Paper Shooting Target Market Size

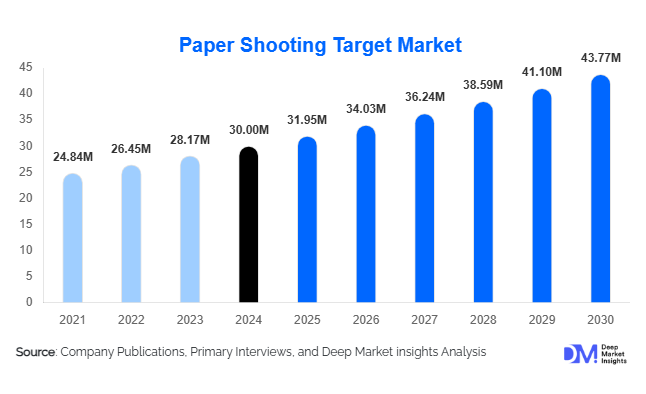

According to Deep Market Insights, the global paper shooting target market size was valued at USD 30 million in 2024 and is projected to grow from USD 31.95 million in 2025 to reach USD 43.77 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing participation in recreational and competitive shooting, expanding infrastructure of commercial and institutional shooting ranges, and the rising demand for cost-effective and disposable training targets worldwide.

Key Market Insights

- Paper targets remain essential for training and practice, especially in law enforcement, military, and civilian shooting ranges due to their low cost, easy replaceability, and visual feedback capabilities.

- Silhouette and tactical threat targets dominate globally, providing realistic training scenarios and forming approximately 35% of the 2024 market share.

- North America leads the global market, driven by an extensive shooting culture, high firearm ownership, and a dense network of shooting ranges.

- Asia-Pacific is the fastest-growing region, led by emerging shooting ranges and increasing recreational and competitive shooting participation in India, Southeast Asia, and Australia.

- E-commerce and online sales channels are gaining traction, especially for hobbyists and smaller shooting clubs seeking convenience and customization options.

- Innovation in eco-friendly, reactive, and smart paper targets is shaping product differentiation and enhancing adoption in training, competitive, and recreational applications.

What are the latest trends in the paper shooting target market?

Digital Integration and Smart Targets

Manufacturers are increasingly developing paper targets that incorporate QR codes, barcodes, or AR markers, enabling automated scoring and real-time analytics. This trend supports hybrid training systems where physical targets are combined with digital tracking, providing actionable feedback for shooters. Smart paper targets are particularly appealing to commercial ranges, law enforcement agencies, and competitive shooters who require precise performance data, allowing for performance tracking, scoring, and integration with software-driven range management solutions.

Customization and Specialty Targets

Customized paper targets, including thematic or branded designs, animal silhouettes, and scenario-specific targets, are gaining traction. Competitive ranges and shooting clubs prefer tailor-made targets for events or specialized training exercises. This trend supports subscription-based consumables and recurring purchases, allowing manufacturers to build long-term customer relationships. Customization also enhances the user experience for hobbyists and sports shooters seeking novelty or personal engagement in practice sessions.

Eco-Friendly and Sustainable Targets

Environmental sustainability is influencing product innovation. Biodegradable and recycled paper targets are increasingly being adopted by shooting ranges and agencies aiming to reduce their environmental footprint. These targets maintain print quality and durability while complying with regulatory and sustainability initiatives, positioning manufacturers who innovate in this space for premium pricing and competitive differentiation.

What are the key drivers in the paper shooting target market?

Rising Popularity of Shooting Sports

Growing recreational and competitive shooting participation worldwide is driving demand for paper targets. Shooting clubs, leagues, and competitions require a steady supply of disposable targets, supporting recurring sales. Media coverage and social media exposure of competitive shooting events have contributed to a wider audience, fueling adoption in emerging markets as well.

Expansion of Commercial Ranges and Training Facilities

Construction of indoor and outdoor shooting ranges, both commercial and institutional, is rising globally. Each range requires large volumes of consumable paper targets, creating a reliable demand stream. Growth is especially notable in North America, Europe, and emerging Asia-Pacific markets, where new ranges cater to civilian, law enforcement, and military users.

Cost-Effectiveness and Accessibility

Paper targets offer a low-cost alternative to steel or electronic targets, making them ideal for routine training and practice. Their affordability encourages repeat purchases, particularly for high-frequency use in law enforcement and shooting ranges, ensuring stable demand in both developed and developing markets.

What are the restraints for the global market?

Competition from Alternative Target Materials

Electronic, steel, and polymer targets are increasingly adopted for instant scoring, durability, and reduced waste. This shift can limit paper target growth, particularly in high-end training environments where advanced scoring technologies are preferred.

Raw Material Price Volatility

Fluctuations in paper, ink, and coating costs can impact manufacturing margins. Supply chain disruptions or increased shipping expenses can raise final prices, potentially suppressing demand in price-sensitive segments.

What are the key opportunities in the paper shooting target market?

Emerging Markets and Regional Expansion

Asia-Pacific and Latin America present substantial growth opportunities due to underpenetrated shooting sports markets. Countries like India, Brazil, Vietnam, and Southeast Asia are seeing rising interest in recreational and competitive shooting, creating demand for locally produced or imported paper targets. Regional expansion strategies and partnerships can secure market share in these high-growth areas.

Smart and Reactive Target Innovations

Developing targets with reactive splatter inks or digital scoring integration allows manufacturers to differentiate their offerings. This innovation enhances user engagement and creates new revenue streams through premium pricing, recurring subscriptions, and value-added services for commercial ranges and competitive shooters.

Subscription and Consumable Models

Target pads and multi-sheet packs support subscription-based models for ranges and institutions, ensuring recurring revenue. These models provide convenience for buyers, reduce procurement complexity, and create long-term supplier loyalty.

Product Type Insights

Silhouette and human-form targets dominate the market, offering realistic tactical training. Standard bullseye and grid targets are widely used in civilian practice and competition settings. Specialty and custom targets, including animal or thematic designs, are growing in niche applications, particularly in hobbyist and competitive environments. Tear-off multi-sheet pads facilitate frequent use, especially in high-volume commercial ranges.

Application Insights

Training and practice account for the largest application share (45%), encompassing law enforcement, military, and civilian practice. Competitive shooting and recreational use are growing steadily, while certification and qualification exercises continue to drive institutional demand. Emerging uses include hybrid training environments combining physical paper targets with augmented reality or digital scoring integration.

Distribution Channel Insights

Direct B2B contracts with law enforcement and ranges remain significant. E-commerce and online retail channels are rapidly expanding, especially for hobbyists and small-club users. Wholesale and retail sporting goods channels continue to provide traditional distribution, while subscription-based delivery models are gaining traction in high-volume institutional segments.

End-User Insights

Commercial shooting ranges and clubs represent the largest end-user segment (30%), driving recurring volume purchases. Law enforcement and military agencies remain consistent buyers for training purposes. Recreational hobbyists are increasingly purchasing customized or downloadable targets online. Competitive shooters contribute spikes in demand around events. Export-driven demand is growing in regions such as Latin America and the Middle East due to limited domestic production.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads with 40% of global demand in 2024. The U.S. is the largest contributor due to widespread shooting culture, high firearm ownership, and a dense network of shooting ranges. Demand is steady, with moderate growth projected through 2030.

Europe

Europe accounts for 20% of the market, led by Germany, France, and the U.K. Recreational shooting clubs and police training facilities are major buyers. Growth is stronger in Eastern Europe, where shooting sports are expanding rapidly.

Asia-Pacific

Asia-Pacific (18–22%) is the fastest-growing region. India, Southeast Asia, Australia, and Japan are key markets. Rising shooting range infrastructure, regulatory support, and increasing participation drive the CAGR of 8–10%.

Latin America

Latin America holds 10% of the market, with Brazil and Mexico as key importers. Growth is influenced by hobbyist adoption and the emerging shooting sports culture.

Middle East & Africa

MEA (8–10%) sees demand from law enforcement, military, and high-income hobbyists. The Gulf states, particularly the UAE and Saudi Arabia, are the fastest-growing markets, supported by premium target imports and modern range investments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Paper Shooting Target Market

- MGM Targets

- Alco Target

- Allen Company

- Champion

- Shoot Steel

- CTS Targets

- Qualification Targets

- The Steel Target Company

- US Targets

- Xsteel Targets

- Red Stitch Targets

- Rangetime

- Krüger-Druck

- Falcata Company

- Toms Targets

Recent Developments

- In March 2025, MGM Targets launched a new line of eco-friendly paper targets with biodegradable splatter coating, targeting commercial shooting ranges in North America and Europe.

- In January 2025, Alco Target expanded production facilities in India to meet rising Asia-Pacific demand, introducing locally printed custom silhouette targets for training and competition.

- In June 2024, Champion developed QR-integrated paper targets enabling automated scoring at shooting ranges, enhancing adoption in commercial and institutional training environments.