Relief Tents Market Size

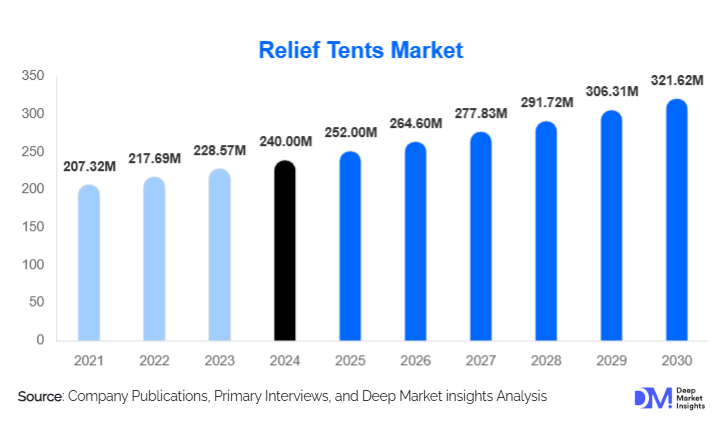

According to Deep Market Insights, the global relief tents market size was valued at USD 240 million in 2024 and is projected to grow from USD 252.00 million in 2025 to reach USD 321.62 million by 2030, expanding at a CAGR of 5% during the forecast period (2025–2030). The growth of the relief tents market is primarily driven by the increasing frequency of natural disasters, rising humanitarian and refugee crises, and growing investments in emergency response infrastructure by governments and NGOs worldwide.

Key Market Insights

- Rapid deployment tents are gaining traction globally, offering emergency shelter solutions in disaster zones, conflict areas, and refugee camps.

- Technological advancements, including modular and inflatable tents, are enhancing durability, portability, and adaptability for extreme weather conditions.

- Asia-Pacific is emerging as the fastest-growing region, driven by rising disaster vulnerability and expanding government relief programs in countries like India, China, and the Philippines.

- North America and Europe dominate procurement, largely led by military, defense, and humanitarian agency demand.

- Integration of multifunctional solutions, such as solar panels, water filtration, and heating systems, is redefining temporary shelter capabilities.

- Government and NGO-led initiatives, combined with public-private partnerships, are supporting long-term investments in relief tent stockpiles and infrastructure.

Latest Market Trends

Modular and Inflatable Relief Tents on the Rise

Manufacturers are increasingly focusing on modular and inflatable relief tents, which allow rapid deployment and easy scalability for large-scale emergencies. These solutions are designed to accommodate varying capacities, from single-family shelters to community-sized camps. Modular tents offer enhanced structural stability, while inflatable designs reduce setup time, requiring minimal manpower. The adoption of such technologies is particularly high in regions prone to recurring natural disasters, ensuring quick shelter provision and improved living conditions for displaced populations.

Integration of Smart and Multifunctional Features

Emerging relief tents are incorporating advanced features such as lightweight fire-retardant fabrics, water-resistant coatings, integrated solar energy solutions, and portable heating or cooling systems. These innovations enhance the usability and comfort of temporary shelters in challenging environments. NGOs and defense agencies are increasingly requesting tents with built-in utilities, which reduces dependency on additional logistics. This trend appeals to organizations seeking both operational efficiency and sustainable, long-term solutions for disaster response.

Relief Tents Market Drivers

Increasing Frequency of Natural Disasters

The growing prevalence of hurricanes, floods, earthquakes, and wildfires has significantly amplified the need for rapid-deployment shelter solutions. Relief tents offer immediate protection for displaced populations, enabling humanitarian agencies to respond efficiently. According to recent estimates, over 200 million people globally require emergency shelter each year, emphasizing the critical role of relief tents in disaster management operations.

Rising Humanitarian and Military Expenditure

Governments and military organizations across the U.S., China, India, and Europe are investing heavily in temporary operational shelters and mobile medical units. Humanitarian agencies, including the UN and Red Cross, are expanding their tent inventories to support refugee camps, vaccination drives, and disaster relief operations. This sustained funding drives market expansion and encourages manufacturers to innovate durable, high-capacity solutions.

Technological Advancements in Tent Materials

New materials, such as PVC-coated fabrics, hybrid composites, and fire-retardant polyester blends, are improving the resilience, lifespan, and adaptability of relief tents. Advanced designs reduce setup time and operational costs, making tents suitable for extreme climates and long-term deployments. This innovation is a major growth enabler, attracting demand from both public and private sector organizations worldwide.

Market Restraints

High Manufacturing and Logistics Costs

High-quality relief tents often involve advanced materials and specialized engineering, making production and transportation expensive. Logistic complexities, including rapid deployment to disaster-affected remote areas, add additional cost burdens. Smaller organizations and low-income countries may face budget constraints, limiting market adoption.

Durability and Maintenance Challenges

Relief tents deployed in extreme weather conditions face wear and tear, potentially requiring frequent replacement or maintenance. Limited access to repair facilities in remote or disaster-hit regions can reduce operational efficiency, constraining market growth.

Relief Tents Market Opportunities

Emerging Regional Demand in APAC and Africa

Countries such as India, China, the Philippines, Nigeria, and South Africa are increasingly susceptible to natural disasters and humanitarian crises. Governments and NGOs are expanding disaster management infrastructure, creating significant procurement opportunities for relief tent manufacturers. Regional expansion enables companies to tap into large, underserved markets with high growth potential.

Advanced Multifunctional Tents

Manufacturers are introducing relief tents with integrated solar panels, water filtration, and heating systems, providing self-sufficient shelters for displaced populations. These multifunctional solutions not only improve living conditions but also reduce reliance on additional equipment, positioning them as premium solutions for humanitarian agencies and military operations.

Government and Multilateral Funding Initiatives

Programs by global agencies, national disaster management authorities, and NGOs encourage public-private partnerships in emergency shelter procurement. Initiatives similar to India’s Disaster Management Act and African resilience programs are opening avenues for large-scale contracts, long-term supply agreements, and infrastructure development, driving market expansion.

Product Type Insights

Pop-up and instant tents dominate the market, accounting for approximately 35% of global revenue in 2024, due to their rapid deployment capabilities. Modular tents, representing nearly 25% of the market, are preferred for semi-permanent settlements and refugee camps. Inflatable tents and traditional frame tents are growing steadily, particularly in extreme weather regions requiring durable and spacious shelters.

Application Insights

Humanitarian and disaster relief agencies remain the largest end-users, contributing over 50% of demand in 2024. Military and defense operations follow, utilizing relief tents for field hospitals and operational bases. Healthcare-focused field clinics and temporary vaccination centers are emerging applications, while event-based shelters present niche growth opportunities. Export-driven demand from governments and NGOs in emerging economies is expected to expand, particularly for pre-positioned stockpiles in high-risk zones.

Distribution Channel Insights

Direct sales to government and NGO buyers account for the majority of market revenue. Specialized B2B suppliers provide tailored tent solutions for emergency response operations. Online procurement platforms and e-commerce channels are gradually gaining relevance, particularly for smaller organizations. Public tenders and long-term supply contracts are the dominant channels for large-scale deployments, ensuring predictable demand for manufacturers.

| By Product Type | By Material | By Deployment Duration | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for nearly 30% of the global market in 2024, driven by U.S. and Canadian military and humanitarian demand. High government expenditure on disaster preparedness, well-funded NGOs, and established supply chains support robust growth. The region focuses on rapid deployment tents, modular shelters, and multifunctional units for both domestic and international relief operations.

Europe

Europe contributes approximately 28% of market revenue, with Germany, the U.K., and France leading procurement. EU-funded humanitarian programs, defense contracts, and NGO-led initiatives support demand for durable and innovative relief tents. Sustainable and energy-efficient tent designs are increasingly preferred, reflecting environmental policies and regulations.

Asia-Pacific

APAC is the fastest-growing region, led by India, China, Japan, and Southeast Asian nations. High disaster risk, government relief initiatives, and NGO interventions are driving growth. Pre-positioning of relief shelters and regional manufacturing hubs enhances responsiveness to crises, making APAC a critical market for expansion.

Middle East & Africa

MEA markets, including the UAE, Saudi Arabia, South Africa, and Nigeria, are expanding due to conflict-related displacement and disaster preparedness initiatives. Investment in semi-permanent and permanent relief settlements supports long-term demand. Regional infrastructure projects and multinational aid programs further enhance market potential.

Latin America

LATAM, primarily Brazil, Argentina, and Mexico, represents a smaller but emerging market. Demand is rising for emergency response solutions, particularly for flood and hurricane-prone areas. Niche operators supplying portable and modular tents are gaining traction among local NGOs and governments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Relief Tents Market

- Carpa Industries

- Heemskerk Innovative Solutions

- Oxfam Shelter Supplies

- Alaska Tent & Tarp

- MSA Tents

- COLEMAN

- Polytan Tents

- WeatherPort

- Kifaru International

- Pacific Shelter Systems

- Ramada Shelter Solutions

- Hubert Tent Company

- Outdoor World Supplies

- Monarch Shelter Systems

- FieldTents Inc.

Recent Developments

- In March 2025, WeatherPort expanded its modular relief tent portfolio to include integrated solar and water filtration systems for refugee camps in Africa.

- In January 2025, Carpa Industries launched rapid-deployment inflatable tents for disaster relief agencies in South Asia, reducing setup time by 60%.

- In February 2025, Heemskerk Innovative Solutions introduced hybrid composite tents with enhanced durability for extreme weather conditions in the Middle East and North Africa.