Plastic Zipper Market Size

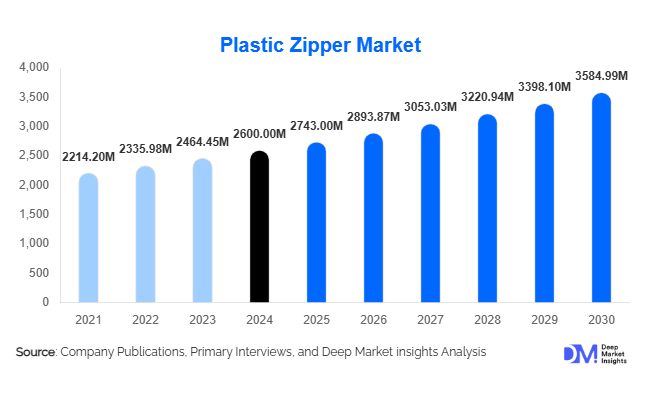

According to Deep Market Insights, the global plastic zipper market size was valued at USD 2,600 million in 2024 and is projected to grow from USD 2,743 million in 2025 to reach USD 3584.99 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The growth of the plastic zipper market is primarily driven by increasing demand from the apparel, bags & accessories, and packaging industries, rising adoption of eco-friendly and recyclable plastic zippers, and expanding global trade in export-oriented garment and packaging sectors.

Key Market Insights

- Apparel and clothing remain the dominant application, driven by demand for lightweight, corrosion-resistant, and aesthetic zippers suitable for sportswear, casual wear, and outerwear.

- Sustainable and eco-friendly zippers are gaining traction, with brands and consumers seeking recyclable, bio-based, and post-consumer recycled plastic options.

- Asia Pacific dominates the market in terms of both production and consumption, led by China, India, and Southeast Asian countries.

- North America and Europe are significant mature markets, with demand concentrated on premium zippers for apparel, luggage, and packaging applications.

- Latin America and MEA are emerging growth regions, driven by rising disposable incomes and increasing domestic apparel and packaging production.

- Technological advancements, including waterproof, invisible, and specialty slider zippers, along with automated production, are reshaping manufacturing and product offerings globally.

What are the latest trends in the plastic zipper market?

Sustainability and Eco-Friendly Zippers

Manufacturers are increasingly focusing on recyclable, bio-based, and post-consumer recycled plastic zippers to align with environmental regulations and consumer preferences. Sustainability trends are influencing design, material selection, and production processes. These initiatives are particularly relevant for apparel brands, luggage manufacturers, and FMCG packaging companies that emphasize eco-conscious branding. Efforts include monomaterial designs for easier recycling, use of biodegradable polymers, and labeling to highlight environmental benefits.

Technological and Functional Innovations

Emerging technologies are enhancing the utility and appeal of plastic zippers. Waterproof zippers, invisible designs for aesthetic appeal, and advanced slider mechanisms are increasingly adopted. Automation and precision manufacturing allow consistent quality for high-volume production, while new materials improve durability and flexibility. Packaging applications are benefiting from reclosable zippers with child-resistant features and barrier properties, catering to consumer convenience and safety. Specialty zippers for outdoor gear and industrial applications are also expanding, driven by material innovation and performance requirements.

What are the key drivers in the plastic zipper market?

Apparel Industry Expansion

The global apparel industry continues to grow, particularly in emerging markets. Rising demand for sportswear, athleisure, and outerwear has increased the need for durable, lightweight, and aesthetically versatile plastic zippers. Fast fashion, combined with higher volumes of garment production in Asia, supports substantial growth in the apparel segment. Apparel manufacturers prioritize flexibility, color matching, and cost-effective solutions, reinforcing plastic zippers’ dominance over metal alternatives.

Growing E-Commerce and Packaging Demand

The surge in e-commerce has increased demand for reclosable and resealable packaging using plastic zippers. FMCG, food, and cosmetic industries are leveraging plastic zippers for convenience, freshness, and improved shelf life. The global trend toward smaller households and on-the-go consumption further drives packaging adoption. Enhanced product functionality, such as child safety, moisture protection, and antimicrobial coatings, is creating opportunities for innovation in this segment.

Sustainability Regulations and Consumer Preference

Regulatory restrictions on single-use plastics and consumer demand for eco-friendly solutions are compelling manufacturers to adopt sustainable plastic zipper materials. Companies are increasingly investing in recycled or bio-based polymers, and compliance with packaging and environmental regulations is becoming a key market requirement. Sustainability initiatives also strengthen brand reputation, particularly in premium apparel and packaging segments.

What are the restraints for the global market?

Competition from Alternative Fastening Methods

Plastic zippers face competition from metal zippers, buttons, snaps, hook-and-loop closures, and other fastening technologies. In applications requiring extreme durability, high aesthetic value, or waterproof performance, alternative solutions may be preferred, limiting plastic zippers’ adoption in certain premium segments.

Raw Material Volatility and Regulatory Costs

Plastic polymers used in zipper manufacturing, such as polyester, nylon, and polypropylene, are subject to price fluctuations influenced by crude oil markets and supply chain constraints. Additionally, compliance with environmental regulations, food safety standards, and packaging laws increases production costs. Small-scale manufacturers may find it challenging to absorb these costs without affecting competitiveness.

What are the key opportunities in the plastic zipper market?

Eco-Friendly and Recyclable Zipper Solutions

The growing emphasis on sustainable products presents a significant opportunity. Manufacturers can develop recyclable, bio-based, and post-consumer recycled plastic zippers to cater to both apparel and packaging segments. Premium brands and regulatory compliance further increase demand for eco-conscious solutions. Offering certified sustainable products can create competitive differentiation and brand loyalty.

Expansion in Packaging Applications

Plastic zippers are increasingly used in FMCG, food, pet food, and cosmetic packaging. Resealable pouches and flexible packaging with plastic zippers ensure product freshness and convenience. Incorporating child-resistant designs, antimicrobial coatings, and moisture barriers creates premium value, attracting new customers and applications.

Emerging Market Penetration

Rapid growth in Asia Pacific, Latin America, and Africa presents opportunities for manufacturers to establish localized production facilities. Reducing lead time, lowering logistics costs, and leveraging government incentives for manufacturing in countries like India, Vietnam, and Brazil can enhance market share and profitability. Emerging markets also allow manufacturers to supply both domestic and export-driven demand.

Product Type Insights

Coil plastic zippers dominate the market, accounting for approximately 30–35% of global demand in 2024. Their flexibility, ease of integration into garments, and cost-effectiveness make them preferred for apparel, sportswear, and casual clothing. Molded plastic zippers (Vislon) and invisible zippers are gaining traction in premium apparel and outdoor gear due to durability and aesthetic appeal. Water-resistant and specialty zippers are emerging as high-value niche products.

Application Insights

Apparel and clothing lead as the largest application segment (45–50% of the 2024 market). Luggage, bags, and accessories are expanding steadily, while packaging applications are emerging rapidly, especially in FMCG and food products. Outdoor gear and industrial applications also contribute, with growth driven by waterproof, high-durability, and specialty zippers. Export-driven demand from garment manufacturers in Asia significantly boosts these applications.

Distribution Channel Insights

Traditional offline channels (wholesale, local distributors, and OEMs) dominate the market (60–65% of 2024 share) due to entrenched supply chains in apparel and packaging manufacturing. Online platforms and e-commerce are growing, particularly for specialized and premium zippers. Direct supply contracts to OEMs, export houses, and packaging companies are increasingly important for high-volume, high-value orders. Distribution innovations also include B2B digital marketplaces and partnerships with large retailers.

End-User Insights

Apparel OEMs, luggage manufacturers, packaging companies, and outdoor gear producers are the primary end-users. Apparel remains the fastest-growing end-use segment, driven by sportswear, outerwear, and casual clothing. Packaging companies are emerging as a key end-use market, leveraging resealable pouches and flexible packaging innovations. Export-oriented apparel and bag manufacturers create additional demand in the Asia-Pacific region, reinforcing global market growth.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the plastic zipper market, accounting for 40–50% of global demand in 2024. China is the largest producer and consumer, followed by India and Southeast Asian countries. Growth is fueled by rising domestic apparel manufacturing, export-oriented production, and expanding packaging demand. The region is also the fastest-growing, with a CAGR above the global average (6–7%), supported by local manufacturing initiatives and government incentives.

North America

North America accounts for approximately 15–20% of 2024 demand, with the U.S. and Canada driving growth. Demand is focused on premium apparel, luggage, and packaging applications. Regulatory emphasis on sustainability and high consumer preference for quality products support the adoption of eco-friendly and functional plastic zippers. Growth is moderate due to mature markets, but remains steady.

Europe

Europe, particularly Germany, Italy, France, and the U.K., represents 15–20% of the 2024 market. Demand is concentrated in premium apparel, luggage, and packaging applications. Strong sustainability regulations, eco-friendly consumer preferences, and technological adoption drive growth. Eastern Europe contributes a smaller share but is gradually increasing its demand.

Latin America

Brazil, Mexico, and Argentina are emerging markets, accounting for 5–8% of 2024 demand. Growth is driven by rising disposable incomes, increasing local apparel production, and the expansion of export-driven industries. Demand for mid-range and premium zippers is rising, though overall volumes remain smaller than in Asia-Pacific and Europe.

Middle East & Africa

MEA accounts for less than 10% of the market. Iconic apparel, luggage, and packaging demand exist in GCC countries and South Africa. Growth potential is high due to low market penetration, rising consumer income, and investments in local manufacturing infrastructure. Imports of zippers are common in countries lacking local production capacity.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Plastic Zipper Market

- YKK Corporation

- SBS Zipper

- Talon International, Inc.

- RIRI Group

- IDEAL Fastener Corp

- Tex Corp Ltd

- Olympic Zippers Ltd

- Hang Sang Zipper Co., Ltd

- YBS Zipper

- KAO SHING ZIPPER Co., Ltd

- Dongguan Yifeng Zipper Products Co., Ltd

- Max Zipper Co., Ltd

- Zipit

- Fujian SBS Zipper Science & Technology Co., Ltd

- Others in the China/Taiwan region

Recent Developments

- In March 2025, YKK Corporation launched a new line of sustainable, recycled polyester zippers for apparel and packaging, aiming to reduce environmental impact.

- In January 2025, SBS Zipper expanded manufacturing capacity in Vietnam to serve both domestic demand and export-oriented apparel markets.

- In December 2024, Talon International introduced water-resistant and invisible zippers for premium outdoor clothing and luggage applications, strengthening its premium product portfolio.