabled manufacturers to deliver superior ANC performance at lower prices, expanding adoption beyond high-end models.

Expansion of Digital Lifestyles and Remote Work

Streaming media, online meetings, and gaming are fueling the need for multi-purpose smart headphones that combine entertainment with productivity. The hybrid work trend has created sustained demand for devices with superior microphones, comfort, and multi-device pairing. As content consumption and remote collaboration tools become integral to daily life, smart headphones are increasingly seen as essential personal technology rather than accessories.

Market Restraints

Price Sensitivity and Feature Cost Trade-offs

While premium models command high margins, cost-sensitive markets face barriers to adoption due to the higher price points of advanced features like ANC and biometric tracking. Manufacturers face a challenge balancing affordability with innovation. The influx of low-cost competitors in emerging economies further intensifies price wars, limiting profitability and slowing the penetration of high-end models in value-conscious segments.

Technical Limitations and Interoperability Issues

Despite advancements, smart headphones continue to face connectivity issues such as latency, limited codec compatibility, and inconsistent multi-device pairing. Interoperability across platforms, particularly between iOS, Android, and Windows, remains a concern for seamless functionality. Moreover, biometric-enabled models encounter regulatory and privacy challenges, especially in health data handling, restricting global standardization and rollout.

Smart Headphones Market Opportunities

Emerging Health-Integrated Hearables

The intersection of audio and health technology represents one of the largest untapped opportunities. Hearables capable of tracking physiological signals can support personalized fitness, stress monitoring, and even medical diagnostics. Partnerships between audio OEMs and health data platforms are opening new business models, from subscription-based wellness services to healthcare integrations. This opportunity extends beyond consumers to the enterprise and sports sectors, where accurate, non-intrusive monitoring is valuable.

Expansion in Emerging Markets

Emerging economies like India, Indonesia, and Brazil present immense potential due to rising disposable incomes and growing digital connectivity. Local manufacturing incentives and favorable import policies (such as India’s “Make in India” initiative) are reducing costs for brands establishing regional production hubs. Affordable smart headphones with localized voice assistant support and durable designs are rapidly capturing volume share in these high-growth markets.

AI-Driven User Personalization

Artificial intelligence is redefining user interaction with headphones. Features like adaptive EQ, contextual audio adjustment, and real-time translation enhance usability. Future headphones will likely employ machine learning to understand user habits, recommending sound modes or optimizing battery life. Brands investing in AI integration are positioned to differentiate through superior user experiences and ecosystem stickiness.

Product Type Insights

In-ear (True Wireless Stereo) headphones lead the market, capturing approximately 57.5% share in 2024. Their compactness, convenience, and compatibility with mobile devices make them the top choice for consumers worldwide. Over-ear models maintain a strong presence in professional and gaming use-cases, while on-ear and open-ear (bone conduction) designs are gaining popularity among fitness enthusiasts. The TWS category will continue to expand rapidly due to falling prices and broader integration of ANC and spatial audio technologies.

Application Insights

The music and entertainment segment dominates with a 38.3% revenue share in 2024, driven by global music streaming, podcast consumption, and video-on-demand platforms. The gaming and esports segment is projected to witness the fastest growth (CAGR 22%), fueled by low-latency audio requirements and immersive gaming environments. Sports and fitness applications are also on the rise as wearables converge with biometric-enabled smart headphones offering performance tracking and voice coaching.

Distribution Channel Insights

Online retail accounts for nearly 62% of total sales, led by platforms like Amazon, Flipkart, and brand-owned D2C websites. Consumers prefer e-commerce for convenience, competitive pricing, and access to verified reviews. Offline retail remains crucial for premium purchases, where hands-on product trials and brand experience play a key role. Hybrid models, combining online marketing with offline pick-up and service support, are gaining popularity among global brands.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America dominates the global smart headphones market, representing approximately 36.7% of total revenue in 2024. High disposable incomes, strong brand presence (Apple, Bose, JBL, Sony), and widespread adoption of premium wireless headphones support growth. The U.S. leads demand for high-end models with ANC, spatial audio, and ecosystem integration, while Canada contributes steady growth in the mid-tier segment.

Europe

Europe remains a significant market, led by the U.K., Germany, and France, with consumers favoring premium audio quality and sustainability. The region is witnessing an uptick in eco-conscious designs, including recycled materials and energy-efficient production. Remote work culture and growing demand for digital entertainment are sustaining headphone replacement cycles and boosting sales across categories.

Asia-Pacific

Asia-Pacific is the fastest-growing market, projected to expand at over 25% CAGR through 2030. China and India lead in volume growth, supported by local brands such as Xiaomi and boAt. Rising smartphone penetration, affordable TWS options, and expanding e-commerce channels are accelerating adoption. Japan and South Korea drive premium segment demand, focusing on high-fidelity audio and noise cancellation technologies.

Latin America

Latin America, led by Brazil and Mexico, is an emerging market characterized by growing smartphone adoption and young, music-loving demographics. Mid-tier wireless headphones dominate this region, though affordability remains key. Local assembly initiatives and cross-border e-commerce are expected to boost accessibility and growth over the next five years.

Middle East & Africa

The Middle East and Africa (MEA) region is gradually catching up, with increasing sales in the UAE, Saudi Arabia, and South Africa. Rising urbanization, youth population, and digital consumption habits are driving demand for wireless and smart headphones. Luxury and lifestyle-oriented consumers in the Middle East are adopting premium brands, while Africa is seeing entry-level wireless devices penetrate rapidly through online channels.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Headphones Market

- Apple Inc.

- Samsung Electronics Co. Ltd. (Harman / JBL)

- Sony Corporation

- Bose Corporation

- Sennheiser Electronic GmbH & Co. KG

- Jabra (GN Audio)

- LG Electronics

- Anker Innovations

- Skullcandy Inc.

- Huawei Technologies Co., Ltd.

- Philips Electronics

- Audio-Technica Corporation

- Shokz

- Xiaomi Corporation

- boAt Lifestyle

Recent Developments

- In June 2025, Apple announced upgrades to its AirPods Pro lineup, featuring adaptive spatial audio and advanced biometric monitoring for fitness tracking.

- In April 2025, Sony launched its next-generation WH-1000XM6 with AI-driven ambient sound adjustment and enhanced battery life.

- In March 2025, Samsung’s JBL division introduced sustainable headphone models made from recycled ocean plastics under its “Green Audio” initiative.

- In January 2025, boAt announced the expansion of its manufacturing operations in India under the “Make in India” initiative, aiming to reduce import dependency by 40%.