Period Patch Market Size

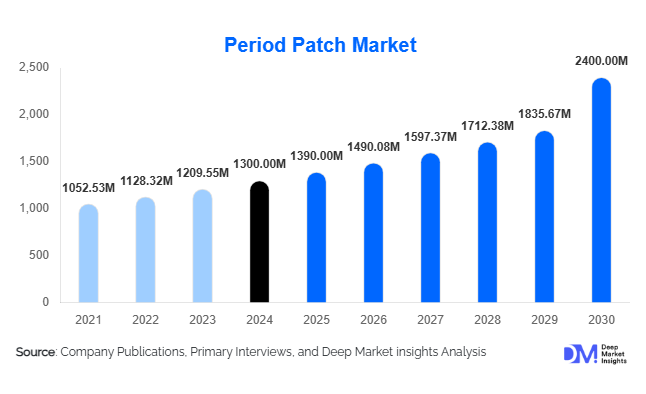

According to Deep Market Insights, the global period patch market size was valued at USD 1,300 million in 2024 and is projected to grow from USD 1,393.6 million in 2025 to reach USD 1,972.93 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The period patch market growth is primarily driven by rising awareness of menstrual health, increasing demand for non-pharmacological pain relief solutions, technological innovations in patch design, and expanding e-commerce penetration for discreet purchase and distribution.

Key Market Insights

- Heat/thermal patches dominate the product type segment, as they provide effective, localized relief for menstrual cramps and are preferred for their convenience and comfort.

- Online and direct-to-consumer channels are leading distribution, accounting for a majority share due to consumer preference for privacy, convenience, and access to a wide variety of options.

- North America holds the largest regional share, led by the U.S., supported by high awareness, strong purchasing power, and early adoption of wellness and femtech solutions.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, urbanization, and growing awareness of menstrual health in countries such as China and India.

- Technological innovations, including longer-duration heat patches, herbal and plant-based formulations, biodegradable materials, and multifunctional designs, are reshaping consumer adoption and brand differentiation.

What are the latest trends in the period patch market?

Herbal and Natural Patch Innovation

Manufacturers are increasingly focusing on herbal, plant-based, and chemical-free patches to cater to consumer preferences for natural, skin-friendly, and sustainable solutions. Biodegradable and compostable materials are gaining traction, aligning with the global trend toward environmental responsibility. Certifications such as organic, cruelty-free, and hypoallergenic further enhance consumer trust and willingness to pay premium prices. This focus on clean-label products is creating differentiation among brands and capturing health-conscious segments.

Technological Advancements and Multi-Functionality

Innovations in adhesive technology, heat consistency, transdermal delivery systems, and multifunctional patches are driving market growth. New products offer longer duration relief, targeted pain alleviation, and integrated wellness features like mood support or hormonal regulation. These developments appeal to younger, tech-savvy consumers who seek enhanced comfort, discreet designs, and multifunctionality in menstrual care products.

What are the key drivers in the period patch market?

Rising Awareness of Menstrual Health

Increased public discussion and education around menstrual health have led to higher adoption of period patches. Women seeking non-pharmacological and localized pain relief prefer patches over oral medications due to fewer side effects and improved convenience. Social media campaigns, influencer endorsements, and health awareness programs have amplified consumer understanding of the benefits of period patches.

E-commerce and Direct-to-Consumer Growth

Online platforms provide privacy, convenience, and access to niche products that may not be widely available in retail stores. E-commerce has enabled smaller wellness and femtech brands to reach a global audience efficiently, contributing significantly to market penetration and volume growth, particularly in price-sensitive and emerging markets.

Product Innovation and Premiumization

Continuous development in patch materials, active ingredients, and design features drives demand. Longer-duration heat, herbal formulations, biodegradable materials, and multifunctional features allow brands to command premium pricing while meeting evolving consumer expectations. This innovation trend enhances brand loyalty and supports higher repeat purchase rates.

What are the restraints for the global market?

Regulatory and Safety Challenges

Patches delivering active ingredients or claiming therapeutic benefits must comply with varying regulatory standards across countries. Clinical validation, skin-safety testing, and approvals increase costs and delay product launches. Ensuring safety from skin irritation, burns, or adverse reactions remains a critical concern for manufacturers.

Cost Sensitivity in Emerging Markets

High-quality heat elements, herbal ingredients, and sustainable materials increase production costs. Price-sensitive consumers in emerging regions may prefer traditional remedies or oral painkillers, limiting market penetration. Additionally, import tariffs, supply chain inefficiencies, and logistics costs can further impact affordability and accessibility.

What are the key opportunities in the period patch market?

Herbal and Sustainable Product Lines

There is strong potential for clean-label, herbal, and biodegradable patches that meet consumer demand for natural and eco-friendly solutions. Products incorporating organic herbal extracts and environmentally responsible packaging can capture premium segments while addressing growing sustainability concerns. Partnerships with certification bodies enhance credibility and market appeal.

Expansion in Emerging Markets

Asia-Pacific, Latin America, and select Middle East regions represent high-growth potential. Rising awareness, urbanization, government menstrual health initiatives, and increasing female workforce participation are fueling demand. Localization in pricing, design, and marketing can enhance adoption in culturally diverse regions like India, China, and Brazil.

Integration of Smart and Multi-Function Patches

Innovative patches that combine heat therapy, herbal actives, or hormone support with wearable sensor technologies provide enhanced consumer value. Longer-duration comfort, discreet designs, and app-connected monitoring are expected to attract tech-oriented users and premium segments, offering differentiation opportunities for brands.

Product Type Insights

Heat/thermal patches dominate the global period patch market (72% share), primarily driven by their proven efficacy in providing drug-free relief from menstrual cramps and discomfort. Consumers increasingly prefer these patches for their convenience, non-invasive nature, and ability to deliver targeted relief without oral medications. Among heat patches, the 8-hour warming comfort variant is particularly favored as it balances effective pain alleviation with practicality, allowing for all-day use with minimal disruption to daily activities. Cool patches are emerging as a secondary product type, gaining traction due to their soothing effects and appeal among consumers seeking alternative or complementary methods for pain relief. Meanwhile, herbal and plant-based patches are capturing attention in premium and clean-label categories, combining natural actives with eco-friendly formulations. Multi-functional patches that integrate longer-duration heat, herbal actives, or ergonomic designs are creating opportunities for premiumization and repeat purchases, reflecting a broader consumer shift toward wellness-oriented and multifunctional menstrual care solutions.

Application Insights

Menstrual pain relief remains the largest application segment, driven by the widespread prevalence of dysmenorrhea and the growing preference for non-pharmacological interventions. Increasing awareness among adolescents, working women, and health-conscious consumers is accelerating adoption across both developed and emerging markets. Beyond pain relief, secondary applications, including hormonal regulation, mood stabilization, and alleviation of bloating or lower back discomfort, are gaining momentum, particularly in premium and multifunctional patch categories. These expanding applications not only broaden the consumer base but also encourage repeat purchases, as women increasingly integrate period patches into their regular menstrual wellness routines.

Distribution Channel Insights

Online and direct-to-consumer channels dominate the market (66% share), driven by convenience, privacy, and access to a wide variety of products. Consumers increasingly prefer purchasing period patches online to maintain discretion and avoid potential social stigma, while also benefiting from product comparisons, subscription services, and doorstep delivery. Pharmacies and drug stores continue to serve as trusted points of purchase, particularly in regions where online penetration is limited, while specialty wellness stores target premium consumers seeking herbal or multifunctional patches. Emerging distribution models, such as subscription-based wellness boxes, not only facilitate recurring revenue but also strengthen brand loyalty. Social media marketing, influencer endorsements, and targeted digital campaigns are reshaping consumer behavior, particularly among younger demographics who actively research products online before purchase.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 42% of the global period patch market, led by the U.S. and Canada. High consumer awareness, preference for non-invasive menstrual pain relief solutions, and a strong inclination toward wellness and femtech products drive regional growth. Online sales are particularly strong, fueled by convenience, privacy, and access to premium products. Heat and multifunctional patches dominate, supported by widespread knowledge of their efficacy. Additionally, government initiatives promoting menstrual health education and workplace wellness programs have contributed to adoption. The growing trend toward self-care, combined with higher disposable incomes and early adoption of new technologies, is expected to sustain North America’s market leadership over the forecast period.

Europe

Europe holds 23% of the global market, with Germany, the U.K., and France as key contributors. Growth is driven by strong regulatory adherence, high consumer preference for sustainable and natural products, and increasing health consciousness. Eco-friendly heat patches and herbal alternatives are particularly popular. Digital marketing campaigns, social media engagement, and influencer endorsements are shaping younger demographic adoption, while increased retail penetration in pharmacies and wellness stores ensures accessibility. Additionally, European consumers favor multifunctional products that integrate comfort, effectiveness, and eco-conscious design, aligning with broader sustainability and wellness trends in the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and Australia, with a CAGR above 9%. Growth is fueled by rising awareness of menstrual health, increasing disposable incomes, rapid urbanization, and growing acceptance of self-care and wellness products. Online and e-commerce channels are increasingly influential, providing privacy and accessibility in markets with cultural sensitivities around menstrual products. Heat patches remain dominant due to their convenience and effectiveness, while herbal and multifunctional patches are gaining traction among premium consumers. Government-led menstrual hygiene awareness programs, rising female workforce participation, and expanding femtech startups further propel market expansion. Export-driven demand from North America and Europe also supports manufacturing and distribution growth in the region.

Latin America

Brazil, Mexico, and Argentina are key markets in Latin America. Although the overall market share is lower compared to North America and Europe, adoption is steadily increasing due to growing awareness of non-pharmacological pain relief solutions and cultural shifts toward self-care. Mid-range heat patches, supported by education campaigns and targeted marketing, are driving demand. Online channels are gradually gaining importance as e-commerce penetration rises. Price sensitivity remains a challenge, but localized product offerings and culturally tailored messaging are helping overcome barriers, supporting steady market growth.

Middle East & Africa

Key markets include the UAE, Saudi Arabia, South Africa, and Nigeria. Premium patch adoption in GCC countries is supported by urbanization, high disposable incomes, and preference for wellness-focused self-care products. In African countries, market growth is gradually emerging due to increasing awareness of femtech solutions and localized manufacturing initiatives. Heat patches dominate in urban centers, while multifunctional and herbal options are beginning to gain traction among higher-income consumers. Investments in educational campaigns on menstrual health and partnerships with NGOs are expected to stimulate further adoption, providing opportunities for sustained regional growth despite the overall modest market share (8%).

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Period Patch Market

- Rael

- BeYou

- Sirona

- Cora

- The Good Patch

- Unexo Life Sciences

- Lilas Wellness

- Popband

- ThermaCare

- Flo Pads

- CareJoy

- Hesta

- Love Wellness

- BloomsCare

- FemAllure

Recent Developments

- In March 2025, Rael launched a new line of biodegradable, herbal heat patches in North America and Asia-Pacific, focusing on sustainable and natural solutions.

- In February 2025, BeYou expanded its online subscription model in India, offering premium multifunctional patches targeting working women and adolescents.

- In January 2025, Sirona introduced advanced heat patches with longer-duration thermal technology and improved adhesive for sensitive skin in European and North American markets.