Polyester Bed Sheets Market Size

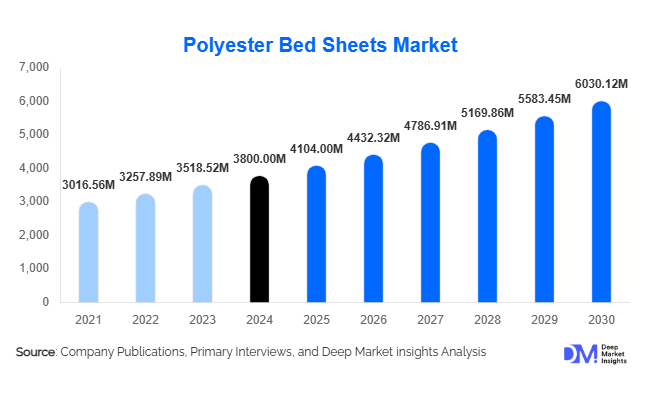

According to Deep Market Insights, the global polyester bed sheets market size was valued at USD 3,800 million in 2024 and is projected to grow from USD 4104 million in 2025 to reach USD 6030.12 million by 2030, expanding at a CAGR of 8% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer demand for affordable, durable, and easy-to-maintain bedding solutions, increasing adoption of microfiber and blended fabrics, and the rapid expansion of e-commerce channels that facilitate global accessibility to home textile products.

Key Market Insights

- Fitted sheets and microfiber polyester fabrics dominate the product landscape, accounting for approximately 40% and 35% of the market share, respectively, in 2024, due to their convenience, softness, and cost-effectiveness.

- Online retail channels are increasingly driving sales, with consumers preferring digital platforms for their wide variety, competitive pricing, and home delivery options.

- Asia-Pacific is emerging as a key growth region, led by China and India, where rising disposable incomes, urbanization, and increasing awareness of home comfort products are boosting market demand.

- North America remains a major market, with the U.S. and Canada accounting for significant demand due to high consumer spending and preference for durable bedding.

- Technological integration, including advanced weaving, dyeing, and wrinkle-resistant treatments, is enhancing product appeal and driving market differentiation.

What are the latest trends in the polyester bed sheets market?

Shift Toward Sustainable and Recycled Polyester

Manufacturers are increasingly incorporating recycled polyester and eco-friendly production techniques in response to consumer demand for sustainability. Certifications such as OEKO-TEX and Global Recycled Standard (GRS) are gaining prominence, influencing buyer choices. This trend supports environmental initiatives while enabling companies to market premium, eco-conscious products that appeal to younger, environmentally aware demographics.

Technologically Enhanced Fabric Finishes

Innovations in dyeing, moisture-wicking, anti-allergen, and wrinkle-resistant technologies are improving product performance and aesthetics. Polyester fabrics are now engineered for better breathability and comfort, making them more competitive with natural fibers like cotton and linen. These advancements are particularly valued by hospitality sectors and premium residential customers seeking both functionality and durability.

What are the key drivers in the polyester bed sheets market?

Affordability and Durability

Polyester bed sheets offer an attractive price-to-performance ratio. Their cost-effectiveness makes them accessible to a broad consumer base, while their resistance to shrinking, wrinkling, and wear ensures longevity. This combination of affordability and durability continues to be a primary driver of global demand.

Growth of E-Commerce and Digital Retail

The proliferation of online marketplaces has enabled easy access to a wide variety of polyester bed sheet options. Online sales channels offer personalized recommendations, competitive pricing, and fast delivery, significantly boosting consumer adoption, particularly in urban and tech-savvy demographics.

Hospitality and Institutional Demand

Hotels, resorts, and institutional buyers are increasingly opting for polyester bedding due to its low maintenance and long-lasting nature. Rising investments in tourism infrastructure and hospitality renovations directly contribute to the growth of the polyester bed sheets market.

What are the restraints for the global market?

Environmental Concerns

The production of polyester relies on petrochemicals, which raises sustainability issues and contributes to microplastic pollution. Growing environmental awareness among consumers may limit adoption unless manufacturers focus on recycling initiatives and sustainable practices.

Competition from Natural Fibers

Despite technological improvements, natural fibers such as cotton and linen are perceived as more breathable and comfortable, creating competitive pressure. Premium bedding consumers continue to prefer natural alternatives for aesthetics and luxury appeal.

What are the key opportunities in the polyester bed sheets industry?

Emerging Markets Expansion

Rapid urbanization, rising disposable income, and evolving lifestyle preferences in countries like India, China, and Brazil present significant growth opportunities. Manufacturers can establish local production or distribution hubs to cater to expanding middle-class populations in these regions.

Integration of Smart Textiles

The introduction of temperature-regulating, anti-microbial, or moisture-wicking polyester fabrics offers opportunities for product differentiation. Such advanced textiles cater to health-conscious consumers and hospitality sectors seeking premium bedding solutions, allowing brands to command higher margins.

Eco-Friendly and Recycled Polyester

With increased consumer preference for sustainable products, there is significant potential for growth in recycled polyester bed sheets. Companies investing in eco-friendly solutions can appeal to environmentally conscious buyers while enhancing corporate sustainability credentials.

Product Type Insights

Fitted sheets dominate the market, accounting for 40% of the 2024 global market, owing to convenience and easy maintenance. Flat sheets and sheet sets remain popular for their versatility and coordinated appearance. Microfiber polyester leads fabric quality segments with 35% share due to softness, affordability, and wide adoption in both residential and commercial settings. These trends are reinforced by online retail expansion and growing institutional demand for low-maintenance bedding.

End-Use Insights

Residential consumers represent the largest end-use segment for polyester bed sheets, driven by affordability and variety. The hospitality sector, including hotels and resorts, is the fastest-growing segment due to the need for durable, easy-to-clean, and cost-effective bedding solutions. Export-driven demand is significant, with the U.S., Germany, and the U.K. being the top importers, while China and India are key exporters. This cross-border trade reinforces global market expansion and enables economies of scale for manufacturers.

| By Product Type | By Fabric Type | By Sales Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

The U.S. and Canada dominate, accounting for roughly 28% of the 2024 market, with growth fueled by high disposable income, lifestyle preferences, and hospitality demand. Consumers are increasingly opting for microfiber and premium polyester blends, while online retail continues to expand.

Europe

Germany, France, and the U.K. are key markets, representing around 25% of global revenue in 2024. Eco-conscious consumer preferences, high-quality standards, and hospitality industry demand drive growth. Europe is also seeing rising adoption of recycled polyester sheets, particularly in the premium segment.

Asia-Pacific

China and India are emerging as the fastest-growing regions, driven by urbanization, rising disposable income, and increasing awareness of bedding hygiene and comfort. This region is expected to see the highest CAGR over the forecast period.

Latin America

Brazil and Mexico are driving growth in this region, with demand from both residential and hospitality sectors. While smaller in overall market share, adoption is accelerating due to improving lifestyle standards and urbanization.

Middle East & Africa

Middle Eastern countries such as the UAE, Saudi Arabia, and Qatar are growing due to high-income populations and luxury hotel expansion. Africa shows potential in select urban markets, but overall adoption remains moderate.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Polyester Bed Sheets Market

- Welspun India Ltd.

- Trident Group

- Springfield Group

- Paraiso Home Textiles

- Grasim Industries

- Bharat Fabrics

- Hawkins Textiles

- Arvind Ltd.

- Bombay Dyeing

- Sheela Foam Ltd.

- HomeTex Pvt. Ltd.

- Vardhman Textiles

- Shahi Exports

- Gokaldas Exports

- Trilogy Bedding Pvt. Ltd.

Recent Developments

- In 2025, Welspun India launched a new line of eco-friendly polyester bed sheets made from recycled PET bottles, targeting sustainability-conscious consumers.

- In 2024, Trident Group expanded its microfiber production facility in India, increasing output for both domestic and export markets.

- In early 2025, Paraiso Home Textiles introduced moisture-wicking polyester sheets tailored for the hospitality industry, enhancing durability and customer comfort.