Natural Vitamin E Market Summary

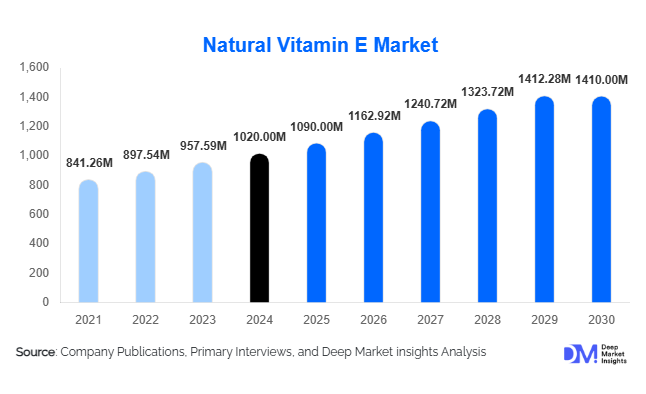

According to Deep Market Insights, the global natural vitamin E market size was valued at USD 1,020 million in 2024 and is projected to grow from USD 1,090 million in 2025 to reach USD 1,410 million by 2030, expanding at a CAGR of 6.69% during the forecast period (2025–2030). The market growth is primarily driven by increasing health consciousness among consumers, the rising preference for natural and clean-label products, and the growing demand from the dietary supplements, cosmetics, and functional foods industries.

Key Market Insights

- Natural vitamin E is increasingly adopted across multiple industries, including dietary supplements, personal care, and functional foods, due to its antioxidant and skin-health properties.

- Dietary supplements remain the largest application segment, capturing a 44.39% share of the market in 2024, driven by preventive healthcare trends and growing consumer focus on immunity and wellness.

- Asia-Pacific dominates the market with a 44.9% share, fueled by increasing health awareness, an expanding middle-class population, and rising disposable incomes in China and India.

- North America shows steady demand, particularly in the U.S., due to mature supplement and personal care markets with a strong preference for natural ingredients.

- Technological integration in extraction methods, such as supercritical CO₂ extraction, is improving yield and purity, supporting higher adoption of natural vitamin E.

- Emerging multifunctional products combining vitamin E with other nutrients are enhancing market differentiation and attracting a broader consumer base.

What are the latest trends in the natural vitamin E market?

Shift Toward Natural and Clean-Label Products

Consumers are increasingly seeking natural and plant-derived ingredients, driving manufacturers to prioritize natural vitamin E over synthetic variants. The clean-label trend emphasizes transparency, sustainability, and traceability of sourcing. Companies are promoting non-GMO sunflower oil-based vitamin E products, which appeal to health-conscious consumers and strengthen brand positioning in dietary supplements, functional foods, and personal care markets.

Technological Advancements in Extraction

Innovations in extraction technologies, including supercritical CO₂ and cold-pressing methods, are enhancing both the quality and purity of natural vitamin E. These techniques reduce chemical residues, increase bioavailability, and allow manufacturers to meet rising global demand efficiently. Improved extraction methods are also enabling cost optimization, making natural vitamin E products more accessible to a wider consumer base and promoting their use across various applications.

What are the key drivers in the natural vitamin E market?

Rising Health and Wellness Awareness

Increasing awareness of antioxidant properties, skin benefits, and immunity support is driving global demand for natural vitamin E. Consumers are integrating vitamin E into daily health routines through supplements, functional foods, and personal care products, fueling steady market growth. The trend is reinforced by proactive healthcare behaviors and preventive health strategies, particularly in developed economies.

Growing Preference for Natural Ingredients

Shifts in consumer behavior toward plant-based and organic products are creating significant opportunities for natural vitamin E adoption. The preference for clean-label and chemical-free formulations aligns with rising environmental awareness and ethical consumption, encouraging manufacturers to prioritize natural sources such as soybean, sunflower, and wheat germ oils.

Technological Adoption and Product Innovation

Advances in extraction and formulation methods are enabling manufacturers to develop multifunctional products that combine natural vitamin E with other nutrients. These innovations enhance efficacy, shelf life, and consumer appeal, particularly in skincare and dietary supplements, thereby accelerating market expansion.

What are the restraints for the global market?

High Production Costs

Natural vitamin E production involves complex extraction processes and dependency on plant-based raw materials, resulting in higher costs compared to synthetic alternatives. This limits adoption in price-sensitive markets, particularly in developing regions.

Supply Chain Vulnerabilities

Availability of raw materials such as soybeans, sunflower seeds, and wheat germ can be impacted by climate change, agricultural constraints, and geopolitical factors. These disruptions pose a challenge to consistent supply and can affect overall market growth.

What are the key opportunities in the natural vitamin E market?

Expansion in Emerging Markets

Asia-Pacific, especially China and India, presents a significant growth opportunity due to increasing health-conscious populations, urbanization, and disposable income. Market players can focus on localized marketing, distribution, and tailored product formulations to capture these rapidly growing consumer segments.

Development of Multifunctional Products

Combining natural vitamin E with other vitamins, minerals, or plant extracts offers multifunctional health benefits. Products targeting skin health, immunity, and anti-aging simultaneously can differentiate brands in competitive markets and cater to premium health-conscious consumers.

Integration of Advanced Extraction Technologies

Adoption of supercritical CO₂ extraction and sustainable processing methods enables higher yield and superior purity. Manufacturers investing in technology-driven production can improve efficiency, ensure sustainable sourcing, and meet the rising demand for premium natural vitamin E products.

Product Type Insights

Tocopherols dominate the market, representing 80.23% of total revenue in 2024. Their antioxidant properties and versatile applications in dietary supplements and cosmetics position them as the leading product type. Tocopherols remain favored over tocotrienols due to wider availability and established efficacy profiles.

Source Insights

Soybean oil led the natural vitamin E source segment in 2024, accounting for 46.71% of the market. Sunflower oil is gaining prominence as a non-GMO, high-purity alternative. Sunflower-based products are projected to grow at a 7.57% CAGR through 2030, reflecting consumer preference for sustainable and plant-based ingredients.

Application Insights

Dietary supplements dominate, capturing 44.39% of the market in 2024. Cosmetics and personal care products are rapidly growing applications, driven by increasing demand for natural skincare and anti-aging formulations. Functional foods and beverages are emerging markets, as manufacturers fortify products with vitamin E to meet health-conscious consumer demand.

End-Use Insights

The dietary supplement industry remains the largest end-use sector, with strong growth expected in North America, Europe, and Asia-Pacific. The beauty and personal care industry is also expanding, driven by natural and organic product trends. Functional foods and beverages represent an emerging end-use segment, benefiting from rising demand for fortified, health-oriented products. Export-driven demand is strong, particularly from developed countries importing premium natural vitamin E for incorporation into supplements and personal care formulations.

| By Product Type | By Source | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads with a 44.9% market share in 2024. Countries like China and India are the largest contributors, driven by growing health awareness, expanding middle-class populations, and increasing supplement consumption. This region is also the fastest-growing market with expected double-digit growth in certain segments.

North America

North America holds 27.4% of the global market in 2024, with the United States dominating due to high consumer spending on dietary supplements and personal care. Canada also shows steady growth, driven by natural and organic product preferences. Mature regulatory frameworks and widespread awareness of natural vitamin benefits support consistent demand.

Europe

Europe, led by Germany and France, shows strong adoption of natural vitamin E, especially in personal care and dietary supplements. Consumers prefer natural, certified, and non-GMO products. Growth is steady, supported by high disposable income and sustainability-driven consumption trends.

Latin America

Brazil and Mexico are emerging markets with growing demand for dietary supplements and personal care products enriched with natural vitamin E. Increased health awareness and urbanization are driving growth in these countries.

Middle East & Africa

Demand is rising in the Middle East, particularly in the UAE and Saudi Arabia, for premium natural supplements and personal care products. Africa's contribution is smaller but growing, especially in the cosmetics segment, driven by interest in natural and sustainable products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Natural Vitamin E Market

- BASF SE

- DSM N.V.

- Kemin Industries, Inc.

- ADM (Archer Daniels Midland Company)

- ATRIUM Innovations

- Emami Ltd.

- Parchem Fine & Specialty Chemicals

- Godrej Industries

- Green Chem Pvt. Ltd.

- Nature’s Bounty

- Eastman Chemical Company

- Dow Inc.

- Marico Limited

- Naturally Splendid Enterprises Ltd.

- Olam International

Recent Developments

- In March 2025, DSM N.V. expanded its natural vitamin E production capacity in Europe to meet rising demand in dietary supplements and cosmetics.

- In January 2025, BASF SE launched sunflower oil-based natural vitamin E products catering to non-GMO and clean-label consumer segments.

- In November 2024, Kemin Industries, Inc. developed multifunctional vitamin E formulations combining antioxidants and skin-nourishing properties for dietary and cosmetic applications.