Residential Fire Extinguisher Market Size

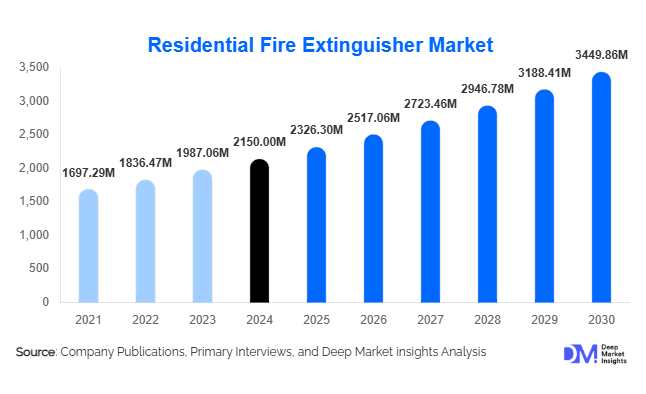

According to Deep Market Insights, the global residential fire extinguisher market size was valued at USD 2,150 million in 2024 and is projected to grow from USD 2,326.30 million in 2025 to reach USD 3,449.86 million by 2030, expanding at a CAGR of 8.2% during the forecast period (2025–2030). The market growth is primarily driven by increasing awareness of home fire safety, stringent residential fire safety regulations, and rising adoption of multi-purpose, portable, and smart fire extinguishers in urban households globally.

Key Market Insights

- Rising adoption of multi-purpose dry chemical extinguishers is driving market growth, as these units can combat Class A, B, and C fires in residential settings.

- Handheld and wall-mounted installation types dominate due to portability and compliance with building safety codes, particularly in apartments and high-rise residences.

- North America leads the market, accounting for 35% of the global share in 2024, driven by stringent fire safety regulations and higher disposable incomes.

- APAC is the fastest-growing region, with China, India, and Japan leading demand due to rapid urbanization and smart home integration.

- Integration with smart home systems and IoT-enabled extinguishers is reshaping consumer preferences, especially in technologically advanced urban households.

- Offline retail remains dominant, although online channels are rapidly expanding due to convenience and increasing e-commerce penetration in emerging markets.

Latest Market Trends

Smart and IoT-Enabled Fire Extinguishers

Technological integration is transforming the residential fire extinguisher market. Smart extinguishers equipped with sensors, mobile alerts, and automatic detection systems are gaining popularity. These devices can communicate with home fire alarm systems or smartphones, ensuring faster response during emergencies. The trend is particularly strong in North America and Europe, where tech-savvy homeowners prioritize connected safety solutions. Additionally, eco-friendly extinguishing agents are being incorporated, catering to environmentally conscious consumers.

Urbanization and High-Rise Residential Demand

Rapid urbanization, particularly in APAC and North America, has fueled demand for fire safety solutions in apartments, gated communities, and condominiums. High-rise buildings are required to comply with local fire codes mandating fire extinguishers in common areas and individual units. This trend ensures sustained adoption of both handheld and wall-mounted extinguishers. Developers increasingly offer these systems as part of new residential projects, supporting long-term market growth.

Residential Fire Extinguisher Market Drivers

Increasing Awareness of Home Safety

Media coverage of residential fire incidents, public safety campaigns, and government initiatives has significantly raised awareness of fire hazards at home. Consumers are increasingly opting for multi-class extinguishers and compact, user-friendly designs to ensure household safety. This heightened awareness directly drives sales in urban and suburban regions.

Regulatory Compliance and Safety Mandates

Stringent fire safety regulations in North America, Europe, and parts of APAC are compelling homeowners and property developers to install fire extinguishers. Compliance with building codes, including periodic replacement and inspection, ensures recurring demand for residential fire extinguishers.

Technological Innovation in Products

Manufacturers are developing lightweight, ergonomic, and multi-purpose extinguishers with smart features and environmentally safe agents. Smart devices connected to mobile apps and alarm systems improve usability and emergency response, attracting tech-conscious homeowners. These innovations enhance market appeal and allow differentiation among manufacturers.

Market Restraints

High Initial Costs and Maintenance

The cost of advanced fire extinguishers and ongoing maintenance may discourage adoption, especially in price-sensitive markets. Regular inspection, refilling, and replacement costs present barriers to widespread usage.

Low Awareness in Emerging Markets

Despite regulations, many regions in APAC, Africa, and LATAM still exhibit low adoption due to limited awareness of residential fire safety norms and affordability issues, slowing overall market growth potential.

Residential Fire Extinguisher Market Opportunities

Expansion into Emerging Urban Regions

Rapid urbanization in India, China, and Brazil is driving new construction of high-rise apartments and gated communities. These developments require fire safety installations, creating opportunities for residential fire extinguisher manufacturers. Compliance with fire safety mandates ensures steady demand, particularly in APAC and LATAM.

Integration with Smart Home Technologies

IoT-enabled fire extinguishers and connected safety systems are emerging as high-value products. Integration with mobile apps, predictive maintenance, and automated alerts allows manufacturers to offer subscription-based services and enhanced safety solutions, attracting premium urban consumers and tech-savvy homeowners.

Government Regulations and Safety Mandates

Governments worldwide are enforcing stricter residential fire safety codes, increasing demand for compliant fire extinguishers. Public awareness campaigns, subsidies, and certification programs encourage adoption, ensuring a long-term growth trajectory for the market.

Product Type Insights

Dry chemical powder fire extinguishers dominate the global market with a 42% share in 2024. Their versatility across Class A, B, and C fires makes them ideal for residential settings. Water and foam extinguishers are growing in niche applications, particularly in high-end homes and kitchen areas, while CO₂ extinguishers are preferred for electrical fire safety.

Installation Type Insights

Handheld fire extinguishers lead with 60% market share in 2024 due to portability, ease of use, and widespread adoption in apartments and villas. Wall-mounted extinguishers are increasing in popularity in high-rise buildings and gated communities to meet regulatory requirements and ensure visibility and accessibility during emergencies.

Distribution Channel Insights

Offline retail dominates with a 55% market share in 2024, driven by hardware stores and specialty fire safety outlets. Consumers often prefer physical inspection before purchase. Online channels are growing at a 12–15% CAGR, fueled by e-commerce penetration, convenient home delivery, and rising awareness in emerging markets.

End-Use Insights

Apartments and condominiums account for 48% of the 2024 market demand, led by urbanization and fire safety regulations. Single-family homes and villas represent a steady segment, while gated communities are emerging as a high-growth segment due to regulatory compliance and increasing safety awareness. Export-driven demand is rising as manufacturers supply residential fire extinguishers to construction projects in emerging economies.

| By Product Type | By Installation Type | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominates with a 35% share of the global market in 2024. The U.S. and Canada drive demand due to strict building codes, high disposable incomes, and technological adoption of smart extinguishers. Urban residential complexes and high-rise apartments are key demand centers.

Europe

Europe accounts for 25% of the global market in 2024, with Germany, the U.K., and France leading adoption. Regulatory mandates, urbanization, and rising awareness support steady growth. Smart extinguishers and multi-purpose units are increasingly preferred in modern residential projects.

Asia-Pacific

APAC is the fastest-growing region, driven by China, India, and Japan. Rapid urbanization, smart home integration, and rising middle-class incomes are fueling adoption. Government incentives and construction growth contribute to rising demand for residential fire safety solutions.

Latin America

Brazil, Argentina, and Mexico are driving slow but steady growth. Affluent consumers and developers are adopting fire extinguishers in new residential projects, while export-driven demand supports the regional market.

Middle East & Africa

UAE, Saudi Arabia, and South Africa are witnessing rising adoption due to urban residential developments and fire safety awareness campaigns. Regulatory compliance and high-income populations support demand for modern and smart extinguishers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Residential Fire Extinguisher Market

- Kidde

- First Alert

- Globe Fire Equipment

- Amerex Corporation

- Fike Corporation

- Tyco SimplexGrinnell

- Chubb Fire & Security

- Hochiki Corporation

- Siemens Building Technologies

- Johnson Controls

- Wormald International

- Fireade

- Senko Advanced Components

- Britannia Fire

- Viking Group

Recent Developments

- In March 2025, Kidde launched a new smart fire extinguisher line with mobile app connectivity and real-time alerts for residential users.

- In January 2025, First Alert introduced eco-friendly dry chemical extinguishers, expanding its sustainable product portfolio in North America and Europe.

- In February 2025, Amerex Corporation partnered with construction firms in APAC to supply compliant fire extinguishers for high-rise residential projects.