Scalp Massager Market Size

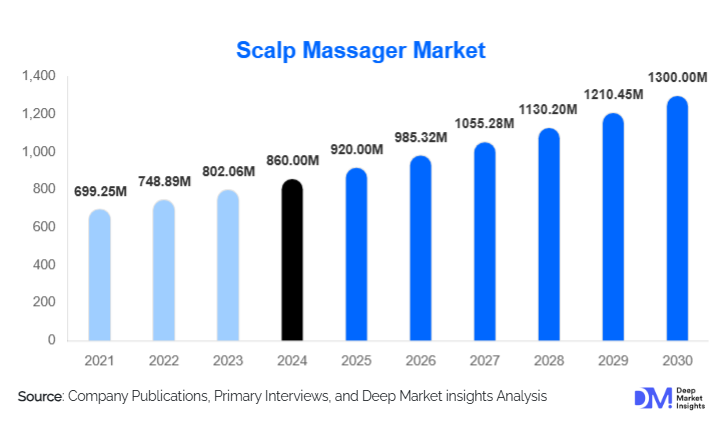

According to Deep Market Insights, the global scalp massager market size was valued at USD 860 million in 2024 and is projected to grow from USD 920 million in 2025 to reach USD 1,300 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The scalp massager market growth is primarily driven by rising consumer awareness regarding scalp health and hair care, increasing stress-related wellness concerns, and the rapid adoption of electric and technologically advanced massage devices across both developed and emerging regions.

Key Market Insights

- Electric scalp massagers dominate the market, favored for multifunctional features such as vibration, heat therapy, and app-enabled controls that cater to both wellness and hair growth needs.

- Asia Pacific leads revenue share, driven by large population bases, rising disposable incomes, and increasing adoption of personal care and wellness devices.

- Online retail is rapidly expanding, supported by influencer marketing, social media promotions, and increased consumer comfort with e-commerce purchases.

- Wellness and stress-relief applications are surging, positioning scalp massagers as integral tools in at-home self-care routines.

- Emerging markets in India, Latin America, and the GCC countries are witnessing the fastest growth due to rising awareness and accessibility of affordable electric massagers.

- Technological innovation, including wearable devices, infrared/red-light therapy, and smart sensors, is transforming consumer engagement and device functionality.

What are the latest trends in the scalp massager market?

Integration of Smart and Multifunctional Features

Scalp massager manufacturers are increasingly incorporating smart features, such as app connectivity, personalized intensity adjustments, and real-time tracking of scalp health. Devices combining vibration, heat therapy, and red-light therapy are gaining popularity, allowing consumers to experience salon-grade treatments at home. Wearable and ergonomic designs are also being introduced, emphasizing convenience, portability, and aesthetic appeal. This trend caters to tech-savvy consumers who seek multifunctional wellness tools that integrate seamlessly into daily routines.

Expansion of Online Retail and Direct-to-Consumer Models

Digital sales channels are reshaping the scalp massager market. E-commerce platforms, D2C brand websites, and social media marketing are driving higher sales by providing product transparency, reviews, and comparison options. Influencer-led campaigns and demonstration videos have boosted consumer trust and awareness. Subscription models and bundled packages with scalp care products are emerging as new avenues to enhance customer loyalty and promote recurring purchases.

What are the key drivers in the scalp massager market?

Growing Awareness of Scalp Health and Hair Care

Rising concerns regarding hair thinning, dandruff, and scalp-related stress conditions are fueling consumer adoption of scalp massagers. Both manual and electric devices are being positioned as preventive and therapeutic solutions, promoting blood circulation, reducing hair loss, and supporting overall hair health. Increased media coverage and digital content on wellness and hair care are also reinforcing market growth.

Technological Advancements and Product Innovation

Manufacturers are differentiating products through innovation, such as multi-speed vibration modes, infrared and LED light therapies, waterproof and portable designs, and smart apps for personalized routines. These features enhance the user experience and allow companies to command premium pricing, boosting revenue potential across developed and emerging markets.

Rising Demand for At-Home Wellness Solutions

The trend of self-care and home wellness has intensified post-pandemic, with consumers seeking convenient ways to relieve stress and improve hair health. Scalp massagers fit seamlessly into home routines and are increasingly marketed as tools for relaxation, mood enhancement, and therapeutic benefits, driving sustained demand in household segments.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

High-quality electric scalp massagers remain costly in price-sensitive regions, limiting adoption. Manual devices, although affordable, offer fewer features, leading to slower penetration of premium products in developing economies.

Regulatory and Safety Concerns

Strict electrical safety regulations, material compliance standards, and claims validation for hair growth or therapeutic benefits pose challenges for manufacturers. Non-compliance can result in product recalls, reputational risks, and increased production costs.

What are the key opportunities in the scalp massager industry?

Smart Wellness Devices and Innovation

Integration of smart technologies such as wearable sensors, AI-assisted scalp health monitoring, and multi-functional massage modes presents opportunities for product differentiation. Companies investing in R&D can capture premium consumers seeking high-tech wellness solutions.

Expansion into Emerging Markets

Regions such as India, Latin America, and the Middle East offer significant growth potential due to increasing disposable incomes, rising awareness of self-care, and expanding e-commerce penetration. Tailored, affordable, and culturally relevant products can accelerate adoption.

Professional and Salon-Based Applications

Beyond personal use, commercial salons and wellness centers are adopting high-end scalp massagers for customer service enhancement and therapeutic treatments. This segment allows premium pricing, repeat sales, and cross-selling with hair care products, driving revenue growth for manufacturers.

Product Type Insights

Electric scalp massagers dominate the global market, representing approximately 64% of revenue in 2024, due to their multifunctionality, comfort, and premium positioning. Manual massagers remain popular in price-sensitive markets, offering affordability and simplicity. The trend toward multifunction devices integrating heat, vibration, and red-light therapy is reshaping the premium segment. The growth of wearable and ergonomic designs is further enhancing adoption among tech-savvy and wellness-oriented consumers.

Application Insights

Stress relief and relaxation applications lead the market, reflecting growing consumer emphasis on at-home wellness. Hair growth stimulation is another key application, driven by rising incidences of hair thinning and scalp-related concerns. Dandruff and scalp health maintenance products are gaining traction in markets with high awareness of hygiene and cosmetic care. Emerging applications include professional salon use and wellness center integration, expanding the functional scope of scalp massagers.

Distribution Channel Insights

Offline retail remains dominant, holding approximately 60% of the market in 2024, as consumers prefer physical inspection of device quality and ergonomics. Online retail is the fastest-growing channel, driven by e-commerce expansion, influencer marketing, and social media awareness campaigns. Direct-to-consumer brand websites, online marketplaces, and subscription-based models are becoming increasingly important for reaching tech-savvy and health-conscious consumers.

End-User Insights

Household/personal use represents the largest end-user segment with a 72% share, due to growing home wellness routines. Professional or commercial use in salons and wellness centers is growing steadily, focusing on premium, high-feature devices. Women dominate the demographic user base, though male grooming adoption is increasing. Age groups 18–45 drive most of the growth, seeking stress relief, hair care benefits, and digital-enabled smart products.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 22% of the global market, driven by the U.S. and Canada, with strong consumer awareness of wellness and hair care products. Online retail and premium electric scalp massagers dominate the region, supported by high disposable incomes and digital penetration.

Europe

Europe accounts for 23% of the market, led by Germany, the UK, and France. Consumers prioritize safety, quality, and multifunctional wellness devices. E-commerce adoption is high, and premium electric devices dominate the market share.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing market (37% share in 2024), driven by China, India, Japan, and South Korea. Rising disposable incomes, middle-class expansion, e-commerce growth, and cultural emphasis on hair care contribute to strong demand. India shows one of the highest CAGRs (8–8.5%), with both manual and electric devices gaining traction.

Latin America

Latin America (6% share) is witnessing gradual growth, with Brazil, Mexico, and Argentina showing rising adoption of mid-range and premium electric scalp massagers. E-commerce growth and influencer marketing are supporting market penetration.

Middle East & Africa

MEA represents 6% of the market, led by GCC countries and South Africa. High-income populations in the Middle East favor premium electric devices, while Africa is seeing gradual adoption, mainly in urban centers and wellness-focused salons.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Scalp Massager Market

- Breo

- Heeta

- Vitagoods

- FREATECH

- Comfier

- MaxKare

- Ryoma

- Beurer

- Panasonic

- Zyllion

- Scalp Massager Co.

- RENPHO

- OSIM

- TouchBeauty

- HoMedics

Recent Developments

- In March 2025, Breo launched an app-enabled wearable scalp massager with vibration and heat therapy, targeting stress-relief and wellness-conscious consumers.

- In January 2025, Heeta expanded its distribution network in India and Southeast Asia, introducing mid-range electric scalp massagers at competitive price points to capture emerging market demand.

- In December 2024, Vitagoods released a multifunctional electric massager integrating red-light therapy for hair growth, targeting premium users in North America and Europe.