Political Campaign Software Market Size

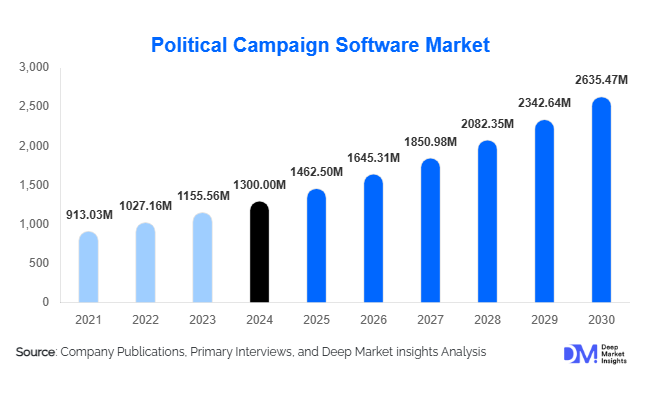

According to Deep Market Insights, the global political campaign software market size was valued at USD 1,300 million in 2024 and is projected to grow from USD 1462.50 million in 2025 to reach USD 2,635.47 million by 2030, expanding at a CAGR of 12.5% during the forecast period (2025–2030). The political campaign software market growth is primarily driven by the increasing digitalization of campaigns, rising demand for data-driven voter engagement, and the integration of AI and predictive analytics for strategic campaign management.

Key Market Insights

- Political campaigns are increasingly adopting cloud-based software solutions to manage voter outreach, fundraising, volunteer coordination, and compliance reporting efficiently.

- AI and predictive analytics are transforming campaign strategies by enabling data-driven decision-making, micro-targeting of voters, and real-time performance insights.

- North America dominates the market, with the U.S. leading adoption due to high campaign budgets, advanced technology use, and regulatory requirements for transparency.

- Asia-Pacific is the fastest-growing region, fueled by rising internet penetration, smartphone usage, and emerging political technology adoption in India, Indonesia, and other countries.

- Political parties remain the primary end-users, accounting for the largest revenue share due to comprehensive campaign requirements and larger budgets.

- Regulatory compliance and data security integration are key differentiators, driving demand for secure, auditable, and GDPR/CCPA-compliant software solutions.

What are the latest trends in the political campaign software market?

Cloud-Based and Modular Platforms Gaining Traction

Campaigns are increasingly shifting from traditional, on-premises software to cloud-based platforms. Cloud solutions provide scalability, lower upfront costs, and remote accessibility for campaign staff. Modular platforms allow campaigns of varying sizes, from grassroots to national, to adopt only the features they need, including voter outreach, fundraising, volunteer management, and analytics. This flexibility has increased adoption among smaller campaigns and NGOs in emerging markets, providing a cost-effective entry point into advanced political software solutions.

AI-Driven Analytics and Voter Targeting

Artificial intelligence and machine learning are revolutionizing campaign strategies by providing predictive insights, voter sentiment analysis, and personalized messaging. Advanced tools now integrate voter databases, social media activity, polling data, and canvassing results to optimize outreach and resource allocation. Real-time dashboards and predictive models enable campaigns to adjust strategies dynamically, improving voter engagement and fundraising efficiency. These capabilities are particularly appealing to tech-savvy campaign teams aiming to maximize impact with limited resources.

What are the key drivers in the political campaign software market?

Digitalization of Campaign Operations

The global shift from traditional campaigning to digital channelsincluding social media, email, SMS, and mobile apps, has increased the demand for integrated software solutions. Digital tools offer measurable, scalable, and cost-efficient methods to engage voters, coordinate volunteers, and manage donations. Campaigns can monitor performance in real-time and adapt strategies, creating a significant advantage over competitors relying on manual processes.

Regulatory Compliance and Data Security Requirements

Governments and electoral bodies are enforcing stricter compliance and reporting requirements for political campaigns. This has created demand for software capable of secure data storage, audit trails, donor reporting, and privacy management. Campaigns must adhere to laws like GDPR, CCPA, and local election regulations, making compliance-focused software a critical growth driver.

Integration of Advanced Analytics and AI Tools

Campaigns increasingly rely on data-driven insights for strategic decision-making. AI-enabled analytics allows for precise voter targeting, micro-segmentation, and optimization of advertising and fundraising campaigns. The adoption of predictive modeling tools is growing across mature markets, providing campaigns with actionable intelligence to increase efficiency and maximize voter engagement.

What are the restraints for the global market?

High Customization and Localization Needs

The political landscape varies significantly across countries, requiring software to be tailored for language, regulatory compliance, cultural preferences, and electoral systems. High customization increases development costs and limits scalability, making it challenging for vendors to create standardized solutions for global deployment.

Data Privacy and Security Concerns

Breaches of sensitive voter data, misuse of personal information, and regulatory violations pose significant risks. Campaigns and vendors must invest in advanced security measures, encryption, and compliance protocols. Security concerns may deter smaller campaigns from adopting advanced software solutions and increase operational costs for providers.

What are the key opportunities in the political campaign software industry?

Emerging Regional Markets

Asia-Pacific, Latin America, and parts of Africa present untapped potential for political campaign software. Growing internet penetration, smartphone adoption, and digital literacy are enabling campaigns to invest in technology-driven solutions. Localizing software features, pricing models, and language support can help vendors capture these high-growth markets, particularly for grassroots campaigns and NGOs.

AI and Predictive Analytics Integration

Advanced analytics tools that combine voter data, social media trends, polling, and canvassing outcomes provide campaigns with actionable insights. Vendors focusing on AI and predictive analytics can differentiate themselves and provide measurable ROI for clients. Opportunities exist in micro-targeting, sentiment analysis, and dynamic campaign optimization, which are increasingly valued in competitive electoral environments.

Regulatory Compliance and Transparency Solutions

Software that ensures adherence to campaign finance laws, donor reporting requirements, and data privacy regulations is increasingly in demand. Vendors offering built-in compliance features, audit-ready reports, and secure data storage can build trust and credibility, particularly among large political parties and advocacy groups operating under stringent legal frameworks.

Product Type Insights

Campaign management modules dominate the market, accounting for approximately 32–35% of the 2024 market. These modules provide core functionalities including scheduling, resource allocation, volunteer coordination, and multi-channel communication. Voter engagement tools and fundraising modules follow closely, reflecting growing emphasis on data-driven outreach and donor management.

Application Insights

Political parties are the largest end-users, contributing roughly 40–45% of the 2024 market. Individual candidates, advocacy groups, and NGOs are adopting software at a faster rate, particularly in emerging regions. Applications span campaign planning, voter segmentation, fundraising, volunteer management, and compliance reporting, with increasing demand for AI-driven analytics and mobile integration.

Distribution Channel Insights

Cloud-based SaaS solutions are the dominant distribution channel, holding around 65–70% of the market. Direct sales to political parties and consultancies, partnerships with campaign strategists, and online self-service subscriptions for smaller campaigns are prevalent. Vendors are leveraging multi-channel distribution to expand reach while providing scalable solutions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America, particularly the U.S., is the largest market, valued at USD 0.55 billion (44–45% of global revenue in 2024). High campaign budgets, mature technology adoption, and regulatory requirements drive software adoption. Cloud-based platforms, AI analytics, and comprehensive compliance tools are widely used in federal, state, and local campaigns.

Europe

Europe holds approximately USD 0.35 billion (25–30% share) in 2024. Growth is driven by GDPR-compliant software, transparency mandates, and increasing use of digital voter engagement tools. Key countries include the U.K., Germany, France, and Spain, with rising interest in AI-based analytics and modular solutions for both national parties and advocacy groups.

Asia-Pacific

APAC represents around USD 0.25 billion (15–20%) in 2024, but is the fastest-growing region. India, Indonesia, Japan, and Australia are leading the adoption due to rising internet penetration, mobile-first strategies, and emerging political tech ecosystems. Growth is fueled by grassroots campaigns and NGOs increasingly investing in digital platforms for outreach and fundraising.

Latin America

Latin America accounts for USD 0.05–0.10 billion (<10%) in 2024, with Brazil, Mexico, and Argentina driving demand. Affluent voters and competitive political landscapes are encouraging the adoption of cloud-based software and mobile solutions, particularly for data-driven campaign strategies.

Middle East & Africa

MEA is valued at USD 0.04–0.06 billion (3–5% share). Africa hosts iconic campaign software demand in South Africa and Nigeria, while the Middle East, led by the UAE, Saudi Arabia, and Qatar, is growing due to high-income populations and technology adoption. Intra-regional campaigns are increasingly using digital platforms for voter engagement and fundraising.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Political Campaign Software Market

- NGP VAN

- ActBlue

- NationBuilder

- Blue State Digital

- EveryAction

- Salsa Labs

- Crowdskout

- Phone2Action

- Intranet Quorum

- Ecanvasser

- Organizer

- Patriot

- Mobilize

- BSD Tools

- Grassroots Unwired

Recent Developments

- In May 2025, NGP VAN expanded its analytics platform with AI-driven predictive tools for voter targeting in U.S. midterm elections.

- In April 2025, ActBlue introduced mobile-first fundraising tools tailored for grassroots campaigns across emerging markets.

- In February 2025, NationBuilder launched a new compliance and reporting module to help international campaigns adhere to local election regulations.