Online Furniture Market Size

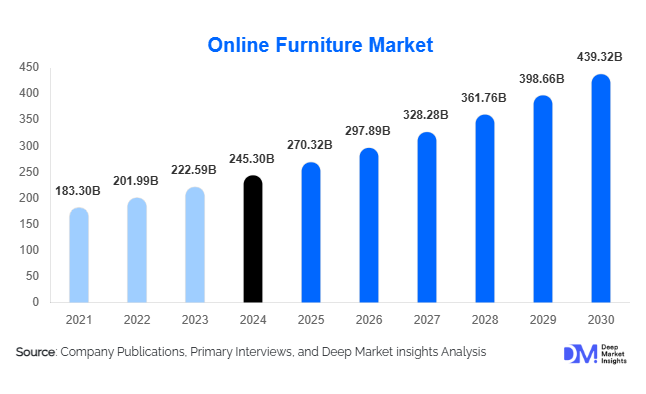

According to Deep Market Insights, the global online furniture market size was valued at USD 245.3 billion in 2024 and is projected to grow from USD 270.32 billion in 2025 to reach USD 439.32 billion by 2030, expanding at a CAGR of 10.2% during the forecast period (2025–2030). Market growth is driven by rising e-commerce adoption, growing consumer preference for home improvement, and technological innovations such as augmented reality (AR) and virtual room visualization, enhancing digital purchase experiences.

Key Market Insights

- Living room furniture dominates online sales, accounting for nearly 35% of global revenue in 2024.

- Asia-Pacific leads the global market with about 45% share, driven by booming e-commerce in China and India.

- Residential end-use accounts for nearly 70% of total demand, propelled by remote work and home renovation trends.

- Solid wood furniture remains the preferred material due to durability and eco-friendly appeal, representing 30% of total online furniture revenue.

- Technology adoption, AR/VR tools, AI-based design configurators, and smart furniture are transforming the customer journey.

- Subscription and rental furniture models are emerging, appealing to younger, urban consumers seeking flexibility and affordability.

Latest Market Trends

Augmented Reality and Virtual Showroom Integration

Major online retailers are investing in AR and VR technologies that allow users to visualize furniture within their own living spaces before purchase. These immersive solutions reduce returns, boost customer confidence, and improve conversion rates. Virtual showrooms now replicate in-store experiences, enabling consumers to explore entire room setups digitally, with custom color, size, and texture options.

Rise of Smart and Modular Furniture

The growing demand for compact living solutions and multifunctional furniture is accelerating innovation. Smart furniture, equipped with wireless charging, LED lighting, and ergonomic adjustments, is becoming mainstream, while modular and foldable designs are addressing space limitations in urban housing. These trends are particularly strong in Asia-Pacific’s high-density markets and are driving premiumization across product categories.

Sustainability and Circular Economy Initiatives

Eco-friendly production, recycled materials, and take-back programs are reshaping the market. Online brands are emphasizing FSC-certified wood, low-VOC finishes, and responsible sourcing. The circular economy model, refurbishment, resale, and furniture-as-a-service, is gaining traction, appealing to environmentally conscious consumers and enabling companies to extend product lifecycles.

Online Furniture Market Drivers

Rapid E-Commerce Penetration

The global shift toward online shopping continues to accelerate, supported by improved logistics, secure payment systems, and mobile-first retail experiences. Furniture e-commerce benefits from enhanced digital merchandising, 360-degree product views, and simplified delivery and installation services. As a result, online sales channels are capturing share from traditional retail stores across all major regions.

Home Improvement and Remote Work Trends

Remote and hybrid work models have elevated demand for home-office furniture such as desks, ergonomic chairs, and shelving units. Simultaneously, rising interest in home décor and interior upgrades is driving recurring purchases through online channels. Increased housing completions, remodeling, and rising disposable income in emerging economies further sustain long-term demand.

Enhanced Supply Chain and Fulfillment Networks

Investment in warehousing automation, regional fulfillment centers, and white-glove delivery services is improving product availability and customer satisfaction. These infrastructure advances are minimizing lead times, reducing return rates, and supporting cross-border e-commerce growth, especially in developing regions where logistics previously constrained expansion.

Market Restraints

High Logistics and Return Costs

Furniture’s bulky nature makes transportation, handling, and reverse logistics costly. Damage during shipping and high return rates can erode profit margins. Maintaining local inventory and developing flat-pack or easy-assembly products are critical strategies to mitigate these challenges.

Consumer Hesitation and Quality Perception

Despite digital advancements, many consumers still prefer physical inspection before buying furniture. Concerns about product quality, dimensions, and color accuracy remain significant barriers. Companies must invest in high-fidelity visualization tools, robust return policies, and customer support to build trust and reduce hesitation.

Online Furniture Market Opportunities

Emerging Market Expansion

Rapid digital adoption in Asia-Pacific, Latin America, and the Middle East offers vast potential for new entrants. Affordable housing development, smartphone penetration, and urbanization are catalyzing demand for online furniture. Targeting tier-2 and tier-3 cities in countries like India and Indonesia can unlock first-mover advantages for global players.

Technology-Driven Customer Engagement

Leveraging AI, AR, and data analytics for personalized recommendations and virtual consultations enhances engagement and conversion. Integrating smart-home connectivity with furniture products further broadens opportunities, as connected living becomes a mainstream consumer aspiration.

Subscription and Rental Models

“Furniture-as-a-service” models are emerging as strong growth avenues, especially among younger consumers and corporate clients seeking flexible furnishing options. Rental and subscription platforms allow customers to upgrade frequently and promote sustainability through reuse and refurbishment.

Product Type Insights

Living room furniture dominates the global online furniture market, commanding approximately 35% of total online sales in 2024 (USD 87.5 billion). This segment benefits from the centrality of living spaces in interior aesthetics and the higher frequency of replacement purchases compared to other furniture categories. Sofas, coffee tables, recliners, and TV stands remain top-selling items, driven by lifestyle shifts toward home entertainment and comfort-centric design. The increasing adoption of modular and customizable configurations has amplified online demand, allowing consumers to visualize and tailor pieces digitally before purchase. Integration of augmented reality (AR) tools, 3D visualization, and AI-assisted interior design on e-commerce platforms has further enhanced consumer engagement and conversion rates. In addition, the growing trend of smaller urban apartments is fueling demand for multifunctional living room pieces that optimize space without compromising on aesthetics.

Material Insights

Solid wood furniture continues to be the most preferred material, capturing nearly 30% of global online sales in 2024. Its enduring appeal lies in durability, craftsmanship, and the premium look it lends to interiors. Consumers increasingly associate solid wood with sustainability and longevity, key factors influencing purchase decisions in higher-value segments. Brands emphasizing certified sustainable timber sourcing (FSC-certified wood) and eco-friendly finishes are gaining traction. Engineered wood and metal furniture follow closely, driven by affordability, lightweight properties, and ease of assembly, features particularly valued in fast-moving urban markets. The rise of do-it-yourself (DIY) culture and flat-pack designs promoted by global leaders like IKEA has further strengthened online sales for engineered materials. Meanwhile, the hybrid use of wood and metal is emerging as a contemporary design trend, blending industrial aesthetics with residential warmth.

Application Insights

Residential applications remain the cornerstone of the online furniture market, accounting for roughly 70% of global revenue (USD 175 billion in 2024). The sector’s expansion is driven by rising homeownership in emerging economies, a post-pandemic focus on home improvement, and the growing influence of remote and hybrid work models. Consumers are increasingly investing in ergonomic furniture, multifunctional setups, and aesthetic upgrades to enhance both comfort and productivity. Online retailers are capitalizing on this trend by offering easy financing options, AR-based visualization, and fast delivery logistics for bulky products. Commercial and institutional furniture, spanning offices, hospitality, education, and healthcare, is witnessing steady recovery following COVID-19 disruptions. As companies modernize workplaces and educational institutions upgrade facilities, the commercial furniture category is forecasted to accelerate post-2030. The rise of co-working spaces and flexible office layouts is expected to further sustain long-term demand in this segment.

| By Product Type | By Material | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

Accounting for about 25% of global revenue (USD 62.5 billion in 2024), North America represents a mature yet highly stable online furniture market. Growth is supported by high disposable income, widespread broadband connectivity, and strong consumer confidence in e-commerce. Major players such as Wayfair, Amazon, and Walmart continue to dominate through competitive pricing, rapid delivery, and expansive online catalogs. The U.S. market particularly benefits from the rise of sustainable product lines and a strong do-it-yourself (DIY) culture. Canada complements this trend with a growing preference for eco-certified and locally sourced furniture. Regional growth drivers include increasing smart home integration, a robust renovation culture supported by home improvement financing, and the penetration of AR-based retail experiences that reduce purchase hesitation for high-ticket items.

Europe

Europe captures around 20% of the global online furniture market (USD 50 billion in 2024), with the U.K., Germany, and France leading regional growth. The market thrives on consumers’ strong environmental awareness and design sophistication, with Scandinavian minimalism continuing to define purchasing trends. European shoppers increasingly prioritize furniture made from recycled or FSC-certified materials, reflecting the region’s leadership in sustainability standards. Regional growth drivers include stringent green regulations, rising adoption of circular economy models, and the digital transformation of traditional furniture retailers into omnichannel platforms. The expansion of cross-border e-commerce and EU-wide logistics integration is further improving accessibility and delivery speeds, enhancing customer experience. Additionally, Germany and the Nordic countries are witnessing a surge in modular furniture demand as urban apartments become smaller and more design-focused.

Asia-Pacific (APAC)

Asia-Pacific is the largest and fastest-growing regional market, commanding roughly 45% of global share (USD 112.5 billion in 2024). The region’s rapid growth is powered by the convergence of mass manufacturing capabilities, digital retail penetration, and rising disposable incomes. China remains the global manufacturing hub and the largest consumer market for online furniture, with brands increasingly blending domestic production efficiency with international quality benchmarks. India and Southeast Asia are witnessing double-digit CAGR, driven by urbanization, rising middle-class consumption, and expanding e-commerce logistics networks. Regional growth drivers include government-led smart city initiatives, aggressive digital payment adoption, and the increasing influence of domestic e-commerce giants like Flipkart and Alibaba. Moreover, young consumers in APAC prefer trendy, affordable, and space-efficient furniture, pushing companies toward subscription and rental models that support flexible living arrangements.

Latin America

Representing approximately 7% of total global sales (USD 17 billion in 2024), Latin America’s online furniture market is on an upward trajectory, spearheaded by Brazil, Mexico, and Chile. The growth is facilitated by the region’s improving digital infrastructure, rising trust in online transactions, and the emergence of regional e-commerce leaders such as Mercado Libre. Regional growth drivers include localized production of affordable modular furniture, the integration of installment-based payment systems, and improved last-mile logistics in urban centers. Consumers in this region favor contemporary designs with practical utility and affordability, reflecting the growing middle-class population. Additionally, domestic furniture manufacturers are increasingly partnering with online retailers to enhance visibility and export potential.

Middle East & Africa (MEA)

The Middle East & Africa (MEA) region accounts for roughly 4–5% of global sales (USD 10–12 billion in 2024) and represents an emerging growth frontier. The Gulf Cooperation Council (GCC) nations, led by the UAE and Saudi Arabia, are driving demand for luxury and designer furniture, reflecting the region’s high-income demographics and booming real estate development. In contrast, African economies such as South Africa, Nigeria, and Kenya are witnessing rising demand for affordable, locally made furniture facilitated by mobile commerce and growing online retail adoption. Regional growth drivers include government initiatives like “Vision 2030” in Saudi Arabia that promote housing development, increased foreign investment in retail infrastructure, and the proliferation of cross-border logistics startups improving e-commerce fulfillment. Sustainability is also emerging as a key theme, with local manufacturers in Africa leveraging recycled materials to serve both domestic and export markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top 15 Companies in the Global Online Furniture Market

- Amazon.com, Inc.

- Wayfair Inc.

- IKEA Group

- Ashley Furniture Industries, Inc.

- La-Z-Boy Incorporated

- Steelcase Inc.

- Herman Miller, Inc.

- Williams-Sonoma, Inc.

- HNI Corporation

- Kimball International, Inc.

- Bassett Furniture Industries, Inc.

- Haverty Furniture Companies, Inc.

- Pepperfry Limited

- Reliance Industries Ltd. (Home Division)

- Otto GmbH & Co. KG