Portable Anti-Static Mat Market Size

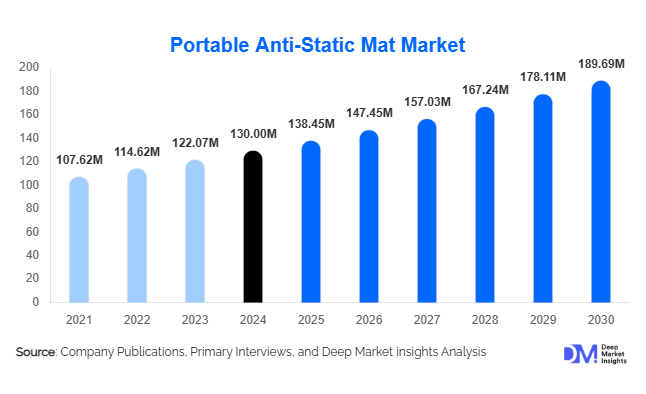

According to Deep Market Insights, the global portable anti-static mat market size was valued at USD 130 million in 2024 and is projected to grow from USD 138.45 million in 2025 to reach USD 189.69 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by the increasing adoption of electrostatic discharge (ESD) protection solutions across electronics manufacturing, semiconductor production, automotive electronics, and laboratories, coupled with rising awareness of workplace safety standards and innovations in durable, portable mat materials.

Key Market Insights

- Portable anti-static mats are gaining traction due to expanding electronics and semiconductor industries, which require stringent ESD protection to prevent component damage.

- Industrial applications dominate the market, particularly in manufacturing, cleanrooms, and laboratories, where static control is critical.

- North America holds a major share of the market, led by U.S. and Canadian demand for certified and high-performance mats in electronics and healthcare sectors.

- Asia-Pacific is the fastest-growing region, driven by expanding electronics manufacturing hubs in China, India, and Southeast Asia.

- Material innovations, including rubber, silicone, and eco-friendly composites, are enabling more durable, portable, and lightweight mat designs.

- Technological integrations, such as sensor-enabled mats and modular foldable designs, are enhancing usability in field service, labs, and repair environments.

Latest Market Trends

Innovation in Material and Design

Market players are focusing on developing mats with superior durability, chemical resistance, heat resistance, and enhanced portability. Rubber continues to dominate the material segment due to its flexibility and robustness, while silicone and hybrid composites are gaining popularity for specialized applications such as cleanrooms and medical labs. Additionally, foldable and lightweight designs are enabling portable usage across field service, repair workshops, and mobile labs, expanding the functional applicability of mats beyond fixed manufacturing environments.

Regulatory and Standards-Driven Adoption

Compliance with international ESD standards such as ANSI/ESD S20.20 and IEC 61340-5-1 is becoming mandatory across high-tech manufacturing and laboratory sectors. Companies are increasingly investing in certified mats to meet these requirements and avoid costly damage to sensitive electronic components. Regulatory enforcement, workplace safety mandates, and cleanroom requirements are driving adoption, while eco-friendly and recyclable mat options are aligning with sustainability and corporate ESG initiatives.

Portable Anti-Static Mat Market Drivers

Expansion of Electronics and Semiconductor Industries

The growing complexity and miniaturization of electronic components have amplified the risk of electrostatic discharge (ESD), especially in semiconductor, consumer electronics, automotive, and IoT applications. Portable anti-static mats provide essential protection during manufacturing, assembly, and maintenance processes. The proliferation of EVs, wearable devices, and smart electronics further fuels the need for reliable ESD solutions, underpinning the demand for portable anti-static mats across industrial and laboratory environments.

Rising Awareness of Workplace Safety and Standards

Global industries are increasingly enforcing workplace safety standards to prevent ESD-related failures. Adoption of ANSI/ESD and IEC 61340-5-1 standards has elevated the requirement for certified mats, especially in laboratories, cleanrooms, and electronics assembly. Companies are integrating ESD control measures into their operational protocols to safeguard components and comply with audits, driving consistent demand growth.

Innovation and Product Differentiation

Companies are introducing advanced mats with enhanced portability, foldable designs, sensor integrations, and eco-friendly materials. These innovations improve usability, durability, and compliance with strict ESD regulations. The availability of smart mats capable of monitoring static discharge levels offers a competitive edge for manufacturers targeting high-value industrial clients.

Market Restraints

Cost Sensitivity in Emerging Markets

Premium mats made from high-quality materials or integrated with sensors are often expensive. Small and medium enterprises (SMEs) and users in emerging economies may find these products cost-prohibitive, limiting adoption in price-sensitive regions. Lower-cost substitutes may compromise quality, impacting overall market growth potential.

Awareness and Proper Usage Challenges

The effectiveness of portable anti-static mats depends on correct installation, grounding, and usage. Lack of awareness in certain regions, improper training, or use of substandard products can reduce efficacy, potentially restraining market expansion. Counterfeit or uncertified mats also challenge adoption, particularly in emerging markets.

Portable Anti-Static Mat Market Opportunities

Emerging Markets and Industrial Hubs

Rapid industrialization and the expansion of electronics manufacturing in countries such as India, Vietnam, and Malaysia present substantial growth opportunities. Low penetration of high-quality portable mats in these regions allows market entrants to capture new demand, particularly in sectors requiring certified ESD solutions. Government incentives and industrial policies support investments, fostering favorable conditions for growth.

Eco-Friendly and Sustainable Product Lines

Rising awareness of environmental sustainability is prompting demand for mats made from recyclable, biodegradable, or hybrid materials. These eco-friendly mats not only comply with corporate ESG policies but also cater to industries like medical, semiconductor, and cleanroom operations, where safety and sustainability are priorities. Investment in R&D for innovative materials can create product differentiation and command premium pricing.

Regulatory Compliance and Technological Integration

Compliance with ESD standards and workplace safety regulations is a key driver. Companies offering certified mats or integrated solutions with monitoring capabilities are well-positioned to benefit. Additionally, sensor-enabled mats, modular designs, and smart monitoring technologies provide opportunities for manufacturers to differentiate products and enter high-value industrial sectors.

Product Type Insights

Floor mats dominate the portable anti-static mat market, accounting for approximately 35–40% of the 2024 market share. Their larger size, durability, and applicability in industrial and cleanroom settings make them indispensable for protecting sensitive electronic components. Table mats and wrist straps complement floor mats but represent a lower market value. Trends toward foldable, modular, and portable floor mats are increasing adoption in mobile workshops and field service applications.

Material Insights

Rubber is the leading material globally, representing roughly 40–50% of the 2024 market value. Its flexibility, durability, chemical and heat resistance, and compliance with ESD standards make it preferred in industrial, laboratory, and cleanroom applications. Silicone and hybrid composites are gaining traction in specialized environments requiring enhanced insulation, portability, and eco-friendliness.

Application Insights

Industrial applications, particularly electronics and semiconductor manufacturing, dominate the market with approximately 50–60% share in 2024. The segment benefits from stringent safety standards, large-scale production facilities, and high replacement frequency due to heavy usage. Cleanrooms, laboratories, automotive electronics, and repair/field-service applications are emerging as growth areas, driving adoption of portable mats for flexible, mobile ESD protection.

End-Use Insights

Electronics manufacturing, semiconductor fabs, automotive electronics, and medical device sectors represent the primary end users of portable anti-static mats. Repair workshops, field-service teams, and labs are emerging applications, particularly for portable and foldable mats. Export-oriented electronics hubs in China, India, and Southeast Asia further drive demand due to international quality compliance requirements. Newer industries, including IoT device assembly and mobile labs, are opening additional growth avenues.

| By Product Type | By Material | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest regional market share (35–45% in 2024), with the U.S. and Canada leading due to mature electronics, semiconductor, and medical device industries. Strict ESD compliance regulations and high demand for certified and premium mats drive growth. Industrial expansion and cleanroom adoption further support market stability.

Europe

Europe accounts for 25–35% of the 2024 market. Germany, the U.K., and France lead adoption due to automotive electronics, high-tech manufacturing, and laboratory applications. The region is increasingly focused on eco-friendly products and compliance with international standards, while Eastern European countries are emerging as growth markets.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by electronics manufacturing in China, India, Vietnam, and Southeast Asia. The region benefits from government initiatives like "Make in India" and "Made in China 2025," incentivizing industrial expansion. Rising awareness of ESD safety and export-quality requirements further accelerates adoption.

Latin America

Brazil, Mexico, and Argentina are the primary markets, with demand fueled by automotive electronics and industrial manufacturing. Although the current market share is small (5–8% in 2024), adoption is increasing due to growing industrialization and repair/service needs.

Middle East & Africa

MEA contributes 5–10% of the global market. Demand is concentrated in GCC countries (UAE, Saudi Arabia) and South Africa for industrial, data center, and laboratory applications. High-income populations and increasing industrial projects are driving growth, while intra-African industrial expansion offers additional opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Anti-Static Mat Market

- 3M

- Botron

- Wearwell

- Andersen Products

- New Pig

- NoTrax

- DENIOS

- Disset Odiseo S.L.

- Stronghold

- RS Components

- Coventry Rubber

- Static Solutions

- Bertech

- Electrostatic Solutions

- AlphaMat

Technological adoption includes sensor-enabled mats, foldable and modular designs, and eco-friendly materials. Companies are increasingly focusing on innovation, certifications, and premium industrial-grade products to differentiate themselves. Pricing trends vary based on material, size, and certifications, with premium mats commanding higher margins while standard vinyl or polyethylene mats cater to price-sensitive users.

Recent Developments

- In March 2025, 3M launched a new range of foldable, sensor-integrated anti-static mats for electronics assembly, emphasizing portability and real-time ESD monitoring.

- In January 2025, Botron introduced eco-friendly rubber mats compliant with IEC 61340-5-1, targeting medical labs and cleanroom environments.

- In February 2025, Wearwell expanded its industrial floor mat portfolio with hybrid composite materials for automotive electronics manufacturing, enhancing durability and chemical resistance.