Recreational CBD Beverages Market Size

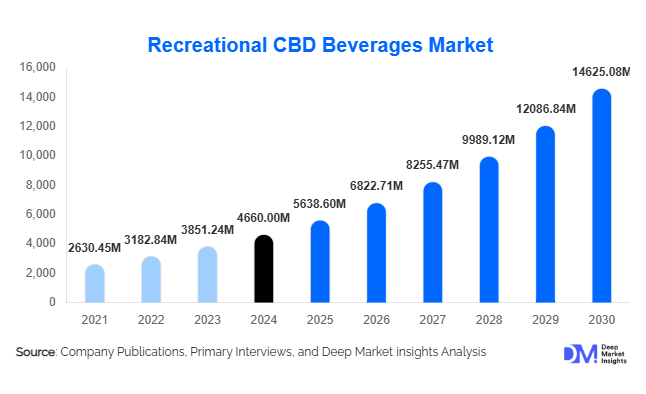

According to Deep Market Insights, the global recreational CBD beverages market size was valued at USD 4,660 million in 2024 and is projected to grow from USD 5,638.60 million in 2025 to reach USD 14,625.08 million by 2030, expanding at a CAGR of 21% during the forecast period (2025–2030). The market growth is primarily driven by the rising popularity of non-alcoholic social beverages, increasing regulatory clarity around hemp-derived CBD, and innovations in beverage formulation and delivery technologies that enhance taste, bioavailability, and convenience for consumers.

Key Market Insights

- Non-carbonated beverages dominate recreational CBD consumption, driven by consumer preference for mild, natural flavors and wellness-oriented alternatives to alcoholic drinks.

- Hemp-derived CBD products lead the market globally due to legal acceptance and low psychoactive effects, ensuring broader adoption across regions.

- North America holds the largest market share, with the USA driving demand owing to advanced regulatory frameworks, high consumer awareness, and mature e-commerce channels.

- Europe is emerging as a fast-growing market, led by the UK and Germany, where non-alcoholic beverage trends and CBD awareness are rapidly expanding.

- Asia-Pacific shows the highest CAGR potential, particularly in Australia, New Zealand, and select Southeast Asian countries, driven by growing wellness culture and middle-class affluence.

- Technological innovations, including nano-emulsion and water-soluble CBD formulations, are enhancing taste, absorption, and consumer acceptability, reshaping market dynamics.

Latest Market Trends

Functional and Non-Alcoholic Social Beverages

Consumers increasingly seek recreational CBD beverages as alternatives to alcoholic drinks. Non-carbonated options such as flavored waters, teas, and wellness-focused drinks are leading demand due to their subtle effects, palatability, and perceived health benefits. Mocktails and ready-to-drink cocktail infusions are gaining traction in social settings, particularly among millennials and Gen Z, reflecting a shift toward low-alcohol or sober-curious lifestyles.

Advances in Formulation Technology

Improved CBD delivery methods, such as nano-emulsions, liposomal encapsulation, and water-soluble formulations, are transforming the consumer experience by enhancing bioavailability and reducing the hemp aftertaste. These technological innovations allow beverage manufacturers to develop products with consistent dosing, better shelf stability, and wider flavor options. Functional additive integration, such as adaptogens, botanicals, and electrolytes, further strengthens the market's appeal to health-conscious and recreational consumers.

Recreational CBD Beverages Market Drivers

Growing Demand for Alcohol Alternatives

The increasing preference for non-alcoholic social beverages is a key driver for recreational CBD drinks. Consumers seeking relaxation, stress relief, and social enjoyment without alcohol are fueling adoption. The trend is particularly strong among urban millennials and Gen Z, who are integrating wellness into lifestyle choices. Beverage companies are capitalizing on this by offering low-dose, palatable CBD-infused options with appealing flavors and attractive packaging.

Regulatory Clarification and Legal Acceptance

As jurisdictions clarify regulations surrounding hemp-derived CBD, manufacturers gain confidence to scale operations and expand product portfolios. Legal frameworks regarding permissible CBD concentrations, THC limits, labeling, and testing standards reduce barriers for domestic and international trade. This provides opportunities for larger beverage companies and startups to enter new markets while ensuring compliance and safety.

Technological Innovation in Beverage Formulation

Advanced delivery technologies, flavor masking, and functional ingredient integration are enabling the creation of premium and mainstream products. These improvements address consumer concerns about taste, effectiveness, and dosage consistency, encouraging repeat purchase. Adoption of sustainable packaging and natural ingredient sourcing further strengthens brand perception and market competitiveness.

Market Restraints

Regulatory Complexity Across Regions

Despite progress, recreational CBD beverages face inconsistent legal frameworks globally. Varying laws on allowable CBD/THC levels, food safety standards, and labeling requirements increase compliance costs and delay market entry in certain regions. Regulatory uncertainty can limit geographic expansion and reduce investor confidence.

Consumer Awareness and Safety Concerns

Limited consumer knowledge regarding CBD effects, purity, and safety can hinder market adoption. Concerns over dosing, potential contamination, or unverified health claims remain barriers. Premium pricing, often double or triple that of comparable non-CBD beverages, further restricts broader accessibility, particularly among cost-conscious consumers.

Recreational CBD Beverages Market Opportunities

Alcohol-Free Social Drink Alternatives

Recreational CBD beverages have a unique opportunity to cater to the growing sober-curious and health-conscious population. Marketing products as enjoyable, social, non-alcoholic beverages can expand target demographics. Collaborations with bars, cafés, and event organizers provide exposure and normalize consumption in social settings, enabling widespread adoption.

Emerging Regulatory Markets and Export Potential

New markets with evolving CBD regulations present export opportunities for established producers. Countries in the Asia-Pacific, Latin America, and parts of Europe are gradually legalizing hemp-derived CBD beverages. Early entrants in these regions can gain first-mover advantages, build brand loyalty, and capture growing demand while navigating regulatory frameworks.

Innovation in Product Formulation and Functional Additives

Integration of nano-emulsified CBD, adaptogens, botanicals, and functional nutrients into beverages allows differentiation and premium pricing. Innovation around flavor, bioavailability, and wellness benefits can attract new consumers, drive repeat purchases, and establish brand recognition in competitive markets.

Product Type Insights

Non-carbonated beverages, including flavored waters, teas, and wellness drinks, dominate the market, accounting for nearly 45% of the global recreational CBD beverage market in 2024. Their mild taste, ease of formulation, and alignment with wellness and lifestyle preferences contribute to their leading position. Ready-to-drink cocktails and mocktails are gaining popularity in social contexts, particularly among young adults seeking alcohol alternatives.

Application Insights

Recreational consumption for social, lifestyle, and stress-relief purposes is the primary application. Consumers use CBD beverages as relaxation aids, alcohol substitutes, or social enhancers. On-premise consumption in cafés, bars, and wellness venues is emerging, while at-home use through e-commerce and subscription models is expanding. Integration with functional additives, such as vitamins and adaptogens, enhances appeal and broadens applications.

Distribution Channel Insights

Online direct-to-consumer sales lead the market, representing approximately 50% of global revenue in 2024. E-commerce allows consumers to access products discreetly and conveniently. Specialty stores and dispensaries provide curated product offerings and expert guidance, while supermarkets and hypermarkets are gradually expanding shelf presence. On-premise distribution in cafés and bars is a nascent but promising channel as regulations permit.

End-User Insights

Young adults (18–34 years) are the largest consumer group, accounting for roughly 55% of market demand. Health-conscious and social consumers drive adoption, seeking low-dose, palatable, and functional beverages. Adults aged 35–54 form a secondary segment with growing interest, while older demographics contribute to premium product uptake focused on wellness and relaxation benefits.

| By Product Type | By Distribution Channel | By Application | By Source Type | By Flavor Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the recreational CBD beverage market, with the USA leading demand due to favorable hemp regulations, high consumer awareness, and robust online retail penetration. Canada contributes through controlled legalization and growing wellness-focused consumption. North America accounted for approximately 45% of the global market in 2024, with continued growth driven by regulatory relaxation and lifestyle adoption.

Europe

Europe, particularly the UK and Germany, represents 28% of the global market in 2024. Growth is fueled by strong demand for non-alcoholic and functional beverages, wellness awareness, and e-commerce penetration. The region is emerging as a fast-growing market for recreational CBD beverages, with young adults and urban populations leading adoption.

Asia-Pacific

Asia-Pacific is witnessing rapid growth, particularly in Australia, New Zealand, and select Southeast Asian countries. Market adoption is supported by rising disposable income, wellness culture, and increasing consumer awareness. CAGR is expected to be the highest globally, as evolving regulations allow new market entry and expansion.

Latin America

Latin America, led by Brazil and Mexico, represents a small but emerging segment. Affluent consumers and urban millennials are driving initial adoption, with future growth expected as regulatory frameworks evolve.

Middle East & Africa

The Middle East and Africa currently hold a limited market share (<5%) due to restrictive regulations. High-income populations in the UAE and Saudi Arabia present potential, while Africa’s growth is linked to hemp cultivation and export opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Recreational CBD Beverages Market

- Canopy Growth Corporation

- Molson Coors Beverage Company

- The Alkaline Water Company

- Phivida Holdings

- Keef Brand

- Koios Beverage Corporation

- Sprig

- Heineken (experimental CBD products)

- Vertosa Inc.

- Recess

- HempFusion

- CBD Living Water

- Lord Jones

- Bloom Farms

- Charlotte’s Web (beverage line)

Recent Developments

- In March 2025, Molson Coors launched a nationwide line of CBD-infused sparkling waters in the USA, targeting non-alcoholic social drink consumers.

- In February 2025, Canopy Growth Corporation expanded its recreational CBD beverage portfolio to Europe, introducing hemp-derived teas and functional wellness drinks in the UK and Germany.

- In January 2025, The Alkaline Water Company launched nano-emulsified CBD sparkling waters in North America, improving bioavailability and taste masking for broader consumer adoption.