Residential Gateway Market Size

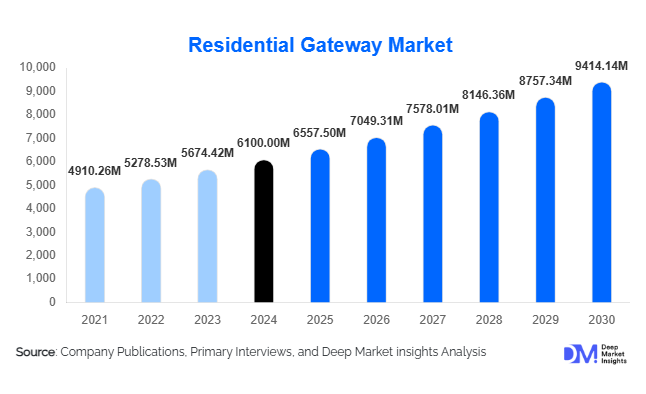

According to Deep Market Insights, the global residential gateway market size was valued at USD 6,100 million in 2024 and is projected to grow from USD 6,557.50 million in 2025 to reach USD 9,414.14 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for high-speed internet, adoption of smart home technologies, and the integration of next-generation connectivity solutions such as Wi-Fi 6/7 and 5G residential gateways.

Key Market Insights

- Wi-Fi 6/7 and 5G residential gateways are redefining home connectivity, enabling faster speeds, reduced latency, and improved support for multiple connected devices simultaneously.

- Smart home adoption is accelerating demand for gateways capable of managing IoT devices, home automation, and security systems, making residential gateways central to connected living environments.

- North America dominates the market due to high broadband penetration, widespread ISP partnerships, and consumer preference for advanced networking solutions.

- Asia-Pacific is the fastest-growing region, driven by FTTH deployments, rising middle-class households, and expanding telecom infrastructure across China, India, and Southeast Asia.

- Europe is a key adopter of hybrid gateways, with consumers and enterprises preferring devices that integrate DSL, fiber, and wireless connectivity options for resilient home networks.

- Technological innovations, including integrated voice gateways, hybrid modems, and AI-based network optimization, are enhancing user experience and reliability.

Latest Market Trends

Wi-Fi 6/7 Adoption and 5G Residential Gateways

The residential gateway market is witnessing significant adoption of Wi-Fi 6/7 devices and 5G-enabled gateways. These technologies are increasingly preferred due to their ability to handle multiple connected devices, reduce latency for streaming and gaming, and provide secure, high-speed home networks. Telecommunication providers are bundling advanced gateways with broadband subscriptions, offering enhanced performance while simplifying installation for end-users. The trend is further reinforced by rising demand for work-from-home solutions, cloud-based entertainment, and IoT ecosystems.

Smart Home Integration Driving Demand

Residential gateways are increasingly serving as central hubs for smart homes. Integration with IoT devices, security systems, smart appliances, and energy management solutions has become a key driver. AI-based optimization and mobile app interfaces allow users to monitor and control home networks remotely, enhancing convenience and security. This trend is particularly strong in urban areas of developed markets, where smart home adoption is highest. Telecommunication companies are also developing proprietary platforms that integrate gateway functionality with home automation, ensuring seamless interoperability.

Residential Gateway Market Drivers

Increasing Broadband and Fiber Deployments

The global expansion of high-speed broadband networks, especially fiber-to-the-home (FTTH) infrastructure, is fueling demand for residential gateways. Governments and telecom operators are investing heavily to provide high-speed internet access, particularly in urban and semi-urban areas. Fiber gateways and integrated modem routers are becoming standard, supporting bandwidth-intensive applications like 4K streaming, online gaming, and virtual collaboration.

Growing Smart Home and IoT Ecosystems

As households adopt smart devices, including security cameras, voice assistants, and energy management systems, demand for capable gateways has surged. Gateways that can manage multiple connected devices securely and efficiently are crucial for modern smart homes. Integration with AI-based network management tools ensures optimal performance, positioning these devices as central to digital living.

Remote Work and Entertainment Requirements

The rise of remote work, online education, and OTT streaming has increased the need for stable, high-speed home networks. Residential gateways that provide reliable connectivity, parental controls, and QoS management are becoming essential for households. This trend is expected to continue as hybrid work and digital entertainment remain prevalent globally.

Market Restraints

High Device Costs in Advanced Segments

High-end residential gateways with Wi-Fi 6/7, integrated modems, and 5G capabilities come with significant price points, limiting adoption in cost-sensitive markets. While basic Wi-Fi routers are affordable, advanced models remain less accessible to lower-income households, which can slow market penetration in emerging regions.

Complexity of Installation and Setup

Advanced residential gateways often require technical knowledge for installation and configuration. Consumers lacking IT expertise may face difficulties, particularly with hybrid or multi-band devices. Although ISPs offer bundled installation services, the setup complexity can remain a barrier for wider adoption, especially in developing countries.

Residential Gateway Market Opportunities

Smart Home and IoT Expansion

The growing global adoption of smart homes presents a significant opportunity. Residential gateways that integrate AI-driven network management, device prioritization, and home automation controls can capitalize on this trend. New entrants can differentiate by offering seamless interoperability with a wide range of IoT devices and smart home platforms, addressing the rising demand for connected living ecosystems.

Emerging Markets in APAC and LATAM

Asia-Pacific and Latin America are emerging as high-growth markets due to increasing broadband penetration, expanding middle-class populations, and government initiatives for digital infrastructure. Companies that focus on affordable yet technologically advanced gateways can tap into these fast-growing regions, leveraging local partnerships and telecom collaborations.

Integration with Renewable Energy and Smart Grid Systems

Residential gateways integrated with energy management systems, smart meters, and renewable energy solutions represent a growing niche. The ability to optimize home energy consumption while providing reliable connectivity opens opportunities for collaboration with utility providers and smart home solution companies. This integration can drive additional value for consumers and encourage adoption of next-generation gateways.

Product Type Insights

Integrated modem routers dominate the global residential gateway market, accounting for approximately 35% of the 2024 market share. These devices are preferred due to their all-in-one functionality, which reduces the need for multiple networking devices and simplifies installation. The segment’s growth is primarily driven by consumer demand for compact, high-performance home networking solutions that integrate modem and router functionalities in a single device. Wi-Fi routers follow closely, fueled by widespread upgrades to Wi-Fi 6 and Wi-Fi 7 standards, meeting the increasing need for reliable, high-speed wireless connectivity. Fiber gateways are rapidly gaining traction in regions with FTTH deployments, supported by urbanization and rising bandwidth requirements for streaming, gaming, and remote work. 5G residential gateways are emerging as a high-potential segment, particularly in North America and Asia-Pacific, driven by the rollout of 5G networks and growing consumer preference for ultra-fast mobile internet connectivity. Standalone routers and smart-home integrated gateways are also experiencing steady growth, the former due to demand for customizable, high-performance networks, and the latter because of increasing IoT adoption and the need for centralized smart home control.

Application Insights

Residential homes remain the largest end-use segment, accounting for over 60% of the 2024 market. The growth in this segment is fueled by the need for reliable broadband access to support remote work, online education, and streaming services. Smart homes and IoT integration are the fastest-growing applications, driven by AI-enabled devices, home automation, and energy management systems, which are reshaping how consumers interact with their home networks. SOHO (Small Office/Home Office) environments are increasingly demanding high-speed, secure residential gateways as hybrid work models expand globally. Additionally, the rising trend of export-driven demand for bundled residential gateway solutions in emerging economies creates opportunities for manufacturers to cater to international markets while supporting growing digital infrastructure needs.

Distribution Channel Insights

E-commerce platforms and direct ISP sales dominate the residential gateway market by providing convenient access to advanced networking devices. Retail channels remain significant in regions where consumers prefer in-store demonstrations, technical support, and immediate product availability. Telecom service providers are increasingly bundling residential gateways with broadband and 5G subscriptions to enhance customer experience, improve adoption rates, and offer after-sales support. The rapid growth of online channels is fueled by increasing digital literacy, mobile device usage, and consumers’ preference for comparison shopping and home delivery, making this channel a key driver of market expansion.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global residential gateway market, with the U.S. and Canada contributing approximately 30% of the 2024 market. Key growth drivers include advanced telecom infrastructure, high broadband penetration, and widespread adoption of Wi-Fi 6/7 and 5G technologies. Consumers in this region increasingly demand integrated gateways that can support multiple connected devices and advanced smart home systems. The region also benefits from strong ISP-led initiatives, including bundled gateway offerings and technical support, which facilitate the adoption of high-end residential gateways. Rising remote work, streaming services, and gaming trends further reinforce the demand for high-performance devices.

Europe

Europe accounts for nearly 25% of the 2024 market, with Germany, the U.K., and France leading adoption. Hybrid and fiber gateways are particularly popular due to the region’s mature telecom infrastructure and focus on high-performance home networks. Regional drivers include strong emphasis on smart city initiatives, IoT integration, and regulatory support for digital infrastructure modernization. Spain and Italy are the fastest-growing countries, driven by rising smart home penetration, increasing FTTH deployments, and growing awareness of cybersecurity features in residential gateways. European consumers also prefer devices capable of managing multiple connected devices efficiently, enhancing overall smart home ecosystem adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, India, Japan, and Australia driving demand. Rapid urbanization, increasing broadband subscriptions, and the expansion of FTTH networks are key drivers. Rising middle-class households, coupled with growing awareness of smart home solutions, support high adoption rates for residential gateways. 5G rollout and increasing mobile internet penetration are also fueling demand for advanced devices, particularly in urban and semi-urban areas. Cost-effective, technologically advanced gateways that integrate Wi-Fi 6/7 and smart home functionalities are expected to capture significant market share in tier-2 and tier-3 cities.

Latin America

Brazil, Mexico, and Argentina are driving moderate growth, primarily in urban centers where broadband infrastructure is expanding. Demand for mid-range gateways is rising among households adopting online education, streaming, and smart home devices. Regional growth is supported by improving telecom infrastructure, government digitalization initiatives, and rising disposable incomes in urban populations. Telecom providers are increasingly bundling residential gateways with broadband subscriptions, accelerating adoption in both residential and small office segments.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing steady growth due to high-income populations, early smart home adoption, and rapid deployment of high-speed internet networks. Africa’s residential gateway market is nascent but shows rising interest in urban centers such as South Africa, Nigeria, and Kenya. Growth drivers include expanding broadband access, increasing awareness of connected home solutions, and government initiatives to promote digital infrastructure. Telecom providers’ investments in fiber and LTE/5G infrastructure are expected to further stimulate residential gateway adoption in these regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Residential Gateway Market

- Netgear

- TP-Link

- Huawei

- Cisco

- D-Link

- Asus

- Arris

- Technicolor

- AVM GmbH

- Zyxel

- HPE

- Samsung Electronics

- Fritz!Box

- MikroTik

- Ubiquiti Networks

Recent Developments

- In March 2025, Netgear launched a Wi-Fi 7 residential gateway with AI-powered device management and enhanced security for smart homes.

- In January 2025, Huawei introduced 5G residential gateways in Asia-Pacific markets, targeting high-speed broadband adoption in urban and semi-urban areas.

- In December 2024, TP-Link partnered with major ISPs in Europe to bundle hybrid DSL/fiber gateways, accelerating the adoption of multi-technology home networking solutions.