Oval Table Market Overview

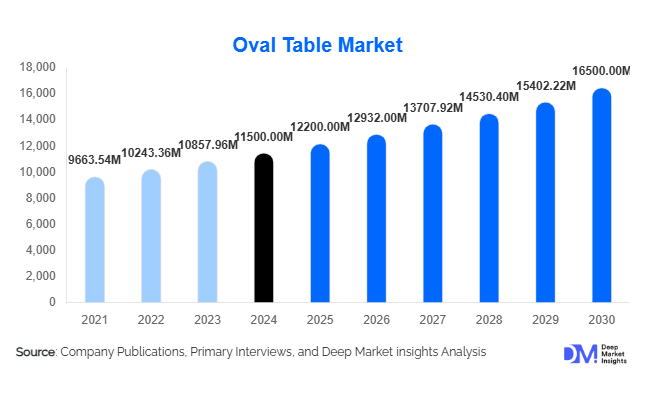

According to Deep Market Insights, the global oval table market size was valued at USD 11,500 million in 2024 and is projected to grow from USD 12,200 million in 2025 to reach USD 16,500 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). Market growth is fueled by the rising demand for stylish, space-efficient furniture, expanding residential construction, and increasing adoption of customizable and sustainable designs across global households and commercial establishments.

Key Market Insights

- Wooden oval tables dominate the market with over 40% share in 2024, owing to their premium appeal and durability.

- Asia-Pacific leads global demand, accounting for about one-third of total sales, driven by rapid urbanization, rising incomes, and furniture export strength.

- Residential applications represent over half of total demand, supported by growing home renovation and interior décor trends.

- Offline furniture retail remains the dominant distribution channel, though online platforms are expanding at double-digit growth rates.

- Sustainable and modular furniture designs are key innovation themes, with manufacturers integrating eco-certified materials and smart features.

- The top 5 players collectively hold a 15–25% share, reflecting a highly fragmented market with significant regional production diversity.

What are the latest trends in the oval table market?

Rise of Sustainable and Eco-Friendly Furniture

Global consumers are increasingly prioritizing sustainability in furniture purchases. Oval table manufacturers are responding by sourcing FSC- or PEFC-certified wood, recycled metals, and low-VOC coatings. Brands are promoting transparency in material sourcing and adopting circular design principles, designing tables that can be disassembled, refurbished, or recycled. Europe and North America lead in implementing eco-regulations and certification systems, while Asian manufacturers are investing in green production to attract export markets. This sustainability focus enhances brand credibility and allows for premium pricing.

Customization and Smart Furniture Integration

Personalization is becoming a decisive factor in furniture purchasing. Consumers prefer oval tables tailored in size, finish, and function. Manufacturers are leveraging 3D configurators and AR/VR visualization tools to enable buyers to preview furniture in their homes before purchase. Meanwhile, integration of technologies such as wireless charging, USB ports, or adjustable height mechanisms is creating a new segment of “smart tables.” These innovations not only elevate functionality but also appeal to tech-savvy and design-oriented consumers seeking multipurpose home furniture.

Growth of Online and Omnichannel Retail

E-commerce platforms are revolutionizing the furniture shopping experience. Major brands and D2C players are investing in digital storefronts, interactive catalogs, and fast shipping capabilities. Consumers in the U.S., India, and Europe are increasingly comfortable purchasing high-value furniture online. Omnichannel strategies that combine physical showrooms with online customization and fulfillment are becoming common. This trend is expected to reshape distribution dynamics over the next five years.

What are the key drivers in the oval table market?

Urbanization and Rising Disposable Income

As global urbanization continues, compact living spaces are driving demand for versatile furniture such as oval tables that maximize utility while maintaining style. Increasing disposable income in developing economiesparticularly China, India, and Indonesia boosting furniture spending. Premium home décor is evolving into a lifestyle statement, accelerating market growth in the mid-to-premium price segments.

Premiumization and Home Renovation Trends

Consumers are increasingly viewing furniture as a design investment rather than a utility purchase. Renovation and home improvement trends, bolstered by social media influence and real estate upgrades, are leading to higher spending on aesthetically appealing dining and living room furniture. Oval tables, with their elegant form and space-saving appeal, are preferred in modern interiors.

Expansion of Hospitality and Commercial Spaces

The global hospitality industry’s post-pandemic rebound is spurring new demand for designer furniture, including oval dining and conference tables. Hotels, cafés, and restaurants are investing in distinctive furniture to enhance customer experiences. Large-scale projects in the Middle East and Asia are further stimulating demand through commercial contracts and interior design partnerships.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuating prices of wood, metal, and glass significantly impact profit margins. Global supply chain disruptions, shipping costs, and regional trade restrictions are challenging stable procurement. Manufacturers reliant on imported materials face higher volatility, particularly in developing regions where local wood supplies are limited or regulated.

Intense Competition and Price Sensitivity

The oval table market is highly fragmented, with numerous regional players offering low-cost alternatives. Intense price competition from Asian manufacturers and substitute products (rectangular and round tables) pressures mid-tier producers. As a result, differentiation through design, sustainability, or technology becomes essential to maintain margins.

What are the key opportunities in the oval table industry?

Eco-Conscious Manufacturing and Certification

Manufacturers investing in sustainable production have a strong opportunity to capture eco-driven consumers. Adoption of certified sustainable wood, recycled materials, and biodegradable finishes enhances brand reputation. Governments are also offering incentives and certifications for green furniture, creating new entry points for compliant manufacturers.

Expansion in Emerging Markets

Rapid urbanization and housing expansion in India, Southeast Asia, and Africa are generating large untapped demand for affordable oval tables. Manufacturers entering these markets with mid-range, modular, or flat-pack offerings can capture significant growth. Local assembly units can also lower logistics costs and cater to regional preferences.

Digital Transformation and Direct-to-Consumer Models

Furniture makers adopting e-commerce and D2C models are well-positioned to benefit from digital retail growth. Personalized interfaces, online AR visualization, and flexible payment options enhance consumer reach. Integrating online channels with local delivery and installation services offers a seamless buying experience that increases conversion rates.

Product Type Insights

Fixed oval tables account for more than 50% of the market in 2024, favored for their simplicity, affordability, and durability. Extendable and folding designs are gaining traction among urban consumers seeking multifunctional furniture. Adjustable-height oval tables, though niche, are seeing demand in home-office and hybrid work settings. Manufacturers offering hybrid designs combining fixed and expandable features are attracting consumers seeking both aesthetics and practicality.

Material Insights

Wooden oval tables dominate global sales with approximately 45% share in 2024, supported by consumer preference for timeless, natural materials. Engineered wood and veneer products appeal to mid-income consumers seeking affordability. Metal and glass combinations are increasingly popular in contemporary interiors, while composite and stone materials cater to luxury buyers demanding uniqueness and durability.

Application Insights

Residential applications represent nearly 60% of total market revenue, driven by rising home ownership, renovation cycles, and premium home décor trends. Commercial applicationsincluding restaurants, cafés, and officesare expanding as hospitality and coworking industries recover. Outdoor and event furniture segments, while smaller, are benefiting from growth in hospitality and event infrastructure worldwide.

Distribution Channel Insights

Offline retail continues to lead with over 50% share in 2024, reflecting strong consumer preference for physical inspection before purchase. However, online retail is the fastest-growing channel, forecasted to record a double-digit CAGR as digital platforms gain trust and offer enhanced visualization and customization options. Direct-to-consumer brands are leveraging social media and influencer marketing to capture younger, design-conscious consumers.

| By Product Type | By Material Type | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global market with approximately 35% share in 2024. China, India, Vietnam, and Japan dominate production and consumption. Rising disposable incomes, urban housing projects, and strong export capacities make this region the manufacturing hub for oval tables. India and Southeast Asia are expected to post a 7–8% CAGR through 2030, driven by domestic demand and regional exports.

North America

North America accounts for roughly 25–30% of global revenue, led by the U.S. and Canada. The market is characterized by high design awareness, strong home renovation activity, and an expanding online furniture retail ecosystem. Premium and sustainable furniture categories are seeing rapid adoption as consumers prioritize aesthetics and eco-certifications.

Europe

Europe holds around 20–25% share, driven by strong interior design culture and sustainability regulations. Germany, the U.K., France, and Italy are leading markets. The region’s stringent environmental policies are pushing demand for certified and recyclable materials. European consumers also exhibit high acceptance of custom and modular furniture designs.

Latin America

Latin America represents 5–8% of global demand, with Brazil, Mexico, and Chile as major markets. Growth is supported by a growing middle class and rising interest in premium and imported furniture. The region’s expanding hospitality and residential construction sectors are expected to boost demand through 2030.

Middle East & Africa

MEA contributes about a 5–7% share. The UAE, Saudi Arabia, and South Africa lead in demand for luxury and commercial furniture. Rapid tourism and hospitality development in GCC countries is spurring demand for designer dining and conference tables. Africa’s emerging housing markets offer long-term potential for affordable, modular furniture solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Oval Table Market

- Alf Uno

- Ambiance Italia

- APULIA Home Decor

- ARAN Cucine

- Artisan Solid Wood Furniture

- BAULINE

- BONALDO

- BONTEMPI CASA

- Bross Italia

- Cancio

- CUCINE LUBE

- DESALTO

- DRAENERT

- Porada

- Calligaris

Recent Developments

- In April 2025, BONALDO introduced a new line of extendable oval dining tables made from FSC-certified wood and recycled metal bases, aligning with sustainability goals.

- In February 2025, BONTEMPI CASA launched a smart oval table collection with integrated wireless charging and LED lighting controls.

- In January 2025, ARAN Cucine expanded its Italian manufacturing facility to increase capacity for export to North America and Asia-Pacific markets.