Security Cameras Market Size

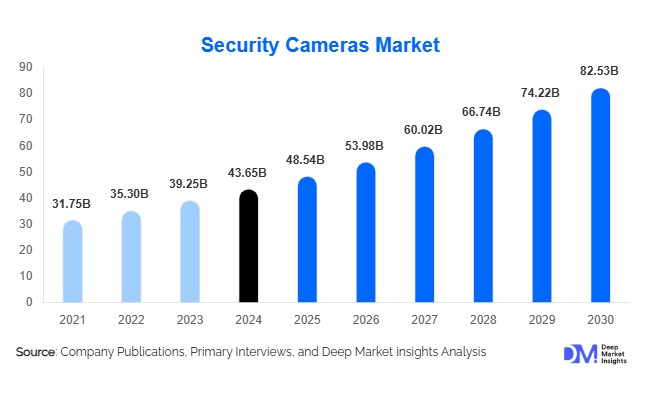

According to Deep Market Insights, the global security cameras market size was valued at USD 43.65 billion in 2024 and is projected to grow from USD 48.54 billion in 2025 to reach USD 82.53 billion by 2030, expanding at a CAGR of 11.2% during the forecast period (2025–2030). The market growth is primarily driven by rising security concerns across residential, commercial, and public sectors, increased adoption of advanced surveillance technologies such as IP cameras integrated with AI and IoT, and the growing trend of smart homes and connected devices worldwide.

Key Market Insights

- IP cameras dominate globally, owing to higher resolution, scalability, and network integration capabilities, making them ideal for both commercial and residential applications.

- Wireless security cameras are gaining traction, offering easy installation and integration with smart home systems, particularly in residential sectors.

- North America holds a significant market share, with the U.S. and Canada leading in adoption due to high security awareness and technological integration in surveillance solutions.

- Asia-Pacific is the fastest-growing region, driven by urbanization, rising crime rates, and government-led smart city initiatives in China, India, and Japan.

- Integration of AI and IoT technologies is reshaping the market, providing features such as facial recognition, motion detection, real-time alerts, and predictive analytics.

- Cloud-based storage adoption and the increasing popularity of smart home security solutions are enhancing the accessibility and flexibility of modern surveillance systems.

Latest Market Trends

AI-Enabled and Smart Surveillance Systems

The adoption of AI-powered cameras and IoT-connected surveillance systems is increasing globally. Features such as facial recognition, object tracking, and predictive threat detection are becoming standard, enhancing operational efficiency and security outcomes. Cloud-based storage and remote monitoring platforms are also on the rise, enabling real-time access and analytics for businesses and homeowners. This trend is particularly evident in commercial and government applications, where proactive security measures are critical. Additionally, integration with smart home devices is becoming a standard consumer demand, enabling seamless connectivity and automated alerts.

Wireless and Cloud-Based Security Solutions

Wireless security cameras with cloud storage solutions are becoming increasingly popular, driven by the ease of installation and minimal maintenance requirements. Consumers are moving away from traditional wired setups due to the flexibility and scalability offered by wireless systems. Cloud-based systems provide remote access, real-time monitoring, and data backup, creating opportunities for subscription-based services. Residential demand is particularly strong for these solutions, while commercial applications are adopting hybrid wired-wireless systems to enhance coverage and reduce infrastructure costs.

Security Cameras Market Drivers

Rising Security Concerns Across Sectors

Increasing crime rates and concerns over theft, vandalism, and unauthorized access are driving demand for surveillance solutions in residential, commercial, and public spaces. Businesses are investing heavily in IP and AI-enabled cameras to protect assets and ensure employee safety. Governments are also expanding public surveillance networks to enhance urban security and law enforcement capabilities, further boosting market growth.

Technological Advancements in Surveillance Systems

Advancements in high-resolution imaging, night vision, AI analytics, and wireless connectivity are transforming the security cameras market. These innovations improve monitoring capabilities, reduce false alarms, and enable proactive threat management. Integration with cloud storage and mobile applications allows real-time surveillance, making systems more user-friendly and efficient.

Affordable and Accessible Solutions

The declining cost of surveillance cameras and cloud storage solutions has made security technology accessible to a broader audience. Residential adoption is growing due to cost-effective smart home security packages, while small and medium enterprises (SMEs) are increasingly installing scalable IP-based systems. This accessibility is expanding the customer base and driving overall market growth.

Market Restraints

Privacy and Data Security Concerns

Privacy issues and concerns over the misuse of surveillance data pose significant challenges. Stricter regulations on data storage and monitoring practices in regions such as Europe (GDPR) require compliance, increasing costs and operational complexity for manufacturers and end-users.

Cybersecurity Threats

As cameras become network-connected, they are vulnerable to hacking and cyberattacks. Security breaches can compromise sensitive information, undermining trust in surveillance systems. Companies must invest in robust cybersecurity measures, adding to operational expenses and acting as a growth restraint.

Security Cameras Market Opportunities

Expansion in Smart Cities and Urban Surveillance

Government initiatives to implement smart city projects and enhance urban safety present substantial growth opportunities. Deployment of AI-enabled cameras in traffic monitoring, public spaces, and critical infrastructure allows governments to improve security while optimizing resource management. Increased funding in infrastructure surveillance is expected to drive consistent demand over the coming years.

Growth of Residential Smart Security Solutions

The rise of smart homes and connected devices is creating demand for wireless, AI-enabled home security systems. Consumers seek convenience, integration with mobile apps, and real-time monitoring capabilities. Manufacturers can capitalize on this trend by developing affordable, easy-to-install systems with advanced features such as motion alerts, facial recognition, and cloud storage.

Integration with AI and Analytics Services

Integrating cameras with AI analytics and cloud platforms offers advanced services such as predictive threat detection, behavior analysis, and automated alerts. This integration creates opportunities for subscription-based revenue models, particularly in commercial and industrial sectors. Enterprises can leverage data insights for enhanced security and operational efficiency.

Product Type Insights

IP cameras continue to dominate the global security cameras market due to their high-resolution imaging, scalability, and seamless integration with cloud-based platforms. They offer advanced features such as AI-driven analytics, remote monitoring, and smart notifications, making them suitable for both commercial and government applications. Analog cameras, while still relevant for cost-sensitive deployments, are gradually being replaced by IP systems as organizations increasingly seek higher image quality and integration capabilities. Wireless cameras are witnessing rapid adoption in the residential sector due to their ease of installation and compatibility with smart home ecosystems, while AI-enabled cameras are gaining traction in commercial, industrial, and public safety sectors. Fixed security cameras remain popular in small businesses and residential setups because of their cost-effectiveness and straightforward installation, providing reliable monitoring without the complexity of advanced setups. Overall, the market is moving toward intelligent, connected surveillance solutions that combine reliability, remote accessibility, and advanced analytics to meet the evolving security demands of various sectors.

Application Insights

Commercial applications remain the largest segment, driven by growing investments in retail, banking, offices, and logistics facilities. Businesses are increasingly deploying cameras to protect assets, monitor employees, and maintain operational safety. Residential surveillance is expanding rapidly with the proliferation of smart homes, where homeowners seek remote monitoring, motion alerts, and cloud-based storage solutions. Government and public safety applications, such as city surveillance, transportation hubs, and critical infrastructure monitoring, are being strengthened by policy mandates and urban security initiatives. Healthcare and industrial sectors are emerging applications, where security cameras not only monitor premises but also ensure compliance with regulatory standards and safeguard sensitive areas. Across all applications, Full HD cameras are widely preferred due to their balance of image clarity and manageable storage requirements, making them versatile for both commercial and residential uses.

Distribution Channel Insights

Direct sales via manufacturer websites, IT integrators, and online marketplaces dominate the distribution landscape, offering ease of purchase and access to technical support. Specialist security integrators and distributors cater primarily to commercial and industrial clients, providing value-added services such as installation, maintenance, and system integration. Offline channels remain relevant, particularly for physical verification and installation services, which are critical for complex commercial deployments. Subscription-based cloud services are emerging as a growing channel, especially for AI-enabled and wireless systems, offering real-time analytics, remote monitoring, and scalable storage solutions. E-commerce platforms are increasingly shaping the residential market by offering competitive pricing, user reviews, and quick delivery, while also facilitating DIY installations for wireless and smart home cameras.

End-Use Insights

The residential and commercial sectors together account for the majority of global security camera demand. Within these, the fastest-growing segments include smart homes, e-commerce warehouses, industrial facilities, and urban public surveillance projects. Export-driven demand is particularly strong, with China and South Korea serving as major manufacturing and export hubs for advanced IP and AI-enabled cameras. Adoption is expanding into emerging industries such as healthcare, transportation, logistics, and critical infrastructure, where surveillance systems support operational efficiency and compliance. Residential users increasingly prefer DIY, wireless, and AI-enabled solutions, while commercial and government entities are investing in integrated systems that provide centralized monitoring, analytics, and scalability.

| By Product Type | By Application | By Connectivity/Technology | By End-Use Sector |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 30% of the global security cameras market in 2024, with the U.S. leading adoption due to technological advancement, high security awareness, and urban infrastructure investment. Canada is also seeing steady growth, particularly in residential and public surveillance. Key drivers include high adoption of smart technologies, with consumers and businesses embracing IoT-connected cameras, cloud storage, and mobile-based monitoring platforms. Additionally, strong government initiatives for critical infrastructure protection, smart city development, and public safety surveillance continue to fuel demand. The commercial sector, driven by asset protection and employee safety, remains a leading application, supported by regulatory compliance and technology-driven monitoring solutions.

Europe

Europe contributed 25% of the global market in 2024, with the U.K., Germany, and France being the largest consumers. The market growth is primarily supported by stringent security and data protection regulations, such as GDPR, which compel organizations to adopt compliant and secure surveillance systems. Commercial and public safety applications are particularly strong due to regulatory enforcement, while residential adoption is increasing with the integration of smart home devices. Technological adoption, such as AI-enabled analytics and cloud-based monitoring, is also driving the replacement of older analog systems, particularly in urban centers. Countries are increasingly deploying integrated surveillance networks to enhance city safety, transportation monitoring, and emergency response effectiveness.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the global security cameras market, with China, India, Japan, and Australia leading adoption. Growth is fueled by rapid urbanization and infrastructure development, which require comprehensive surveillance solutions for smart cities, industrial parks, and commercial facilities. The increasing adoption of AI and IP-based systems, along with government initiatives promoting urban safety and public security, are major growth drivers. Rising crime rates and increasing awareness of security needs are accelerating investments in both residential and commercial segments. China and India are also emerging as key export hubs, supplying advanced surveillance solutions globally while simultaneously scaling domestic adoption across urban and industrial zones.

Middle East & Africa

The MEA region is witnessing steady growth, led by the UAE, Saudi Arabia, and South Africa. Drivers include heavy investment in public infrastructure, industrial surveillance, and urban security projects. AI-enabled and wireless camera adoption is rising, particularly in government and commercial applications. Increased awareness of security threats, regulatory compliance in urban centers, and the modernization of industrial facilities are supporting market expansion. The region’s demand is also boosted by smart city initiatives and large-scale infrastructure development, which require integrated, scalable surveillance networks.

Latin America

Brazil and Mexico lead security camera adoption in LATAM. Growth is driven by urban security initiatives, increasing commercial investments, and rising awareness of asset and personal protection. Residential adoption is gradually increasing, particularly in metropolitan areas, with wireless and cloud-enabled systems gaining popularity. Infrastructure development in industrial parks, transportation hubs, and logistics centers is creating new opportunities for IP-based and AI-enabled surveillance solutions. Government-led urban monitoring projects and public safety programs are further contributing to regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Security Cameras Market

- Hikvision

- Dahua Technology

- Axis Communications

- Hanwha Techwin

- Bosch Security Systems

- FLIR Systems

- Honeywell Security

- Avigilon (Motorola Solutions)

- Panasonic Corporation

- Samsung Techwin

- Canon Inc.

- Pelco

- CP Plus

- VIVOTEK

- Tyco Security Products

Recent Developments

- In June 2025, Hikvision launched a new AI-powered camera series with cloud-based analytics targeting smart city and industrial applications.

- In March 2025, Axis Communications expanded its cloud surveillance portfolio in Europe, integrating real-time analytics and IoT capabilities.

- In January 2025, Dahua Technology announced a strategic partnership with a global AI analytics provider to enhance predictive security solutions for commercial applications.