Pure Cotton Mattress Protector Market Summary

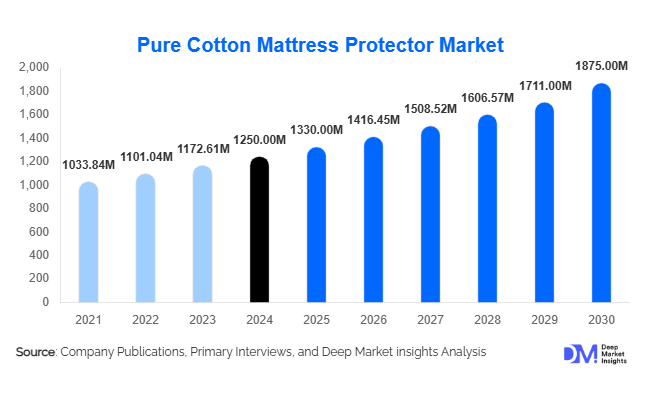

According to Deep Market Insights, the global pure cotton mattress protector market size was valued at USD 1,250 million in 2024 and is projected to grow from USD 1,330 million in 2025 to reach USD 1,875 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer awareness of hygiene and sleep quality, rising demand for sustainable bedding, and growth in the hospitality and healthcare sectors requiring high-quality protective bedding solutions.

Key Market Insights

- Residential demand dominates the market, fueled by urban consumers seeking hypoallergenic, breathable, and comfortable bedding solutions.

- Hospitality and healthcare adoption are increasing, as hotels, resorts, and hospitals invest in premium cotton mattress protectors to improve hygiene standards.

- Technological innovations, including antimicrobial finishes, temperature-regulating fabrics, and moisture-wicking designs, are creating new premium product offerings.

- Online retail is rapidly growing, enabling greater accessibility and product variety, while offline retail still holds a major share due to tactile consumer preference.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class populations, urbanization, and expanding e-commerce channels.

- Sustainability trends are favoring pure cotton, with consumers increasingly opting for eco-friendly, organic, and biodegradable mattress protectors.

What are the latest trends in the pure cotton mattress protector market?

Sustainability and Organic Product Adoption

Manufacturers are increasingly emphasizing 100% organic and eco-friendly cotton mattress protectors. Consumers are seeking certified organic fabrics that are biodegradable and free from harmful chemicals. Eco-conscious manufacturing practices, such as reduced water consumption and sustainable farming, are becoming standard. Retailers are highlighting product certifications, such as GOTS (Global Organic Textile Standard), to appeal to environmentally aware buyers. The growing preference for sustainable bedding is also influencing premium pricing strategies and driving differentiation among market players.

Technology-Enhanced Fabric Solutions

Emerging technologies, including antimicrobial, moisture-wicking, and temperature-regulating finishes, are being integrated into cotton mattress protectors. These innovations increase consumer value by enhancing hygiene, comfort, and durability. Smart textile adoption is particularly attractive to tech-savvy consumers and premium hospitality clients. Manufacturers are also experimenting with quilted designs, hybrid cotton blends, and hypoallergenic coatings to differentiate offerings. The trend is enhancing product performance and allowing companies to command higher margins.

What are the key drivers in the pure cotton mattress protector market?

Rising Health and Hygiene Awareness

Consumers are increasingly concerned about allergens, dust mites, and bacterial contamination in bedding. Pure cotton mattress protectors, being breathable and hypoallergenic, are preferred across residential, hospitality, and healthcare sectors. Awareness campaigns highlighting health benefits and better sleep quality have further fueled market adoption.

Growth in Hospitality and Healthcare Sectors

Hotels, resorts, and hospitals are investing in premium bedding products to maintain hygiene standards and provide comfort. Bulk procurement of cotton mattress protectors ensures longevity and reduces operational costs, making these sectors a critical growth driver. Emerging economies investing in tourism and healthcare infrastructure are expanding this demand.

Expansion of Online Retail Channels

E-commerce platforms have made pure cotton mattress protectors accessible to a broader audience. Consumers can compare products, read reviews, and access competitive pricing. Online retail adoption is accelerating, particularly in urban and semi-urban markets, complementing traditional offline channels.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

High costs of 100% pure cotton mattress protectors limit penetration in price-sensitive regions. Consumers often prefer cheaper synthetic alternatives, which constrains overall market adoption. This is particularly relevant in Latin America, South Asia, and Africa.

Competition from Synthetic Alternatives

Polyester and microfiber mattress protectors are widely available, offering stain resistance and low maintenance at lower prices. The affordability and accessibility of synthetics create competitive pressure on pure cotton products, especially in budget-conscious segments.

What are the key opportunities in the pure cotton mattress protector market?

Hospitality and Healthcare Expansion

The global hospitality and healthcare sectors are increasingly adopting premium mattress protectors for hygiene and longevity. This trend creates substantial volume-driven opportunities, particularly in emerging markets where hotels and hospitals are expanding infrastructure and upgrading facilities.

Technological Innovations in Textiles

Integration of antimicrobial finishes, moisture-wicking fabrics, and temperature-regulating technologies presents opportunities for product differentiation and premium pricing. Companies investing in R&D can tap into tech-savvy consumers and premium institutional buyers seeking high-performance bedding solutions.

Eco-Friendly and Organic Product Demand

Growing awareness about sustainability and eco-conscious lifestyles is driving demand for organic cotton mattress protectors. New entrants and established players can capitalize by offering certified organic products, environmentally-friendly packaging, and sustainable manufacturing practices, appealing to environmentally-conscious consumers globally.

Product Type Insights

Fitted mattress protectors dominate the market, accounting for 35% of revenue in 2024, due to ease of use, universal fit, and washability. Zippered protectors are gaining traction in premium hospitality segments, while quilted and padded options appeal to consumers seeking added comfort and luxury features. The trend toward protective bedding with durability and hygiene benefits has consistently supported fitted protectors as the market leader.

Material Grade Insights

100% pure cotton accounts for 70% of the material segment, reflecting a strong preference for natural, breathable fabrics. Consumers increasingly prioritize hypoallergenic and organic-certified options. Cotton blends have niche demand in budget-conscious segments but lack the premium appeal of pure cotton offerings.

Size Insights

Queen-sized mattress protectors lead globally, representing 40% of the market, driven by widespread use of queen beds in residential and hospitality sectors. Double and king sizes follow, with strong adoption in hotels and luxury households.

End-Use Insights

Residential use accounts for 50% of the market, driven by growing urban populations investing in hygiene and sleep comfort. Hospitality and healthcare sectors are rapidly expanding, with hotels, resorts, and hospitals procuring large volumes of mattress protectors to meet hygiene and durability standards. Export demand is increasing from North America and Europe to the APAC regions, where premium bedding solutions are imported for hospitality and residential applications.

Distribution Channel Insights

Offline retail channels, including specialty stores, department stores, and supermarkets, currently dominate the market with a 55% share, as consumers prefer physically inspecting bedding products. Online retail is the fastest-growing channel, leveraging e-commerce platforms, brand websites, and digital marketing to enhance accessibility, product comparison, and convenience.

| By Product Type | By Material Grade | By Size | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 30% of global revenue, led by the U.S. due to high consumer awareness, disposable income, and preference for premium organic bedding. Canada also contributes significantly to regional demand, driven by residential and hospitality adoption. Growth is supported by increasing e-commerce penetration and health-conscious consumer trends.

Europe

Europe accounts for 25% of the market share, with Germany, the UK, and France leading demand. Consumers prefer eco-friendly and sustainable bedding, and strong hospitality infrastructure boosts institutional procurement. The region emphasizes organic certification and quality standards, supporting premium product adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a projected CAGR of 8%, led by China, India, Japan, and Australia. Rising urban populations, growing middle-class households, and increased e-commerce adoption drive market growth. Hotels and hospitals are upgrading bedding standards, further expanding demand.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is experiencing rising demand due to luxury hotels and high-income consumers. Africa contributes to domestic hospitality demand, especially in urban centers and emerging luxury hotels.

Latin America

Latin America, particularly Brazil and Mexico, is witnessing moderate growth driven by residential demand and slow adoption in the hospitality sectors. Consumers show a preference for budget-friendly and mid-range cotton mattress protectors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pure Cotton Mattress Protector Market

- SleepWell

- Sealy

- Tempur-Pedic

- Frette

- Serta

- WestPoint Home

- Godrej Interio

- Bombay Dyeing

- Welspun

- Springs Global

- BedStory

- Kurlon

- American Bedding

- White Dove

- Bamboo Living

Recent Developments

- In May 2025, SleepWell launched a new range of organic cotton mattress protectors with antimicrobial finishes, targeting both residential and hospitality sectors.

- In April 2025, Sealy introduced temperature-regulating cotton mattress protectors in North America, combining comfort with improved hygiene benefits.

- In February 2025, Tempur-Pedic expanded its e-commerce platform to offer customized fitted mattress protectors, including organic-certified and quilted options, enhancing direct-to-consumer sales.