Online Education Market Overview

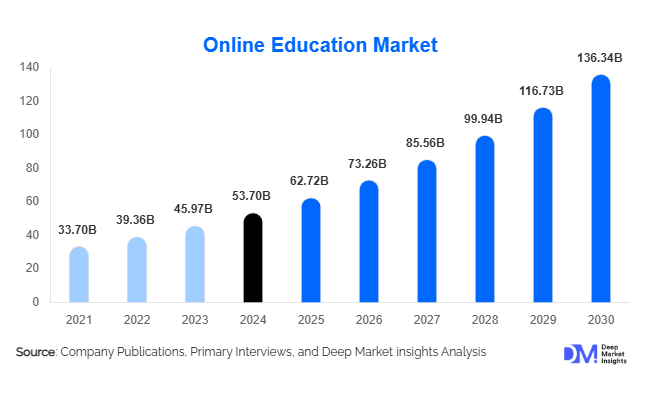

According to Deep Market Insights, the global online education market size was valued at USD 53.7 billion in 2024 and is projected to grow from USD 62.72 billion in 2025 to reach USD 136.34 billion by 2030, expanding at a CAGR of 16.8% during the forecast period (2025-2030). The online education market growth is driven by rapid digital adoption in education, growing demand for flexible and affordable learning models, and increasing collaboration between EdTech platforms and employers to deliver job-ready skills.

Key Highlights

- Stackable micro-major credentials are redefining academic and professional pathways by allowing learners to combine short, job-specific courses into recognized qualifications.

- AI-powered co-teacher systems are transforming engagement through automated grading, personalized feedback, and adaptive learning support.

- Corporate upskilling partnerships between EdTech firms and enterprises are aligning online learning outcomes directly with workforce requirements.

- Regulatory flexibility and micro-credential recognition are encouraging new entrants and innovative business models in digital education.

- Asia-Pacific emerges as the fastest-growing regional market for online education, driven by youth demographics, affordable connectivity, and large-scale government e-learning programs.

- North America retains the largest market share, supported by strong EdTech investment, institutional adoption, and AI-driven learning ecosystems.

- Professional certification and corporate training remain the leading product segments, driven by demand for job-relevant, skill-based learning.

- Blockchain-based credential wallets are gaining traction, offering verifiable learner profiles and improved transparency for recruiters and institutions.

- Rising adoption of nano-learning modules is bridging informal social learning with formal academic credit systems.

- Growing private-sector participation in emerging markets is fueling localized content development and multilingual platform innovation.

What are the most recent trends in the online education market?

Stackable Micro-Majors Redefining Learning Pathways

Online education is shifting from single-skill certificates toward stackable “micro-major” programs. These allow learners to combine 3–5 micro-credentials into a recognized specialization, such as Data Analytics or Digital Marketing Foundations, endorsed by employers. This modular approach improves completion rates and enhances employability by linking learning directly to workforce demand.

AI Co-Teacher Integration: Enhancing Engagement

Instead of replacing educators, institutions are adopting AI-powered co-teacher tools that handle diagnostics, feedback, and progress tracking. These AI agents analyze student behavior to recommend remedial lessons or generate quizzes in real time. The approach reduces faculty workload and supports scalable, adaptive instruction without compromising instructional quality.

Rise of Nano-Learning Through Short-Form Platforms

Educational institutions are incorporating 60–120 second micro-lessons, inspired by social media content, as official learning modules. Platforms are building micro-assessment systems that credit learners for completing short interactive videos, enabling continuous, bite-sized learning. This bridges informal digital learning with formal academic recognition.

What are the key growth drivers in the online education market?

Corporate Demand for Job-Bundle Skills

Employers are increasingly recruiting based on job-ready “skill bundles” rather than degrees, driving partnerships with online education providers. Courses combining technical, analytical, and soft skills, such as “data storytelling” or “AI project operations”, are gaining traction. This shift supports rapid reskilling initiatives and enhances the ROI of corporate learning programs.

Regulatory Flexibility for Alternative Learning Models

Governments and accreditation bodies are approving experimental EdTech programs, such as AI-based teaching pilots and industry-certified micro-credentials. This trend reduces barriers for new entrants, encouraging innovation while promoting accountability through outcome-based accreditation systems.

Employer Co-Funding and Subscription Learning

Companies are increasingly subsidizing employee learning through subscription-based EdTech partnerships, allowing access to thousands of online courses for a flat annual fee. This corporate co-investment model reduces learner cost burden and supports large-scale workforce transformation programs.

What are the restraints for the global market?

Assessment Integrity Challenges in Short-Form Learning

The growing popularity of nano-learning formats complicates exam validation and plagiarism control. Verifying learner identity and ensuring consistent assessment standards across micro-modules remain key challenges. Developing scalable, AI-secured proctoring systems and project-based evaluations is critical to sustaining online education industry credibility.

Credential Saturation and Recognition Fatigue

The oversupply of low-quality online certifications is creating learner confusion and employer skepticism. Without standardization, many micro-credentials lack recognition, diluting market value. Institutions addressing this through clear credential hierarchies and employer co-endorsed programs are better positioned for trust and adoption.

Data Privacy and Platform Dependence

Widespread use of global content platforms for online learning, especially short-video apps, raises data privacy and regional compliance issues. Regulations such as GDPR and emerging AI transparency mandates are tightening oversight, requiring robust governance frameworks and transparent data-handling practices.

What are the key opportunities in the online education market?

Employer-Backed Micro-Major Certifications

Collaborating with enterprises to co-develop stackable micro-credentials that guarantee interviews or hiring consideration can bridge the education-employment gap. These employer-backed certifications add credibility and attract learners seeking tangible job outcomes.

AI Teaching Assistant Platforms for Small Institutions

Developing plug-and-play AI co-teacher solutions that handle grading, formative assessments, and adaptive learning analytics presents a strong opportunity. Such SaaS products empower small universities and training firms to deliver scalable, personalized instruction without major infrastructure costs.

Credential Wallets and Verifiable Learner Profiles

Blockchain-backed credential wallets that store, verify, and share learner achievements offer long-term potential. Integrating these wallets with recruiter platforms enhances transparency, reduces credential fraud, and improves hiring efficiency.

Product Type Insights

Professional certification courses dominate the market for online education, driven by high employability value and strong industry alignment. Degree-based online programs maintain a steady share, particularly in postgraduate studies. Short courses and nano-learning modules are the fastest-growing segment, driven by convenience, low cost, and content personalization.

Application Insights

The online education market is segmented into academic learning, corporate learning, skill development and vocational training, test preparation, and K–12 learning. Each segment demonstrates unique growth dynamics driven by digital transformation and evolving learner expectations.

Academic Learning

The academic learning segment continues to grow steadily due to increased institutional adoption of hybrid learning models. Universities and schools are integrating digital platforms for curriculum delivery, student management, and assessment systems. This shift toward blended learning environments is expanding the digital infrastructure of educational institutions worldwide.

Corporate Learning

Corporate learning remains one of the fastest-growing applications, driven by the shift toward continuous professional development. Enterprises are prioritizing digital platforms for employee reskilling and compliance training, particularly in post-pandemic remote and hybrid workplaces. The rise of role-based learning paths and AI-powered training modules is further strengthening this segment.

Skill Development and Vocational Training

The skill development segment is expanding rapidly due to surging demand for job-oriented digital skills. Courses in data analytics, coding, and digital marketing are attracting large-scale enrollments from both students and working professionals seeking employability-focused certifications. Government-led skill missions in India, Southeast Asia, and parts of Africa are reinforcing this trend.

Test Preparation

The test preparation segment is growing on the back of rising competition for standardized exams. Online platforms offering adaptive and personalized test prep for GRE, GMAT, SAT, and IELTS are witnessing strong adoption, particularly in emerging economies where higher education mobility is increasing.

K–12 Learning

The K–12 segment is driven by the growing adoption of interactive and gamified learning content. Schools and parents are embracing digital platforms that offer curriculum-aligned, personalized, and engaging content for children. The integration of AI tutors and gamified assessment tools is enhancing learning engagement and improving learning outcomes.

Distribution Channel Insights

Learning Management Systems (LMS) and dedicated EdTech platforms dominate content delivery, offering scalable and data-rich ecosystems. Direct-to-learner mobile apps are expanding rapidly, particularly across Asia-Pacific and Latin America. Partnerships with employers, universities, and governments are strengthening institutional channels, creating recurring revenue streams for EdTech providers.

| By Learning Type | By Platform Type | By Technology | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global online education market, supported by mature digital infrastructure, strong EdTech investment, and widespread adoption of AI-based learning tools. High adoption of EdTech and corporate upskilling initiatives continue to drive regional growth. Universities and corporations across the U.S. and Canada are investing heavily in adaptive learning platforms and custom training ecosystems, reinforcing North America’s dominance in innovation and content quality.

Europe

Europe is witnessing accelerated adoption fueled by EU-backed digital competence policies and a strong cultural emphasis on lifelong learning. The European Commission’s Digital Education Action Plan, combined with national digital literacy frameworks in Germany, the U.K., and France, is boosting cross-border recognition of online certifications. Public-private partnerships and the recognition of micro-credentials are further strengthening Europe’s market outlook.

Asia-Pacific

Asia-Pacific remains the fastest-growing region, driven by government-led digital education programs and a large youth population. Initiatives such as India’s Digital Education Mission, China’s “Smart Education” strategy, and Southeast Asia’s regional e-learning projects are fostering large-scale adoption. The region’s affordable internet access, smartphone penetration, and mobile-first learning culture make it a major growth hub for both global and local EdTech firms.

Latin America

Latin America’s online education market growth is supported by increasing internet connectivity and an expanding base of EdTech startups. Brazil and Mexico are leading markets, emphasizing affordable mobile-based education and workforce skill enhancement. The region is also witnessing growing partnerships between universities and online learning platforms to democratize access to higher education.

Middle East & Africa

The Middle East & Africa region is gaining momentum with expanding private sector participation and a surge in e-learning startups. Investments in digital education infrastructure by the UAE, Saudi Arabia, and South Africa are enabling hybrid learning ecosystems. The region’s focus on bridging educational access gaps and national skill-building initiatives positions it as a key emerging growth frontier.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Online Education Industry

- Coursera Inc.

- Udemy Inc.

- edX (2U, Inc.)

- Byju’s

- Udacity

- LinkedIn Learning

- Skillshare

- Khan Academy

- FutureLearn Ltd

- MasterClass

- Duolingo Inc.

- Pluralsight LLC

- Emeritus

- OpenLearning Limited

- Chegg Inc.

Recent Developments

- In June 2025, Adaptemy was recognized by TIME Magazine for its leadership in developing interactive tools and gamification features. The platform leverages AI to streamline teacher support, enhance student engagement, and optimize classroom efficiency.

- In May 2025, CodeSignal launched updates to its AI-native skills assessment and experiential learning platform. The enhancements introduced real-time, adaptive assessment technologies, earning it a spot in TIME Magazine’s global EdTech rankings.

- In April 2025, Xello was nominated to TIME’s 2025 World’s Top EdTech Companies for its College and Career Readiness platform. The platform utilizes data-driven insights and continuous updates to help students prepare for competitive job markets and college applications.

- In June 2025, Cengage unveiled the “AI Leveler Tool,” an adaptive solution designed to personalize learning resources and support student reading comprehension, highlighting the growing adoption of AI-driven content at scale.