Piano Market Size

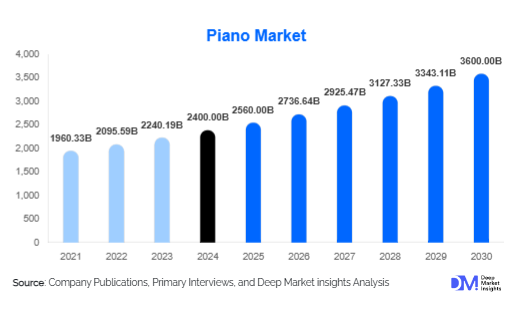

According to Deep Market Insights, the global piano market size was valued at USD 2,400 million in 2024 and is projected to grow from USD 2,560 million in 2025 to reach USD 3,600 million by 2030, expanding at a CAGR of 6.9% during the forecast period (2025-2030). The piano market growth is primarily driven by the rising demand for digital and hybrid pianos, the expansion of music education programs, and increasing consumer interest in luxury and lifestyle products across emerging economies.

Key Market Insights

- Digital pianos are witnessing the fastest adoption, driven by affordability, portability, and integration with smart technologies.

- Grand pianos continue to dominate the premium segment, sustaining demand among professional musicians, institutions, and luxury buyers.

- Asia-Pacific leads the global market in both production and consumption, with China and Japan being major hubs.

- North America and Europe remain strong luxury markets, where upright and grand pianos are symbols of cultural heritage and lifestyle.

- Music education expansion worldwide is driving institutional purchases, especially in schools, universities, and conservatories.

- Online distribution channels are growing rapidly, offering direct-to-consumer models, financing options, and wider accessibility.

What are the latest trends in the piano market?

Technology-Integrated Hybrid Pianos

Hybrid pianos, combining the acoustics of traditional pianos with the versatility of digital features, are gaining traction worldwide. These instruments appeal to both professionals and hobbyists by offering authentic touch and sound with added benefits such as silent play, recording, and Bluetooth connectivity. Manufacturers are investing heavily in this segment as it bridges the gap between tradition and modern music-making, creating long-term adoption potential.

Growing Demand for Affordable Entry-Level Pianos

With rising disposable incomes in Asia-Pacific and Latin America, entry-level digital pianos are experiencing robust growth. These instruments provide access to music education at an affordable price point, fueling first-time adoption. Subscription-based music apps bundled with digital pianos are also attracting younger demographics, creating an ecosystem that promotes recurring engagement and brand loyalty.

What are the key drivers in the piano market?

Expansion of Music Education

The global focus on extracurricular learning and creativity has made pianos a central instrument in schools, conservatories, and universities. Countries such as China, South Korea, and Germany are actively expanding music programs, generating steady institutional demand. The cultural prestige of piano learning continues to support long-term growth.

Rising Popularity of Digital Pianos

Digital pianos are revolutionizing the market due to their affordability, compactness, and advanced features like volume control, recording, and connectivity with music apps. These attributes are making them attractive to urban households with limited space and to beginners seeking cost-effective learning options.

Pianos as Lifestyle and Luxury Products

High-end grand and upright pianos are positioned as luxury investments, often featured in premium homes, hotels, and cultural spaces. Leading manufacturers are collaborating with designers and luxury brands to release limited editions, targeting affluent buyers seeking exclusivity and prestige.

What are the restraints for the global market?

High Ownership Costs

The piano market faces challenges due to high initial investment costs and long replacement cycles. Premium acoustic models require regular maintenance, further discouraging middle-income buyers from making purchases.

Shift in Consumer Entertainment Preferences

Growing competition from digital entertainment options such as gaming and streaming services is diverting household spending away from traditional musical instruments. Manufacturers must innovate to retain consumer interest and engagement.

What are the key opportunities in the piano industry?

Integration with E-Learning Platforms

The rise of online music education platforms presents an opportunity for piano makers to bundle digital pianos with subscription-based courses. This integration ensures recurring revenue and helps build long-term brand loyalty among younger learners.

Rising Demand in Emerging Markets

Countries such as India, Brazil, and Southeast Asian nations are witnessing growing interest in piano learning due to rising disposable incomes and increasing cultural exposure. Affordable digital pianos are expected to be the entry point for these markets, creating fresh growth avenues.

Sustainability and Eco-Friendly Manufacturing

Growing environmental consciousness is encouraging manufacturers to adopt sustainable materials and energy-efficient production practices. Eco-labeled instruments appeal to environmentally aware buyers, particularly in Europe and North America, enhancing brand positioning.

Product Type Insights

Digital pianos dominate the market with approximately 42% share in 2024, driven by rapid adoption among beginners and urban households. Upright pianos hold around 35%, sustaining steady demand among schools and hobbyists. Grand pianos account for 18% of the market, primarily serving professionals and luxury buyers, while hybrid pianos capture about 5% but are expected to grow at double-digit rates through 2030.

End-User Insights

Institutional buyers, particularly schools and conservatories, represent the largest end-user category, driving consistent demand for upright and digital pianos. Residential users are the fastest-growing segment, supported by e-learning, compact digital models, and aspirational purchases in emerging economies. Professional musicians and studios continue to drive the premium and luxury piano segment, sustaining long-term cultural demand.

Distribution Channel Insights

Offline retail accounts for nearly 60% of sales in 2024, dominated by specialized instrument stores. However, online channels are rapidly expanding with around 40% share, driven by direct-to-consumer models, online financing, and growing consumer trust in e-commerce for high-value instruments. Hybrid retail platforms offering digital try-outs and financing bundles are expected to disrupt the traditional sales model further.

| By Product Type | By End-User | By Distribution Channel | By Price Range |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents 28% of the global market in 2024, led by the United States, which maintains strong demand for both luxury grand pianos and entry-level digital models. Institutional spending and affluent residential buyers continue to sustain this region’s growth.

Europe

Europe accounts for 24% of the market, with Germany, the U.K., and France being the leading consumers. The region is notable for its cultural heritage in piano music and sustained demand from institutions and professionals. Eco-friendly instruments are gaining particular traction here.

Asia-Pacific

Asia-Pacific dominates with a 38% share in 2024, led by China and Japan. China is the largest global producer and consumer of pianos, while Japan maintains leadership in premium digital models. India and Southeast Asia are emerging high-growth markets due to rising household incomes and growing music education adoption.

Latin America

Latin America holds about 6% share, led by Brazil and Mexico. Demand is driven by rising music culture and expanding urban middle-class populations. Entry-level and mid-range digital pianos are most popular in this region.

Middle East & Africa

This region accounts for 4% of the global market, driven by affluent buyers in the UAE, Saudi Arabia, and South Africa. Luxury pianos are often used in hotels and cultural venues, sustaining niche demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Piano Market

- Yamaha Corporation

- Kawai Musical Instruments

- Steinway & Sons

- Roland Corporation

- Casio Computer Co., Ltd.

- Samick Musical Instruments

- Young Chang

- Hailun Piano Co., Ltd.

- Schimmel Pianos

- Blüthner

- Bösendorfer

- Mason & Hamlin

- Fazioli

- Bechstein

- Korg Inc.

Recent Developments

- In May 2025, Yamaha launched a new hybrid piano series integrating AI-based sound optimization and cloud-enabled recording features.

- In March 2025, Steinway announced expansion into China with new luxury showrooms targeting affluent consumers in Tier-1 cities.

- In January 2025, Casio introduced a subscription-based e-learning bundle with its latest digital piano lineup, targeting young learners worldwide.