Music Publishing Market Size

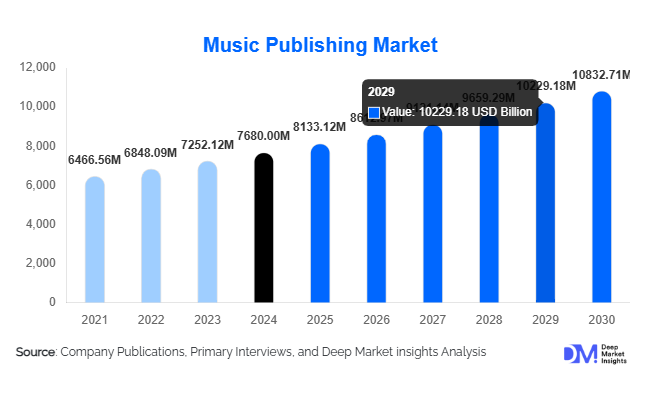

According to Deep Market Insights, the global music publishing market size was valued at USD 7,680.00 million in 2024 and is projected to grow from USD 8,133.12 million in 2025 to reach USD 10,832.71 million by 2030, expanding at a CAGR of 5.9% during the forecast period (2025–2030). Market growth is driven by surging digital music consumption, rapid expansion of synchronization (“sync”) licensing across film, television, and gaming, and increased adoption of technology-enabled rights management systems. As streaming and interactive media mature globally, music publishers are experiencing diversified revenue streams and stronger catalog monetization.

Key Market Insights

- Performance and mechanical rights dominate the market, collectively accounting for more than 70% of global publishing revenues in 2024.

- Digital streaming platforms contribute approximately 60% of total market revenue, underscoring the industry’s digital-first evolution.

- North America leads the global market with around 35% share (USD 2.6 billion in 2024), followed by Europe (30%) and Asia-Pacific (25%).

- Asia-Pacific is the fastest-growing region, fueled by expanding mobile streaming and local-content monetization in India, China, and Southeast Asia.

- The top five publishers control 70% of the market value, with Sony Music Publishing, Universal Music Publishing Group, and Warner Chappell Music leading globally.

- AI and blockchain-based royalty tracking are transforming transparency and efficiency in royalty collection and rights management.

Latest Market Trends

Expansion of Sync Licensing Across Media

Synchronization (“sync”) licensing, using music in films, TV shows, games, and advertising, is rapidly becoming a core growth pillar. Publishers increasingly collaborate with streaming-video platforms, game studios, and advertising agencies to secure high-margin sync deals. Rising production of OTT content, short-form videos, and interactive media experiences has significantly broadened licensing volumes. This trend also boosts cross-border music export as regional catalogs gain international exposure through global media platforms.

Technology-Driven Rights Management

Music publishers are embracing data analytics, AI, and blockchain to address royalty leakage and metadata inaccuracy. Automated rights registration and real-time royalty dashboards enable faster and more transparent payment processing. Blockchain-based ledgers help verify ownership and license terms across jurisdictions. These tools empower songwriters and independent publishers with greater visibility while reducing administrative overhead for global majors.

Music Publishing Market Drivers

Rising Global Digital Music Consumption

Streaming services such as Spotify, Apple Music, and YouTube have reshaped music consumption. Each stream generates performance and mechanical royalties, scaling publisher revenues across territories. Global internet penetration and affordable data plans are propelling listening hours upward, creating steady, recurring income for rights holders.

Growth in Content Licensing for Visual and Interactive Media

Film, television, advertising, and gaming industries increasingly license music to enhance audience engagement. The rise of OTT streaming and video games has expanded sync opportunities. High-value placements in popular shows or AAA games provide publishers with premium fees and international exposure for catalog songs.

Emerging Market Expansion

Developing regions in Asia-Pacific and Latin America are under-monetized yet rapidly digitizing. Mobile-first consumers and local music creation are fueling new royalty streams. Publishers entering these markets through joint ventures or local acquisitions are benefiting from first-mover advantages and favorable regulatory support for creative industries.

Market Restraints

Royalty Collection Inefficiencies

Incomplete metadata, fragmented collection societies, and delayed royalty settlements remain a challenge. Smaller publishers and independent songwriters often face under-reported usage and cash-flow delays, impacting confidence in royalty systems. Although digital solutions are mitigating issues, uniform global standards are still evolving.

Market Saturation in Mature Regions

North America and Western Europe have high streaming penetration, limiting organic volume growth. Intense competition and regulatory scrutiny of major catalog acquisitions further constrain expansion. Price pressures and declining physical sales also restrict margins for publishers operating solely in mature markets.

Music Publishing Market Opportunities

Technology-Enabled Direct Artist Publishing

Self-publishing and direct licensing platforms are gaining traction, allowing songwriters to retain greater control and revenue share. Publishers offering AI-driven metadata optimization, automated registration, and transparent royalty dashboards can capture this emerging segment while reducing operational friction.

Regional Localization and Cross-Border Collaborations

Localized content in languages such as Hindi, Spanish, and Korean is in high demand globally. Collaborations between Western and regional artists increase catalog export potential. Publishers investing in regional songwriting camps and co-publishing agreements are positioned to tap new royalty flows and cross-cultural audiences.

Catalog Acquisition and Investment Momentum

Institutional investors and private equity funds are treating music catalogs as long-term income-producing assets. Catalog buyouts and royalty fund formations create liquidity for songwriters and bolster the market’s capital inflow. Publishers expanding their portfolios through strategic acquisitions can enhance market share and royalty stability.

Product Type Insights

Performance Rights remain the cornerstone of the global music publishing market, accounting for nearly 40% of total revenue in 2024, equivalent to approximately USD 3.0 billion. This segment benefits from consistent income generated by public performances, radio broadcasts, live events, and global streaming plays across leading digital platforms. The growth is underpinned by the proliferation of digital streaming and social media video content, both of which rely heavily on licensed music. Furthermore, improved performance-tracking technologies and data analytics tools are enabling more accurate royalty distribution, increasing transparency and trust among rights holders. Mechanical rights follow with about 25% market share, sustained by global streaming downloads and physical media resurgence among collectors. Meanwhile, synchronization (sync) rights are emerging as the fastest-growing product type, fueled by surging investments in film, television, advertising, and short-form content production across global streaming services such as Netflix, Amazon Prime Video, and Disney+. Sync rights are expected to experience a double-digit CAGR through 2030 as demand for original soundtracks and brand-specific compositions continues to expand.

Application Insights

Streaming and Digital Platforms dominate the application landscape, capturing nearly 60% of total publishing revenue in 2024. This dominance reflects the transformation of consumer listening habits, with platforms like Spotify, Apple Music, YouTube, and Tencent Music generating billions of royalty-bearing streams daily. The segment’s growth is further supported by the integration of music into social media platforms such as TikTok, Instagram, and Snapchat, which have evolved into key revenue sources through micro-licensing and short-form audio clips. Film & television applications remain robust, supported by global demand for licensed background scores and theme compositions. Additionally, gaming and interactive media are emerging as high-margin segments, driven by the expanding gaming industry, virtual concerts, and immersive experiences within metaverse ecosystems. These digital applications are expected to create new monetization models for publishers, including adaptive and AI-generated music tailored to gameplay and user experience.

End-Use Insights

The streaming media industry remains the primary end-use sector for music publishing, contributing over one-third of total market revenue. However, gaming and interactive media represent the fastest-growing end-use segment, bolstered by the rise of AAA titles, mobile gaming, and VR/AR-based environments that increasingly demand high-quality original soundtracks. Advertising and branding applications are also gaining momentum as global brands invest in music-driven marketing campaigns, sonic branding, and social media advertisements. Meanwhile, film and television production continue to drive substantial sync licensing revenues, especially through international co-productions and OTT content creation. Export-driven demand is becoming a key growth lever as emerging economies with expanding creative sectors, such as India, South Korea, and Brazil, see rising music licensing activity for global entertainment and advertising markets. This cross-border integration of content production is enhancing royalty inflows for both local and international publishers.

| By Product Type | By Revenue Source | By Application | By Distribution Channel | By End Use / Buyer |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global music publishing market, commanding approximately 35% share (USD 2.6 billion in 2024). The region’s dominance is anchored by established industry players, extensive intellectual property portfolios, and a robust licensing ecosystem. The United States, in particular, benefits from being home to major global publishers and performance rights organizations (PROs) like ASCAP, BMI, and SESAC. Regional growth is driven by strong demand for sync licensing in Hollywood film and TV production, digital streaming saturation, and expanding ad-supported music models. Additionally, the surge in live concerts and music festivals across the U.S. and Canada post-pandemic has revitalized performance-based royalties. Technological advancements in AI-driven royalty analytics and the adoption of blockchain for transparent rights tracking further strengthen North America’s leadership position.

Europe

Europe holds around 30% of the global market (USD 2.25 billion in 2024), supported by structured collective rights management systems and strong copyright enforcement frameworks. The U.K., Germany, and France represent the largest markets, with organizations like PRS for Music, GEMA, and SACEM ensuring effective royalty collection and distribution. European publishers benefit from the continent’s rich musical heritage, diverse genres, and sustained growth in streaming consumption. Increasing sync licensing in the advertising and independent film industries is further fueling market expansion. Drivers for regional growth include the rapid rise of digital distribution in Eastern Europe, EU-wide copyright reforms supporting fair remuneration, and cross-border licensing agreements that simplify multi-territorial operations. The region’s emphasis on cultural preservation and the adoption of sustainable, tech-enhanced publishing models also contribute to steady long-term growth.

Asia-Pacific

Asia-Pacific (APAC) is the fastest-growing region, accounting for about 25% (USD 1.9 billion in 2024) of the global market. Rapid digitalization, smartphone penetration, and regional streaming platforms such as Tencent Music, JioSaavn, and Melon are driving unprecedented royalty growth. Key drivers include the explosion of local-language content in India, Japan, China, and South Korea, along with government-backed creative industry initiatives. The rising popularity of K-pop, Bollywood soundtracks, and anime music exports is significantly contributing to regional publishing revenues. Moreover, cross-border partnerships between Asian publishers and Western catalog holders are enabling broader international monetization. By 2030, APAC is expected to surpass Europe in market share as licensing frameworks mature and digital collection systems expand. The integration of AI-based composition tools and NFT-backed music ownership models will further enhance publisher profitability in the region.

Latin America

Latin America represents approximately 5% of the global market (USD 0.4 billion in 2024), with Brazil, Mexico, and Argentina leading regional performance. The region’s growth is propelled by the global success of Latin music genres, such as reggaeton, salsa, and urban pop, which have gained strong traction across streaming platforms worldwide. Increasing collaboration between Latin American artists and U.S. or European labels is enhancing royalty flow and sync licensing opportunities. Key growth drivers include the rise of regional streaming services, expanding mobile internet penetration, and increasing brand partnerships in music marketing. Government-backed cultural promotion policies and digital rights modernization efforts are also improving royalty collection and compliance across the region.

Middle East & Africa

The Middle East & Africa (MEA) collectively accounts for about 5% (USD 0.4 billion in 2024) of the global market but is witnessing strong acceleration. In the Middle East, GCC countries such as Saudi Arabia and the UAE are prioritizing creative economy diversification as part of national strategies like Vision 2030, driving investments in music publishing and live entertainment. Africa, led by South Africa, Nigeria, and Kenya, is benefiting from a booming Afrobeats scene, rising streaming adoption, and growing interest from global publishers seeking catalog acquisitions. Drivers for MEA growth include government-led music infrastructure development, local PRO establishment, and digital distribution partnerships that are formalizing royalty ecosystems. These initiatives are gradually unlocking the region’s vast untapped potential in performance and syncing licensing revenue streams.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Music Publishing Market

- Sony Music Publishing

- Universal Music Publishing Group

- Warner Chappell Music

- BMG Rights Management

- Kobalt Music Group

- Concord Music Publishing

- Peermusic

- Downtown Music Publishing

- Round Hill Music

- Hipgnosis Songs Fund

- Primary Wave Music

- Reservoir Media

- Songs Music Publishing

- Anthem Entertainment

- Pulse Music Group

Recent Developments

- In July 2025, Warner Music and Bain Capital launched a joint venture to invest up to USD 1.2 billion in music catalog acquisitions, expanding their publishing portfolio across global markets.

- In May 2025, Sony Music Publishing introduced an AI-powered rights-management system to improve royalty tracking and metadata accuracy across international platforms.

- In March 2025, Kobalt Music Group partnered with YouTube Music to enhance royalty data analytics and provide transparent real-time reporting for independent songwriters.