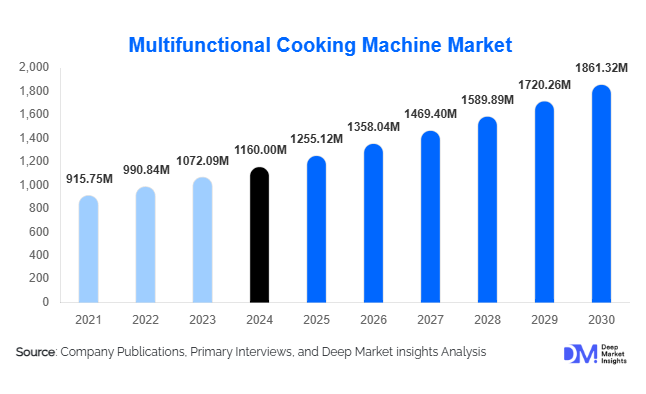

Multifunctional Cooking Machine Market Size

According to Deep Market Insights, the global multifunctional cooking machine market size was valued at USD 1,160 million in 2024 and is projected to grow from USD 1,255.12 million in 2025 to reach USD 1,861.32 million by 2030, expanding at a CAGR of 8.2% during the forecast period (2025–2030). Market growth is primarily driven by the rapid adoption of smart home technologies, rising consumer preference for convenient and healthy cooking, and the expansion of e-commerce channels enabling global accessibility for premium kitchen appliances.

Key Market Insights

- Smart and IoT-enabled multifunctional cooking machines are reshaping home kitchens, offering remote control, voice activation, and automated recipe programming.

- Medium-capacity models (2.1–4.0 liters) dominate global sales, addressing the needs of urban households seeking compact, family-size appliances.

- Residential consumers account for nearly 70% of total demand, driven by busy lifestyles, urbanization, and rising health consciousness.

- Multi-cookers lead the market by product type, holding approximately 35% of the 2024 market share due to their versatility and cost efficiency.

- Asia-Pacific is the fastest-growing regional market, supported by increasing middle-class income and expanding digital retail ecosystems.

- North America and Europe collectively hold over 50% of the market value, led by consumer demand for premium, connected kitchen solutions.

Latest Market Trends

Smart Kitchen Integration Accelerating

Technological convergence is a major trend in the multifunctional cooking machine market. Manufacturers are integrating AI, sensors, and app connectivity to deliver fully automated and adaptive cooking experiences. Smart multi-cookers with Bluetooth and Wi-Fi connectivity allow users to control temperature, monitor cooking progress, and receive recipe guidance in real time. Voice assistant compatibility through Alexa and Google Home is becoming standard in high-end models. These innovations are enhancing user convenience, energy efficiency, and safety, driving strong adoption in premium household segments globally.

Health-Oriented and Sustainable Cooking on the Rise

Consumer preferences are shifting toward healthy, low-fat, and sustainable cooking methods. The integration of air-frying, steaming, and slow-cooking functions supports dietary trends such as clean eating and plant-based diets. Manufacturers are also adopting eco-friendly designs using recyclable materials, low-energy components, and safe non-stick coatings. Governments in Europe and North America are introducing stricter efficiency and safety standards, incentivizing manufacturers to develop compliant, environmentally responsible products. The combination of health, convenience, and sustainability continues to define the next generation of multifunctional cooking machines.

Multifunctional Cooking Machine Market Drivers

1. Changing Lifestyles and Urban Living

Rapid urbanization and the growth of dual-income households have intensified the need for compact, time-saving cooking solutions. Multifunctional machines combine several functions, such as steaming, frying, pressure cooking, and blending, into one appliance, reducing space and simplifying meal preparation. The trend toward smaller kitchen spaces and home-cooked convenience meals strongly supports market expansion across major urban centers worldwide.

2. Technological Innovation and Smart Feature Integration

Continuous innovation in connectivity, automation, and AI-based cooking algorithms has significantly upgraded the value proposition of multifunctional cooking machines. Smart sensors for temperature, pressure, and humidity ensure precise results, while app-based recipes and cloud connectivity enhance user engagement. Companies are investing heavily in R&D to differentiate through technology, giving rise to “connected cooking ecosystems” within modern smart homes.

3. Growing Health Awareness and Dietary Shifts

Consumers’ preference for low-fat, nutrient-rich, and hygienic cooking methods has accelerated the adoption of appliances capable of steaming, air frying, and slow cooking. These functions align with popular diet trends such as keto, vegan, and Mediterranean. Marketing strategies highlighting “healthier cooking at home” have become key growth drivers in both mature and emerging economies.

Market Restraints

High Initial Costs

Advanced multifunctional cooking machines with IoT capabilities and premium build quality are relatively expensive, limiting affordability in price-sensitive regions. Cost remains a barrier for mass adoption in markets such as Southeast Asia, Africa, and Latin America. Moreover, rising raw material and electronic component costs can further elevate final retail prices.

Complexity and Maintenance Issues

With more features comes greater complexity in operation and maintenance. Users often face a steep learning curve, and malfunctions in integrated systems can be costly to repair. Ensuring product reliability and after-sales service availability remains a challenge for manufacturers expanding into new markets.

Multifunctional Cooking Machine Market Opportunities

Expansion of Smart Connected Appliances

Integrating AI, IoT, and voice control presents a lucrative opportunity for both existing and new market entrants. Manufacturers can introduce machines that automatically detect ingredients, adjust cooking parameters, and sync with health apps. Partnerships with recipe platforms and smart home ecosystems will further increase consumer engagement and drive premium sales.

Emerging Market Penetration and Localization

Developing economies across Asia-Pacific, Latin America, and Africa offer substantial untapped potential. Customizing appliances to suit regional cuisines and power requirements can help global brands capture these fast-growing markets. Localization strategies such as modular product design and affordable smart variants are expected to enhance adoption among middle-income consumers.

Health and Sustainability Integration

As sustainability becomes a purchasing criterion, energy-efficient and eco-friendly cooking machines are gaining attention. Products designed with recyclable materials, minimal energy consumption, and low food-waste features will find strong acceptance. Marketing messages around “healthy and green cooking” are expected to resonate with younger, health-conscious demographics globally.

Product Type Insights

Multi-cookers lead the global market, accounting for nearly 35% of total revenue in 2024. Their appeal lies in versatility, compactness, and ease of use. Consumers prefer multi-cookers capable of performing multiple functions boiling, slow cooking, steaming, and sautéing, in one appliance. Air-fryers and all-in-one processors are the fastest-growing subcategories, benefiting from health-conscious cooking trends and social media-driven demand for quick, nutritious meals.

End-Use Insights

Residential consumers dominate the multifunctional cooking machine market, contributing around 70% of 2024 global sales. Growth is fueled by time-poor urban populations seeking smart home solutions. The commercial segment, including restaurants, catering services, and institutional kitchens, is expanding rapidly, leveraging multifunctional appliances to reduce labor costs and streamline operations. The rising popularity of cloud kitchens and ready-to-eat meal providers is expected to further drive commercial adoption by 2030.

Distribution Channel Insights

Offline retail remains the primary distribution channel, contributing about 65% of market revenue in 2024, as consumers prefer to physically evaluate large appliances before purchase. However, online sales channels are expanding quickly due to the rise of e-commerce platforms and brand-owned digital stores. Retailers are adopting omnichannel strategies, offering online demonstrations, AR-based kitchen visualizations, and easy financing options to attract digital-native consumers.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America represents roughly 28% of the global market value in 2024, driven by strong demand for premium smart kitchen appliances in the U.S. and Canada. Consumers exhibit a high willingness to pay for convenience, automation, and energy-efficient devices. The region also leads in the adoption of app-connected and AI-driven cooking systems.

Europe

Europe holds around 24% of the market share in 2024, with Germany, the U.K., France, and Italy leading demand. Stringent EU regulations on energy efficiency and safety standards have accelerated the adoption of certified, eco-friendly cooking machines. European consumers are particularly receptive to sustainability-driven product innovations and smart kitchen ecosystems.

Asia-Pacific

Asia-Pacific dominates in terms of volume and is the fastest-growing region, expanding at an estimated CAGR of 13% from 2025 to 2030. China, India, Japan, and South Korea are key growth hubs, supported by rapid urbanization and expanding e-commerce penetration. Rising middle-class income and cultural affinity for home-cooked meals make APAC a critical region for long-term industry expansion.

Latin America

Latin America accounts for approximately 8% of the global market. Brazil and Mexico lead demand, driven by increasing household appliance ownership and exposure to global smart home trends. The region is witnessing growth in mid-range models as local distributors expand retail networks and financing options.

Middle East & Africa

The Middle East & Africa region contributes around 6% of the total market value. GCC countries such as the UAE and Saudi Arabia are experiencing strong demand for luxury smart kitchen appliances, while South Africa is emerging as a price-sensitive but growing market. Government-led initiatives to boost local manufacturing and retail infrastructure are supporting future growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Multifunctional Cooking Machine Market

- Philips

- Instant Brands

- Ninja (SharkNinja)

- Tefal (Groupe SEB)

- Breville

- Cuisinart

- KitchenAid

- De’Longhi

- Bosch

- Panasonic

- Black+Decker

- Morphy Richards

- Midea Group

- Xiaomi Smart Home

- Kenwood

Recent Developments

- In June 2025, Philips launched its new AI-powered smart multi-cooker range with adaptive recipe control and app-based remote monitoring, targeting premium households across North America and Europe.

- In May 2025, Instant Brands introduced a multifunctional cooking ecosystem integrating voice assistant support and self-cleaning technology, enhancing connected kitchen capabilities.

- In February 2025, Tefal unveiled its sustainable appliance lineup built from 60% recycled materials, aligning with Europe’s circular economy targets and energy efficiency mandates.