Senior Safety Kitchen Appliances Market Size

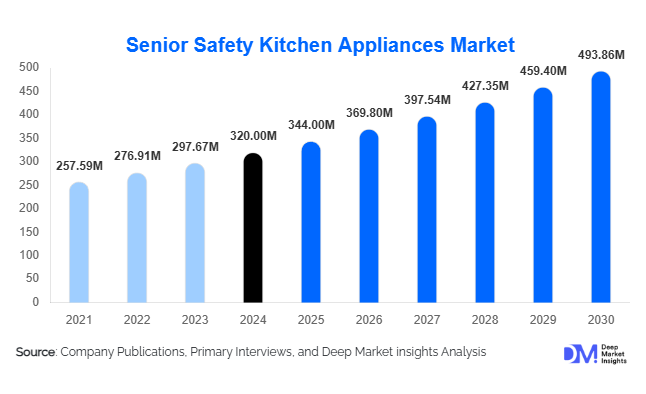

According to Deep Market Insights, the global senior safety kitchen appliances market size was valued at USD 320 million in 2024 and is projected to grow from USD 344.00 million in 2025 to reach USD 493.86 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The market growth is primarily driven by rising global senior populations, increasing adoption of smart home technologies, and growing awareness about kitchen safety and accident prevention for elderly users.

Key Market Insights

- Smart and IoT-enabled kitchen appliances are gaining traction, offering voice control, automatic shut-off, and remote monitoring to enhance senior safety and convenience.

- North America dominates the market, with the U.S. and Canada leading demand due to high disposable incomes and early adoption of smart appliances.

- Europe remains a strong growth region, driven by government initiatives promoting senior-friendly housing and a rising senior population.

- Asia-Pacific is emerging as the fastest-growing market, with urbanization, rising income levels, and a rapidly aging population in countries like China, Japan, and India.

- Residential and healthcare end-users are key demand segments, with assisted living facilities increasingly adopting safety-enhanced kitchen appliances.

- Technological innovation, including AI-enabled monitoring, predictive alerts, and IoT integration, is reshaping product offerings and consumer engagement globally.

Latest Market Trends

Smart and Connected Appliances Leading Growth

Smart ovens, voice-controlled microwaves, and IoT-enabled refrigerators are at the forefront of market adoption. These devices provide real-time alerts, automatic shut-off mechanisms, and predictive maintenance features, significantly reducing the risk of kitchen accidents among seniors. Manufacturers are increasingly integrating AI and machine learning algorithms to enhance usability, allowing appliances to adapt to individual usage patterns and provide preventive alerts for overheating, door safety, or unattended cooking.

Growing Focus on Senior-Friendly Safety Standards

Regulatory bodies in Europe and North America are mandating safety certifications and ergonomic designs for appliances targeting elderly consumers. Features like anti-tip dishwashers, soft-close refrigerator doors, and boil-dry protected kettles are becoming standard. This trend is fueling innovation in product design while increasing consumer confidence, driving both adoption and premium pricing for senior-friendly appliances.

Senior Safety Kitchen Appliances Market Drivers

Increasing Senior Population Globally

The rapid growth of the global elderly population is a major driver for the senior safety kitchen appliances market. Seniors are increasingly seeking independence in daily activities, including cooking, which necessitates safe and user-friendly appliances. Countries like Japan, Germany, and the U.S. have a higher percentage of elderly citizens, driving both demand and innovation for kitchen products designed to reduce accidents and enhance convenience.

Rising Adoption of Smart Home Technologies

Smart home penetration is accelerating globally, particularly in North America and Europe. Connected appliances equipped with sensors, automation, and remote monitoring are gaining popularity. Seniors and caregivers can now control appliances via mobile apps or voice commands, reducing risks associated with manual operation and providing peace of mind for family members. Integration with broader home automation systems further enhances usability and safety.

Growing Awareness of Kitchen Safety

Awareness campaigns, healthcare recommendations, and insurance incentives have increased focus on senior safety in domestic environments. Kitchen-related accidents, including burns, scalding, and electric shocks, are common among older adults. Educating consumers and caregivers on the benefits of safety-enabled appliances has significantly driven adoption and willingness to invest in premium products designed to minimize hazards.

Market Restraints

High Product Costs

Senior safety appliances, particularly smart and IoT-enabled models, often come at a premium price. This limits accessibility for price-sensitive consumers, especially in emerging economies. While adoption is strong among high-income households, affordability remains a challenge for widespread penetration in middle-income segments.

Technology Adoption Barriers

Despite rising awareness, some seniors face challenges in using smart appliances due to limited tech literacy. Complicated interfaces, frequent software updates, and connectivity requirements may discourage adoption, particularly in less tech-savvy populations. Manufacturers need to design intuitive interfaces and provide training or caregiver support to overcome this barrier.

Senior Safety Kitchen Appliances Market Opportunities

Integration of IoT and AI Technologies

IoT-enabled appliances with AI monitoring present enormous growth potential. Smart ovens, refrigerators, and dishwashers can now predict potential hazards, provide alerts, and even automate cooking sequences, ensuring safety for seniors. Companies investing in AI-driven solutions can differentiate their products while commanding premium pricing, especially in North America and Europe, where smart home adoption is high.

Expanding Senior Demographics in Emerging Economies

Countries like China, India, and Japan are witnessing a sharp rise in the elderly population. Affordable, culturally adapted senior-friendly appliances can capture this emerging market. Urbanization, rising disposable incomes, and growing awareness of domestic safety needs provide a strong platform for new entrants and existing manufacturers to expand their footprint in the Asia-Pacific.

Commercial and Healthcare Applications

Assisted living facilities, hospitals, and senior care centers represent a high-value segment for safety kitchen appliances. These institutions prioritize compliance with safety standards and operational efficiency. Tailored products like anti-tip dishwashers, programmable ovens, and leak-proof kettles offer recurring demand opportunities and strategic partnerships with healthcare providers.

Product Type Insights

Among product types, safety ovens and stoves dominate the market, holding approximately 28% of the 2024 market share. The segment’s leadership is driven by high adoption in residential households and healthcare facilities due to frequent usage and accident prevention needs. Induction cooktops and electric ovens with automatic shut-off features have gained popularity, reflecting growing consumer preference for technologically advanced and user-friendly appliances.

Application Insights

Residential applications account for the largest demand share, closely followed by healthcare and assisted living facilities. Seniors prefer appliances that reduce the risk of burns, fires, or accidental operation. Hospitals and senior care homes are increasingly adopting smart kitchen appliances for staff efficiency and patient safety. Emerging applications include hospitality services focused on senior guests and technologically enhanced assisted living kitchens, which are driving incremental growth.

Distribution Channel Insights

Offline retail, including hypermarkets and specialty stores, remains the dominant distribution channel, providing hands-on experience and direct demonstrations for safety features. Online retail is growing rapidly, offering convenience, detailed product comparisons, and direct-to-consumer engagement. B2B sales to healthcare and assisted living facilities are also expanding, particularly for bulk orders of safety-enhanced appliances.

End-User Insights

Residential users represent the largest segment, driven by safety-conscious seniors living independently. Assisted living and healthcare facilities are the fastest-growing end-users, seeking compliance with safety regulations and operational efficiency. Export-driven demand is increasing, particularly for Europe and North America, where specialized senior-friendly appliances are imported to meet rising institutional requirements.

| By Product Type | By Technology | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominates with 35% of the global market share in 2024, led by the U.S. High disposable incomes, early smart home adoption, and strong awareness of senior safety appliances drive demand. Canada also shows steady growth, particularly in assisted living facilities implementing safety standards.

Europe

Europe accounts for approximately 30% of the market, with Germany, France, and the U.K. leading demand. Aging populations, government incentives for senior-friendly housing, and high consumer awareness are key growth drivers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, Japan, and India as key markets. Urbanization, increasing disposable income, and rising elderly population contribute to strong CAGR projections. Smart home adoption is accelerating, especially in urban centers.

Latin America

Brazil and Mexico are emerging markets with gradual adoption. High-end residential segments and healthcare facilities are driving initial growth, although affordability remains a challenge.

Middle East & Africa

UAE, Saudi Arabia, and South Africa show moderate demand. Growth is concentrated in urban residential areas and premium senior living facilities, supported by high-income households and imported smart appliances.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Senior Safety Kitchen Appliances Market

- Whirlpool Corporation

- LG Electronics

- Samsung Electronics

- Panasonic Corporation

- Electrolux AB

- Haier Group Corporation

- Bosch Home Appliances

- GE Appliances

- Sharp Corporation

- KitchenAid

- Arcelik A.Ş.

- Midea Group

- Fisher & Paykel

- V-ZUG AG

- Siemens Home Appliances

Recent Developments

- In January 2025, Whirlpool launched a series of IoT-enabled induction cooktops with automatic shut-off and voice control features targeted at senior consumers.

- In March 2025, LG introduced smart microwaves with predictive safety alerts for assisted living facilities in North America and Europe.

- In May 2025, Panasonic expanded its senior-friendly kitchen appliance line in Asia-Pacific, including refrigerators with door alarms and temperature control alerts.